For time-pressed investors who are looking for stock ideas, with sufficient capital to take action.

|

| Source credits |

A common question I often get is how and where I get my investment ideas from. If you count just SGX, NYSE, NASDAQ and HKSE (the stock markets I’m most interested in), there are a gazillion listed stocks alone…all of which could provide an opportunity. So where does one get started?

For me, I get my stock ideas from anywhere and everywhere. It could be from reading the news, an analyst report, a (non-fiction) book, seeing a brand when I’m overseas, or hearing about a “stock tip” from my friends.

As long as you cultivate an open eye and mindset, there really are opportunities to be found everywhere. For instance, my investment into Disney (almost a 50% gain now) was sparked off when I noticed plenty of children carrying Frozen and Marvel-themed backpacks while I was out on a casual stroll through a neighbourhood mall. That piqued my curiosity enough to wonder and decide to study the parent stock (Disney), and the rest is history.

I’m always on the lookout for opportunities, even in casual conversations with friends or colleagues who aren’t stock investors, because sometimes even the latest consumer trend could be the next multi-bagger. After all, that was my experience with Apple when I was younger; I would certainly also invest into Dyson now if only they were listed!

But if you struggle to spot opportunities like these, there’s another solution that has recently popped up on my radar: subscriptions to stock mailing lists.

Similar to analyst reports from brokerages, these stock mailing lists are run by often seasoned investors who dedicate their full time to researching and writing about stock opportunities. While most aren’t as technical as the ones you get from your local brokerage, they’re usually easier to read and also provide insights into stocks you’ve probably never heard of before.

Free Resources Online

If you know how to discern the good picks from the bad eggs when you’re reading for investment ideas online, then frankly speaking, you don’t need to pay for stock mailing lists because you’re fully capable of finding your own stock ideas!

Save the money and use your own time to generate your own picks instead.

But if you’re not a fan of the resources online, then perhaps following an investor whose opinion you value could be a good starting point. Some of such investors I respect write for free online, while others charge for their time and effort spent. Some offer both free and paid resources (including yours truly. IPO resources from me will always remain free on this blog.)

Bear in mind that not every investor goes in deep into research either. By the way, some of the best resources I read for investment ideas include articles by The Fifth Person, Investment Moats, and Dr Wealth. Check them out if you haven’t already.

Almost everyone has an opinion on a stock. What’s undervalued to one investor could be overpriced to another. At the end of the day, you need to be able to judge for yourself. So if you’re concerned that you don’t know how to differentiate between the many differing opinions on the web when it comes to stocks, then a good tip would be to follow the writers whom you respect and know they do not compromise on their research process.

If you find there aren’t enough of such free resources for you, then perhaps a paid subscription to a stock mailing list might be another place to look.

Are such stock mailing lists worth it?

It really depends on what you wish to get from such a subscription. Generally, if you’re looking for viable investment ideas, such a service could be useful because they curate what they believe to be quality stocks and narrow down the entire universe for you to focus on a few opportunities.

While some of the reports go into pretty extensive detail and financial figures / ratios as well, they’re definitely not as detailed all the time, so you’ll have to manage your expectations there.

Two important factors to consider before you subscribe are:

- Profile of the research analyst(s)

- Cost

To determine cost vs value, an easy way to calculate it would be to divide the number of stock ideas or reports that you’ll be getting by the subscription fee. Everyone’s threshold would be different when it comes to assigning a dollar amount to such a value, but personally, I’m willing to pay up to S$50 for a really good stock idea. Hence, if I’m paying S$200 a year to a subscription that doesn’t give me at least 4 good stock ideas to look into in any given year, then I tend to terminate my membership thereafter.

Folks Who Aren’t Suitable for Such Mailing Lists

Of course, not everyone might be suitable to start with such mailing lists. If you’ve a small capital base, then you might be better off doing your own research instead. If you’ve plenty of time on your hands, then perhaps you could save the monies as well and DIY.

