Costs eat into our investment returns, so it is important that we pick a brokerage that helps us keep our transaction charges low. With online brokerages today like Futu, you can now get a free Apple (NASDAQ:AAPL) share + other freebies with moomoo when you open your account before 30 April 2021.

If this is your first time hearing about moomoo, they’re the global version of China’s Futubull (富途牛牛). Widely used in China and Hong Kong to gain access to the HK and US markets, Futu Holding Limited has over 13 million users worldwide, so it was exciting to hear that they’re finally coming to Singapore!

—

How many of you remember our earlier years of investing, where we had limited options for brokerages in Singapore and had no choice but to pay $20 – $25 per trade?

Coupled with minimum lot sizes (which used to be 1000 shares per SGX counter back in those days) and the importance of keeping our investment costs under 1% (given that paying just 1% could result in us giving up 1/3 of our wealth!), it was no wonder that most beginners would struggle to start their first stock portfolio with anything less than $10,000.

Today, that has all changed. Thanks to the emergence and innovation of online brokerages, we can now say goodbye to high costs…and hello to better UI/UX, platform features, and even free trading data and charting tools!

This has lowered the barriers for anyone to start investing or trading, and has made it more accessible for retail investors – even younger investors with smaller starting capital – to start.

And now, there’s a new online brokerage player in town: Futu.

Perks of moomoo

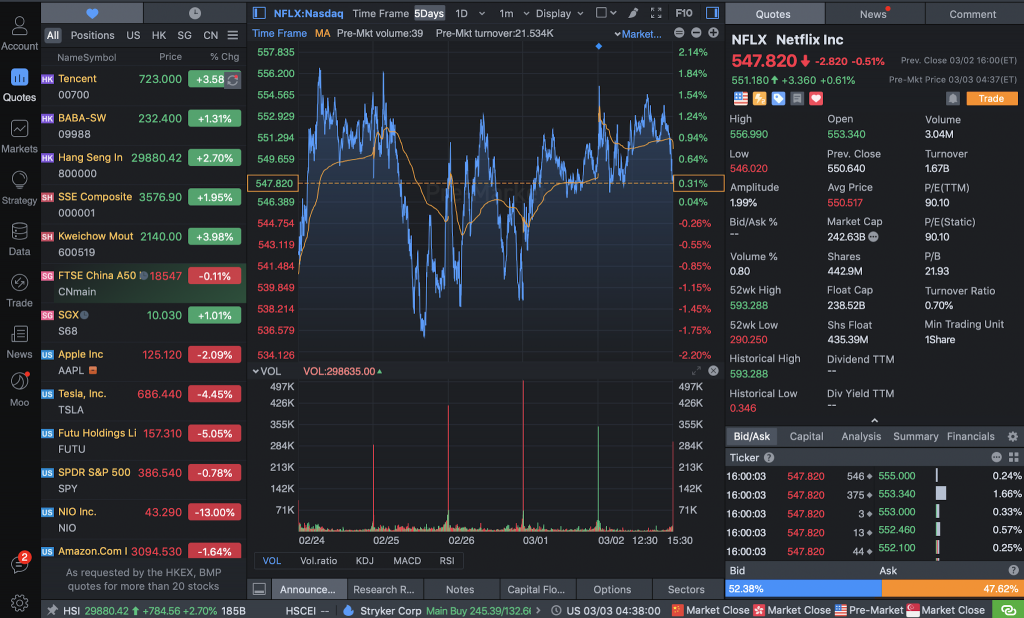

Aside from its low fees, there’s a lot to like about both their desktop platform and mobile app for trading. Here’s a quick screenshot of my desktop version, where you can see there’s various tools offered that most brokerages do not normally provide for free, including:

- Market depth (aka Level 2 data)

- Trading and charting analytics

- Conditional alerts via their “AI monitor” to auto-alert you when there’s significant movements in price or indicator(s)

