When our government decided to implement CareShield Life as a mandatory national insurance scheme for all Singaporeans aged 30 onwards, I knew we could no longer afford to ignore the issue of long-term care and its costs.

There are generally 6 types of ADLs being assessed:

Unfortunately, CareShield Life does not cover you in the event of moderate disability where you are unable to carry out 2 ADLs independently…

However, even though you don’t qualify for CareShield Life payouts at this stage, you’re likely to already start incurring costs for long-term care or caregiving fees. Recovering stroke patients are a good example of such folks.

I personally feel that getting additional coverage from private insurers makes sense, in order to cover this gap.

Disclaimer: please assess your own financial situation and needs in order to decide whether you too, wish to purchase supplementary insurance to protect yourself and your family against disability

But before you rush off to buy the plan with the highest coverage, remember that we have to factor in our other insurance needs as well – such as hospitalization coverage, critical illness, home mortgage, etc.

These will also require us to allocate sufficient budget and ensure we have enough cash flow to pay for all the different insurance needs in our life.

Which is why if you’re most concerned about affordability, then you’d want to look at Income’s Care Secure.

Review of Income’s Care Secure

Benefits

Once you’re diagnosed with the inability to perform 2 ADLs, your monthly payouts begin and your future premiums will be waived during your entire period of disability (whether temporarily or or life). You will also receive a lump-sum payout of 300% of your chosen monthly benefit.

For those of you worried about the financial burden on your loved ones, Care Secure also provides an additional 25% of your monthly benefit, up to 36 months in a lifetime as Dependant Benefit. You will be glad to know that Income’s definition of “Dependant” extends to your children, your parents (including step-parents or adoptive parents) and even your parents-in-law.

Considering how Income believes in helping our era be the last sandwich generation (remember their emotional ad?), I can imagine many people benefiting from the broader definition.

Premiums

We can use up to $600 of our MediSave account each year to pay for insurance premiums on our CareShield Life supplements. Do note that if your insurer charges you more than $600 in annual premiums, you will need to pay the rest in cash, so you should factor that in over the payment period that you have selected.

In other words, if your cash expenses are $200 a year and you’ve opted to pay until age 95, then please think about how you intend to fund this in your retirement years (e.g. your savings? Or are you expecting your kids to help to pay then?)

Here’s what the annual premiums currently look like for a monthly benefit of $1,200 (premium term up to age 67):

Impact of getting covered at a later age

Now, if you were considering putting this off until a later age, think again.

Not only do you risk being uninsured for 2 ADLs during this period, you will also be incurring higher costs when you start your coverage at a later age.

Using the above table, it is clear that starting later will mean you end up paying not only higher annual premiums, but also higher total premiums over your lifetime. This is is another reason why you might want to start looking at getting your CareShield Life supplement sooner rather than later.

What happens once I hit 3 ADLs?

Once you’re confirmed by a MOH-accredited severe disability assessor to have severe disability (inability to perform 3 ADLs or more without assistance), you will now qualify for CareShield Life payouts.

(please refer there for the footnotes)

Hence, at this stage, the monthly benefit that you will be getting from Care Secure will be inclusive of your CareShield Life payout. For instance, if you’ve opted for a $1,200 monthly benefit plan, then you will now be getting $588 from Care Secure and the remaining $612/month from CareShield Life (as of 2021).

While some people are (rightfully) concerned about the possibility of Income’s payouts being zero eventually (since there will come a time where CareShield Life payouts cross the monthly benefit level), I encourage you to do the math and calculate when exactly this will materialize for you.

For the $1,200 monthly benefit plan, if we were to use the current projected 2%^ growth rate by MOH (and assume the growth rate remains constant), this means that it will only be in 2056 onwards where Income’s $1,200 will now be less than what CareShield Life pays out each month (the payouts will hit $1,199.94 in 2055).

^The 2% figure only applies till 2025, so if MOH changes that subsequently, you may want to adjust your calculations accordingly.

In this case, I would then ask myself – is it worth paying ~$28/month to protect myself against the possibility of long-term disability over the next 34 years?

In terms of affordability, Care Secure truly stands out.

And if you feel $1000+ may no longer be enough in the event of severe disability, then you may want to think about whether you need, and can pay for, a higher payout level. If you were to go for Care Secure with a higher monthly benefit e.g. up to $5,000, it will take 109 years upon CareShield Life’s inception before payouts hit $5,092.95 i.e. in the year 2128 (assuming CareShield Life payouts grow at 2% a year).

With this insight, I hope you can now better understand why Care Secure may have been unfairly criticized on social media, and consider again whether this plan might in fact be a better option for you.

Closing Thoughts

Most of us have probably never thought of planning for the costs of long-term disability care until our government announced CareShield Life last year.

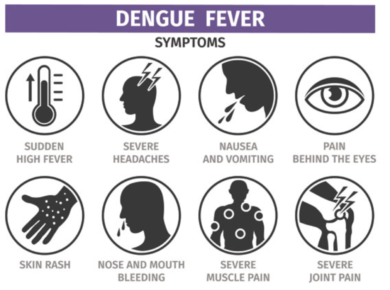

And contrary to what most people think, disability does not just affect those who are older (although the elderly are definitely more prone to it). There have been plenty of cases of young people who have been diagnosed with moderate to severe disability. All it takes is one unlucky accident, or a stroke, or a heart attack, or…just pure bad luck.

Which is the point of insurance, isn’t it? To insure us against potentially large financial risks that could befall us if we suay.

If you have dependents like me (parents, in-laws and young children), it makes sense to start planning and getting insured for this as soon as you can, so that you do not risk passing the burden onto them.

Various MPs have also called for more support for caregivers. The 2019 figures already show that the majority of 9 in 10 caregivers who left the workforce were women, who then went on to struggle with uncertainty over their own careers, mental health and financial adequacy in their old age.

If you and your spouse are protected with a plan like Care Secure, at least you still have other options – such as hiring a domestic helper – instead of having to quit your job entirely. By outsourcing the stress of finances to an insurer, you also have more room to deal with the mental and emotional stress of having to care for a loved one who is unable to look after themselves anymore.

Combine the trend of rising costs with smaller family sizes, and you can see why we’re going to be in trouble if we do not start preparing early. Gone are the days where multiple siblings used to come together to split the cost of caring for a family member. Rather than pass this financial burden to my spouse or our children in the future, I believe it is essential to get covered earlier while I can.

The only question left is how much to cover for – and that’s a decision you’ll need to make for yourself considering your own financial ability and preferences. If you’re unsure, feel free to arrange for a consultation with any of Income’s advisors, whom I’m certain will be more than happy to guide you.

Find out more about Care Secure and how it can supplement your CareShield Life plan here.

Disclosure: This post is written in collaboration with Income as part of their awareness campaign for Care Secure.

You may also read about the other CareShield Life supplements here, researched independently with my own opinions on the available plans in the market.

Important Notes

This article is for general information and should not be relied as financial advice. All opinion and information in this article are solely those of SG Budget Babe. SG Budget Babe is responsible for the accuracy and completeness of all information and intellectual property used in this article. NTUC Income is not responsible to any party for this article. You should seek advice from a qualified advisor if in doubt. Buying insurance that are not suitable for you may impact your ability to finance your future insurance needs. Precise terms, conditions and exclusions of this plan are found here.

Protected up to specified limits by SDIC.

Information is correct as at 4 November 2021.

For customised advice to suit your specific needs, consult an Income insurance advisor.