Based on the mailing lists where I’m subscribed to, I’ve also realised that the following profiles of investors may not be entirely suitable:

Dividend investors – many of the mailing lists available focus on overseas stocks, and for Singaporean investors, you’ll be subjected to withholding tax which make it a lousy strategy to build your dividend portfolio based on overseas counters. You’ll be better off looking at REITs instead, or check out Dividend Machines by The Fifth Person to learn how to do your own research.

Investors who buy purely on “stock tips” – if you’re expecting to be spoon-fed such that you can immediately put your money into a stock just by reading a report, then these mailing lists would be a recipe for your own disaster.

The strategy should be to use these stock ideas as a base to go forth and conduct your own research and judgement. If you don’t take ownership and effort with your own money, then that is almost akin to speculating, and you’re just setting yourself up for a higher failure rate.

Reviews:

I’m currently subscribed to several mailing lists where I receive periodic updates on stocks that they reckon are worthwhile investments to go into. From there, I sieve out the ones that sound appealing enough to me, and proceed to do my own research and analysis before I decide whether to buy or skip.

Here’s my review of 4 resources, and I hope this helps you decide if it’ll be suitable for you as well before you sign up:

1. Alpha Lab by The Fifth Person

Their proposition:

I concur with many of their stock picks, many of which they’ve bought at an even lower price than me, lol. However, due to the subscription price, it’ll be best only for time-pressed investors who already have a substantial capital base (eg. min. $20,000) to start.

2. Stansberry Pacific Research

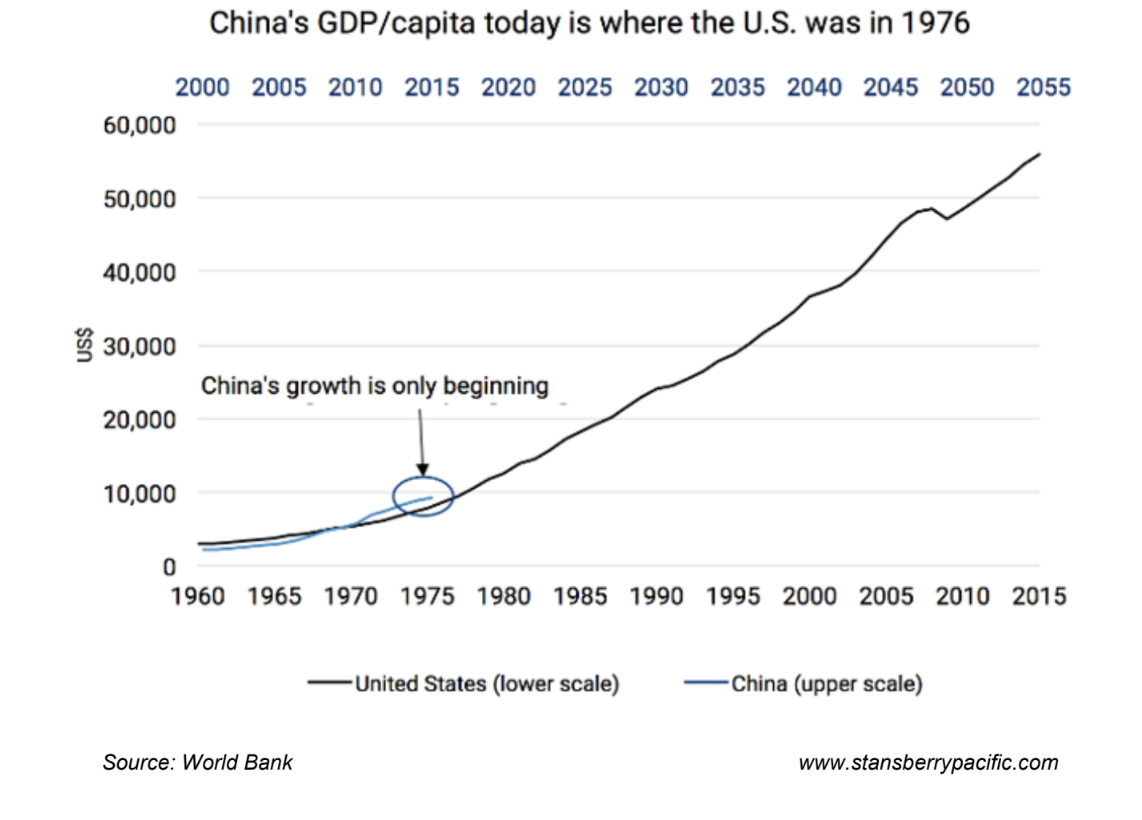

Looks at global stocks across several stock markets, and particularly delves into undervalued gems in Asia. From their newsletter, I came to know of several companies that are benefiting from the growth of China, that I didn’t previously know of. Here’s some data extracted from one of their recent stock picks:

