1.7%* p.a. for the first year on your first $10,000 with no lock-in period and the flexibility to withdraw your funds anytime.

At such attractive rates, it is no wonder that short-term insurance savings plans have been all the rage lately.

We’ve seen the banks slash their interest rates over and over again in the past 6 months alone – and consumers haven’t been spared. What used to be a 2 – 3% p.a. interest on your savings (in exchange for salary credit / spending on your credit card / GIRO bill payments) are now like a rare Pokemon.

In this economic climate, I foresee short-term insurance savings plans will most likely continue to remain popular amidst a falling interest rates environment. If you haven’t yet already explored parking your cash into one of these plans, you’re easily missing out on up to 1.7%* p.a. – such as the latest one by Singtel Dash.

Overview: Dash PET by Etiqa Insurance

Benefits:

- 1.7%* on your first $10,000 for the first year

- Your capital is guaranteed and SDIC protected

- Financial assistance benefits in the event of COVID-19

- Death benefit of up to 105% of your account value

The fine print:

- Must maintain minimum account value of $50 (which is easily done because you can use your Dash wallet almost everywhere)

In fact, it looks like Singtel Dash has added more features to their offering now with Dash PET (Protect, Earn and Transact), making it a little different compared to its predecessor, Dash EasyEarn!

I also compared this with its other equivalent competitors, and as of January 2021, the rates offered by Dash PET are in fact the highest that you can get from insurance savings plans in the market right now (the other 2 – if you know who – have since stopped new user sign-ups.

Get up to $410 with capital guaranteed

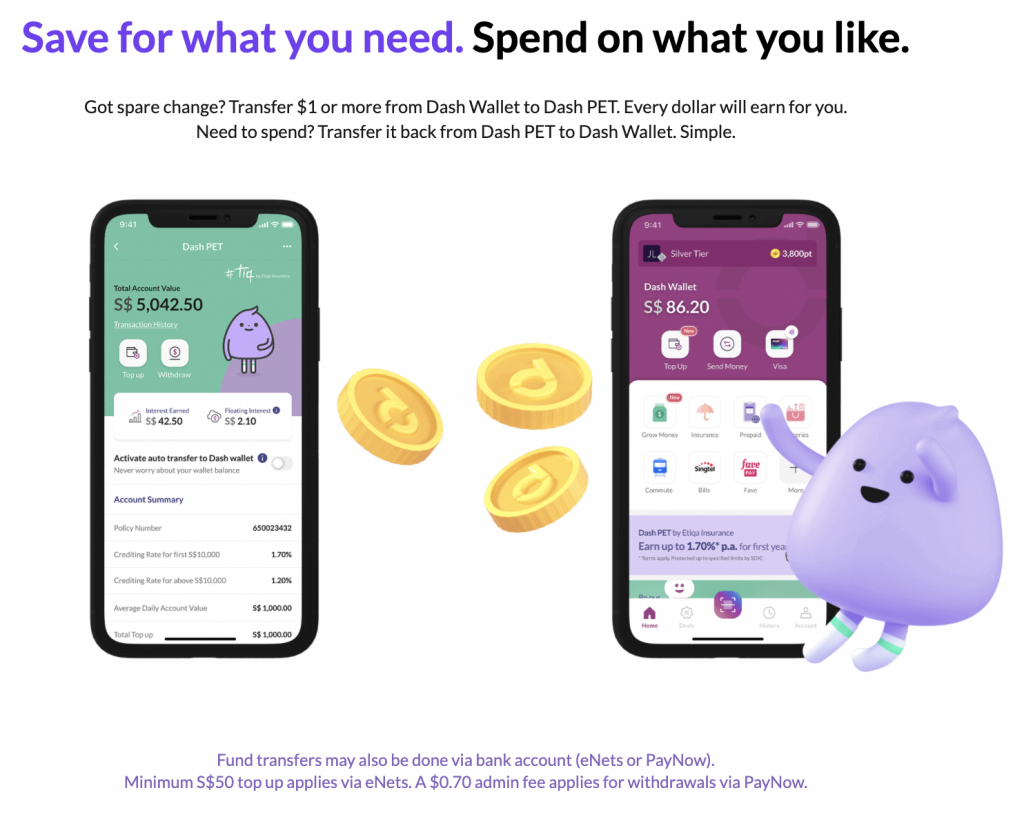

You can deposit any amount between $50 to $30,000 through PayNow, eNets or your Dash Wallet in order to start.

