Before you start your investing journey proper, I always tell my readers that there are 4 key questions they’ve to ask themselves first:

|

| Image credits |

1. How much BUDGET do you have to invest?

The capital you have will mostly determine which style of investing could be more suitable for you at this point in time; bear in mind that brokerage fees are incurred with each transaction you make, and some markets (eg. SGX) have minimum lots requirement (100 shares), so if your capital base is low, you may have fewer options available to you.

For instance, if you have just $100 / month to invest, then you might want to look at a Regular Shares Savings plan instead (read more here) to kickstart your investment portfolio. And when your monthly invested capital grows to a larger sum, perhaps switching over to a lump-sum investing approach might help you reduce your brokerage fees.

Your capital size doesn’t just determine your investment options, it also has huge implications on your returns.

Which is easier? Earning 5% on a $100k base, or 25% on a $20k investment?

Both gives you the same eventual reward of $5,000 but it is much easier looking for investment tools that can give you 5% yield (many REITs should easily hit this requirement) as compared to spotting a grossly undervalued stock that has the potential to rise 25% in the near future.

The first option would also skew you towards the style of dividend / income investing, whereas the latter would be more likely a value / growth investor. The skillset required for each also vary considerably, so if you didn’t ask yourself the question of “how much budget do I have?” in the beginning, you could have wasted too much time trying to pick up a style of investing that you eventually won’t be using.

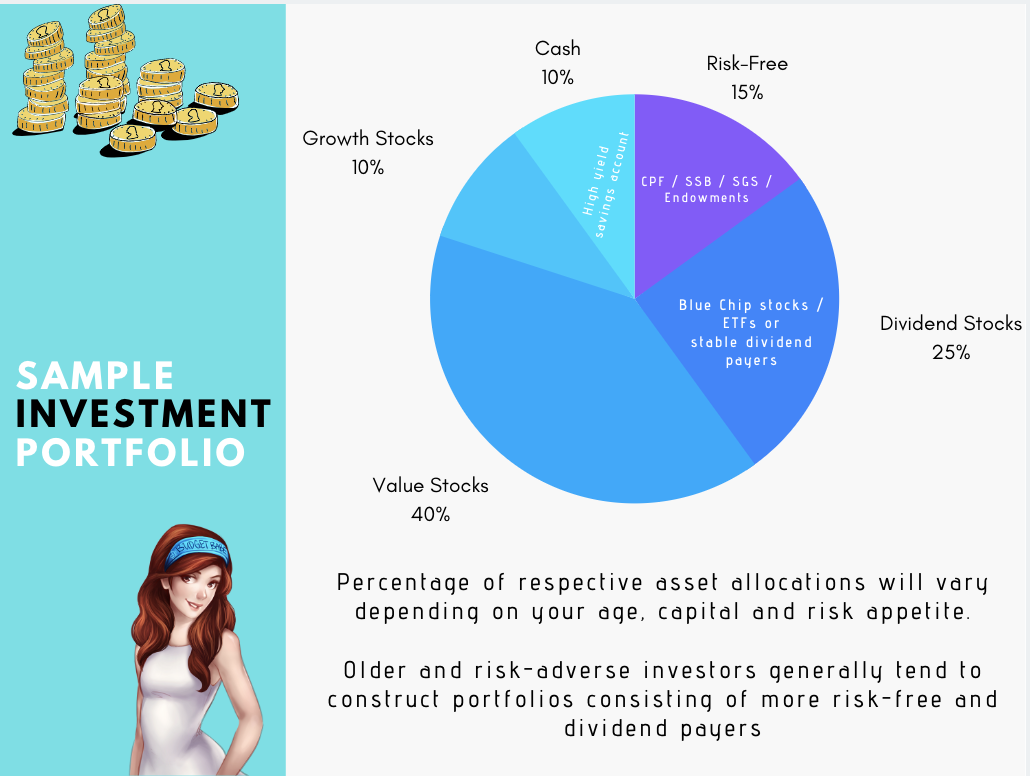

2. How much RISK are you able (or willing) to stomach?

As the adage goes – “High risks, high returns. Low risks, low returns.” Your risk appetite goes a long way in determining the type of investment instruments (and style) that you end up picking.

For instance, a retiree with a sizeable capital base (painstakingly saved up from working over the years) would probably not want to take too much risks with his money, because that sum is meant to fund his retirement. His physical health may not allow him to stomach too many heart-churning incidents either; a 20% drop in his portfolio overnight could be too much of a shock and might even induce a heart attack!

If you’re young and your earning potential is still unlimited, then you might be open to taking more risks with your money, even trying out tools such as forex trading, options, cryptocurrency or more. After all, if you lose the money, you can still earn it back easily, but the same can’t be said of retiree investors.