“It also has one of the highest profit margins in the industry, with operating margins of 13 percent, and a return on equity of 37 percent. In contrast, Ford is at 4.2% operating margins, and half of company X’s ROE.

While Ford produces 2.6 million vehicles a year from 29 different factories, this Chinese carmaker manufactures 1.25 million cars a year from just 11 car plants in China.”

An interesting option for value and growth investors who are looking to capitalise on the growth of Asia and Asian stocks.

Patreon

Disclosure: My own stock subscription list.

I also run a Patreon with such reviews, but be forewarned that my reports are generally very long, given the depth of financial analysis and qualitative evaluation. I would say this is only for readers who like my style of investing, and who have ready capital (but no time) to spare to do your own research.

Each report generally takes me about a week to research, and another 2-3 days to write, so I take immense pride in the articles I write here as I go in-depth and even look at the next buy / sell levels that I’ll take action on. My Patreon is basically a place where I park my own investment thesis before I buy / sell a stock, except that paid readers can access them as well.

Nonetheless, my investment profile is definitely not as prolific as many other investors, and I wouldn’t recommend for most people to subscribe to me unless you (i) wish to support my blog and (ii) look at stocks in a similar approach like me i.e. qualitative > quantitative, although both aspects must and are always analysed.

VIA Club

Disclosure: Affiliate links included for VIA Club.

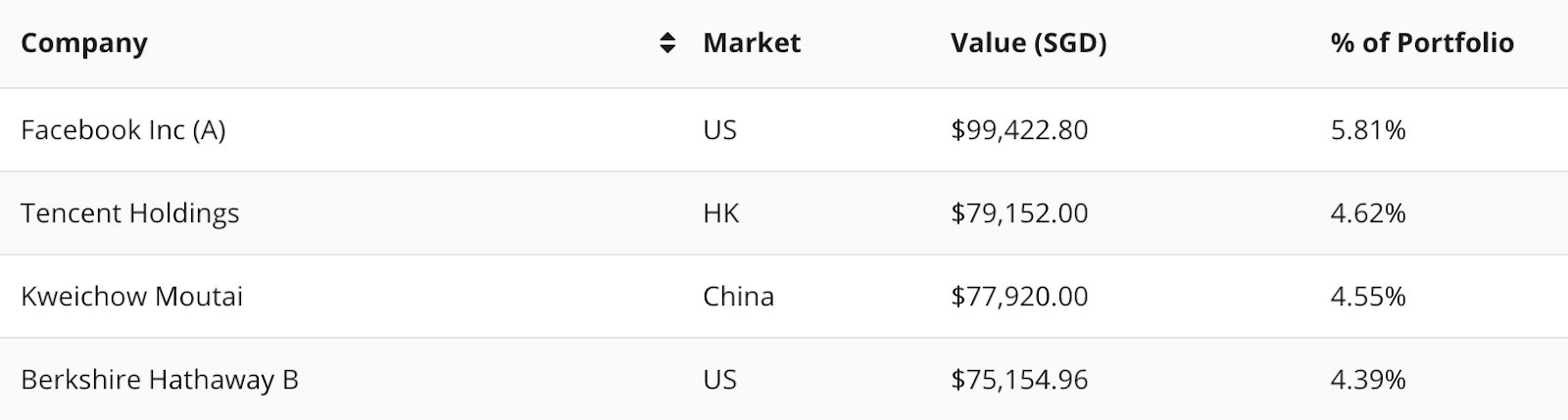

Stanley is a respected investor within the Singapore and Malaysia scene, as he sloughed through 8 years before he started seeing massive gains in his portfolio. Today, he is a full-time investor and spends his hours researching and sharing about companies, including SGX-listed ones. If you’re keen on following someone with a $1.5 million investment portfolio and potentially mirror his trades, then VIA Club might just be for you.

