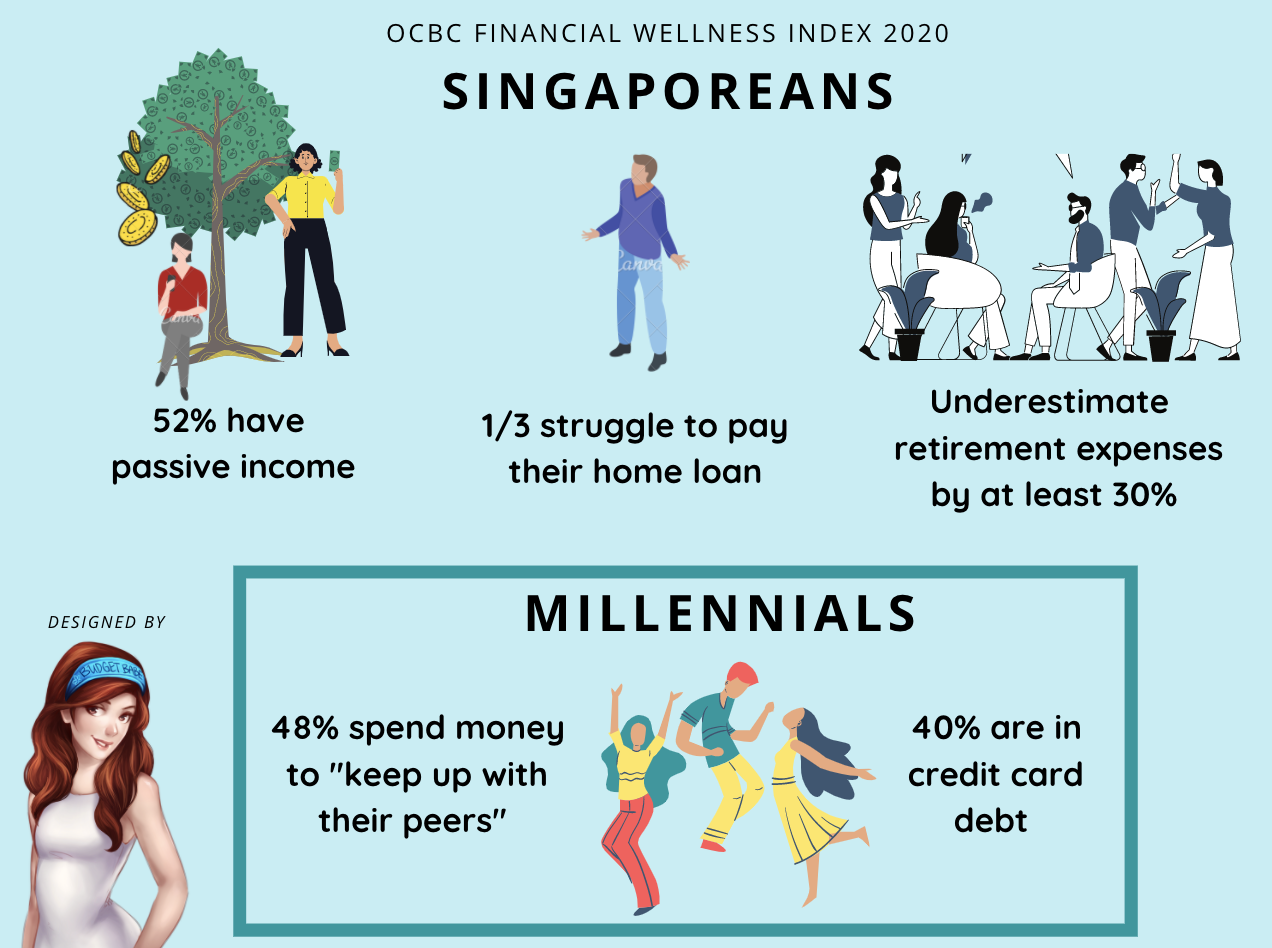

Check how you fare against your peers when it comes to your level of financial wellness. More people want more comfortable retirement lifestyles but are grossly underestimating what it will cost to get them there. One-third of Singaporeans are having trouble paying their home loans, while almost 40% of Millennials are only paying the minimum sum on their credit cards. If you fall into any of these groups, you need to get out…fast.

