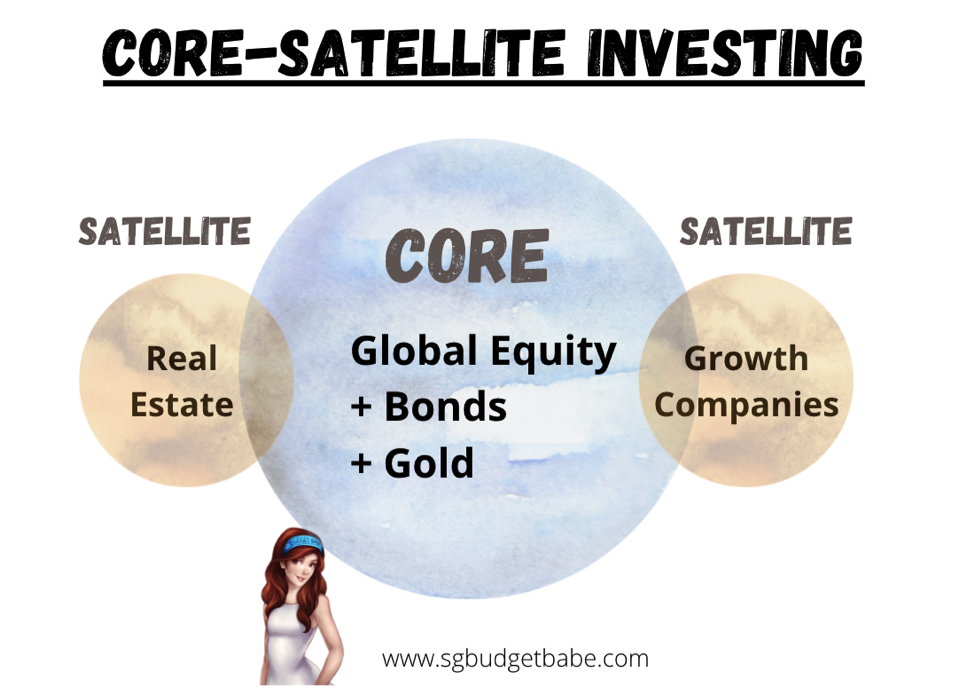

Never before has the developed world seen the Fed print so much money. What will the unprecedented levels of quantitative easing today mean for the economy, and how should investors adapt to the new normal? The core-satellite investment strategy could be one possible approach. Here’s how you can execute it in your own portfolio.

Before you even think about what stocks to invest in, it is important to have and understand your own overall portfolio strategy. This is where the Core-Satellite approach has been gaining traction, especially among investors who wish to diversify across asset classes, sectors and regions to maximise returns and minimize risk. The core provides broad market exposure while the satellites offer the potential of enhanced diversification, outperformance, or both. In simple terms, this consists of:

|

The Core |

The Satellites |

|

Long-term investments that form the bulk of your fund allocation |

Trend-based, more reactive in nature |

|

|

|

You could execute this through several ways.

- The DIY approach – where you buy directly into individual bonds / stocks / alternative assets

- Investing via ETFs – using a combination of exchange-traded funds across different sectors, themes, asset classes, etc

- Syfe – the easiest way of implementing a core-satellite strategy by using their portfolios as your building blocks.

The DIY Approach

The DIY approach suits hardworking investors best, or those who are willing to put in the hours and effort to study the industry, the business, the financial health of a company, assess the valuations, the risks, the competitive landscape, and more.

Of course, with information widely available online today, there’s nothing stopping the average investor from copying robo-advisors or even hedge funds on their allocations or stock holdings. I wouldn’t recommend this copycat method though, because if you don’t know why a stock is worth buying, then you won’t know when to sell or what to do when stock prices go south.

The real problem, however, lies with the costs as well, because you need to take into account trading fees and commissions that need to be paid to your brokerage. Depending on which you use, there may even be a monthly custodian fee to service. And if you have a widely diversified portfolio with a larger number of stocks, these costs can very quickly add up.

We haven’t even talked about minimum lot size. In recent weeks, I’ve had readers ask me how they can own Amazon when they only have S$2,000 to invest. The answer is, you can’t (at least not directly). At time of writing, you would need a minimum capital of at least US$5,000 if you wish to own at least 1 share of the following stocks in total:

- Amazon $2,961

- Tesla $1,500

- Apple $385

- Microsoft $202

- Walmart $131

And that’s not even counting in the rest of your “core” portfolio holdings. To create the core-satellite approach by yourself, the real downsides are in capital size, transaction fees/commissions, time and effort needed to monitor and rebalance your portfolio.

