If you have a private hospitalisation insurance (Integrated Shield plan) with riders, you will now need to pay 5% co-payment in the event that you claim for a bill.

Prior to April 2019, all IP insurers offered full riders that allowed consumers to enjoy zero co-payment regardless of bill size. This, however, has since been phased out by the Ministry of Health, and effective April 2021 (today), all IP policyholders will be subject to the 5% co-payment requirement…yes, even if you had bought a full rider prior to the 2019 change.

How will this affect me?

As consumers, this means that we will no longer be able to claim 100% of our hospitalisation bills. Instead, you will now need to pay 5%, although this amount has been capped at $3,000.

As prudent financial planning, this means that you should ideally have stashed away at least $3,000 per year per person in your household in your emergency fund to prepare for any unexpected hospitalisation bills alone.

Do I need to go for my insurer’s panel specialists only?

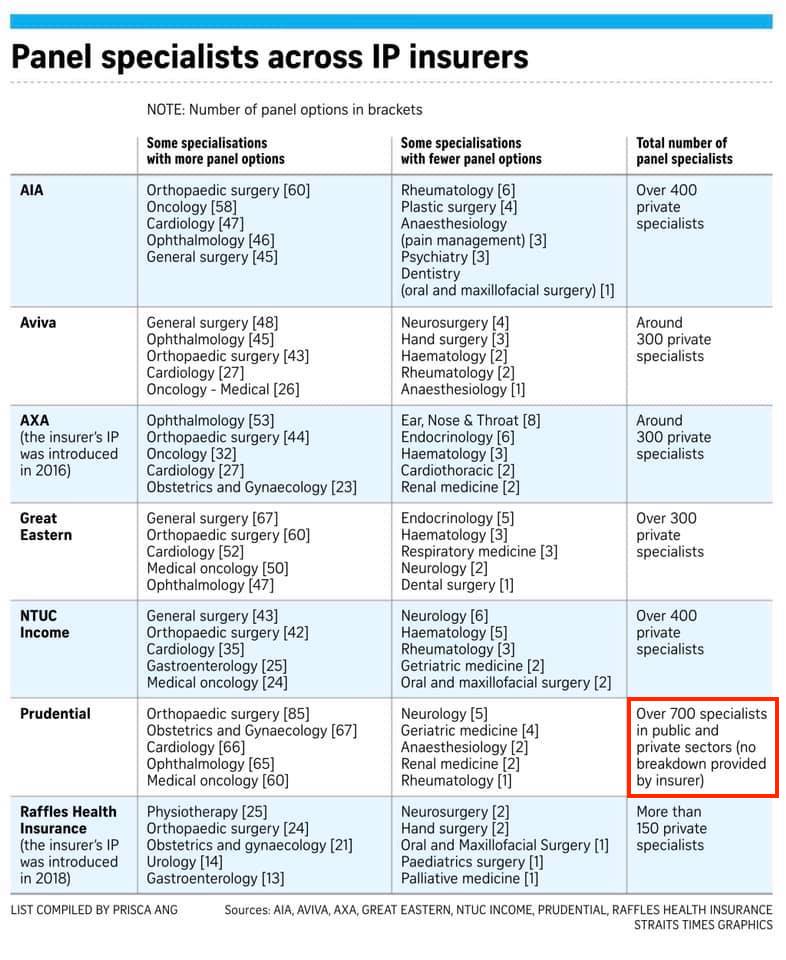

The $3,000 co-payment cap only applies if you get treated by your insurer’s panel of specialists. At this moment, here are the variety offered by each insurer respectively:

|

| Credits: The Straits Times |

If you choose a non-panel specialist for treatment, you may have to pay additional costs since the $3,000 co-payment cap will not apply to you.

But while you may have seen some people complaining that because of this change, they have had to switch specialists because the one(s) they had been seeing was not on their insurer’s panel. But the fact is that the majority of patients do not have to do this, and even if you do, going beyond the $3,000 cap only matters if your total bill for the year exceeds $60,000.

According to LIA, less than 3% of patients have claims that exceed this bill size.

So in short, if you’re worried about having to pay more than $3,000, then you should try to choose a specialist from your insurer’s panel. But if changing specialists isn’t always a viable option, then you don’t have to fret as much – because the odds of being in that 3% of patients who have to pay an outsized co-payment sum are generally still low for now.

Possiblity of lower premiums

The good news is, several insurers have announced that they’ll be reducing their premiums by up to 50% as a result. We can look forward to this in the near future.

Our insurance premiums for hospitalisation coverage has gone up tremendously in the past few years. I’ve had my plan ever since I graduated, but easily paid double of my first few years premiums (when I was in my mid-20s) in recent years.

For some other insurers (like Prudential, AIA and Great Eastern), they’ve since moved to claims-adjusted pricing, where you’ll enjoy a discount on your subsequent year’s premiums if you did not make any claims against your policy this year. I’ve personally been benefiting from this because I’ve not made a single claim since the first day I bought my policy.

Lower premiums will be welcomed by most consumers.

TLDR: IP policyholders will no longer have as much freedom as before to choose any treatment or specialist that they wish to see. But this should ultimately lead to lower costs for everyone over the long term.

But that doesn’t mean it is all bad. Ever since full riders were introduced a few years ago, hospitalisation fees have been rising too quickly beyond the affordability levels of the general public. Hence, I see this as a good move in the long run for everyone.

If you’re wondering which is the best hospitalisation insurance to go for, stay tuned for my upcoming blog post.

With love,

Budget Babe

5 comments

$3000 out of 5% means the bill is at least $60k. For such a large bill, it's highly likely that the co-payment of $3000 can be settled with Medisave.

Definitely, you raise a good point. And when we look at the data, the odds of being in that 3% of patients who have a bill higher than $60,000 are fairly low.

So I don't think we should have to worry as much, although it'll be financially prudent to set aside $3,000…just in case 😛 you can call me kiasu!

Hi SGBB "yes, even if you had bought a full rider prior to the 2019 change."

Does this mean if I bought my rider back in 2017, I am affected too? I can't seem to find articles on this. I thought this applies to those who bought their insurance from Apr 2019 only.

For now, everyone is affected unless you are with Prudential. But there is no guarantee when they are going to impose the co-payment.

that's correct, you should be receiving a notice from your insurer soon. there's been several articles on this, including those reported in the Straits Times: "The Ministry of Health (MOH) has welcomed the latest measures by private insurers to adjust the terms for those on existing Integrated Shield Plans (IP) with riders that cover hospital bills in full. NTUC Income has begun informing policyholders on such plans that they will soon have to co-pay part of their bills when their policies are renewed. Four other insurers having IPs with such riders say they are moving policyholders to co-payment riders, or considering doing so.

NTUC Income had, from Feb 3, started informing around 160,000 policyholders of IPs with riders covering hospital bills in full that their plans will have a new co-payment feature for renewals from April 1."

https://www.straitstimes.com/singapore/health/moh-welcomes-measures-by-insurers-to-adjust-terms-for-full-rider-ips-and-require-co

For final confirmation, wait for the letter from your insurer as it'll take time for the changes to be rolled out and policyholders to be informed accordingly.

Comments are closed.