With 1 in 2 Singaporeans already having some form of passive income, you’ll be lagging behind your peers during retirement if you’ve yet to start. What’s more worrying is that only about 60% of women have started planning for retirement, in contrast to 70% of the men. If you’ve yet to start, check out how you can use OCBC Financial OneView and OCBC Life Goals on the OCBC Mobile Banking app to help.

If you’ve been wondering what you need to do now in order to ensure you’ll have enough for retirement, a good start is this nifty mobile banking app which has all the digital financial planning tools you need. It not only helps you gain a bird-eye view of your finances, but will also provide suggestions on how you can make better financial decisions.

Plus, if you’re a fan of (virtual) envelope budgeting, you can also make use of the budgeting tool in the app to separate your “not-to-be-touched” savings from your regular spending money. What’s more, you can also plan better by getting insights on your money, and even find out how much you may need for your child’s education expenses or for your retirement with OCBC Life Goals.

What I appreciated most was that OCBC Life Goals retirement planning tool served as a great reminder on 3 key messages – the role our CPF plays, the need to build multiple sources of income, and the impact of starting early. Read on to see how my journey was like!

—

First, we start planning in 3 simple steps:

Step 1: Get a macro view of your finances

Step 2: Get insights and identify where you need to start planning

Step 3: Simulate and run projections on what you’ll need for your goals (e.g. children’s education fees, your retirement monies)