OCBC released their 2020 Financial Wellness Index last month, which seeks to uncover gaps in Singaporeans’ financial well-being. While reading the report, several results stood out to me – some good, some bad.

The good news is,

Half of Singaporeans have passive income

This was a surprise to see, but an encouraging result.

Dividends from stocks contributed to the bulk of passive income for most, while others had sources from interest earnings and rental.

Naturally, passive income took a hit this year due to the COVID-19 economic crisis that saw many companies slashing their dividends. With low global interest rates here to stay, the yield offered by most fixed income instruments has also gone down.

With all that layoffs this year, we’ve seen how your income can easily go to zero in an instant once your company cuts your job. There are simply no guarantees when you depend on your salary as the sole source of your income.

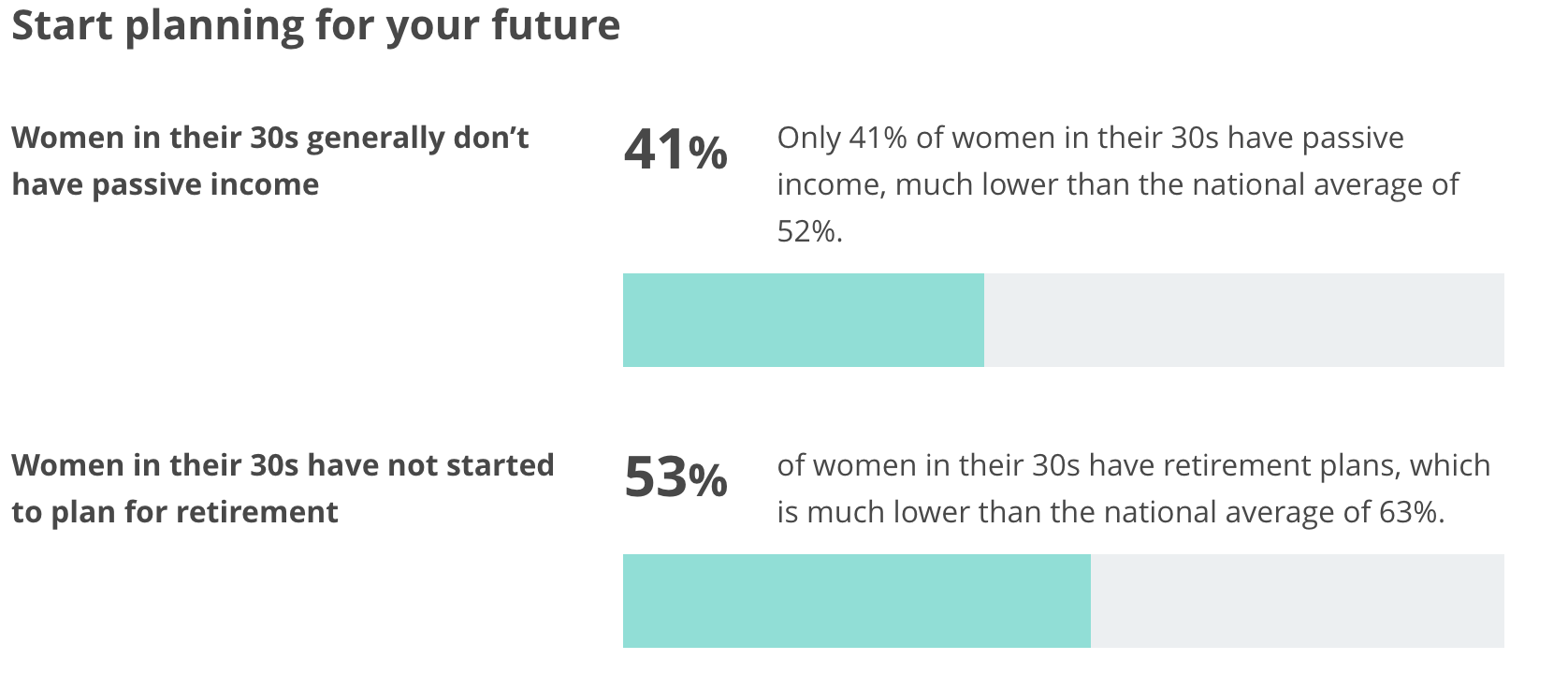

As a female investor myself, it was also interesting to note that the women had better investment performance than the men, which seems to coincide with my belief that the fairer gender does have certain intrinsic strengths that we can harness to excel in this area.

