As long as you shop online or travel overseas (Johor Bahru included), you really should be getting a multi-currency card to reduce your expenses by as much as 30%. Or, as long as you fit into any of the below categories:

- Travel overseas at least twice a year (includes trips to JB!)

- Online shopping (eg. Taobao, Kickstarter, Book Depository, Skype credits, Coursera)

- Exchange students abroad

- Foreign subscriptions (eg. Netflix, Spotify, Dropbox, Google)

While banks and credit card companies will try to entice you to spend abroad using their credit cards, bear in mind that you’re actually paying a lot of unnecessary money – mostly in the form of dynamic conversion charges (DCC) and unfavourable exchange rates.

You might as well get a multi-currency card (“global” card) and save more money.

What Can I Do With a Multi-Currency Card?

Save money, duh – you pay lower fees and exchange currencies for a lower rate.

Save time – gone are the days where you need to queue at a money-changer before each overseas trip.

With a global card, you simply need to top up your account (takes only a few seconds and can be done from your mobile phone) before you go, and the card will auto-convert your balance to the currency you’re spending in at the best available rate.Depending on which provider you choose, you might also enjoy other perks like a disposable virtual card to prevent online fraud, additional cashback, or even linking several cards in one digital wallet.

Which Card Provider Should I Choose?

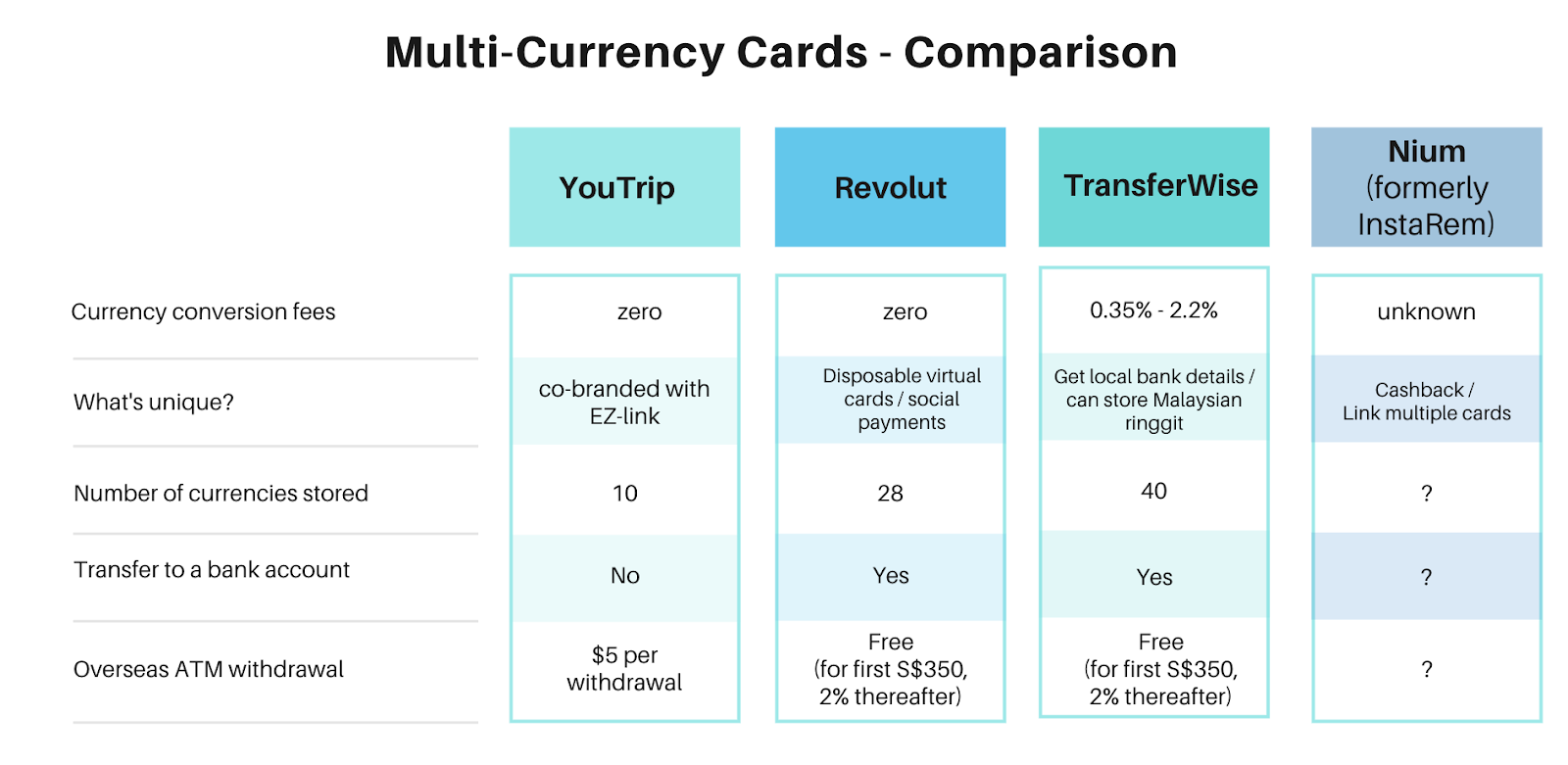

The above summary table shows how the competition stacks up. To be frank, they each have their strengths, so ultimately you’ll have to decide which card best fits into your lifestyle and spending patterns.