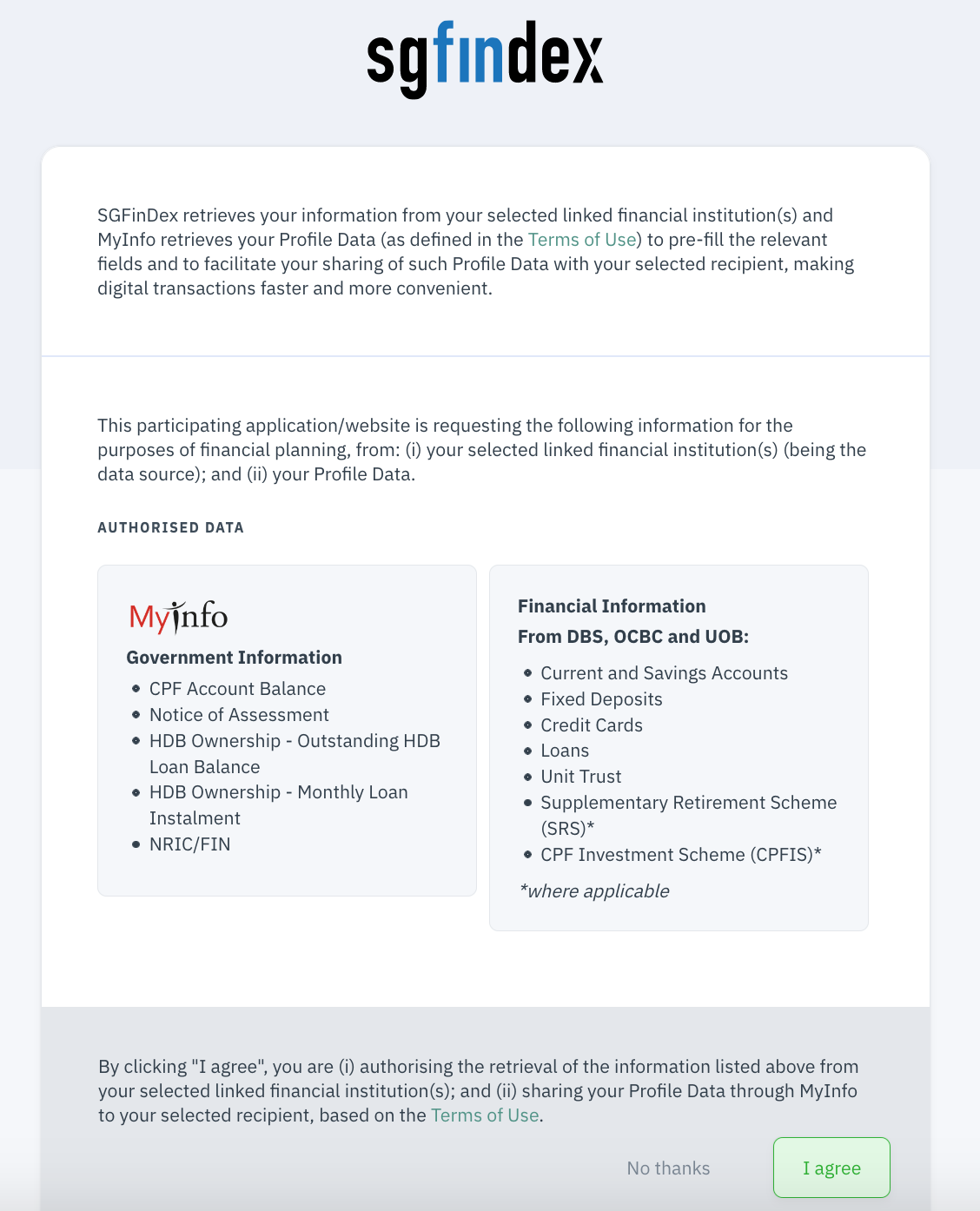

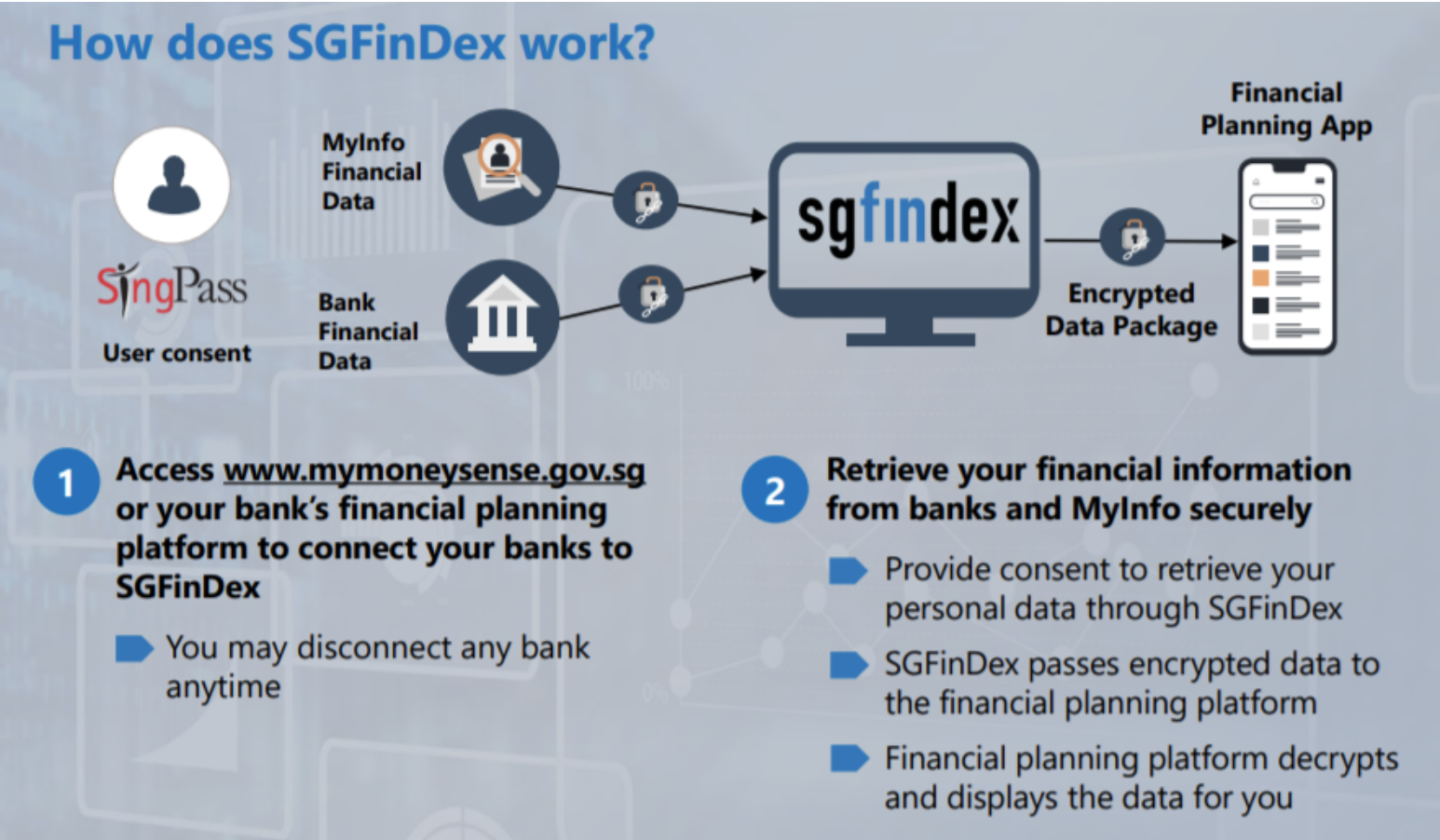

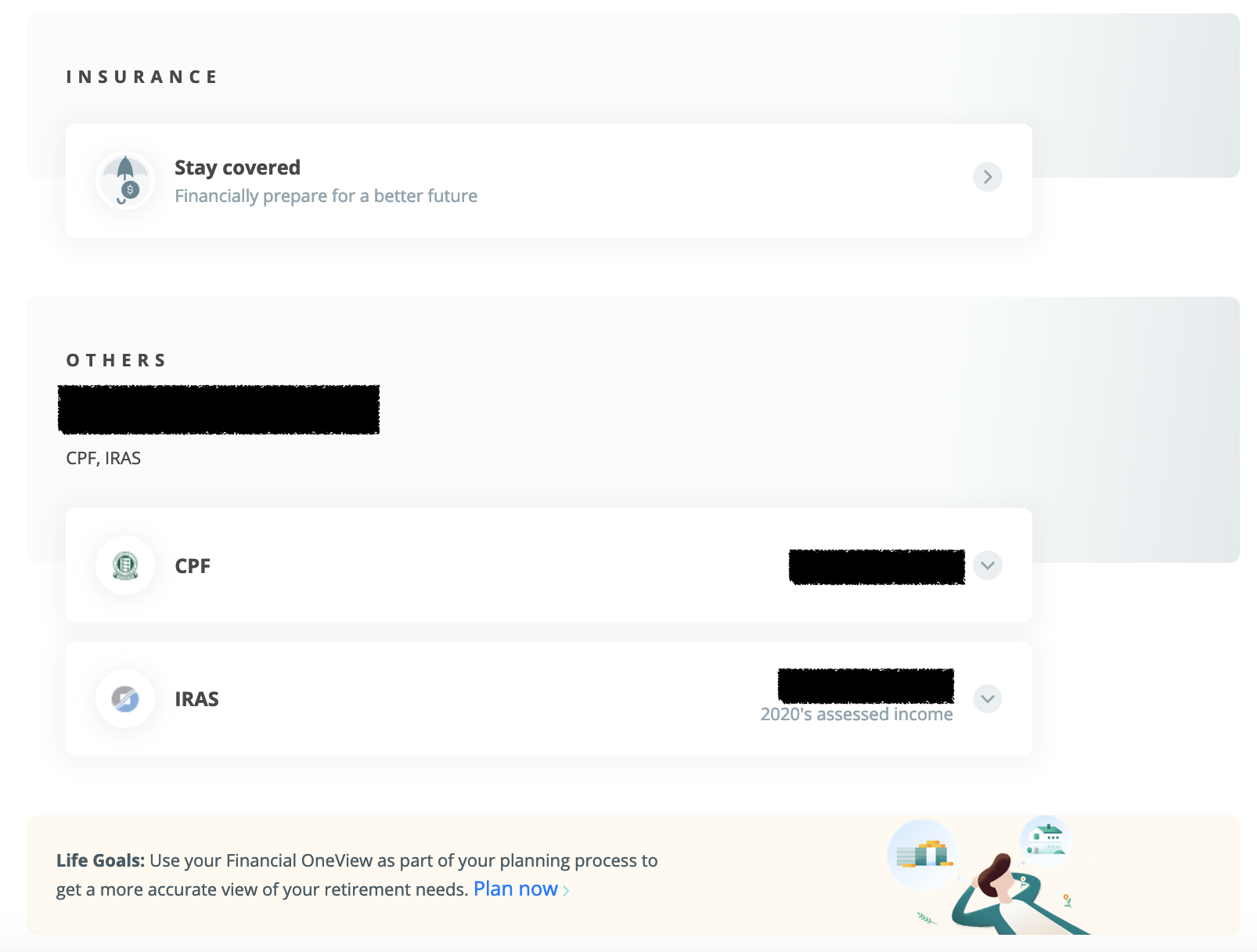

Thanks to SGFinFex, you can now easily do this by consolidating on OCBC Financial OneView to get a picture of your overall financial health.