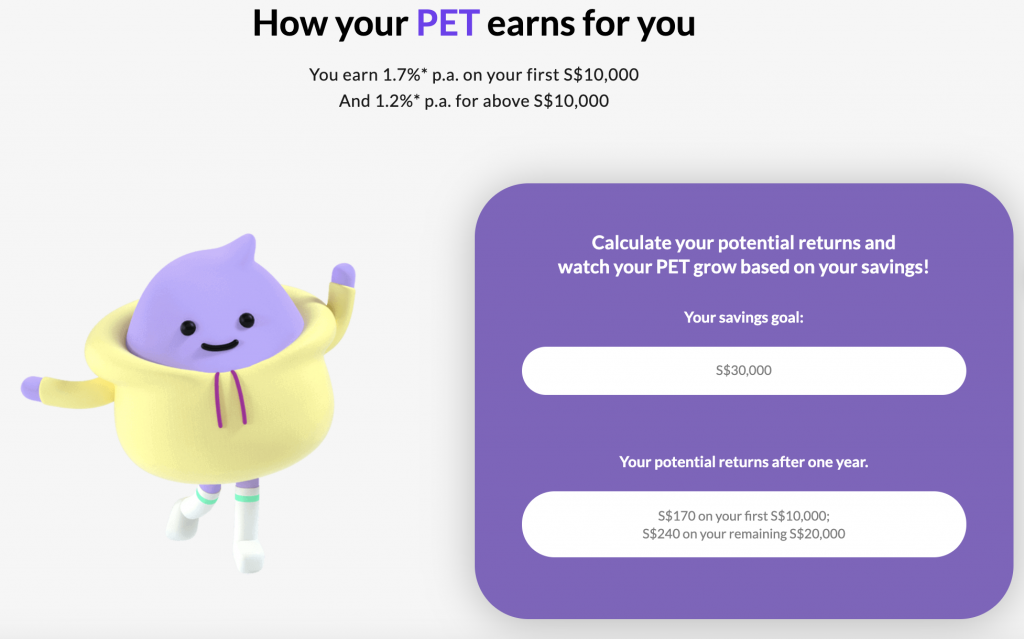

For the first year, Dash PET will give you 1.7%* p.a. on your first $10,000 and 1.2%* on your balance thereafter.

This means that if you maximize the allowable account value (of $30,000) you’ll get:

- 1.7%* x $10,000 = $170

- 1.2%* x $20,000 = $240

- Total returns on $30,000 in 12 months = $410

If you’re a low risk-taker and don’t want to subject your savings to any rude market shocks, you’ll be hard-pressed to find anywhere else that’ll pay you this much i.e. $410.

What’s the catch to this 1.7%* p.a.?

The only thing you need to do is to make sure your average daily account value balance for the calendar month doesn’t fall below the minimum $50. You’ll then be able to see your interest being credited into your account on the 1st of every calendar month.

(FYI: interest is calculated on a daily basis, but credited monthly on the 1st)

It’s that simple – there’s no additional steps needed!

How do I withdraw my funds?

Dash PET is an insurance savings plan with no lock-in period in this case, so you can be assured that your funds are liquid enough for you to withdraw in the event that you need them.

And in this age of digital wallets, withdrawing your funds for usage is super easy. By withdrawing your funds directly into your Dash wallets, you can now use it for e-payments, public transport, remittance, or more.

I’ve already tested my Dash wallet to pay for food at the hawker centre, an MRT ride and even remit funds to Philippines for my helper…and it worked like a breeze.

But if you prefer to withdraw to your bank account via PayNow instead, do note that there’ll be a $0.70 processing fee for each withdrawal transaction.

What you can use it for

Since we still can’t travel, you can park your travel funds here for the time being while waiting for travel restrictions to be lifted. And if you already have idle funds sitting in your Dash wallet, transferring the money into Dash PET might be a good move because your money will then earn you a higher daily interest!

Dash PET can also be a pretty good place to park your emergency funds, or short-term savings for an upcoming big-ticket expense (e.g. wedding / renovation / pregnancy).

If you’re an investor, remember how most of us used to park our investment war chest funds in the Singapore Savings Bonds while waiting for market opportunities? But sadly, the recent rates have hardly been attractive for me to put in my cash.

And even if you took a higher risk and already have your war chest parked in a cash management account instead, it might be worth considering Dash PET for a higher rate at up to 1.7%* p.a. as an additional avenue to save.

TLDR Conclusion

1.7%* p.a. with no hoops to jump through isn’t an offer you’ll come across often in today’s climate. You’ll be hard-pressed to find a better product to optimize your savings with.

There’s no excuse for you to let your savings remain stagnant (or grow slower than before) just because global interest rates are being cut everywhere else. As long as we keep looking out for alternative financial tools, there’s bound to be newer options popping up – like Dash PET.

Plus, the last time I shared about how you could get $400 with Singtel Dash EasyEarn here, so many of you signed up that the tranche was completely filled just 11 days later! So if you missed that last year because you weren’t among the #fastestfingersfirst, you’ll want to make sure you act fast this year.

I can’t say for sure when the tranche will fill up this time, but given how so many of you are on another waitlist now with no visibility on when you’ll finally get it, you may not want to drag your feet on this one.

Head over here to learn more about Dash PET!

Disclosure: This post is written in collaboration with Singtel Dash.

Disclaimers

- The information is meant purely for informational purposes and should not be relied upon as financial advice.

- *For the first S$10,000 Account Value: Guaranteed 1% p.a. + 0.7% p.a. bonus for the first policy year. For above first S$10,000 Account Value: Guaranteed 1% p.a. + 0.2% p.a. bonus for the first policy year

- This policy is underwritten by Etiqa Insurance Pte. Ltd. (Company Reg. No. 201331905K). This advertisement is for general information only. Full details of the policy terms and conditions can be found in the policy contract on dash.com.sg/dashpet. Terms apply. Protected up to specified limits by SDIC. As buying a life insurance policy is a long-term commitment, an early termination of the policy usually involves high costs and the surrender value, if any, that is payable to you may be zero or less than the total premiums paid. You should seek advice from a financial adviser before deciding to purchase the policy. If you choose not to seek advice, you should consider if the policy is suitable for you. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is accurate as at 8 February 2021.