YOUTRIP

BEST FOR busy professionals and the older generation

If you want a fuss-free solution with the best rates, then YouTrip is the top choice.Among all the providers, YouTrip’s user interface is the simplest to use. Coupled with the fact that it has been around since 2018 and is co-branded with EZ-link, this makes it easier to introduce it to your parents who may still be skeptical about cashless technology. Just tell them that over 400,000 Singaporeans are already on it, and there’s no reason for them to miss out. It doesn’t have swanky features like remittance or saving vaults, but you won’t need them anyway if all you’re looking for is a card to spend with.

YouTrip’s biggest advantage is that it offers the best rates with no conversion fees or surcharges. Nothing is charged to the consumer; they earn money from the merchants instead. On several occasions where I compared the exchange rates between YouTrip, Revolut and TransferWise, YouTrip (almost) always came out tops.

Some people argue that you can’t withdraw your balance from local ATMs – but neither can the other providers so that point is moot. Plus, that’s hardly a big deal considering how you can easily spend via public transport or link your card to ShopBack Go and use the money to pay for your meal. Using this method, I’ve been able to zero-ise it without issues.

Use “GIMME5” to get $5 when you apply for your YouTrip card here!

REVOLUT

Best for online security and social payments

There’s so many benefits with Revolut that I hardly know where to begin – low rates, saving vaults, multi-lock card features, an option for virtual cards that self-destruct after usage (somewhat like SnapChat) and even social payments!

If you frequently travel with friends, then Revolut truly is a no-brainer (get your friends on it too) due to its function that allows you to split bills with your contacts easily (similar to WeChat). No other card provider gives you this ability to send and receive money from your friends, and you don’t even need to be in the same country either. Imagine finally being able to send emergency money to a friend or family member on the other side of the world! Parents who have children studying overseas will no doubt find this feature extremely useful.

With its real-time exchange rates and no commission fees, you’ll no longer be ripped off whenever you have to transact with a foreign merchant. There’s also a lot to love about its gorgeous card designs, which comes in 3 different options depending on your membership tier. At the sign-up page, you’ll have to top up $20 to verify your identity which goes straight into your card balance thereafter.

For those who frequently make online payments, you’ll appreciate the card’s multi-lock feature and disposable virtual cards that self-restructure and re-generate upon a successful transaction. The card credentials, which are only valid for a one-time use, is especially handy for card payments to shady websites that you don’t trust to handle your card details. With just a small monthly subscription fee to the Premium or Metal tier, there is no more need to be afraid of credit card fraud anymore. And considering the rise of Singapore victims to online scams, you could easily issue a disposable virtual card for yourself or your parents’ one-time use so that there’s zero possibility of fraud.

You also get to withdraw from overseas ATMs for free, up to S$350 per month, as the fees are absorbed by Revolut. Get 2x of that with Premium, or 3x if you’re a Metal member.

Psst, if you’re on the Metal tier, you also get a whole host of other perks like cashback, unlimited FX transactions, overseas travel insurance that also covers anything bought with Revolut (including damage of items), family and youth accounts (still in the works), unlimited disposable virtual cards and even commission-free stock trading (still in the works)!

The only downside to Revolut is that you need to pay a mark-up for currencies exchanged on weekends, which you can easily avoid by doing this on other days instead. Set notifications for a preset exchange rate (just like on a FX trading platform) and make your exchange then. And, unless you convert above S$9,000 a month, there are absolutely no conversion fees at all.

Get your FREE Revolut card here.

TRANSFERWISE

Best for remittance, businesses and exchange/overseas students

When I studied abroad almost 10 years ago, I ended up paying a lot of fees to the banks in the form of higher exchange rates and ATM withdrawal fees. At that time, cashless payments weren’t that popularized yet. If I had TransferWise back then, I could have saved so much more.

Aside from exchange students, TransferWise is also the best option for anyone who receives salary or make regular payments in foreign currency (including freelancers who work with overseas clients, or e-commerce shops paying their China suppliers). This is due to the fact that you can get your bank details in each currency wallet, which none of the other multi-currency card providers offer.

You can also store up to 40+ different currencies in your account, which is the most among all the digital wallets.

Its biggest downsides? There is a slight currency conversion fee, usually about 0.7% (to find this, click on their website and key in the currencies that you want, then divide backwards to find out the rate) so if you’re only using this for online payments and irregular holidays, then you might as well go for lower rates via other brands instead.

Get your TransferWise card here.

INSTAREM

Best for convenience and cashback.

InstaRem (now rebranded to Nium)’s most exciting proposition is that it converts all your spend into the “online” transaction category, so you can now get around MCC codes in this way What’s more, you can link up to 5 Mastercard debit/credit cards to a single AMAZE card, thus declutterring your wallet.

On top of that, the AMAZE card also offers 0.5% cashback on top of to your existing credit card rewards. This means that you can double-dip your rewards to earn even more cashback (or cashback on top of your miles / points)!

Get your amaze card here.

TLDR: Which is the best multi-currency card to get?

With so many options available, it can be dizzying to decide which would be the best card to get. Of course, we all want the card that offers the lowest exchange rate, but after studying each of them I realised that the rates are generally competitive.

Revolut’s rates could be slightly higher than its peers on weekends, but otherwise, they’re pretty much all the same. Unless you’re transacting a huge amount, the minute differences shouldn’t bother you too much.

What should you use to decide then?

- If you want the best rates and get your parents on it, then choose Youtrip

- If you’re concerned about online security and social payments, then choose Revolut

- If you mainly need to send money abroad, then choose Transferwise

- If you want cashback, then the no-brainer option is InstaRem

With love,

Dawn

1 comment

Nice info given! You might want to see the following link.

https://www.pennycryptoclub.com/mco-visa-debit-card/

Comments are closed.