|

| Source: The Straits Times |

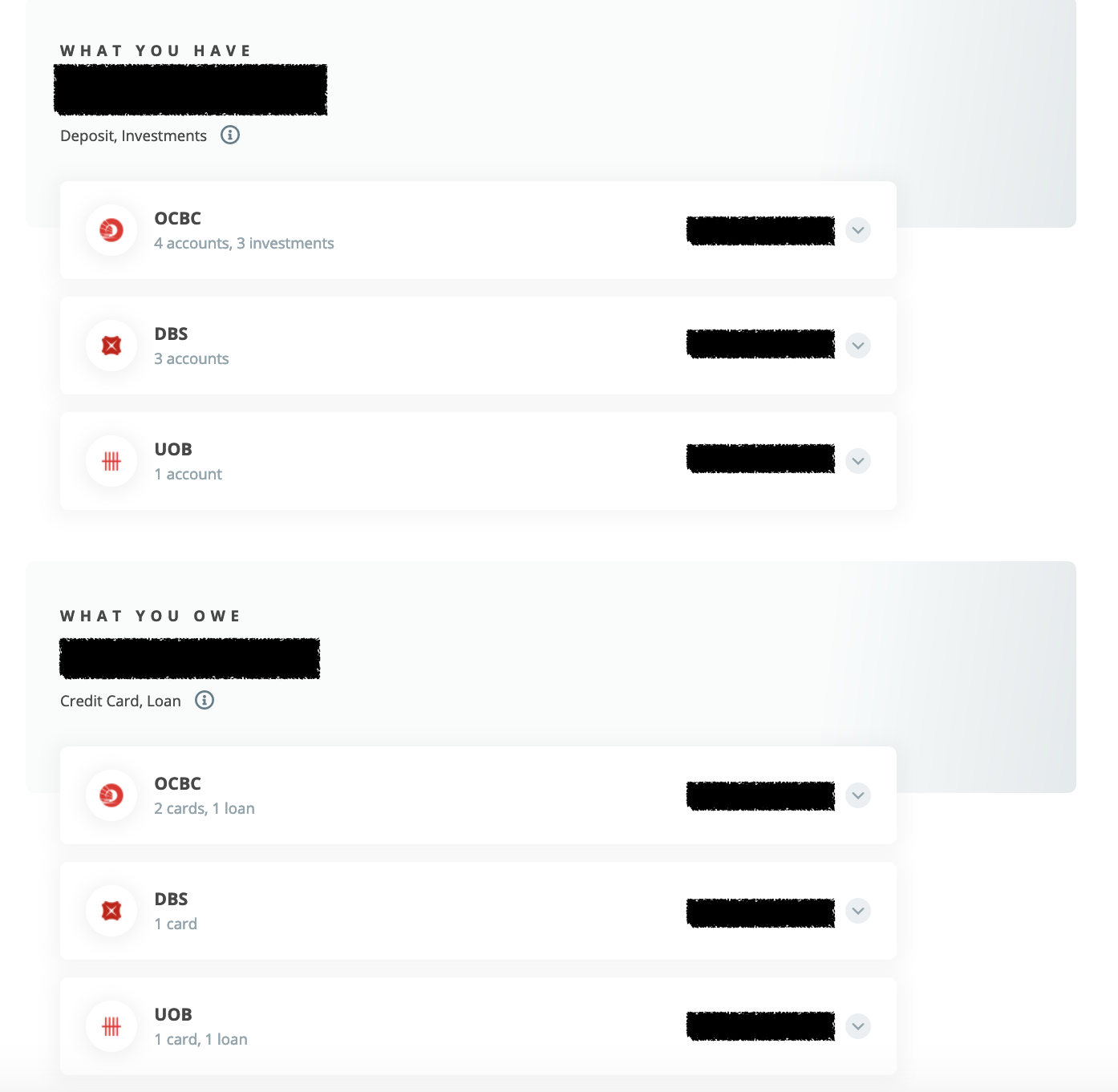

Once everything had been synced, OCBC Financial OneView was able to factor in my entire net worth across my various bank accounts, income, housing loan, and even my current CPF savings to help me plan for retirement.

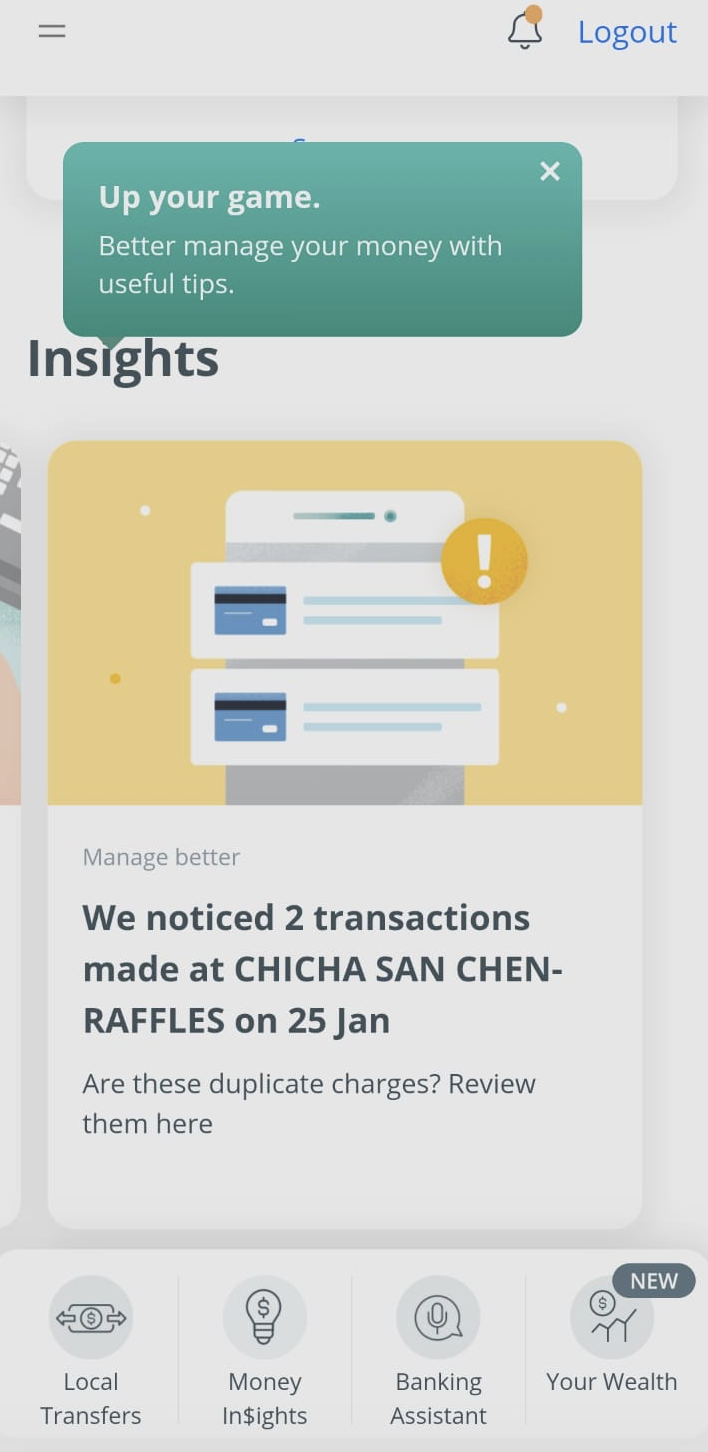

If you already have the OCBC Bank mobile app on your phone, you might even have noticed the brand-new ‘Personalised Insights’ feature that helps to track your spending and “nudge” you when you might be going off-track:

|

| Spending on bubble tea too often? The app will “nudge” you with these reminders, so that you’ll think twice the next time 😛 |

