Did you know? More Singaporeans are making cash top-ups to their own CPF accounts and that of their loved ones, with over 1.6 billion in the first 10 months of 2019.

I’m definitely part of that statistic, as I’ve been topping up $7,000 to my CPF Special Account (SA) every year. Aside from the tax reliefs, this move was also instrumental in helping me to compound my CPF monies at a much faster rate.

If you aren’t already doing so, it might make you wonder if you’re missing out on something. But before you simply follow the herd, it is important to understand why we’re doing so, and then decide if it works for your situation too.

In my case, I started my CPF journey in 2014, after speaking to many wiser and older folks (including my dad). I got to understand the need to optimise my CPF early enough, in order to leverage on its benefits for my retirement.

One of the first moves I made was to:

Make Cash Top-Ups To My CPF

I’ve been topping up a specific sum of $7,000 without fail each year. Why $7,000? Because that’s where I get maximum tax relief from making cash top-ups.

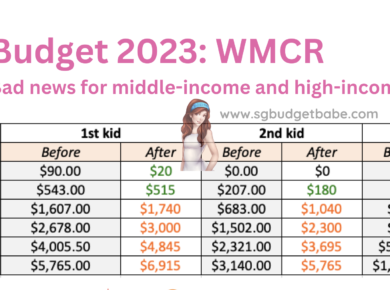

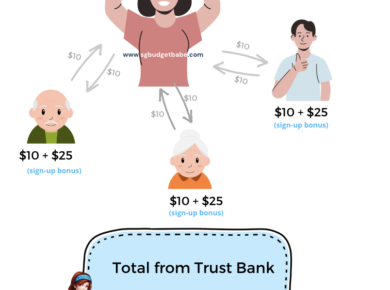

For those of you who don’t know – if you are making cash top-ups for yourself, you can enjoy tax relief equivalent to the amount of cash top-ups made, up to $7,000 per calendar year (until you’ve reached the prevailing Full Retirement Sum).

If you are also making cash top-ups for your loved ones – parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings, you can enjoy additional tax relief of up to $7,000 per calendar year. You can read more about the Retirement Sum Topping-Up Scheme here.

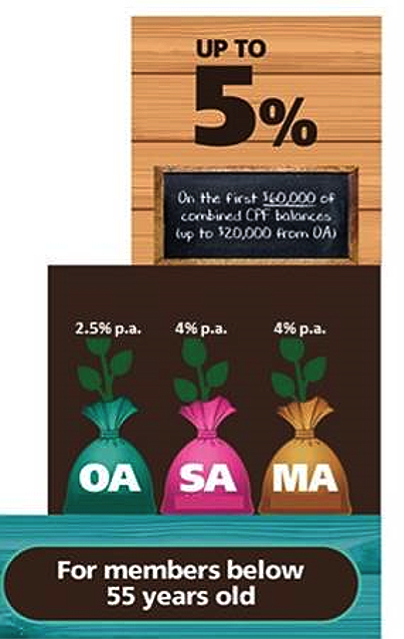

With the first $60,000 of your combined CPF balances ($20k from your Ordinary Account) earning an additional 1% a year, that also means that the sooner you get to that $60,000 milestone, the more years you get to earn that 5% (SA) and 3.5% (OA) interest.

The hack is to leverage on this extra 1% interest by reaching $60,000 as soon as possible, so you can leave it to compound for longer.

Cash top-ups help you to increase your CPF savings, which then allows you to (i) earn more interest and (ii) compound that sum faster. The sooner you start, the more it’ll grow.

The next move I made was to:

Transfer CPF Savings from my OA to SA

If liquidity isn’t a key issue, then transferring from your Ordinary Account (OA) to Special Account (SA) makes a lot of sense because you get more interest. But if you need the funds in your OA to pay for your housing (whether now or in the future), then you can also do a calculated transfer, whereby you leave some funds in your OA just in case.

That’s what I did. When I first started on my CPF journey, I wasn’t sure how much my future house would cost me (will we be able to get a BTO? Or will we need to get resale, considering how old our parents are?). As such, I transferred a bulk of my OA funds to my SA, leaving just enough so that I have the option of using my CPF to pay for my house if we needed to.

