Grab has just launched their latest feature – AutoInvest – to help you invest as you spend. Is it any good, and who is it suitable for?

Ever since Grab acquired robo-advisory Bento earlier this year, we knew something was brewing. The answer is now clear, with AutoInvest being progressively rolled out starting from today.

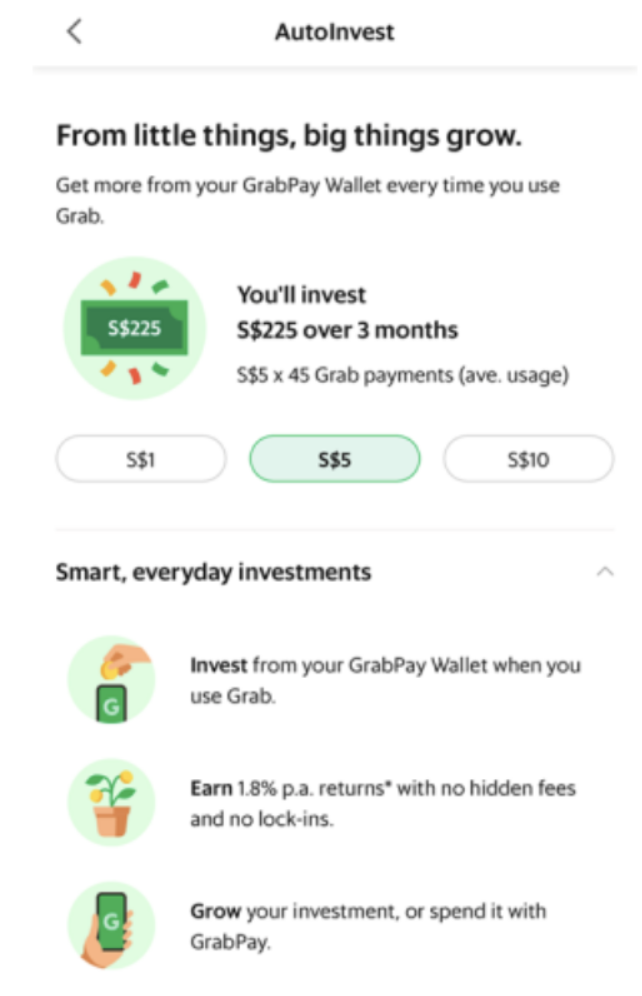

You’ll now be able to invest as you spend with your everyday Grab transactions, from as little as $1 per transaction made with Grab services. This happens automatically once you’ve completed the initial set-up and whenever you

- book a Grab ride

- order via GrabFood

- shop via GrabMart

- Pay with your GrabPay Wallet or Card

Each time you use Grab, an amount (that you choose upon the set-up on AutoInvest) will be transferred and invested. There’s no lock-in period or penalties, which means you can transfer your money back to your GrabPay Wallet whenever you wish.

Returns: 1.8% per annum

Fees: less than 0.45% p.a. (i.e. less than $0.45 for every $100 invested)

For execution, your funds will be placed in a portfolio of money market and short-term fixed-income mutual funds managed by Fullerton Fund Management and UOB Asset Management. Rebalancing takes place every quarter, and Grab says they earn less than $0.20 for each $100 that you invest.

“With the right use of technology and the solution we are launching, you can start with one dollar. You don’t need a different mind space and hours of research – product features, fee comparison, safety – to do this” – Chandrima Das, Head of Wealth

Because the minimum sum is so low, it should eliminate much of the barriers that many beginner investors are confronted with when they first start investing. Although robo-advisory platforms like Syfe and MoneyOwl have reduced that barrier significantly, there are still many people who have yet to start investing – and this is where AutoInvest may come into handy.

During the media briefing held last month, I asked if the deposits are insured or protected by the SDIC. The short answer is no, which isn’t surprising given that the invested amounts are likely to be much lower. So if you want protection on that front, then perhaps another solution like Dash EasyEarn would be more suitable (2% p.a. for a minimum of $2,000).

The biggest value I see in Grab’s AutoInvest feature is its ability to get beginners to start investing. So if you’ve had no luck convincing your uninterested spouse (or friend) to get started, this might just change their mind.

If you don’t already see the Invest circle icon on your Grab home screen (which was what happened for me), tap on More to expand the list and you’ll be able to find it. If not, check in again as the feature is being progressively rolled out starting today.