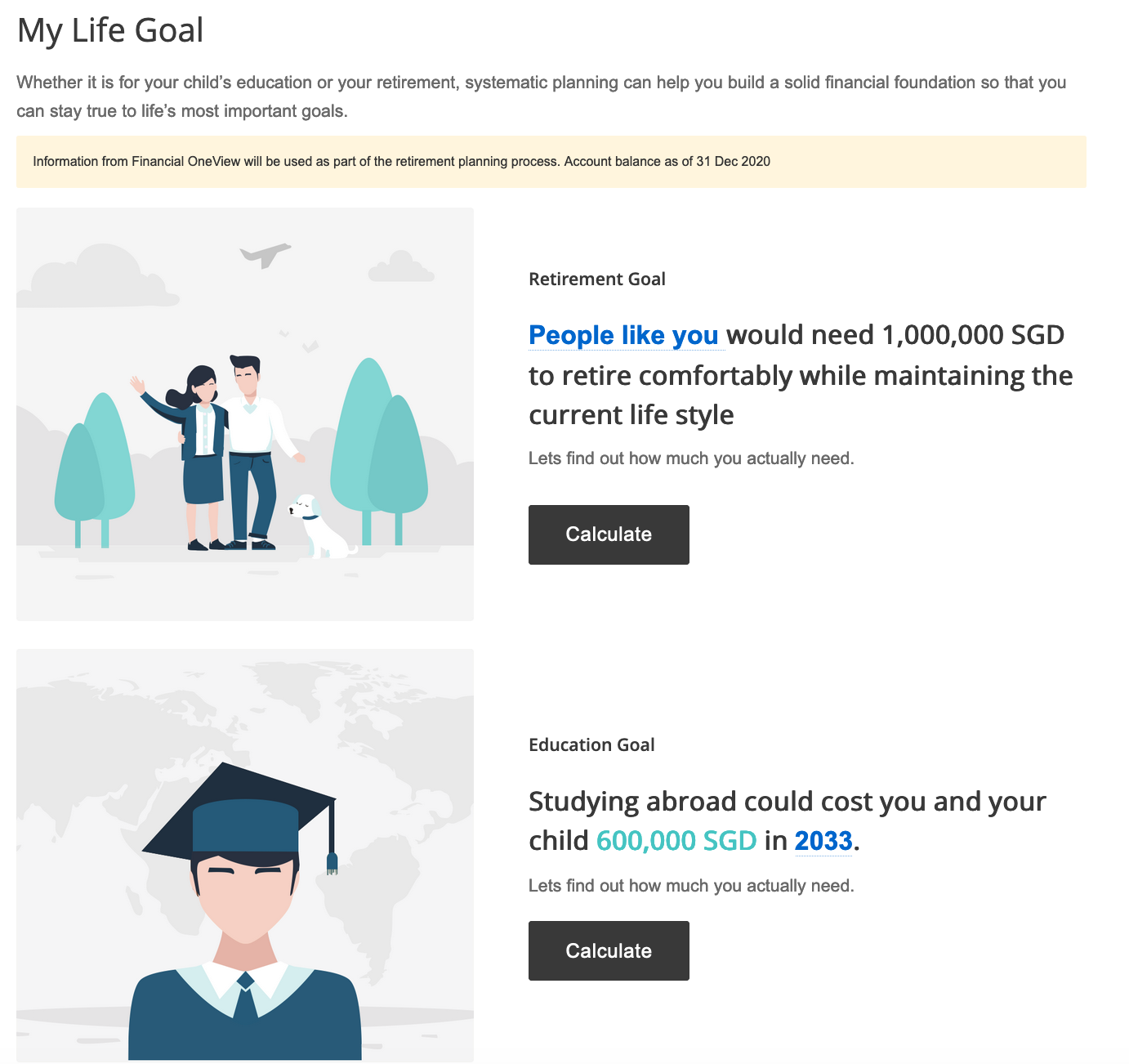

Under “Life Goals”, you’ll be encouraged to start thinking about more long-term objectives for retirement and your children’s education.