Now that my house is settled, I’ve opted to leave enough in my OA to pay for a year of my mortgage. This serves as an emergency fund, just in case we ever run into cash liquidity issues, especially given the current economic climate. I then transferred the rest of my OA savings to my SA, to grow my pot of gold for retirement.

My dad also made a strategic move with his CPF, which was to:

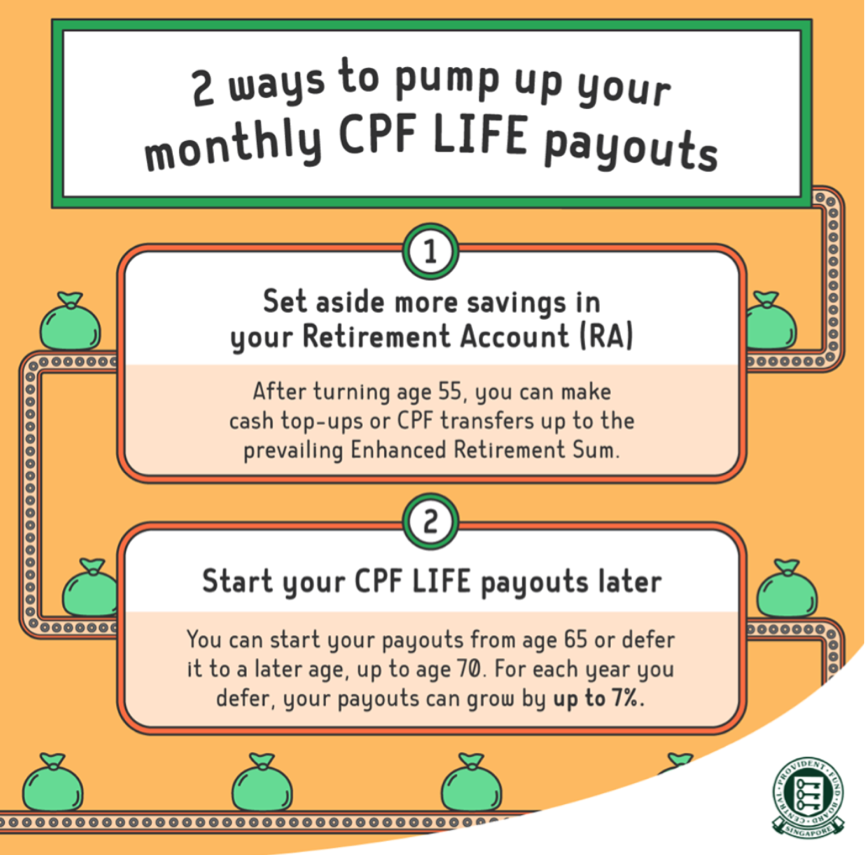

Delay His Starting Payout Age

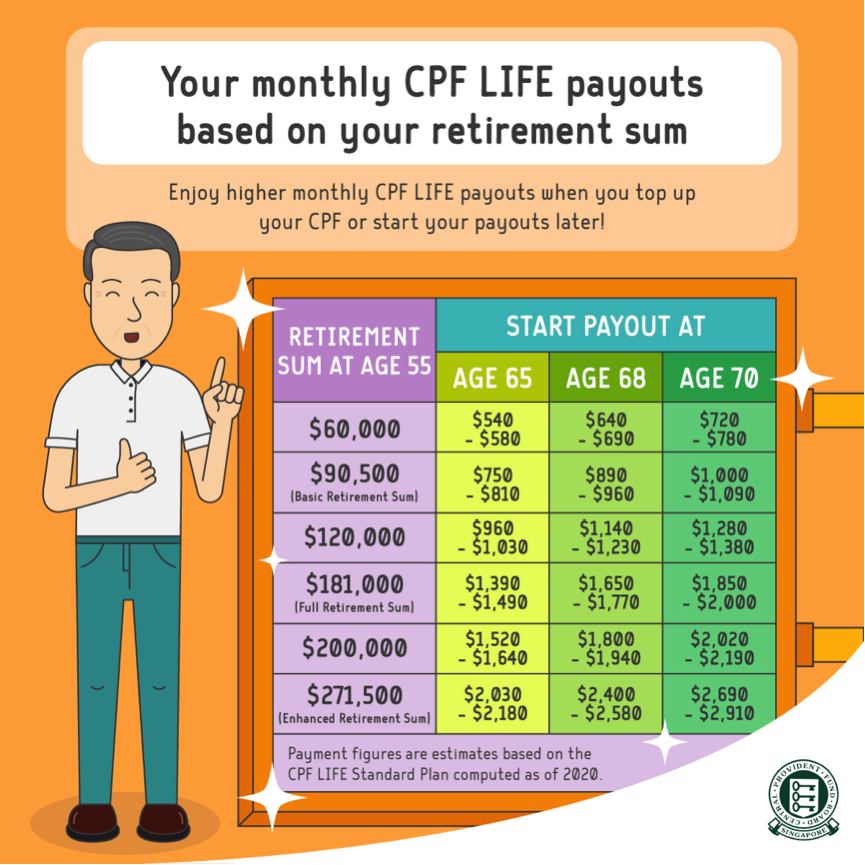

As my dad did not have much retirement savings on his own, mainly due to an unexpected medical condition and treatments that depleted his savings, he always believed that CPF LIFE would become one of his core retirement income streams when he retires. The monthly payouts that he receives from it for the rest of his life would go a long way towards paying for his living expenses.

As he was still working and didn’t need the extra income immediately then, he chose to delay his starting payout age (at 65) so that he could receive a higher payout later on.

As for us, we are glad that he has CPF LIFE, because if not, he would be completely dependent on me for his monthly allowance in future. This would have been extremely difficult because I too, have my own bills to pay and 4 other dependants to support.

This was what my dad told me, when I asked him why he did not start his monthly payout when he was able to at age 65. Another factor was that because he delayed his CPF payouts, he was motivated to continue working for another 2 years instead of retiring when he could, and that helped him to accumulate more funds as well.

You Decide What You Want Your CPF To Be

For people like me, CPF is a fantastic safety net to ensure we have our basic retirement needs covered. But for some others, it might not be, especially if you’re a high-income earner and can get better returns outside of what CPF is offering. In that case, then it probably makes sense to channel your funds elsewhere and build up your own retirement fund.