In fact, if you’ve followed his call in December on Facebook, you would be sitting on 50% of profits by now…within just 7 months. Back then, he released a report on Facebook, deeming it as his “favourite company for 2019”. (Psst, it was my favourite stock in 2018 too.)

|

| Stanley’s portfolio, available on VIA Club |

You’ll also get access to:

- Live updates on a cool S$1.5 million portfolio

- Weekly market reports and stock analysis

- Premium podcasts with senior management of listed companies

- Community discussions

I have a similar investment approach to Stanley’s and his picks are usually stuff already on my watchlist as well, which is why I generally appreciate reading through his reports and thoughts on the company before I start my own research.

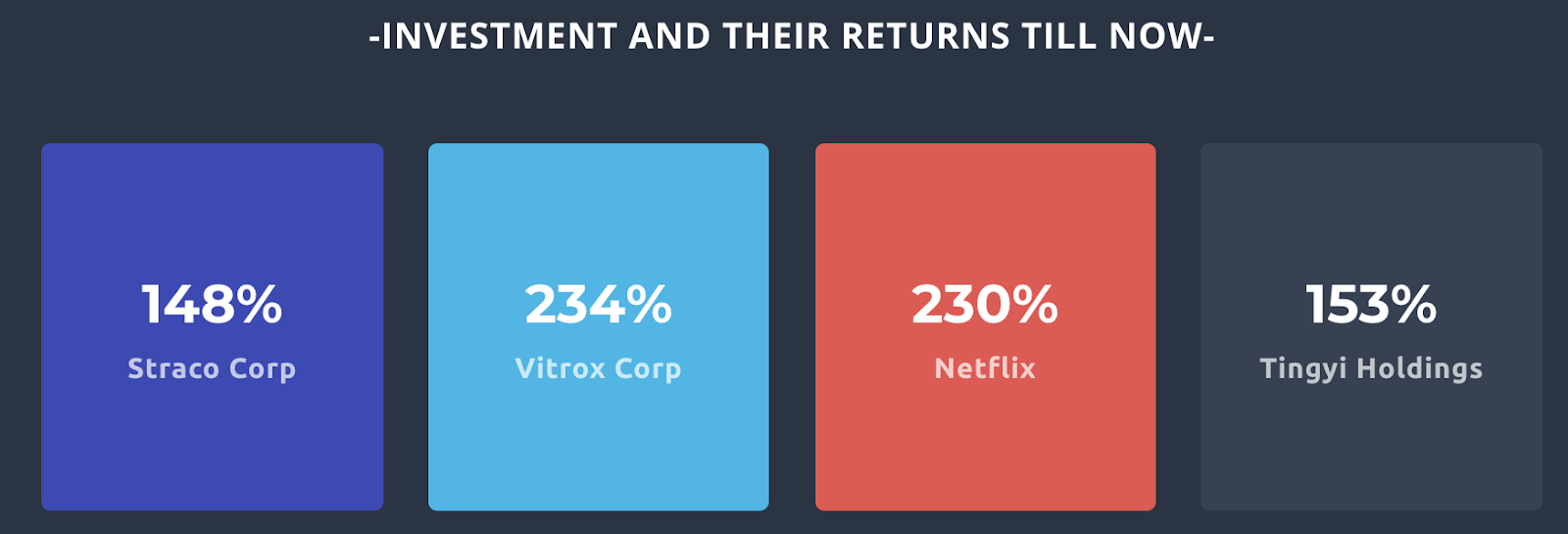

Here are some of his other investment picks:

For those of you who are keen on US, HK and SG stocks, then Stanley’s picks may be right up your alley. And if you’re interested to try it out, you can use the promo code “SGBB” to get 25% off (valid till end July 2019) so it brings the price down to just USD 126 a year.

That’s less than $15 a month for one good stock idea.

If you’re not willing to fork out that amount, don’t worry – there’s always free resources as well. Just scroll back up and you’ll find the links to those 🙂

With love,

Budget Babe