If you’re looking for a place to park your spare cash while earning 2%* p.a. for the first year with the option to liquidate anytime you wish, Dash EasyEarn by Etiqa Insurance might just be your answer.

Based on the Fed’s latest mandate, global interest rates are probably going to stay low for the next few years. Leaving your savings in traditional bank accounts where you only earn 0.05% p.a. interest a year is akin to letting the value of your money be eroded by inflation. Not such a good idea!

We’ve been seeing a reduction of interest rates across the world, and Singapore hasn’t been spared. While this has been good news to borrowers (lower interest on their loans), savers have been lamenting about finding the next best place to park their money.

Can you still get good returns on your savings in this climate? The answer is yes, if you know where to look.

How about an insurance savings plan where you’ll get 2%* p.a. returns for the first year, with the flexibility for you to top up and access your funds any time you need to?

** Important note: The rates has since been revised to 1.8% p.a. as of 25 September 2020. All rates of 2% p.a. will continue to apply for those who successfully signed up between the date of this article till 24 September 2020.

If you have spare cash lying around, you might want to consider Dash EasyEarn. This is an insurance savings plan where your capital is protected by SDIC, making it suitable as a lower-risk financial instrument in return for a pretty attractive rate of return.

There’s absolutely no lock-in period, and only requires S$2,000 for you to get started.

I’ve to admit, when I first came across this plan, I was initially skeptical because 2%* p.a. for the first year in this economic climate sounded too good to be true. But after reviewing it in detail, there’s hardly anything NOT to like about this policy.

Here are the key features that I really like:

· Higher returns of 2%* p.a. for the first year – beats most investment options currently available.

· Liquidity – no withdrawal penalties. You can access your money anytime by withdrawing to either your Dash wallet (free) or to your bank account (S$0.70 service fee per withdrawal)

^Each top up must be a minimum of S$500.

Every S$10,000 that you keep in Dash EasyEarn could give you S$200 extra instead. The limitation is that there’s a maximum limit of S$20,000 for the account value, so if you have anything more than that, you’ll need to look for other options after maximising Dash EasyEarn.

What you can use it for

If you’re a saver, Dash EasyEarn can be a pretty good solution for storing your emergency funds or short-term savings for an upcoming big-ticket expense (e.g. wedding / renovation / pregnancy). Even your travel funds can be parked here for the time being while waiting for this pandemic to be over.

If you’re an investor, this would be a good lower-risk option to park your investment war chest that gives you a decent return while waiting for opportunities in the market to emerge?

How does it compare to other options?

At 2%* p.a. for your first year, this is far more attractive than other options where you could park your money:

|

Single Premium |

Interest for first year (assuming no changes to account value) |

Monthly interest for first year (assuming no changes to account value) |

|

S$2,000 |

S$40^ |

S$3.34^ |

|

S$20,000 |

S$400^ |

S$33.36^ |

This also has a lot more flexibility compared to most endowment plans, where your money is locked up for anywhere between 1 – 20 years…in exchange for typical returns that are generally below 5% p.a.

How it works

Open up the Dash app, tap on “Grow Money” and key in the amount you’ll like to start your account with (min. S$2,000 and up to a maximum of S$20,000). If you’re new to Dash, signing up is free (you don’t have to be a Singtel customer), and you’ll receive up to $2 cashback on your first (online or retail) purchase!

Once you complete your personal particulars and ID verification, you can proceed to make payment via eNETS and you’re done!

Tip: As each bank and each individual may set a different eNETS daily limit, do log in to your online banking to ensure that your daily limit allows for the transaction to go through.

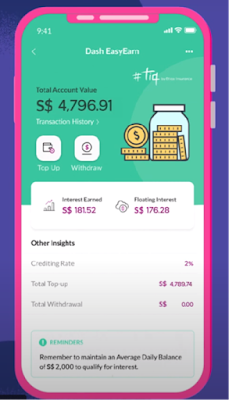

You can easily manage your account from the app to view policy documents, top up or withdraw your funds, view your transaction history as well as the interest credited each month. Interest is calculated on a daily basis which is also reflected in the ‘Floating Interest’ part of the app.

Simply maintain the daily average balance of S$2,000 in your account to qualify for the 2%* p.a. returns for the first year. After the first year, you’ll earn 1.5% p.a. on your balance – still a pretty good return in my opinion.

To top up or withdraw your funds, simply launch the Dash app > tap on Grow Money > Home page > Top Up / Withdraw. You can choose to withdraw your funds to your Dash wallet for spending (no fee), or to your bank account via PayNow ($0.70 service fee per withdrawal transaction applies). There’s a lot of flexibility given that Dash payments are accepted at many places including online, public transport, hawker centres and supermarkets, amongst others.

TLDR Conclusion

I really like this product, and have to applaud Singtel Dash for this move towards digital financial services. Dash EasyEarn should encourage more young Singaporeans to save and grow their savings at high returns and without much hassle.

It’s a decent option as an insurance savings plan, and the best part is that with unlimited withdrawals to your Dash wallet at any time, your funds are barely even locked up since you can easily pay for your public transport rides, hawker meals and even retail / online shopping.

The 2%* p.a. rate of return for the first year is also available for a limited time only, so if you want to make your savings work harder for you, I can hardly think of a better product than Dash EasyEarn to park it in for now.

Head over here to find out more about Dash EasyEarn!

Disclosure: This post is written in collaboration with Singtel Dash.

Important Update from the Sponsor (25 September 2020):

The rates for Dash EasyEarn will now be revised to 1.8% (due to the revision on the bonus rate to 0.3%) for the first policy year.

For those of you who successfully signed up within the 10 days of reading this original post, your rates will not be affected. Existing Dash EasyEarn users will continue to enjoy 2% p.a. (guaranteed 1.5% p.a. + 0.5% p.a. bonus) for the first year starting from your policy start date, including subsequent top-ups.

In addition, Etiqa Insurance will be extending an additional Financial Assistance Benefit for COVID-19 to all new and existing Dash EasyEarn policy holders. For more information on the benefits and other terms of this Financial Assistance Benefit, please visit this page.

Disclaimers

*Guaranteed 1.5% p.a. + 0.5% p.a. bonus for first policy year, available on a first come, first served basis. *2% p.a. effective for sign-ups up to 24 September 2020 (date inclusive): Guaranteed at 1.5% p.a. + 0.5% bonus for the first policy year.

1.8% p.a. effective for new sign ups from 25 September 2020: Guaranteed at 1.5% p.a. + 0.3% p.a. bonus for the first policy year, available on a first come, first served basis.

^The illustration of interest earned is based on the mentioned starting account value at 2.00% p.a. for one year with no withdrawals or top-ups in between. Actual interests earned may differ from the illustration.

Other terms apply. This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). This content is for reference only and is not a contract of insurance. Full details of the policy terms and conditions can be found in the policy contract. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 11 September 2020.