For those of you who prefer to outsource their wealth-building to robo-advisors (like Syfe), would you prefer to be stuck with a limited handful of investment portfolios to choose from, or do you prefer to have a wider variety?

If you answered the latter, then you may want to check out Syfe and their latest offering, the Core portfolio(s) with 3 portfolio options for you to choose from: Defensive, Balanced, or Growth.

Designed to be your core portfolio (read this for the core-satellite strategy I’ve talked about previously), it will also provide exposure to the world’s second-largest market (China) and the rapidly-growing technology industry in today’s digital revolution. What you’ll get is thus a portfolio with holdings of stocks, bonds and gold across 23 globally diversified markets and over 3,500 companies.

What is in the Core portfolio(s)?

Each portfolio consists of 18 ETFs across stocks, bonds and gold that are managed by Vanguard, Blackrock, etc…i.e. the world’s largest asset managers. The stocks you’ll be invested in include Apple, Microsoft, Tesla, Alibaba, Tencent and many more.

Previously, many investors lamented during Syfe’s webinars that none of Syfe’s portfolios offered exposure to the Chinese market. And if there’s one thing about Syfe that really impresses me, it is how they react and innovate to offer new products that cater to what investors want. I observed this previously when they launched their Equity100 portfolio, and then again when Cash+ came out as an alternative to bank deposits in a time of low-interest rates. Today, they’ve added Core to integrate the secular trends of Chinese growth companies and technology stocks.

Syfe has also integrated their Smart Beta strategy, which tilts towards large-cap companies with growth and low-volatility factors.

So, how is that being pulled off?

In essence, your exposure to China basically comes from 2 main ETFs: the iShares MSCI China ETF (MCHI) and KraneShares CSI China Internet ETF (KWEB).

That means your funds will be invested into companies such as Meituan Dianping, Pinduoduo, Baidu, Kuaishou…basically leading tech giants that are benefiting from the growth of China’s Internet population, which still has room to grow. China’s Internet population is still only at a 61.2% penetration rate right now vs. the U.S. rate of 89.5%.

With Syfe’s Core portfolios, you get a pretty significant exposure to the Chinese market. For example, the Core Growth portfolio has a 14% geographical allocation to China, while the Balanced and Defensive portfolios come in at 7% and 4% respectively.