If you’re among the 48% of Singaporeans who don’t yet have passive income, what’s holding you back?

For ideas on how to build multiple sources of income (both active and passive), check out this article here.

One-third of Singaporeans are having trouble paying their home loans

Unsurprisingly, this crisis has caused more people to fall behind on their mortgage payments.

If you’re facing the same, consider applying to your bank for deferment of your mortgage payments. This can help lower your monthly debt payments, and the relief measures last until 31 December 2020. For those who experienced job losses or a pay cut during this period, some banks like OCBC and DBS currently charge a reduced monthly rate of 60% your usual loan amount.

Otherwise, check if you can refinance your mortgage for a lower interest rate, which can help to reduce your monthly outflows.

If the situation prolongs and all else fails, you may want to consider if downsizing your home might make more sense for you.

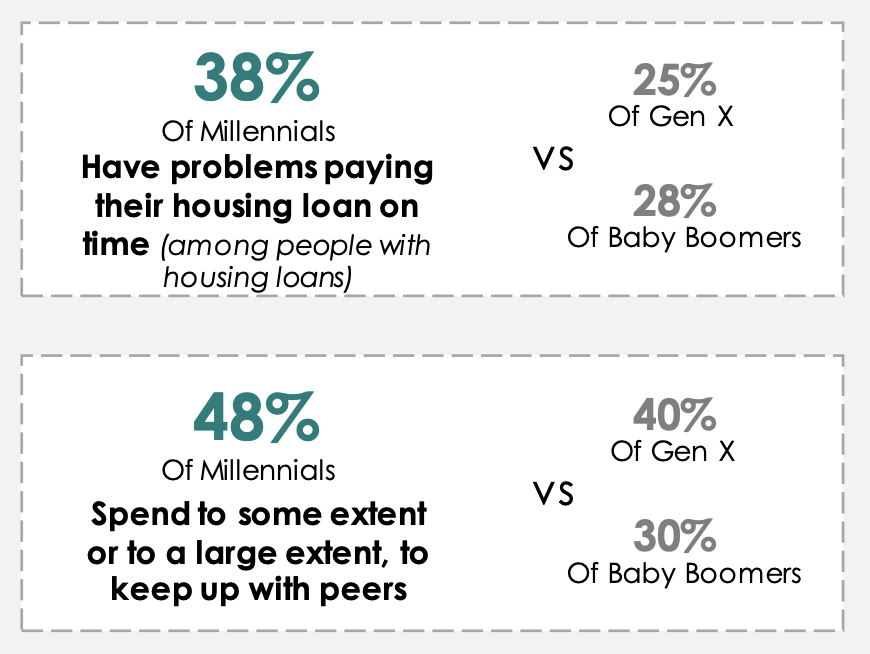

4 in 10 Millennials spend to “keep up” and are in credit card debt

Millennials (defined as age 21 – 39) generally did not fare well in the survey.

They’re not only spending more to keep up with impressions, but are also guilty of paying only the minimum sum on their credit cards (40%).

This is a big mistake! Even if you only owe $5,000 on credit cards and pay just a minimum $50 each month, it will take you more than 14 years to clear the debt, by which you would have spent close to $4,000 on the interest alone.

Last weekend, it was revealed that for most people who fall into serious financial trouble, the top cause tends to be the seemingly harmless act of overspending to indulge themselves. Whereas being thrifty was seen as a virtue in the past, today, much of social media extols spending and consumerism is being promoted instead.

This 39-year-old freelancer almost went bankrupt from spending more than $60,000 on beauty. And if you think the solution to this is to increase your income, think again. A $10k salary was not enough for this lady’s shopping (she ended up owing $250,000 on 8 credit cards), and even $30,000 high income-earners found themselves in $2 million of debt).

