The Internet can be a dangerous place for ignorant investors.

The author’s credentials also seemed pretty legitimate enough, as he claimed that he had been studying the industry for “years” and was a (supposed) expert in this field.

After about an hour of reading (and my own cross-research to verify his statistics), I was almost convinced that the stock was a good investment opportunity…until I saw this (super) tiny print buried near the bottom which disclosed that

- the issuer had provided a marketing company with a budget of over USD 600,000 for its advertisement campaign

- the writer (blogger) of the post had been paid more than USD 15,000 to endorse the ad

- the writer himself does not own shares of the company that he was promoting

Was it all talk but no action? In this case, it apparently was.

Which brings me to my point:

The Internet has nuggets of valuable information, but it also concurrently full of misleading ideas and is rife with elaborate pump-and-dump schemes.

If you’re an ignorant investor, you’re more likely to fall prey to these and end up potentially losing most of your money.

I’m not sure how I feel about the company spending more than half a million to attempt to boost its share price through such marketing tactics, but what I’m certain is that the blogger’s actions absolutely are a huge NO in my rulebook.

And I worry about other investors who may have read that post too and thought, “dang, I better invest in this stock now before it is too late!” And before you judge these victims for being stupid or dumb, bear in mind that not everyone may be observant (or knowledgable) enough to tell the difference between what’s probable and what’s not.

With all the elaborate pump-and-dump schemes on the Internet these days, we definitely need to be more careful with what we read and act on.

I love reading finance blogs and different bloggers talk about their bull/bear case for a stock, but they are never a buy/sell recommendation for me. Instead, I use them to spot great stock ideas, then follow up with my own research and analysis, before deciding whether to add (or remove) it to my stock portfolio.

But at the same time, I’m seeing so much misinformation out there that it is starting to worry me. This gets worse on social media, where information is usually presented in bite-sized chunks and may not carry the full complete picture. It is not wrong to say a stock is “undervalued” because of [insert reason], while leaving out the rest of the red flags. (Or perhaps, the author of the statement didn’t even know of the red flags in the first place).

Often, one red flag might just be all a stock needs to collapse.

During the early months of this year, there were plenty of people telling others to “buy SIA stock” online. Just look at what has happened since. The same happened for oil, and we also know how that has since played out.

What’s an investor – especially the beginners – to do?

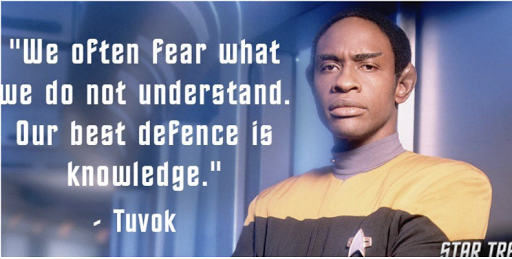

Our best defence is KNOWLEDGE

No one will (or can) save you from the misinformation on the Internet…except yourself.

When it comes to investing, the more you ask for fish, the more likely you are to (eventually) get burnt. The very same stock could make a lot of money for some, while losing tons of money for others.

Your best bet is to get educated so that you learn how to tell the difference between what’s real and what’s not.

Just because Blogger A is bullish on Stock ABC doesn’t mean that you should buy it. In the same vein, just because Blogger B is bearish on Stock XYZ doesn’t mean you ought to liquidate it from your portfolio immediately.

At the end of the day, you need to contextualise their thesis and incorporate it into your own investment process and views. And no one can do this for you…except yourself.

3 comments

is it you teach all these classes? or someone else?

they're my own – I filmed during the Circuit Breaker since we couldn't have the physical workshop! I cancelled the physical one because I got too worried about the virus – that was in early March before the social distancing measures kicked in

good work

Comments are closed.