Having trouble understanding how to invest? Ever wished that there was a simple and affordable course you could take to learn and get you started with your investment portfolio right away – one that didn’t require shelling out thousands of dollars? If you’ve enjoyed learning from my writings thus far, check out the Academy for my newly-launched courses taught in the form of video lectures. Go through the lessons at your own time and pace, or even replay certain modules if you need to. Have fun learning!

Back in February (at the start of the market crash), I mentioned that the stock market was going to go lower and had originally promised readers to do a one-day investing crash course to help them navigate it. This was posted on my social media, and close to 1,000 people signed up – even when I hadn’t yet released any details on topics, venues, cost or even a fixed concrete date for the event.

But then I cancelled it before the social distancing measures kicked in, because it seemed more socially responsible to preserve people’s lives than to risk it at a one-day event. Many of you then asked me to do it online instead – an idea which I initially pushed back on – but after more and more of you wrote to me with the same request, I eventually caved.

So here’s the results of what I’ve been up to during the Circuit Breaker:

The SGBB Investment Academy

The Academy contains courses that will help you navigate the (often confusing) world of investing. If you’ve always struggled to learn by yourself (be it through books or the Internet) because the jargons are too technical for you, then I hope you’ll find this useful.

For instance, when it comes to evaluating a company’s earnings, I teach valuation concepts like Price-to-Earnings ratio in terms of thinking about how long it will take for the company to accumulate that much earnings to pay back the amount paid for each share.

- I also explain the underlying assumptions with this formula, including how you’re taking earnings to be constant today and in the future, and why the traditional advice of going for companies with P/E ratios of no more than 15 simply does not work for growth stocks or companies who are steadily growing their earnings over time.

Type of Courses Available

- Index Investing – this is suitable for folks who are looking for a fuss-free, minimal effort investment portfolio. Whether it is through selecting your own exchange-traded funds (ETFs), a Regular Shares Savings (RSS) plan, or investing through robo-advisors like MoneyOwl, AutoWealth or EndowUs, I lay out the different options and how you can choose between and among them.

Psst, get this course for free by answering a simple question! Read till the end for details. - REITs Investing – if you’re keen on building a REITs portfolio that will pay out regular dividends to your bank account, this course will teach you how to do that. The Singapore market has been fantastic for real estate investment trusts, and retail investors have gained from both dividend payouts and capital gains on the better ones. In this course, I walk you through how I analyse REITs, and why I don’t use quantitative models like REIT “scorecards” because different REIT sectors have different characteristics that are hard to generalise. For instance, while long tenancy contracts are always more favourable, applying a fixed range (for WALE) to retail REITs would most likely have you eliminating the sector entirely.

- Dividend Investing – want to create an income-producing portfolio that will pay you for life? REITs aren’t the only instrument for you to use, as you can also choose from other stable, dividend-yielding stocks like blue chips, etc. In this course, I teach you how to assess the business and financial health of a dividend-paying company, so that you know whether they’ll be able to continue paying dividends for a long time to come. We’ll also focus on capital preservation, because dividend stocks that pay but have their share price decrease aren’t what you would want.

- Value Investing – based on the teachings of legendary investors Warren Buffett and Benjamin Graham, this course combines everything I learnt about investing in undervalued stocks and how to profit from them. I’ll teach you how I identify such undervalued stocks, introduce a variety of valuation methods, and share how I personally calculate the intrinsic value of a stock. This formula is not taught in most of the investing books I read, and I explain why I rely (and trust) this approach more than the discounted cash flow (DCF) model due to the inherent assumptions involved.

- Growth Investing – searching for the next Facebook or Amazon? In this course, I walk you through how to identify and analyse growth stocks, especially when they fail conventional valuation advice eg. negative operating cash flows, high price-to-earnings multiples (i.e. what Graham would describe as being overvalued). I explain why a high P/E valuation now may actually turn out to be cheap in the future, and share how the key to profiting from growth stocks is to identify quality growth companies and paying for them.

On top of that, I also share exactly WHEN to buy and sell a stock, with specific signals identified separately for dividend, undervalued and growth stocks each.

If you’ve enjoyed learning from my writings / Youtube channel thus far and my style of teaching, then perhaps these courses will help you better understand how to invest, and most importantly, start investing once you graduate from the course.

If you’re still uncertain on how to start investing even after completing it, send me your questions and I’ll help guide you until you get there 🙂