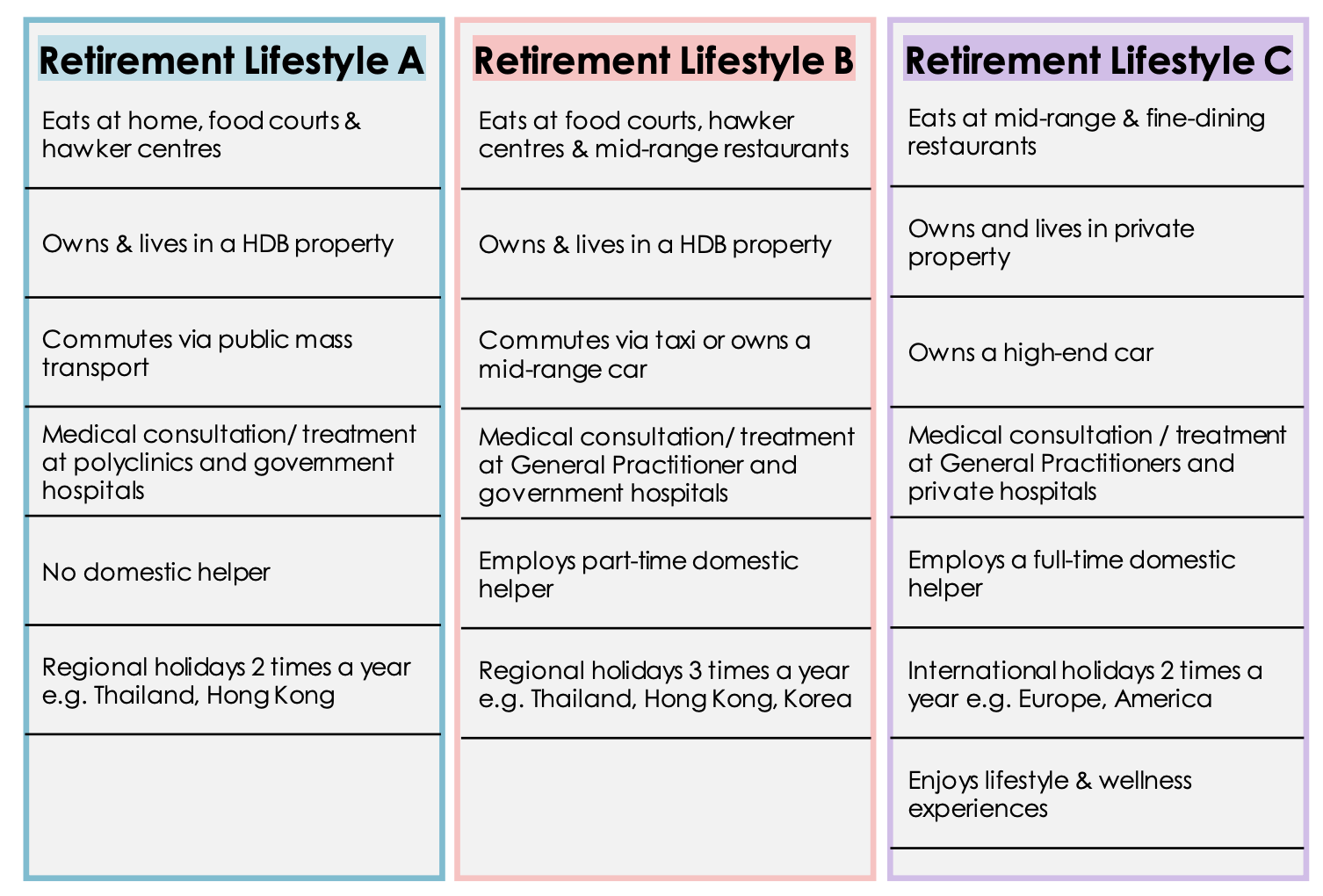

The survey also highlighted gaps in the population’s retirement planning.