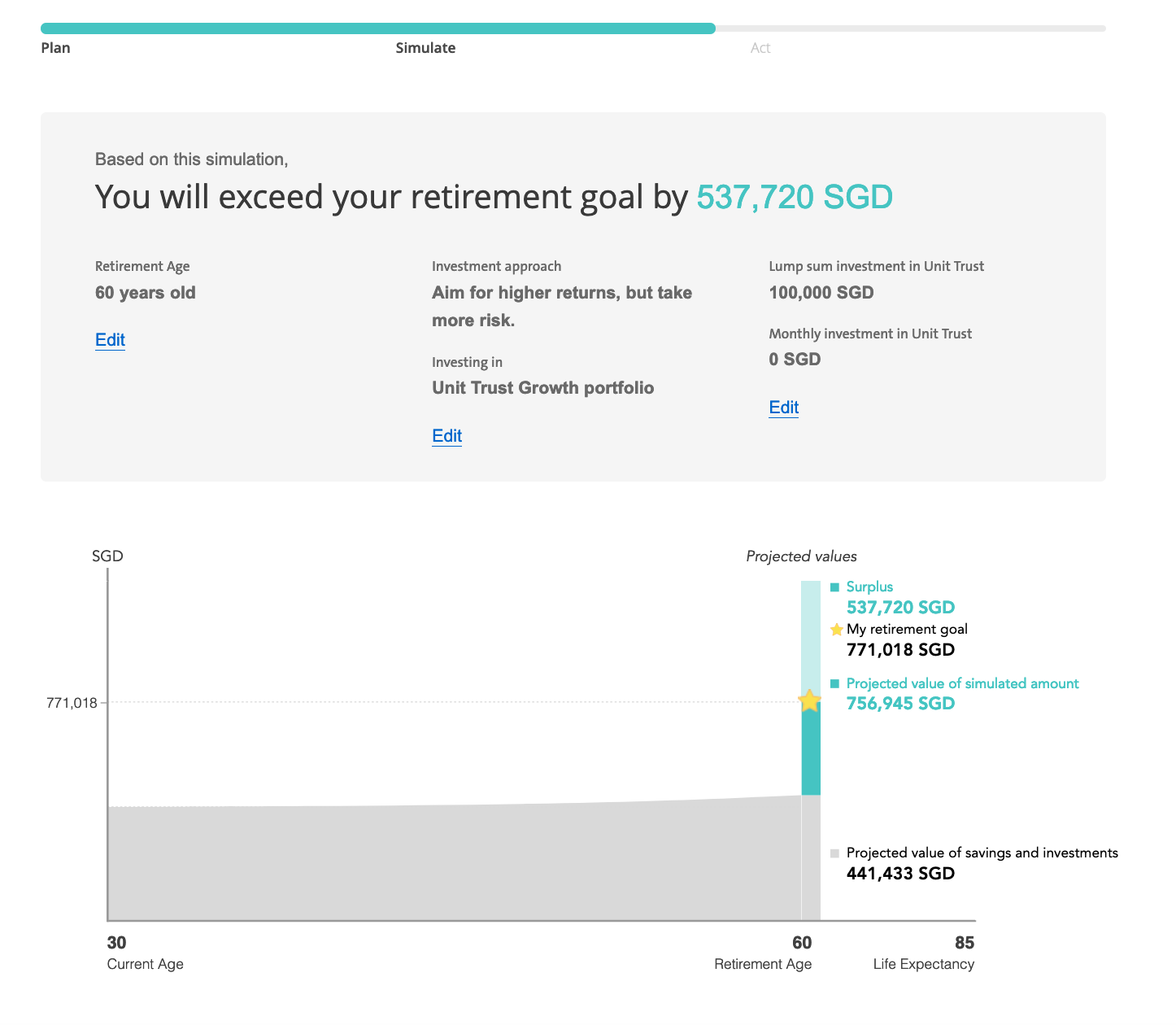

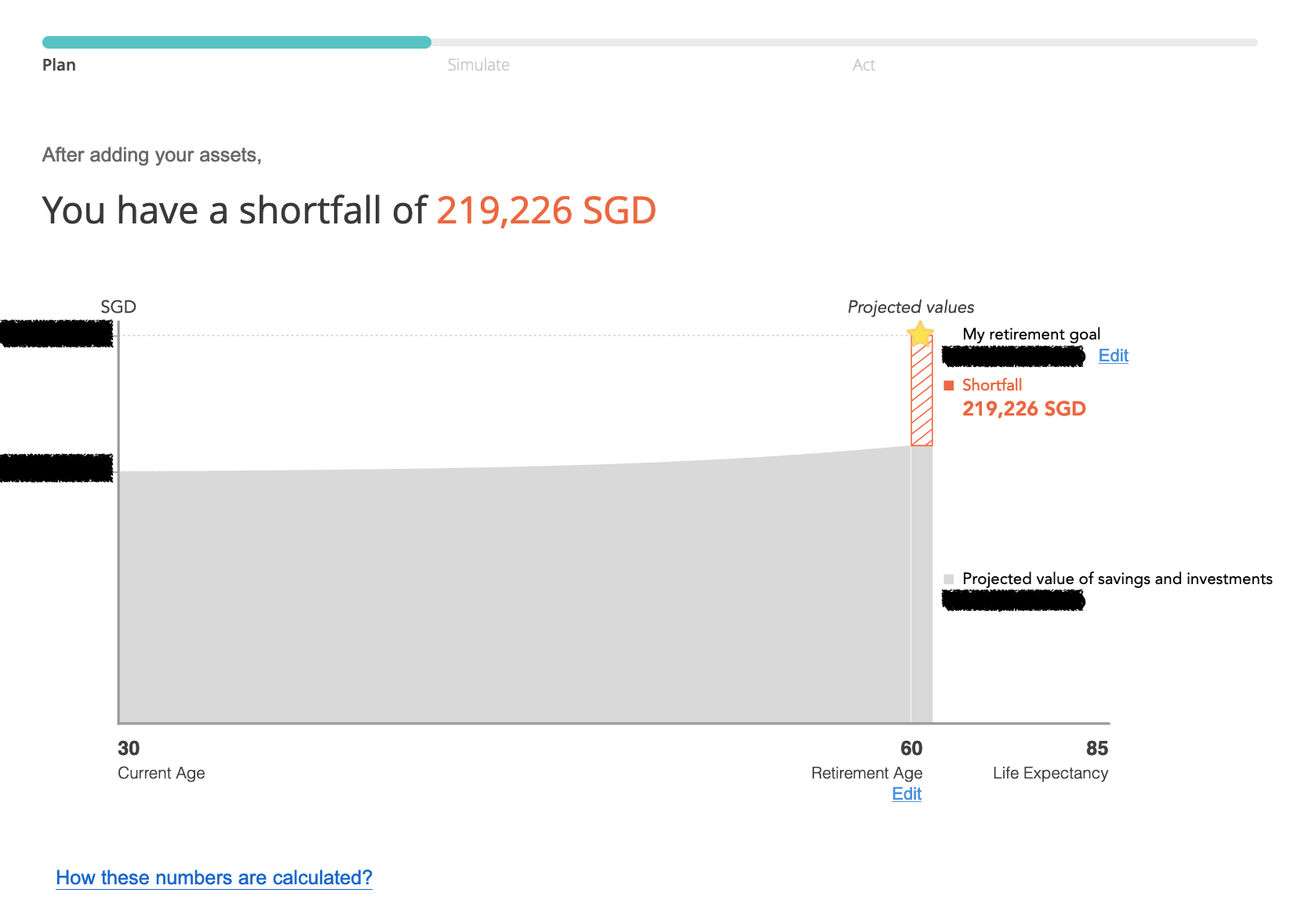

I wanted to see the type of suggestions the tool would propose for someone who isn’t on track for retirement, so I tried a (fake) simulation which gave me this:

