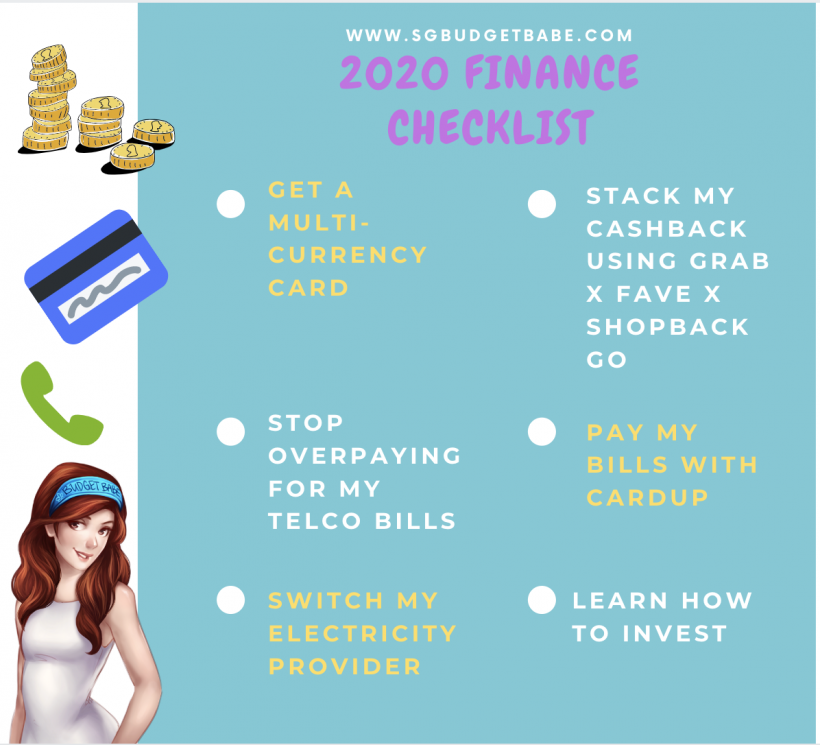

Aiming to save more money in 2020? Here are some tips on how you can start.

The trick to really reaching your financial goals this year is to start with actionable steps, and I’ll share with you several tips to start on right away if you want to succeed this year.

1. Reduce Your Expenses By Getting a Multi-Currency Card

Stop paying for your overseas expenses (yes, that includes Netflix) at unfavourable credit card rates when life has gotten so much better with the introduction of multi-currency fintech providers in our local scene.

Cue YouTrip and Revolut, which are my top two favourites. But there’s a whole bunch to choose from, so take your pick!

Not sure what to get? Read more here.

2. Switch to a SIM-only Plan

The days of postpaid mobile plans are (almost) over. If you’re still paying anything more than $40 for your monthly telco bill, it is high time you made a switch.

With SIM-only plans now available, you can get 5 GB of data and 100 minutes of calls for just $10. Need more talktime or data? Compare here.

3. Switch Your Electricity Retailer

You’re a fool if you continue to stay with SP when Singapore has already rolled out its open electrical market which has resulted in lower prices for consumers.

I chose Geneco, but go ahead and pick the electricity provider that serves you best.

Tip: If your parents are super reluctant to change and you’re too lazy to correct their misconceptions, just tell them to switch to SP Wholesale. That’s so much cheaper than remaining status quo!

4. Maximise Your Cashback By Stacking

It is no longer good enough to have a cashback card – today, you’ll want to be stacking multiple cashback providers in order to get even more money back!

One easy way is to combine UOB One x GrabPay x FavePay, or ShopBack Go! Simply use your UOB One credit card to top up your Grab credits and pay using FavePay or tap your physical GrabPay Mastercard linked to ShopBack Go (if the merchant doesn’t accept Fave).

You can easily get 5% + 5% + Grab rewards with this hack, which you can then use to convert to vouchers to offset your rides or purchases with other merchants. And that’s not even counting in the cashback you earned via Fave / ShopBack Go yet!

5. Pay Your Bills With CardUp

If you haven’t already known about CardUp, it is about time you start paying your bills which otherwise do not qualify for credit card rewards via this method.

Insurance premiums, income tax, car loans, condominium fees and even your helper’s monthly salary can be paid via CardUp for a small fee in exchange for either cashback or miles, which you otherwise wouldn’t get.

Since you HAVE to pay those bills anyway, you might as well get some rewards out of it!

6. Learn How To Invest

After you’ve cut down your expenses with the above tips and grown your savings, it si about time you put your money to work for you.

There’s no excuse today, even for the laziest of folks. The finance scene has seen plenty of new entrants in the last few years since this blog was started, and you now have more options than I ever did back then. If you’re super worried about starting while you’re still a beginner, then choose from robo-advisors or regular saving plans while you build up your own expertise. I also like MoneyOwl for their access to Dimensional Funds.

After that, promise yourself you’ll read more books (here’s a good list, based on your financial literacy level) or even better, save your time and go for an investment course to learn how to create and manage your own portfolio.

Start on the above 6 steps, and you’re less likely to finish off 2020 regretting that you didn’t meet your goals once again.

Any other great tips? Share with me in the comments below!

With love,

Budget Babe