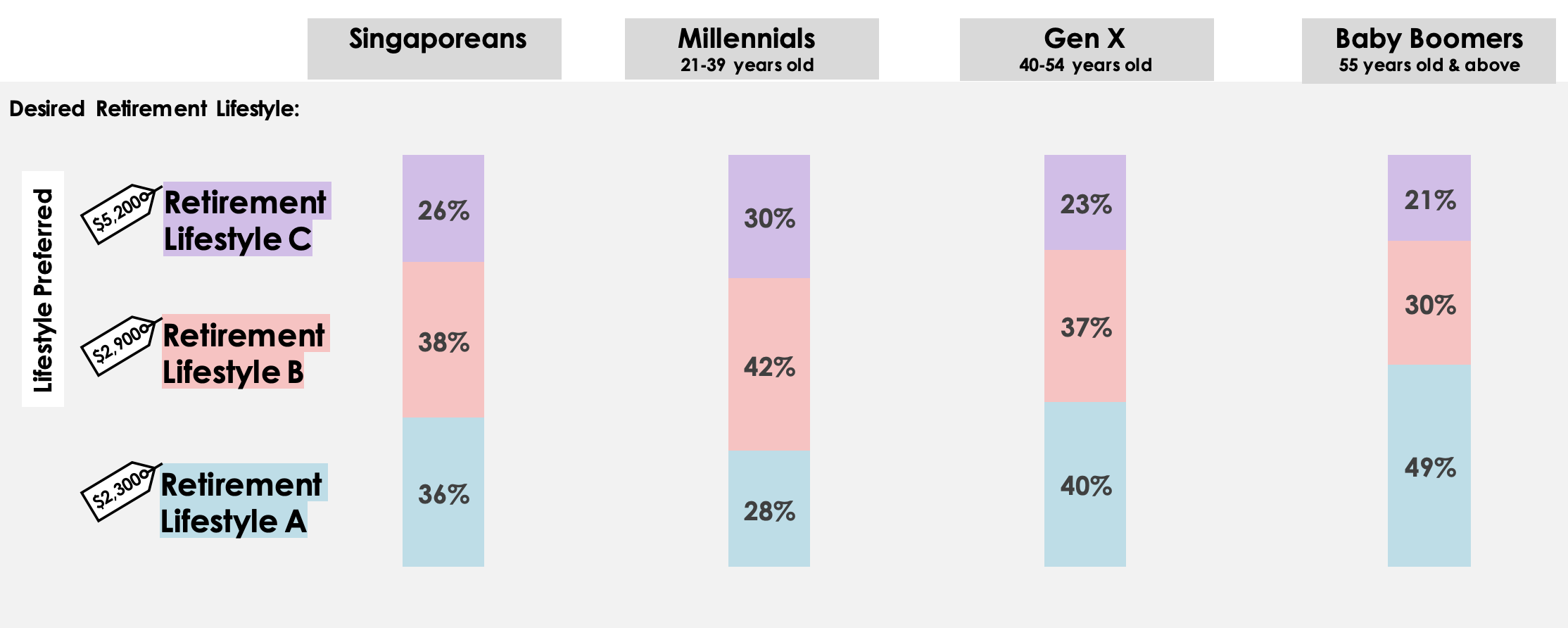

Singaporeans today increasingly want a more comfortable retirement lifestyle.

I was surprised to see that 3 in 4 Singaporeans generally expect to live their retirement years with a better quality of life, which includes commuting by private transport, seeking private medical consultation and travelling abroad 2 – 3 times a year.

Remember how such lifestyles weren’t even that common just a decade ago?

People used to refrain from calling cabs, but with the rise of ride-hailing apps like Grab and GoJek today, we’re spending a lot more than we used to on transport. When I was a kid, holidays were a luxury for even my parents and their peers, but today, taking multiple trips abroad in a year has become a norm for many.

Over the years, these spending habits have become normalized in our culture.

I won’t be surprised if our expectations continue to rise.

But there’s a problem.