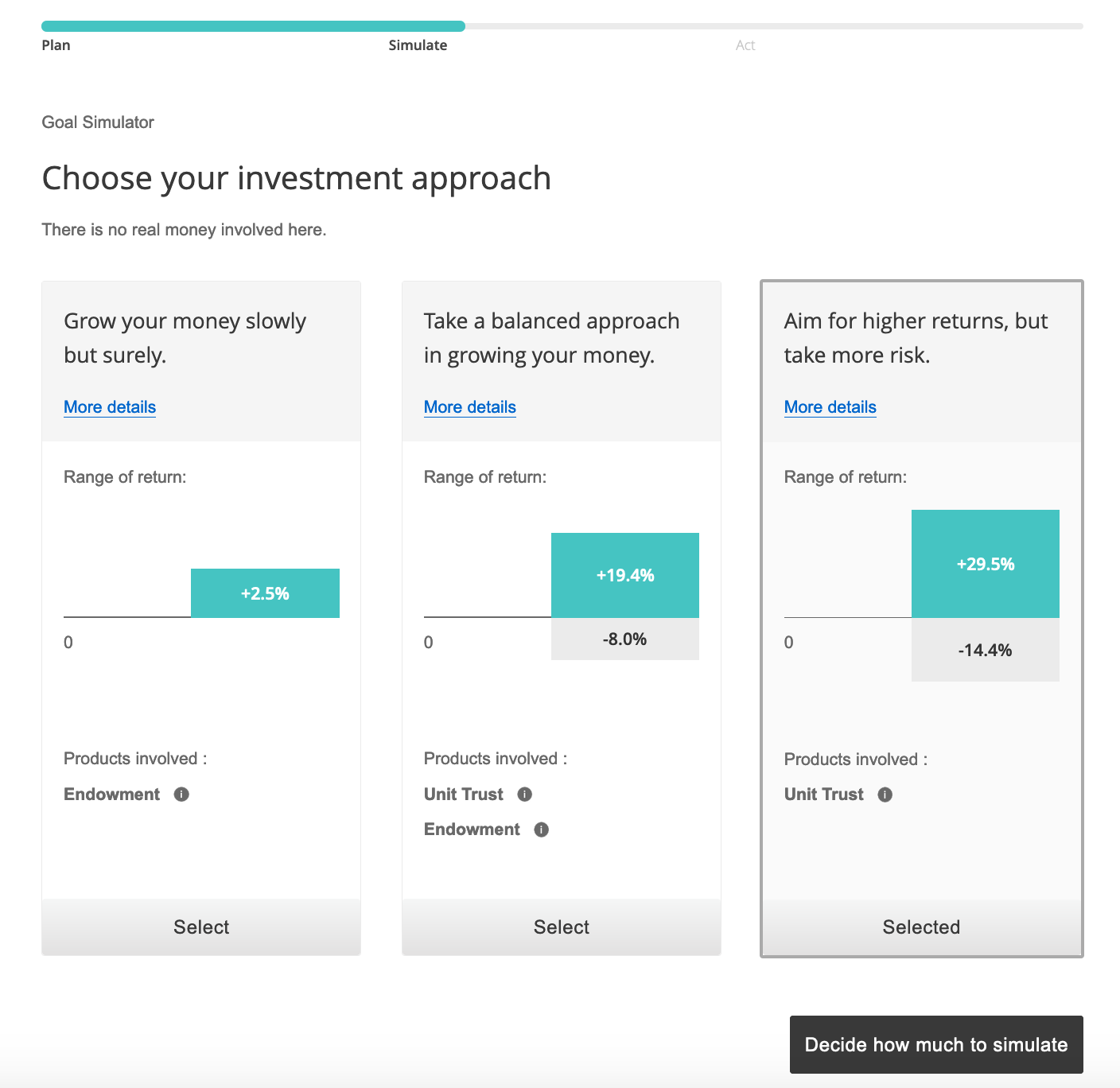

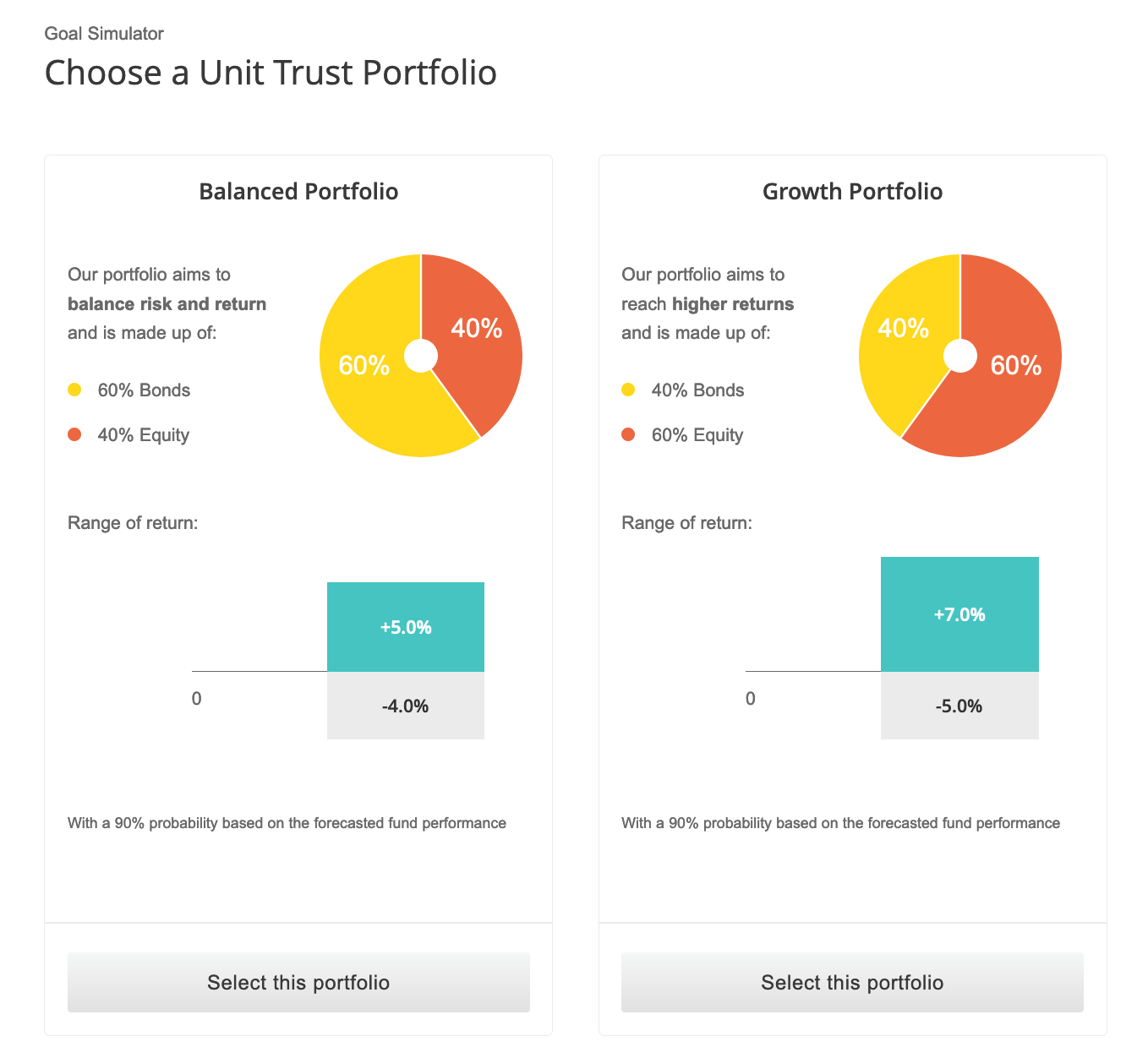

The following investment products were then proposed:

While your preferred choice of investment products may differ, I feel this does provide a good picture for folks who haven’t started investing at all, as it shows the power of what investing can do for your financial future.

1. CPF is a crucial foundation for our retirement adequacy.

One of the best moves I made in my 20s involved (i) making voluntary cash top-ups to my CPF-SA and (ii) transferring a bulk of my OA to my SA.

It not only helped to reduce my taxes, but also ensured that my CPF grew at a rate faster than inflation. And as my salary grew, my CPF contributions also grew in tandem over the years, enabling me to hit $100,000 in net savings before I was 26.

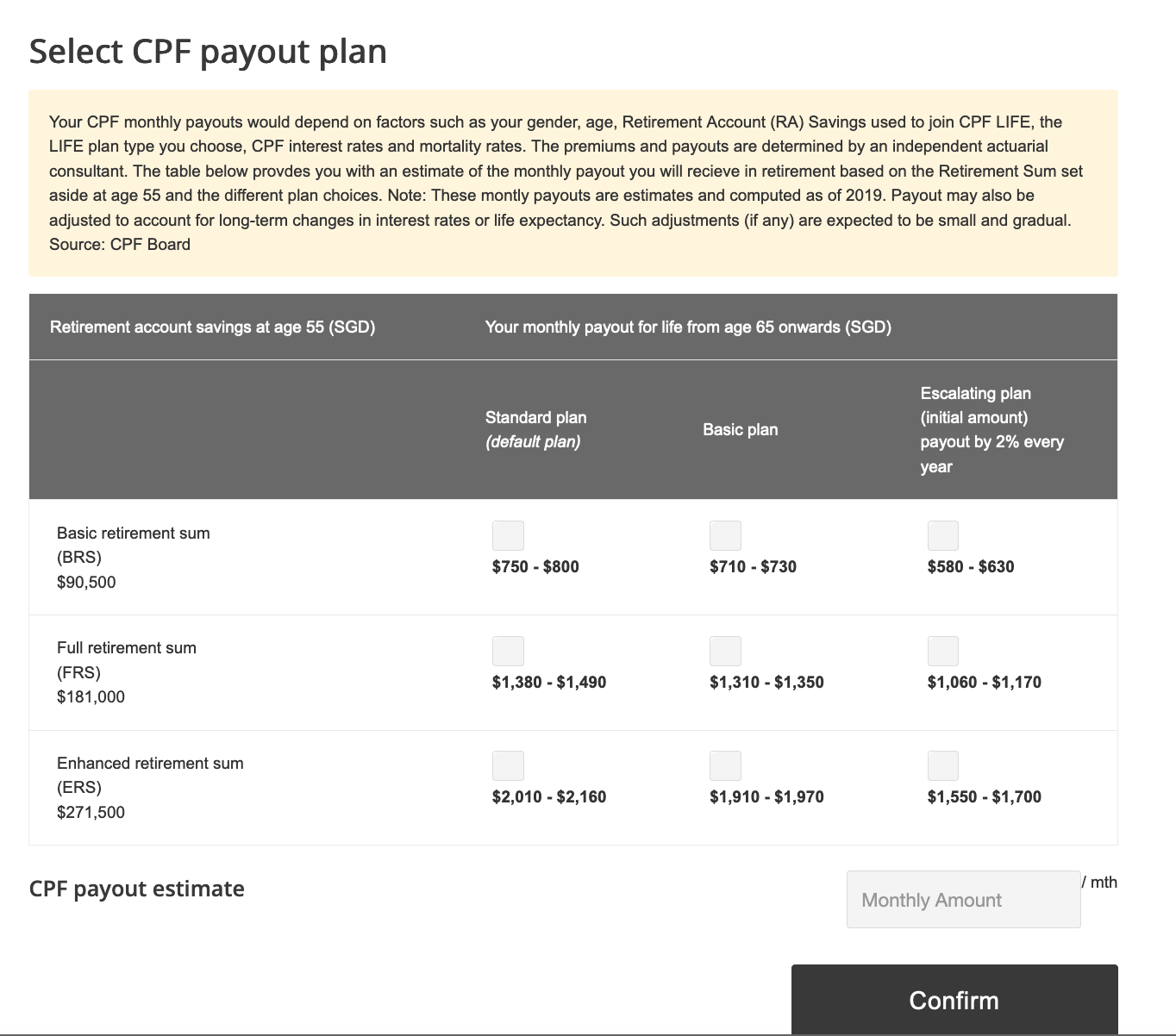

You’ll be asked to choose your desired CPF Life payout plan. Since I’ve already planned to ensure my CPF savings hits the ERS sum before I retire, I selected the ERS Standard Plan accordingly.

My dad is currently retired, and the same story goes – with minimal cash savings, his CPF payouts form the bulk of his living expenses in retirement.

With at least $2,000 of CPF payouts in mine, that’s a good start, but still not enough.