The ETF Method

There’s another shortcut if you’re trying to reduce the trading fees, and that is to invest in Exchange Traded Funds (otherwise known as ETFs). The Invesco QQQ Trust, for instance, tracks the largest 100 non-financial companies listed on NASDAQ – this includes your Apple, Netflix, Facebook and more.

Some investors prefer to use ETFs to create a diversified portfolio instead of investing individually into each stock counter. That’s a great way as well. You’ll still need to study each ETF though before you invest, which includes looking at the fees, tracking error, stock allocation, and more.

Building A Core-Satellite Portfolio with the help of Syfe

Alternatively, for those of you looking for a lot less work, you could use a robo-advisor like Syfe – it functions somewhat like you outsourcing the heavy-lifting of your investment portfolio to a robo-advisor to help you instead.

Thanks to the use of technology, the fees charged are significantly lower than if you outsource this to a fund manager. In fact, the fees of 0.4% to 0.65% per year are often even lower than if you were to do it yourself.

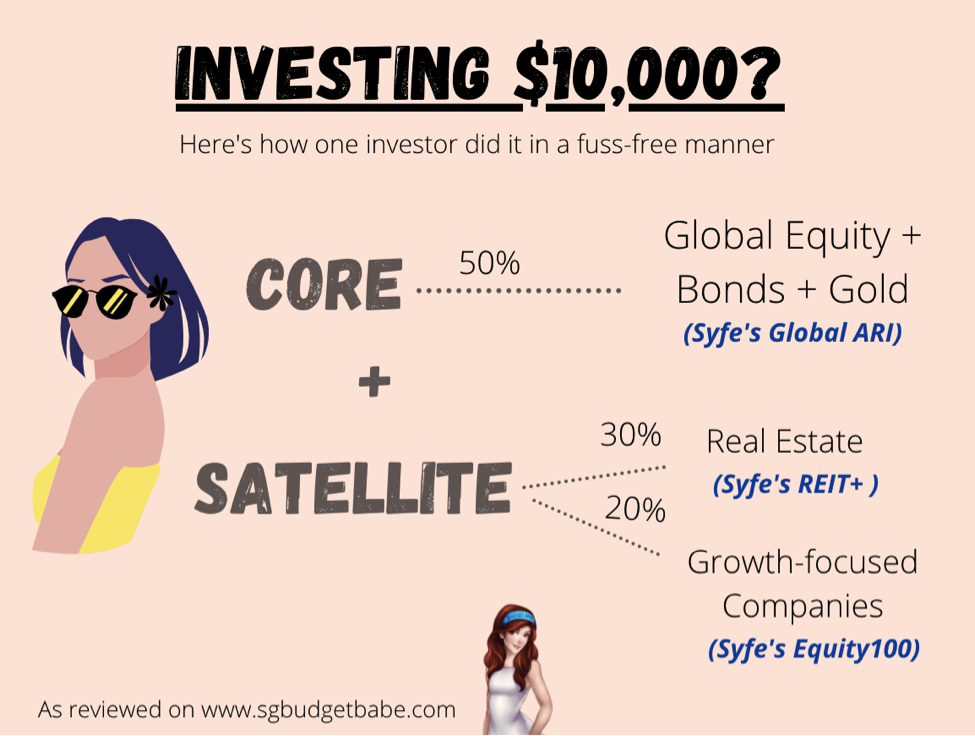

Deciding exactly how to build your core-satellite portfolio can also be tricky. This is why Syfe offers complimentary consulting sessions with their wealth advisors. Here’s a real-life case study of a Singaporean investor and how she did it:

|

Recommended Portfolio Holdings |

Investment Strategy |

Reason |

|

50% Global ARI |

Core |

Holistic portfolio with equity, bond and gold ETFs Dynamically managed to optimise returns and reduce adverse losses. |

|

30% REIT+ |

Satellite |

Provides exposure to Singapore’s real estate market. Provides income as well as the potential for capital gains. |

|

20% Equity100 |

Satellite |

Provides exposure to growth-focused companies, as well as the opportunity for higher risk-adjusted returns over the long-term. 100% equities hold higher risk, which is why a smaller allocation is recommended. |

If you want a customized recommendation for yourself, feel free to schedule a free call with Syfe’s advisors to run through your own needs and risk profile.

Before the launch of Equity100, investors could only use Syfe’s Global ARI portfolio as their core and the REIT+ portfolio as a satellite. But with the latest launch of their Equity100 portfolio, this is a huge change.

Ever the skeptic, I took a closer look at their Equity100 portfolio with my main question in mind – what’s stopping me (or any other retail investor, really) from simply duplicating what they have via my DIY method?

