There’s no one else who cares more about your wealth than you. And in today’s climate where the cost of living is rising faster than (most of) our salaries, coupled with inflation and the erosion of cash value over time…it is even more essential that you start taking wealthcare seriously.

If there’s anything 2020 has taught us, it is about how we all need to be smarter about our spending (e.g. not have our money “leaking” out e.g. to unused subscriptions or memberships) and budget better so that we don’t run into cashflow issues.

With all that money printing by governments worldwide, 2020 also showed us how we need to hedge or invest our cash so that its value doesn’t get eroded over time. One way that many people have done this is by hedging with inflation-proof assets such as gold, or even digital gold i.e. Bitcoin.

But what about you? What are YOU doing for your own wealthcare?

If you’ve not done anything differently with your finances in the past 1 year, don’t let your excuses hold you back anymore, especially when there’s so many tools available today to help make it a lot easier for anyone to get started.

Most of the financially “woke” generation are using a combination of various tools:

- an app for budgeting

- another to track our net worth (some use traditional Excel sheets, while others have since migrated to SGFinDex)

- and another app / platform for investing

And if you invest across multiple asset classes – gold, unit trusts, stocks, cryptocurrencies, etc – it can get quite tedious to manage all the different tools.

I get it, I really do. What usually then happens is that since you don’t have time to open up all your different apps or Excel sheets on a regular basis to track, it becomes another one of those “out of sight, out of mind” matters…

..but still, that’s no excuse!

Start by making wealthcare a HABIT.

They say it takes 21 days to form a habit. You can get there faster with an all-in-one digital solution that you’ll end up using often.

Hugo is an upcoming player that might just address this. I recently viewed a demonstration by their team and was sufficiently impressed – I’ll update more in another article once the app has gone live and I’m not bound by non-disclosure agreements anymore!

In the meantime, here’s what I can share and what struck me as impressive:

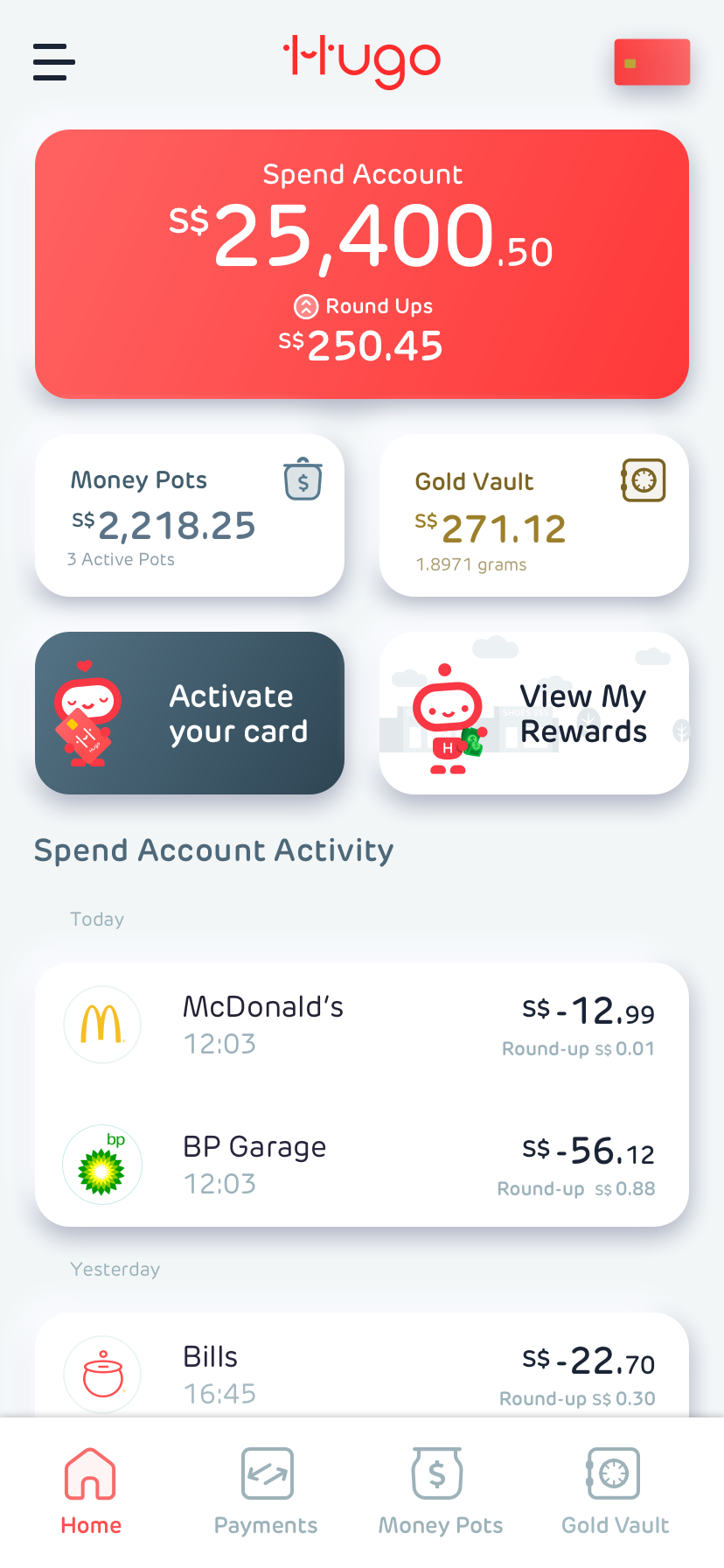

Hugo is building a spend analytics and recommendation engine which can help us to spend less by suggesting reduction, switching or even substitution opportunities.