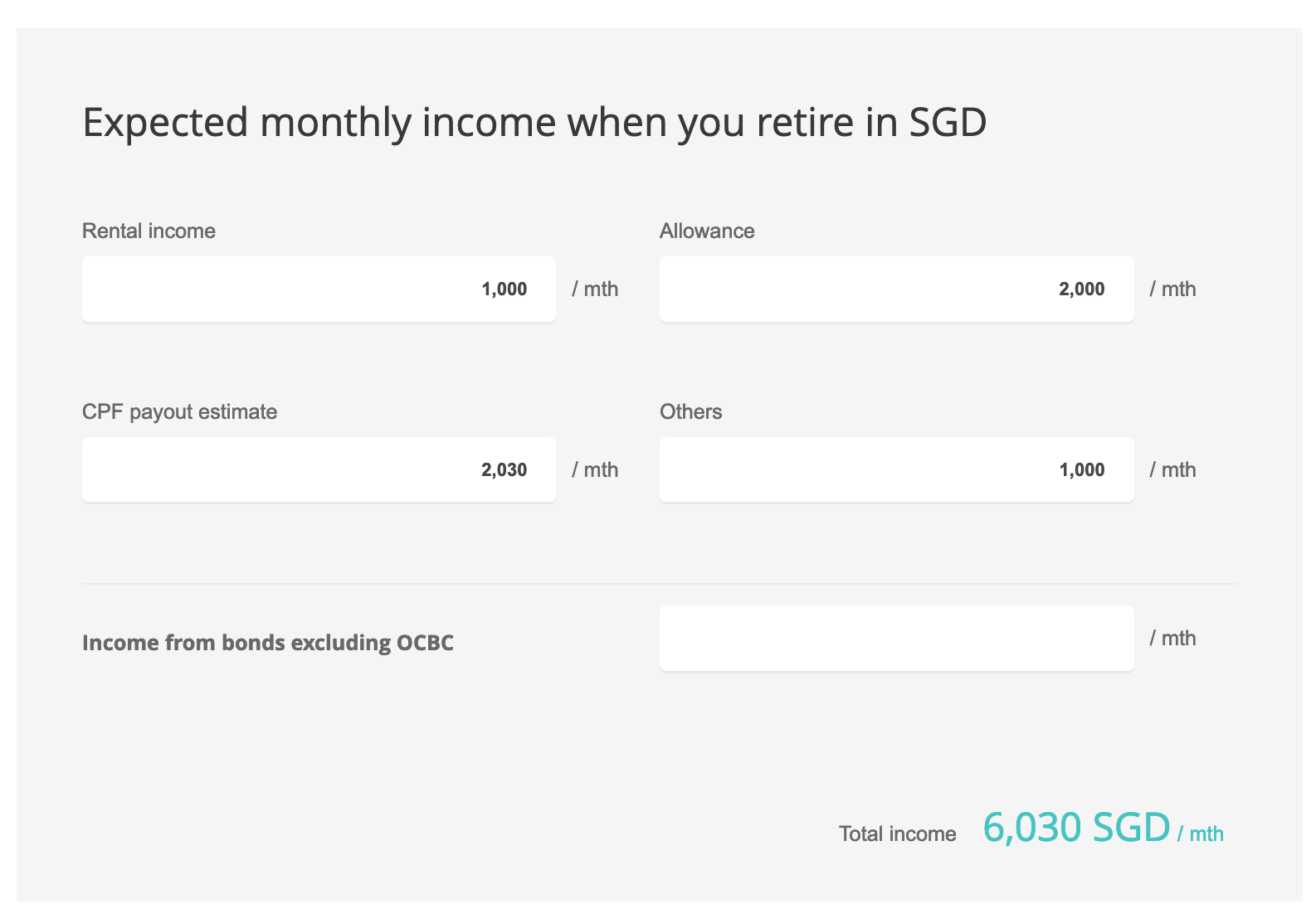

2. Building a combination of multiple sources of income will help me to meet my retirement cashflow needs.

So I tried again, this time using the following plans and assumptions:

- Rental income: from an investment property

- Allowance: 5% annual dividend payouts from an investment portfolio

(If you think this is unrealistic, it is actually just 5% yield on a $500k portfolio, which should not be hard to reach by the time you’re 60.) - Others: passive income from business and royalties