3 portfolios to choose from

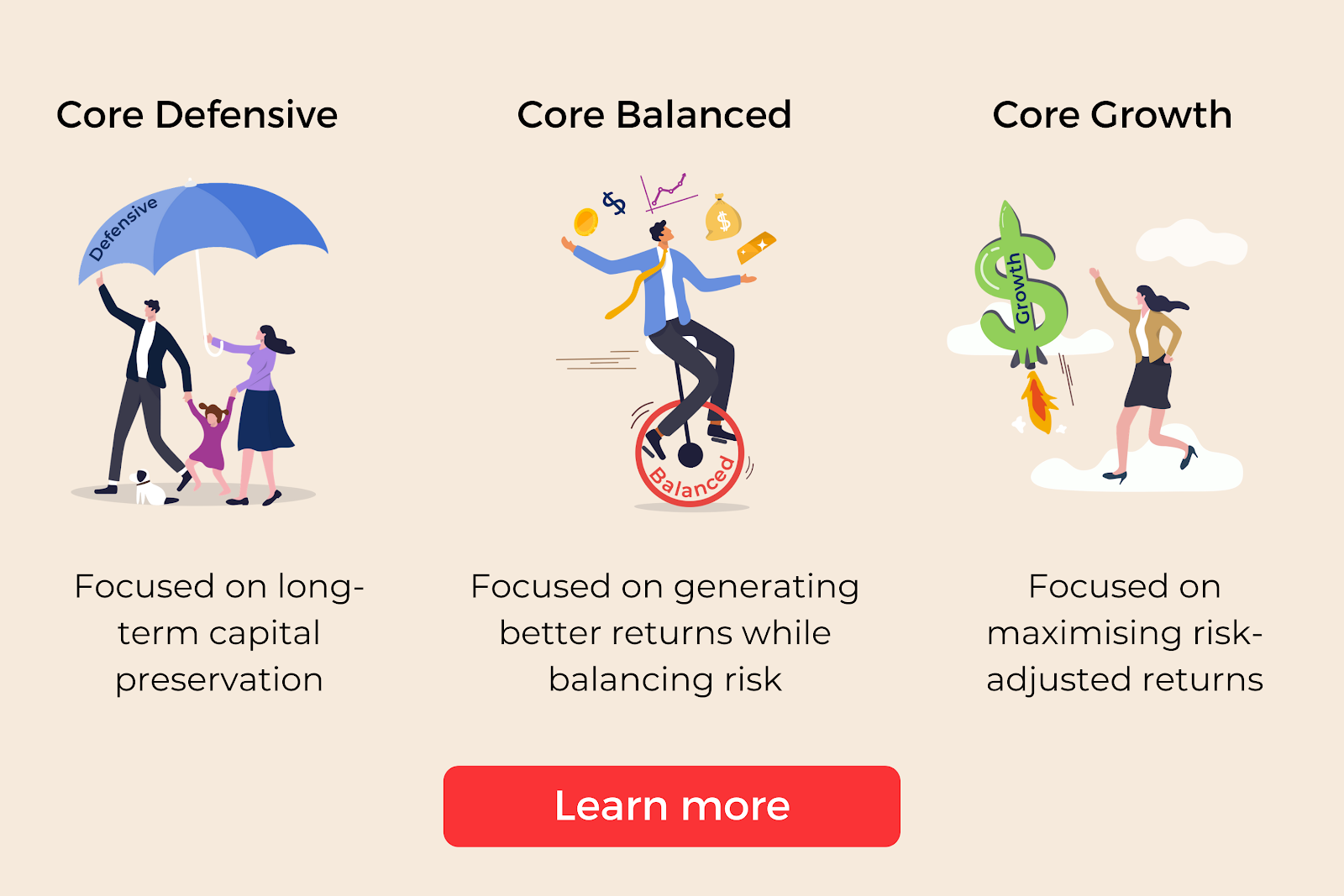

Depending on your risk appetite, you can choose between the Growth, Balanced or Defensive portfolio – or even a combination of them.

For instance, if you’re like me and believe that equities will outperform bonds and gold in the next few years (especially given the low borrowing rates coupled with high returns on invested capital in the right sectors), then you may want to go for the Core Growth portfolio, which has 68.8% allocation to equities.

On the other hand, if you’ve not been able to stomach the volatility in the stock market in the past few months, then you may prefer the Balanced or Defensive portfolio instead.

And if you’d rather have an even higher exposure to equities, there’s always the option to go for a 100% exposure to stocks via Syfe’s Equity100 portfolio instead, or use that as a satellite strategy to complement your Core portfolio.

Can I DIY instead?

Of course! There’s absolutely nothing stopping you from referencing the ETFs that Syfe has consolidated in their Core portfolios and replicating it in your own DIY portfolio. In the name of transparency, Syfe even openly discloses what they invest in:

But the better question to ask here is, will it be worth my while to DIY?

If you’re not feeling up for the consistent monitoring and rebalancing of your portfolio, then you can always outsource these to Syfe to do it for you. What’s more, their feature of automatically reinvesting your dividends also allows you to compound your gains over time for an even larger return.

What about fees?

As there are no brokerage commissions, sales charge per transaction or even a minimum investment amount, this makes investing in Syfe’s portfolios more cost-efficient than trying to invest in the underlying ETFs on your own.

In fact, most index investors would probably have migrated to robo-advisors like Syfe by now, given the ease, convenience and lower fees involved vs. managing their own DIY portfolio.

Because of the significantly lower fees, you can also apply dollar-cost averaging by setting up a recurring bank transfer to deposit funds into your Syfe portfolio(s) on a regular basis. This is one of the easiest ways to enforce discipline…vs. signing up for an investment-linked plan instead (a lot of advisors are selling these on social media nowadays, which comes with higher fees that eats into your returns).

Can I have more than one Core portfolio?