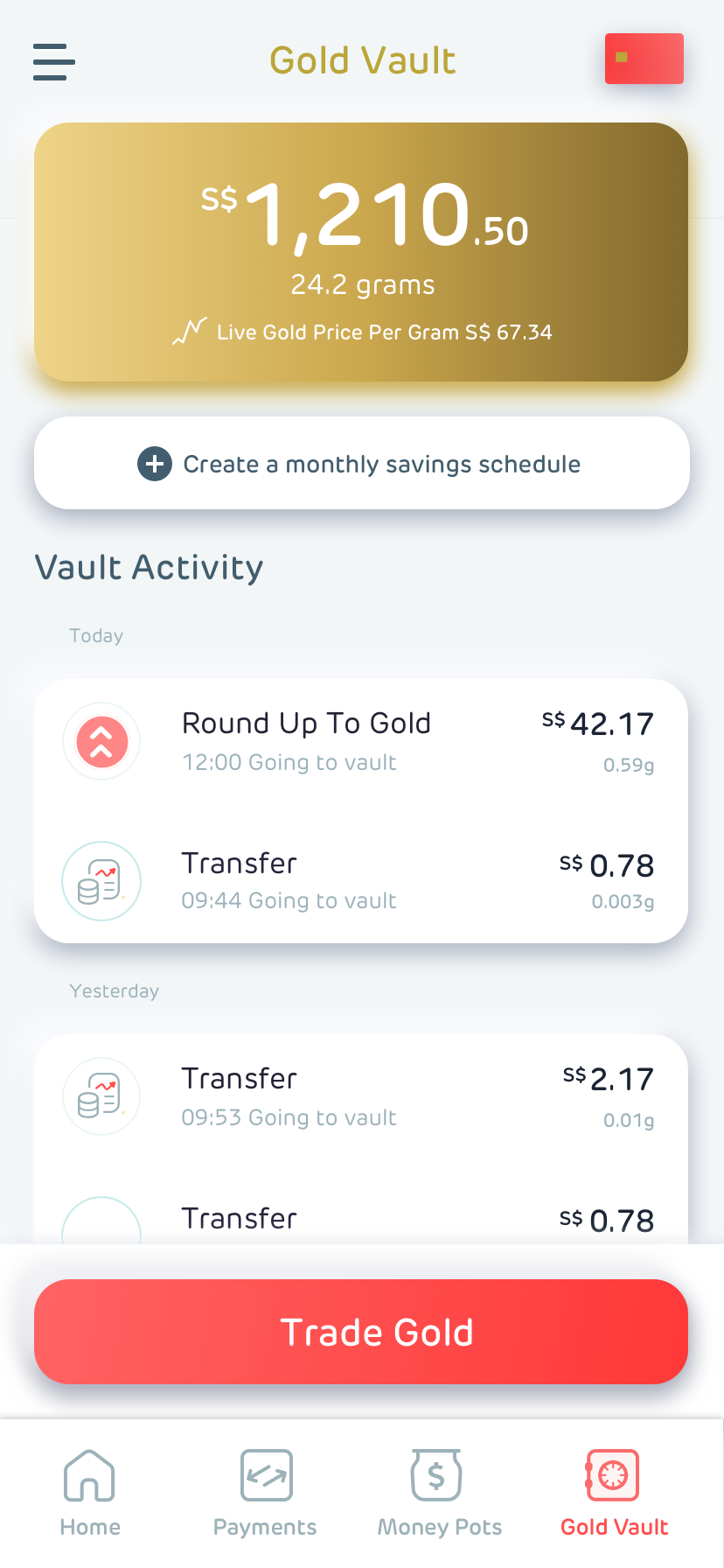

Thanks to fintech, there’s now a more intuitive way to do that. Hugo’s promise is to make saving become a habit as every purchase made gets rounded up to the nearest dollar (Roundups), which gets automatically swept each week into your Gold Vault for saving. That way, you won’t have to do anything but watch your cash savings accumulate and transform into a long-term gold investment that hedges against inflation.