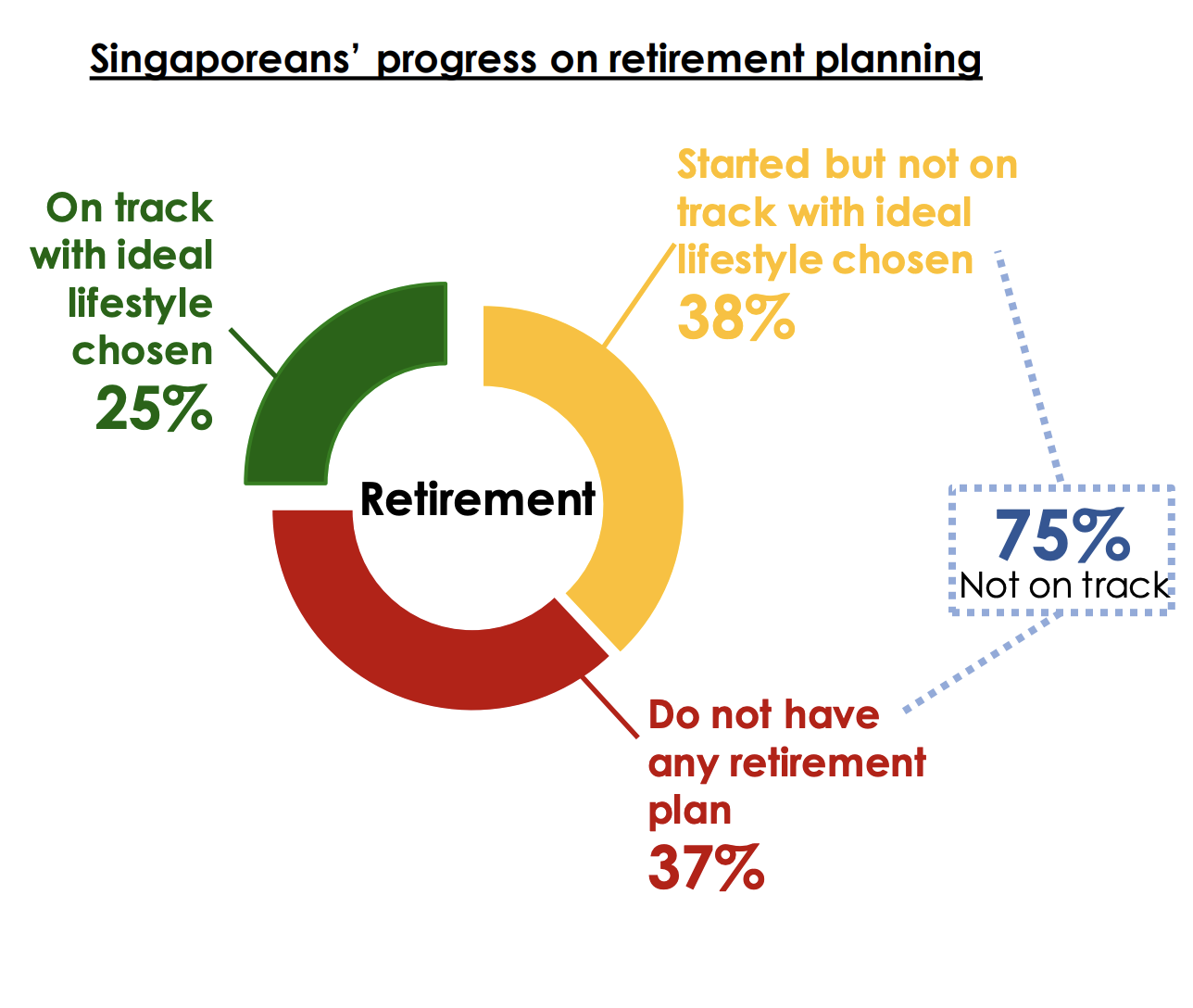

As a result, many Singaporeans are falling behind in their retirement plans, with 75% not on track. And if you belong to the 37% who have yet to start, please stop procrastinating.

The longer you wait, the more you will need to save, and therefore the harder it becomes.

When you start early instead, you get to ride on the power of compounding to grow your money for you.

There are plenty of interesting insights from the OCBC Financial Wellness Index 2020, so you can check it out here.

You may also want to do a health check on your own finances by taking the Financial Wellness Quiz – it should only take you 3 minutes to complete and doesn’t require you to input any personal details.

I then clicked on the “People Like You” section to see how I’d fare against my peers – thankfully, I seem to be generally ahead in all aspects (except that I only seek out professional advice to review my financial plan every other year).

How did you fare in the Financial Wellness Index?

If you’ve taken the Financial Wellness Quiz and compared yourself against your peers, and still feel that you’re not able to meet your goals, do not be discouraged.

As your circumstances change and needs evolve, so will your financial plan.

6 months of expenses mean different things to a single person vs. a married couple with children vs. a sandwiched couple with young children and elderly parents to care for.

That’s why it is important to start early, plan well, and conduct periodic reviews of your financial plans to make sure you can reach your goals eventually.

In fact, I’d argue that the information and tools available to us today puts us in a much better position to retire than the generations before us.

The question is, are you keeping track?

If not, best to go and do your 3-minute financial health check here now.

You do not need to enter any personal details to take the quiz.

Once you know where your gaps lie, you can then come back to this blog to learn how I did it.

Disclosure: This post is sponsored by OCBC. All opinions are my own.