Of course, age alone is not a determiner of your risk appetite. Some people are inherently risk-adverse, and you sometimes can tell from their general behaviour even in the most ordinary of settings (eg. “no we can’t go for lunch earlier than 12pm sharp, or we could get in trouble if our boss finds out! let’s wait for a little more?” 😛 ). They prefer to work at a stable job where their monthly income and employee benefits are guaranteed, and would never dare to start their own business. Entrepreneurs, in this sense, tend to have higher risk appetites, and would even go into a previously unexplored market even when everyone tells them they would fail. Why, did you really think everyone around Jack Ma took him seriously when he shared his vision of building the world’s largest e-commerce company, especially for someone who didn’t know a single line of code and what’s more, in an age where eBay was the incumbent in China?

I have friends who are so risk-adverse that when I tell them to DIY their own investment portfolios to save up for their children’s university funds, especially given the long time horizon they have (18 years!), they prefer not to take any risks and would rather sign up for an endowment plan with a local insurer. Even when newer investment options such as MoneyOwl were launched, they didn’t want to consider them because they were too afraid to invest.

Find out your risk appetite and you’ll then know what investments to put your money into, all while you sleep comfortably at night.

3. What is your EMOTIONAL competency?

Warren Buffett and Charlie Munger, arguably two of the greatest investors of our time, are well known for their patience and their ability to stay calm even in severe market downturns.

In fact, they embrace market crashes instead of panicking like your next-door neighbour, because they see it as an opportunity to buy cheap stocks, rather than fretting over how much money their portfolio has lost.

When Charlie Munger was managing the Daily Journal (newspaper), he accumulated $20 million in cash balance and did nothing, patiently waiting for the right opportunity to deploy the money into. And that opportunity came in 2009, where he then made his move and invested the entire balance in two bank stocks that had plummeted to dirt-cheap levels: Wells Fargo and Bank of America. Within the next 6 years alone, that money grew so much (600%) until they were asked by the SEC to explain why and how a newspaper had a $130 million investment portfolio.

The best investors I’ve met (in real life) are also folks with these two traits of great patience and the ability to act calmly even in times of crisis. On the other hand, many sad tales of investors who have lost their money usually have a common theme of acting impatiently (often ignorantly, too) and who panic buy / sell, only to regret later on.

Work on your emotional competency to become a better investor. It is something I’m consciously working on, too!

4. How much TIME do you have?

The amount of time you have will also have a huge impact on the type and style of investing you go for. There are three aspects of time – time for learning, time for monitoring, and time in the market.

When you first start investing, you will need to spend time learning the knowledge and skills involved. Otherwise, how will you spot undervalued stocks if you don’t even know what metrics to recognise them by? How will you know for sure if that company is indeed poised for growth vs the odds of being just another sexy growth story stock that fails to deliver on its promise?

If you have plenty of time and little money, you might want to try self-learning through books and online investment blogs. You can find my list of recommended investment books here, classified by level of difficulty.

If you’ve little time and you’re willing to pay to shortcut your learning curve, I highly recommend going for courses such as Dividend Machines, Investment Quadrant or the comprehensive FBIC by Dr Wealth.

After you’ve picked up some skills, the next step would be to start looking for and researching on investment opportunities. Given that there are thousands of stock counters to choose from and you only have limited cash, how will you know which stocks to buy?

If you’ve a lot of free time to do research, then make an effort to read the news regularly (I recommend The Straits Times, Business Times, The Edge and The Financial Times for a start) and you should be able to pick up some good names over time. If, however, you’re time-pressed like me and juggling between work and kids, then one option I’ve recently found to be rather useful is to subscribe to stock mailing lists and narrow down your choices from their picks.

How much time you have to monitor the markets also matter. Trading often involves a lot of time and effort, and traders can’t afford to slack off or their investments could go awry. Index investors do not need to watch the markets often, and keeping abreast of macro economic matters is often sufficient. Value investors will need to expound more effort in checking stock prices and reviewing companies’ annual reports at least once every year, so they can spot when the value is recognised or destroyed and sell / buy accordingly. Growth investors might want to keep a close eye on acquisitions and general consumer sentiment, on top of the financial numbers to make sure the company is growing profitably.

On the other hand, many rich people who are busy running their business(es) seldom have time to watch the markets and spot market investment opportunities, which is why they usually work with private fund managers to manage their money for them, and they’re more than willing to pay the high(er) fees incurred.

Your time in the market will also determine which investment tools might be more suitable for you. Using back the same example of the retiree investor above, he might not have enough years left to wait for an undervalued stock to become recognised by the market, or even watch a growth stock attain its full potential. Neither would it be entirely appropriate to sell a 15-year endowment plan to a 75-year-old retiree (unfortunately, this was what one of my readers encountered with a bank representative when she brought her elderly mother to withdraw money). In contrast, younger investors (20s – 30s), can afford to wait out their investment thesis to materialize, and hence may be more drawn to value or growth investing.

—-

Thus, don’t rush into investing before you ask yourself these 4 questions. Once you have the answers, you’ll know which style and tools suit you best.

With love,

Budget Babe