The short answer: capital, time and effort.

Syfe Equity100 Review

Syfe Equity100 invests in over 1,500 of the world’s top stocks, selected based on a dynamic factor-investing strategy that combines growth, size and volatility factors for risk-adjusted returns. Fans of factor-investing will love this one.

Read more about their factor-investing strategy here.

Amazon. Netflix. Microsoft. Altria. As an investor in the Syfe Equity100 portfolio, we can gain access to all these stocks and more, with no minimum investment sum required. See how this stands out in stark contrast to the DIY and ETF approach?

You could also easily perform your Dollar-Cost Averaging (DCA) strategy into this portfolio on a regular basis, since there are no more hefty transaction fees to worry about (again, unlike the DIY and ETF approach).

How does it work?

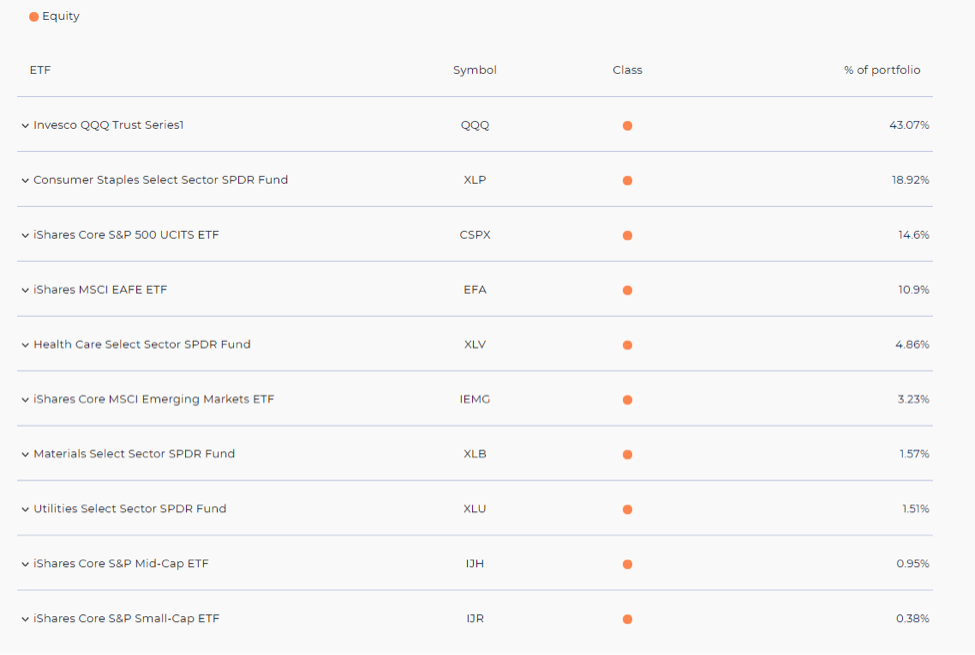

The Syfe Equity100 portfolio invests in multiple international ETFs that consist of stock holdings in the world’s most valuable companies. You get exposure to companies in the US, developed market countries in Europe, Australia and Asia, and emerging market countries such as China, India and South Korea. One interesting portion to note is Syfe’s inclusion of the iShares Core S&P 500 UCITS ETF, which is domiciled in Ireland i.e. making it more tax efficient for us investors (as compared to a US-domiciled ETF tracking the same S&P 500 index).

Here’s the current allocation breakdown:

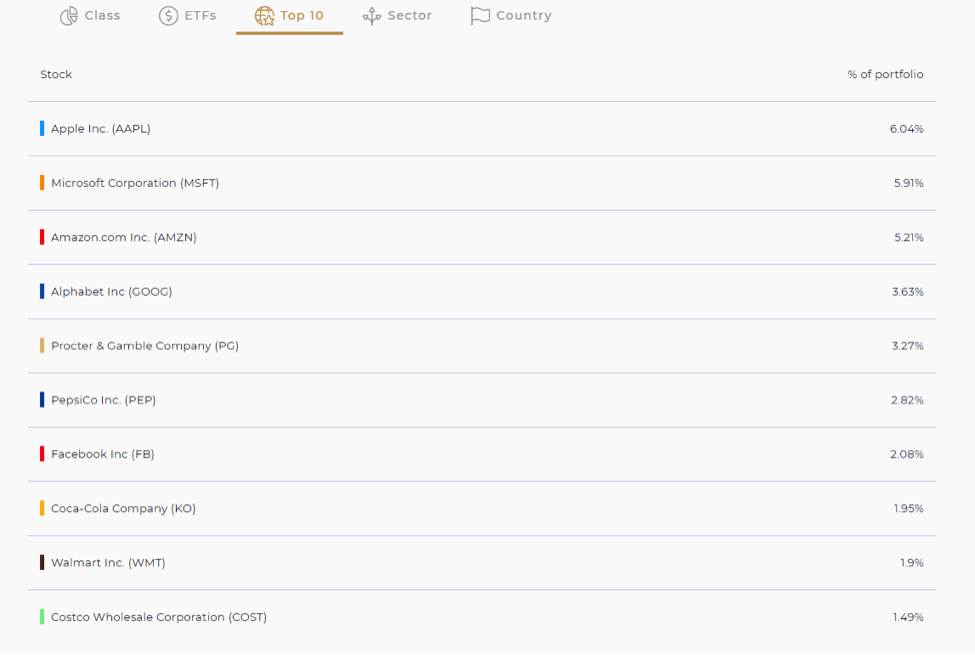

Here are its current top 10 stockholdings, but expect this to change as stock prices move up and down:

And here is the portfolio’s 10-year average annual return. Of course, these are back-tested and historical performance does not guarantee future returns, but this should serve as a useful guide nonetheless for those of you wondering how this strategy would have fared over the past 10 years:

The tech sector, via the Invesco QQQ Trust, constitutes the largest exposure right now. This is followed by the Consumer Staples Select Sector SPDR Fund (XLP) which gives you access to more defensive stocks like Procter & Gamble or Coca-Cola.

Not surprising at all, considering how tech stocks have significantly gone up in recent months – and are likely to be the biggest beneficiaries of a post-covid19 world. Of course, there are some headwinds in the foreseeable future, including regulatory pressures and competition which are already happening now.

This is another reason why Syfe’s dynamic factor strategy is so compelling. Based on broader cyclical trends and changing market conditions, they will change the factors investors are exposed to over time. If growth stocks – which a lot of tech stocks happen to be – start underperforming, Syfe will tilt the Equity100 portfolio to value stocks instead.

This doesn’t mean they will be changing factors anytime soon. Given the current market cycle, they do not foresee the large-cap, growth and low-volatility factors they have selected to go out of favour at least for the next year and likely longer. This is because it can take years or even decades for factors to mean revert. You can understand more about this concept here.

No discussion is ever complete without fees, and this is why I can see Syfe truly looks attractive with their low 0.4% to 0.65% annual management fees. The only other fee to consider is the ETF management fee, charged by ETF providers. Even this is a small amount of around 0.15% per year that’s built into the prices of the ETFs you buy. With a $10,000 portfolio, that comes up to about $5.42 of managed fees a month.

Is Core-Satellite Investing For You?

Bearing in mind that Equity100 is 100% invested in equities, it is probably better to use it as a satellite portfolio.

If you want to get exposure across different asset classes, including equities, bonds and gold, one way of structuring it would be to combine with their Global ARI portfolio or even their REIT+ portfolio, which I’ve reviewed previously here.

For those unfamiliar with Syfe’s Global ARI portfolio, it is an ETF portfolio diversified across different asset classes, sectors and geographies. It is risk-managed using Syfe’s proprietary Automated Risk-managed Investments (ARI) strategy. In simple terms, the ARI algorithm adjusts your asset weights when it detects a significant increase in volatility. This cushions against major losses in adverse markets. When volatility subsides, the algorithm increases your allocation to riskier assets like equities. If you are interested, read more about their strategy here.

Whichever way you choose to build your core-satellite strategy, the premise is the same – you get to save on an incredible amount of time and effort from having to no longer monitor or rebalance your own portfolio.

Sounds like something that could solve your investment woes? Before you jump the gun, you can first attend the upcoming webinar that I’ll be co-hosting with Syfe where we’ll share more about how Syfe portfolios via the core-satellite approach can be done for folks in their 20s, 40s and 60s…and at different starting investment sums.

This will be happening on 10 September 2020, and even if you’re not intending to use Syfe, it’ll be worth tuning in to learn more about the core-satellite approach so you can potentially adopt it for your own portfolio.

Thinking about getting the Equity100 portfolio?

- $10 bonus for your first deposit above $500

- $50 bonus for your first deposit above $10,000

- $100 bonus for your first deposit above $20,000

Sponsored Message from Syfe:

Budget Babe readers opening an account for the first time can now enjoy FREE management fees up to your first $30,000 for 6 months! Use promo code BUDGETBABE to enjoy this limited promotion. Learn more about the fee waiver here.

Disclosure: I have opted not to include my own affiliate links in this article, which was written in collaboration with Syfe. All opinions are that of my own.