My Recommended Course

|

| Get it for $799 with a promo code. |

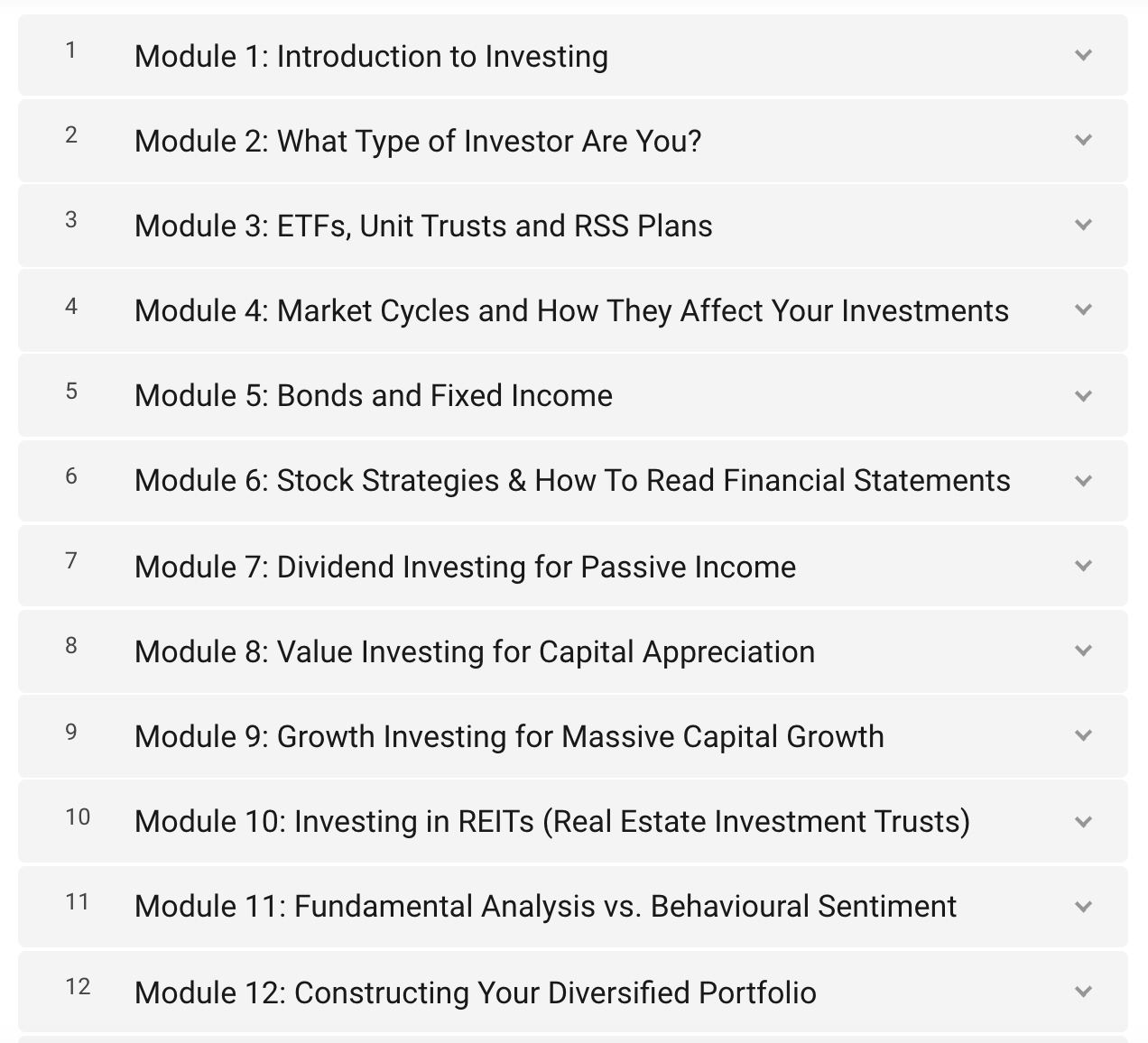

Of course, for those who want a more comprehensive approach (instead of sticking to just ONE investing method), my favourite course is the Strategic Investing Masterclass. This is basically the course that I wish had existed for myself when I started investing years ago, and is the equivalent of what would otherwise be a 3-day workshop for me to conduct. It covers everything you need to know in a single course, including:

- Economic cycles and the stock market

- Index investing (ETFs, unit trusts and RSS plans)

- How to analyse and invest in bonds

- How to read the financial statements

- Dividend stocks investing

- Value investing

- Growth investing

- REITs investing

- Psychological bias that hinder your investing and how to overcome them

- Asset allocation

The 4 portions in bold are often taught in separate courses, which go for $3,000 and up in Singapore. That means you’ll easily end up paying $10,000 or more to learn all the different strategies.

Hardly viable for beginners who don’t have a lot of investment capital to start out with.

So that’s where my course comes in, and I’m sure this is THE best course you’re gonna find in the whole of Singapore for this price tag. You’ll be hard-pressed to find anything for a lower price that will cover so much depth – this masterclass has over 80 video lessons alone!

In the masterclass, I will also walk you through how to choose the best investment approach and strategy that will work for YOU, because your life circumstances, financial ability, risk appetite, psychological reactions to money and resources (time, effort) will determine whether one approach is more suitable than another.

Get it for only $799 when you enter a promo code.

The only thing I don’t cover in the comprehensive masterclass are forex and options trading – because as the name suggests, this is a strategic, long-term investment course, and not one meant for short-term traders. For that, you can sign up for other courses in the market – I’ve personally attended previews of some going for a minimum of $2,500. It wasn’t something I could afford when I was a beginner, which is why I hope the academy will help those of you in this position.

If you’re a reader, you don’t have to pay full price! As a token of thanks for your continuous support for my writings over the years, simply email me to get a promo code off your purchase for the Strategic Investing Masterclass, or sign up for my mailing list here and unlock one!

P.S. Wanna get the Index Investing course for free? Enter the promo code **** here by answering the question : When did Budget Babe start this blog? (answer: 20**)