In my last article, I wrote about how a couple can own a HDB and a private property without incurring hefty ABSD on their second property, by using the HDB owner-occupier model.

Many of you have DM-ed me for more details about this, thus prompting this article. Without further ado, here’s (i) how the scheme works, (ii) the pros and cons you should take note of, as well as (iii) how to incorporate this into your property plans moving forward.

Important disclosure: This information is for reference only, and not a recommendation nor individual advice to your situation as I have zero clue on your context while reading this article. I am not authorized by any government agency or stat board to write this, especially not HDB (who’s in charge of HDB matters) and IRAS (tax matters). All effort has been made to provide accurate information at time of publishing, and if you spot any inaccuracies, please leave me a comment below. You should always seek out professional advice before executing any legally-binding moves in your property.

What is the HDB owner-occupier scheme?

The manner of your property ownership will determine many outcomes down the road, including financial implications such as whether you’re legally liable to pay ABSD on a second property.

Most couples choose Joint Tenancy or Tenancy-in-Common, but little is known that you can also go for a third option: owner-occupier. This will become particularly useful if your household intends to purchase a second property in the near future.

At the point of purchasing your HDB, you will need to indicate your ownership structure. If you are buying a BTO, this will be shown to you during the application phase:

If you are buying a resale flat, you can do this with the conveyancing lawyer helping you with the legal ownership documents. In this case, you will need to purchase as a sole owner and indicate that you (or your spouse) is the Sole Lessee.

The other spouse can thus be put as an essential occupier, which helps you towards meeting the eligibility criteria by HDB to purchase a flat. If you’re unsure, you can read more about HDB’s eligibility conditions for new flats here and resale flats here respectively.

There are certain rules you need to follow:

- All applicants and occupiers listed in the flat application do not own other propertylocally or even overseas,

- and have not disposed of any within the last 30 months.

- Occupiers can only be your immediate family members.

What are the pros and cons?

In real estate, ownership interest in a property refers to the rights that one (or multiple owners) hold on the property. When a couple co-owns their property, both of them have legal rights to it. In the case of joint tenancy, the surviving spouse will then own 100% of the property in the event that the other were to suddenly pass away. You can read more about this here on HDB’s website.

Disadvantages

But the biggest drawback of being an occupier means you do not own any rights to the property, even though you are recognised as family members in the HDB flat.

This means that in the event of any legal dispute (e.g. divorce), things could get messy if you are trying to lay claims to the property. It doesn’t matter even if you have contributed to repaying the mortgage, since the legal ownership structure shows that you are merely an occupier rather than a co-owner. To contest this, you will need to fight your case in court (which will also incur hefty legal fees) with no guarantee that you will win.

Aside from (a lack of) legal rights, there are other cons of this method as well:

- you cannot use an occupier’s income assessment for your loan application on the house

- the occupier’s CPF cannot be used

- the occupier will also need to fulfil the MOP (Minimum Occupation Period)

You must also note that since you’re buying a HDB, the MSR (Mortgage Servicing Ratio) of 30% will also apply on the sole owner’s income.

So this method only works if you have complete trust in the other party, and the one who’s the sole (legal) purchaser has sufficient income and CPF to meet the criteria for the downpayment and loan.

Advantages

Of course, the silver lining in this arrangement is that upon completion of MOP, the occupier can then go on to purchase a private property without incurring ABSD.

Why? This is because since the occupier does not have any legal interest in the HDB, it will not be factored into his/her property count.

The private property is thus considered the first property that he/she owns, so no ABSD is payable. This will easily save you at least 6 digits in stamp duty, or even more if you’re buying a higher-priced property.

Is this legal? Of course it is…until our government closes this loophole.

How come I didn’t read about this on HDB’s website?!

Have lah. The information is just not structured in the way you wish it was, but that doesn’t mean it isn’t legal. If you look carefully at the wording, you will see it:

Pay attention to the grammar! Now you know why your teachers said to master English, eh?

How can I incorporate this into my property plans?

I’m married now and own a HDB with my spouse. Can I use this method?

If you currently own a HDB with your spouse and you’re thinking of buying a private property, unfortunately there is no way you can benefit from this owner-occupier method. HDB no longer allows married couples to “decouple” in this way when they changed the policy a few years back, so this loophole no longer works. Instead, read my previous article here for other solutions on how you can structure it such that you will not incur ABSD.

If you are thinking of selling your HDB, then you may want to think carefully about how you want to structure your next purchase in order to ensure you’re not subject to the prevailing ABSD policies.

I’ve written about this in more detail previously, and you may read more here.

How much can this method save me?

Not having to pay ABSD can have significant savings e.g. $170,000 on a $1 million condo apartment, or even $6.8 million on this $40 million Good Class Bungalow. Thus, if this method works for you and your partner, you may want to sit down and properly discuss it (together with the pros and cons).

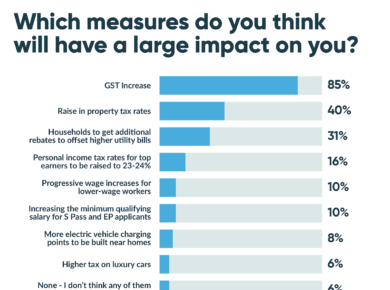

May I also remind you to always be prudent in your property purchases, and not overstretch your finances. While the TDSR has recently been lowered from 60% to 55%, I also do not personally believe in maxing out your limits unless you have ample spare cash and/or other liquid investments.

Property remains an attractive and resilient asset in Singapore due to many reasons, including our political stability, lack of natural disasters, our attractiveness to foreigners (for work and/or investment), and more. As our government is still building up and transforming our landscape (you can always study the URA masterplan for clues), there are many opportunities for potential capital appreciation in property, especially if you’re savvy enough to snag an undervalued one.

However, because property is possibly the largest purchase you’ll ever make in your life, you cannot afford to make a wrong move.

So please tread with caution and I suggest that you speak to a licensed realtor (I’m biased but I highly recommend my husband if you need professional help. He was the one who opened up my eyes to many of these things), or even a lawyer for advice before you proceed, otherwise it may be too late in the future to undo any damage already done(even if it was done unknowingly).

My husband has agreed to help advise my readers in his professional capacity, so if you need some guidance and lack a trusted advisor, you can always DM me on Instagram here and I’ll link you up.

Important Disclaimer: The information presented here is for reference and educational purposes only. I do not represent nor speak on behalf of any government agencies or statutory board, and definitely not for HDB, IRAS, CEA, URA, MND, etc, which is why you cannot and must not take my words as a confirmation in any way. It is best that you engage a professional or get any confirmation that you want in legal black-and-white before you execute a move in order to protect yourself. I do NOT advocate breaking of any laws in Singapore when you’re buying property, but I’m a firm believer that you should be educated on the prevailing policies and how best to structure your purchase and/or investment(s) in order to reduce your relevant taxes liable.

With love,

Budget Babe