But not everyone has that luxury. Some of us (especially if you’re the sandwiched generation stuck between supporting your children and elderly parents) struggle to have enough left to save for our own retirement.

Which is why you have to decide what works best for you. You’re in full control of what you choose to do with your CPF, and whatever you act on now will determine your returns later. For instance,

- If you choose to wipe out your OA for your house, then you have to be prepared to have less in your retirement savings. This in turn may translate to lower monthly payouts during your retirement.

- If you choose to make cash top-ups and OA-to-SA transfers early, then you get to take advantage of more interest paid to you and thus grow your retirement savings significantly.

There are many ways to utilise your CPF, but just like my dad, I intend for CPF LIFE to be one of my core streams of income when I retire (together with stock and shareholder dividends). Which is why it makes sense to start accumulating more money in my SA beyond my usual salary contributions –> so that I can achieve the Full Retirement Sum earlier –> and then let the 4% base interest pay for future incremental adjustments.

What other CPF moves do you guys make?

For more tips on what you can do with your CPF, head over to their Facebook page and Instagram here.

This post is written in collaboration with CPF Board. All opinions are that of my own, showcasing my own personal journey of actions that I’ve already made prior to this.

2 comments

This comment has been removed by a blog administrator.

HOW I GOT A GENUINE LOAN!

i was in need of loan some month ago. i needed a loan to open my restaurant and bar, when one of my business partner introduce me to this good and trustful loan lender STEVE WILSON that help me out with a loan of $420,000, and is interest rate is very low, thank God today. I am now successful, If you are look for any kind of loan. You can Email him at: stevewilsonloanfirm@gmail.com or whatsapp:+16673078785, Company website:https://stevewilsonfinancialloanfirm.webs.com/

Thanks Steve.

Comments are closed.