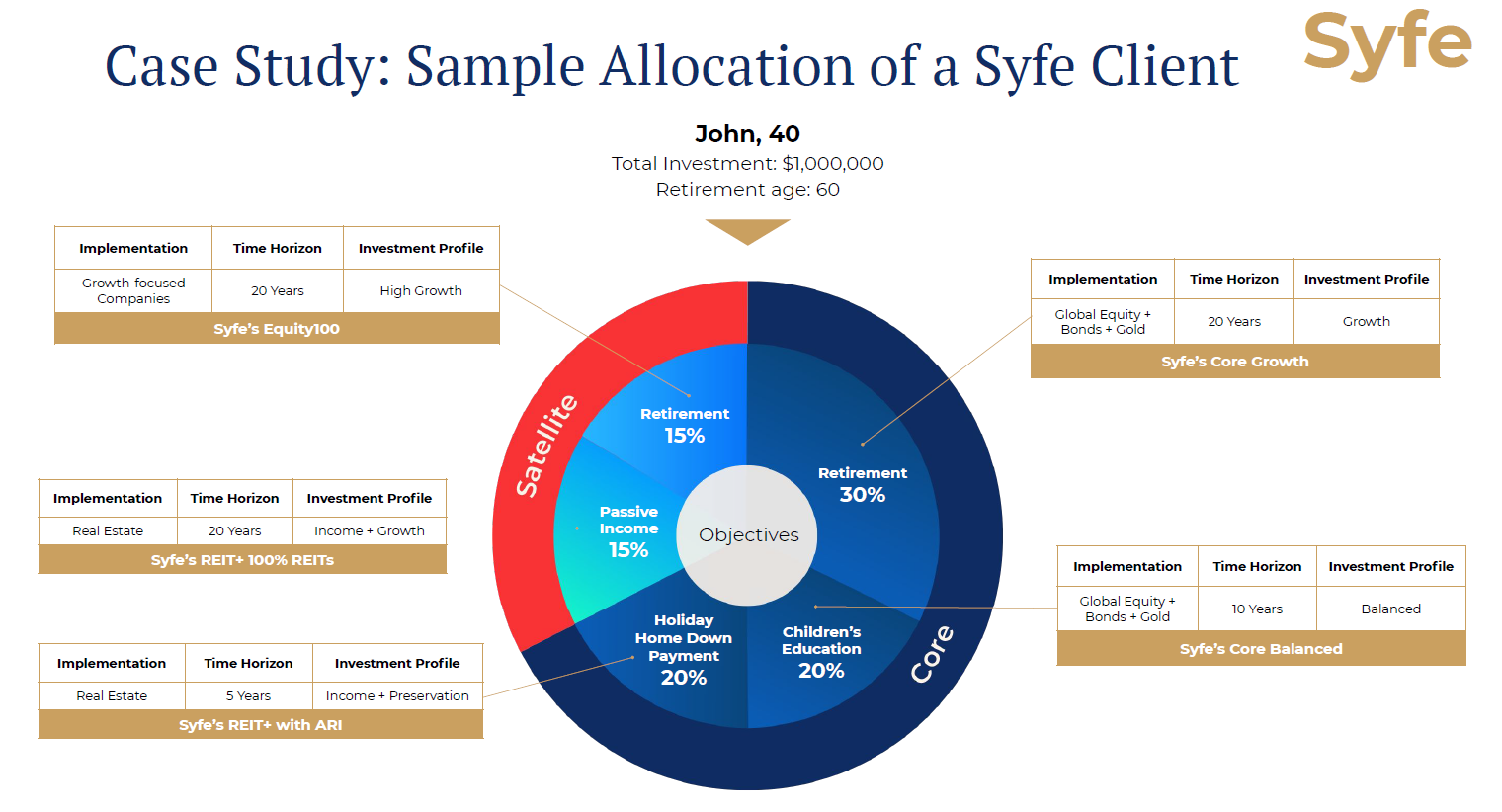

If you’re having trouble choosing between the 3 portfolio options, the good news is that you don’t have to.

Depending on your investment objectives, you can select the relevant Core portfolio that fits what you’re looking to achieve. For instance, if you’re investing towards retirement for the next few decades, then the Core Growth portfolio may be a more appealing choice.

On the other hand, if you’re saving up for a shorter-term goal such as your house downpayment or wedding, then the Core Defensive or Core Balanced portfolio may make more sense for less surprises on your capital.

Here’s an example of how you may use Syfe’s portfolios as part of an overall core-satellite strategy:

If you’re interested to find out more, you can also book a free call with Syfe’s wealth experts for a non-obligatory chat on how this can be customized to your needs.

Is it safe to invest in Syfe?

I get this question a lot, and what I always respond is that you’ve to look at the company’s founders, their financial backing and the answer should be clearer from there.

Aside from being MAS-licensed, Syfe was founded by former UBS Director Dhruv Arora and recently even closed a S$25.2 million Series A funding round. Compared to many of the other robo-advisory platforms, few can boast that kind of credentials, so I’m personally not worried about funds parked in Syfe.

If you’re looking to outsource your investments and start investing via Syfe, don’t forget to use promo code BUDGETBABE to have your management fees waived for the first 6 months (up to your first $30,000).

And in full disclosure, I’ve opted NOT to include my own affiliate links in this article, so you can be rest assured that I do not receive any benefits whether or not you sign up with Syfe. But if you’re still concerned, feel free to join us in our upcoming webinar on 28 April, 7pm to discuss more details about how the Core portfolios work, and address any questions you may have.

Register for the webinar here.

Disclosure: This article is written in collaboration with Syfe. All opinions are that of my own.