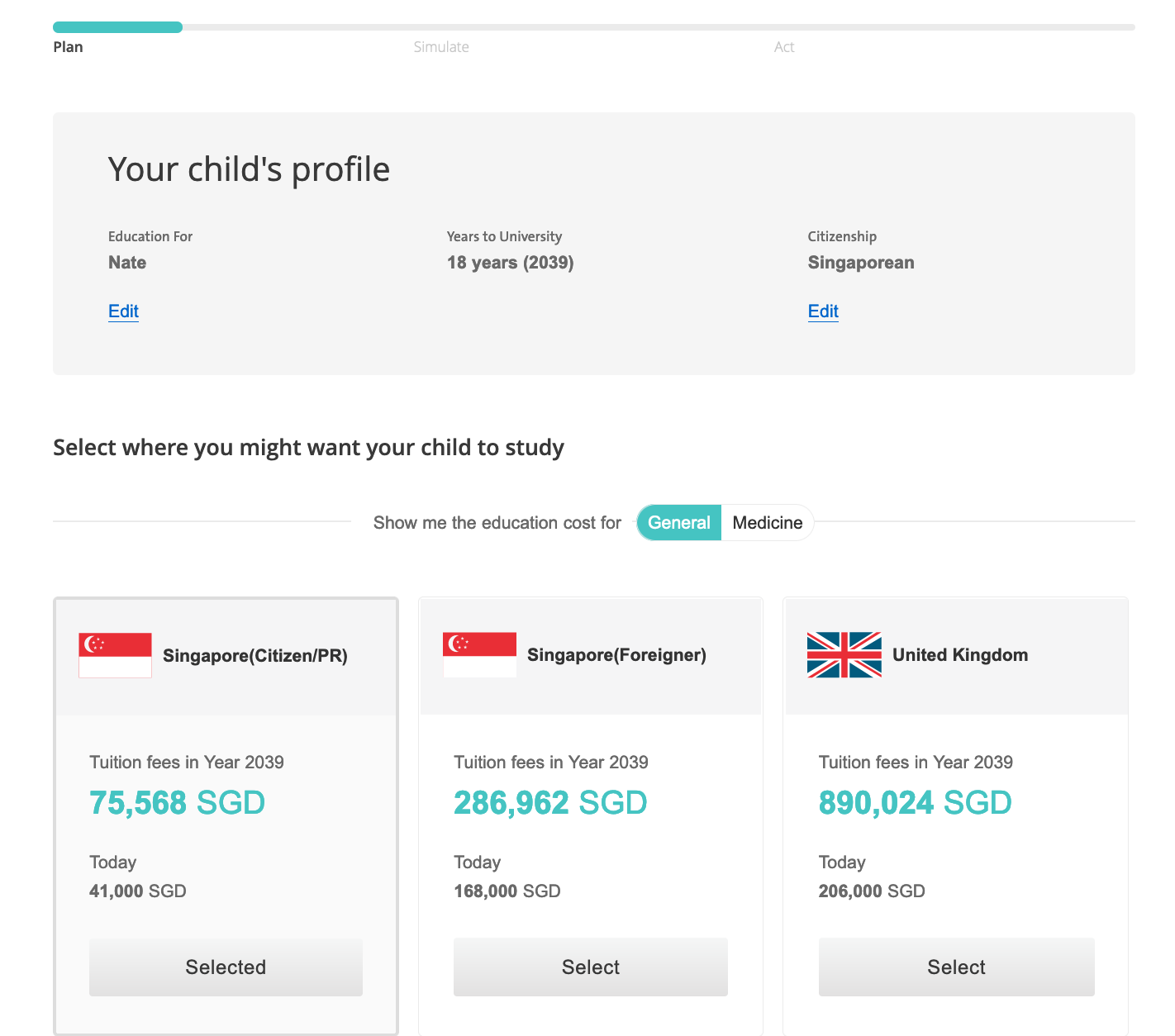

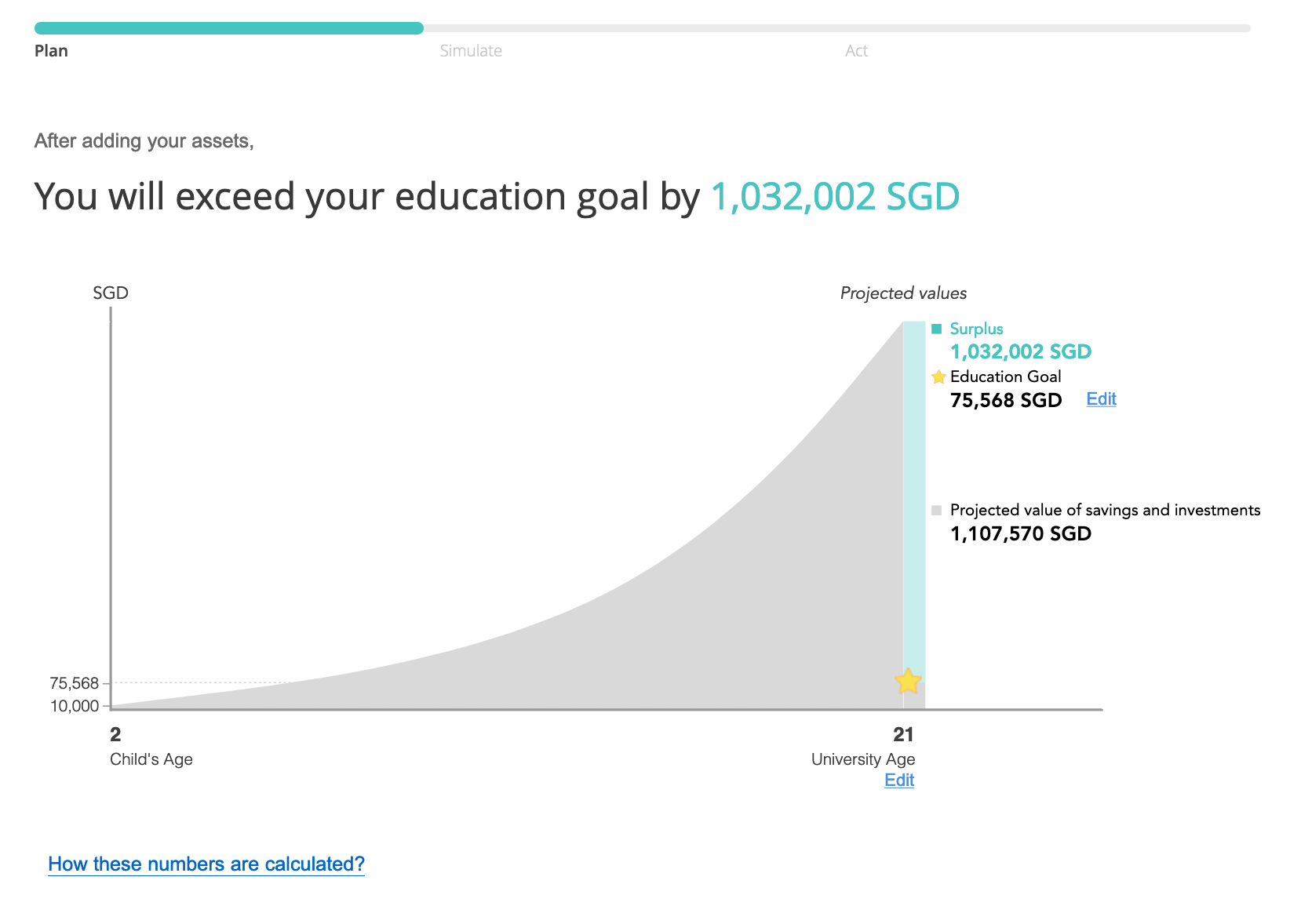

3. By starting early, we are likely to have enough for our kids’ education.

To be honest, my husband and I do worry whether we’ll have enough for our children’s education fees, especially given how quickly university fees have been rising over the years.

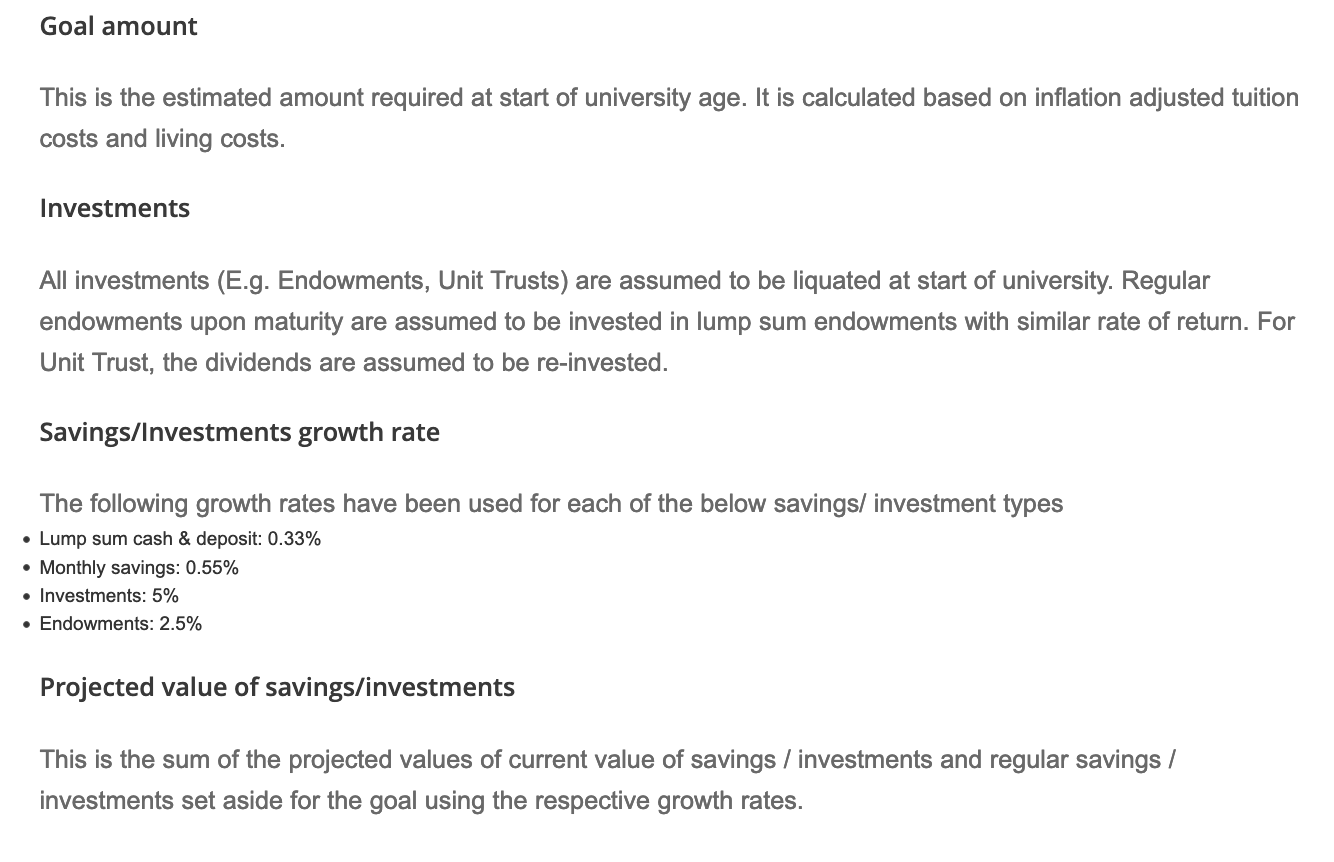

If you were wondering how I got here, these are the inputs:

- $10,000 investment portfolio (at age 2)

- $4,000 cash (from Baby Bonus)

- $350 monthly investment

- Get insights on your finances

- Understand your goals, and your current gaps

- Simulate different financial outcomes of your investments

- Build your portfolio (the tool links directly to the bank’s products so you can get started right away if you want to)

- Review regularly to make sure you’re on track to achieving your goals