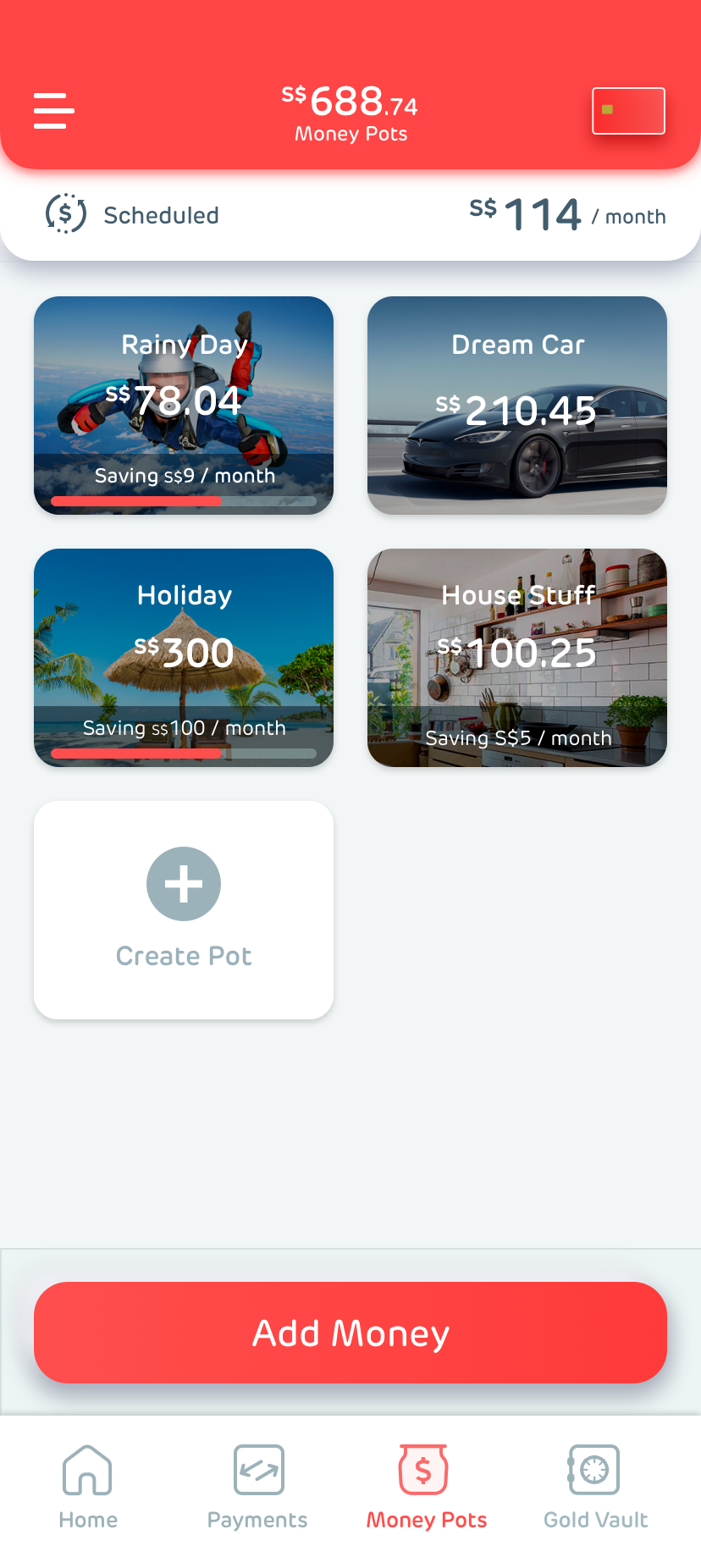

On the app, we’ll also be able to set up your own savings schedule and the different goals that we’re saving up towards via a Money Pots feature.

Remember how we used to save when we were kids? Back then, we would keep our spare change and put them in our piggy bank.

Why not keep my savings in cash instead of gold?

To ensure that your cash savings do not get eroded over time, you can hedge it by converting your cash into gold in an easy manner through Hugo’s Gold Vaults…or let the app automatically do that for you.

This is interesting because without any minimum amount requirements (for when your spare cash is swept into the vault via Roundups; and there is no minimum if you want to manually purchase) and no lock-in period, it’ll make gold investing a lot more accessible to the masses. What’s more, how this works is that you basically get physical gold allocated to you against your investment value, which is stored in an accredited LBMA (London Bullion Market Association) vault in Singapore, and further insured by Lloyds of London for added security.

If you intend to use the Hugo app to trade gold instead of accumulating it for the long term, you can also do so…but I’d personally just use it for a long-term investment instead of trying to trade frequently with it. Nonetheless, if you realllllllly want to trade, do note that transaction fees are 0.5% for each buy/sell transaction.

In essence, you can budget, spend, save and grow your wealth (through gold for now) all within one single app.

Unfortunately right now, Hugo is not yet open to the public…unless you’re one of the (lucky) exclusive few who have already been granted trial access! It’ll be available in April, but in the meantime you can get on the guestlist so that you’ll be among the first to get access to the app.

I’m impressed by what I’ve heard and seen so far, so I’ll update this review again in April/May when the app is live and share with you guys how the experience was like for me – was it intuitive? Safe? Secure?

As a special sign-up bonus for all Budget Babe readers who are keen to get on the guestlist, the Hugo team is giving out $20 Goldback® and other referral rewards once you successfully get on the guestlist!

Disclosure: This post is written in collaboration with Hugo, an upcoming fintech company whom I’ve been in touch with since last year. I’m quite excited for their app to go live – especially with all that integration on gold – and am looking forward to seeing how it’ll help you guys achieve your financial goals! In the meantime, you may want to register on their guestlist to secure the sign-up bonus for yourself first!