- Premarket and post-market trading access for US stocks (including live quotes and trading volume)

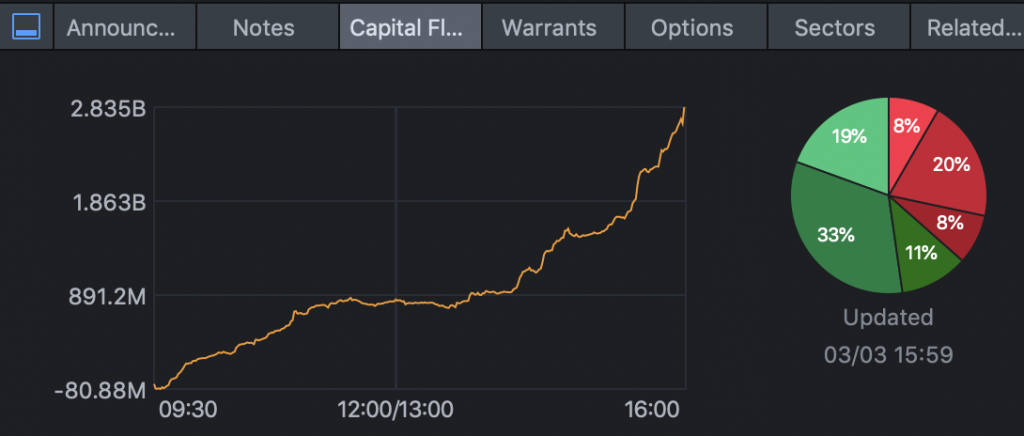

- Capital inflows into a stock

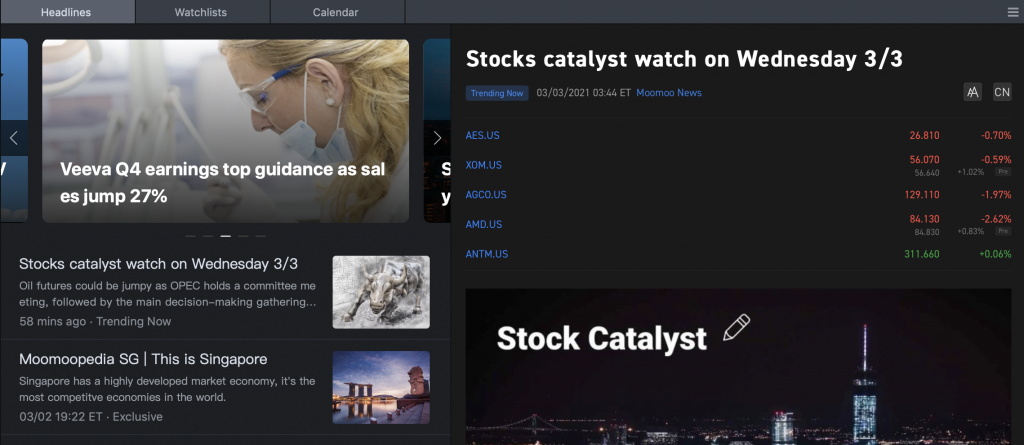

- News

and more. Those of you who trade frequently should find many of these tools useful in your analysis.

As I was among the early users of the app to test it for you guys, I had to deposit in USD back then because SGD transfers weren’t ready yet. Even then, I found it compelling enough to do so for the promise of a year’s worth of commission-free trades and 1 free Apple share (worth about USD 130). Today, you guys are luckier – because you can now transfer directly to their DBS account in SGD.

Oh, and if you’re wondering,

Q: How long did will it take for my deposit to show up in my moomoo account?

I transferred on a Sunday, and could already see it in my account on Monday.

Do note that moomoo users will have to transfer funds from their personal bank accounts (transfers from third-party accounts, joint accounts, e-wallets and cash transfers will not be accepted) to prevent money laundering, and you will need to state your moomoo ID in the transaction reference or comment.

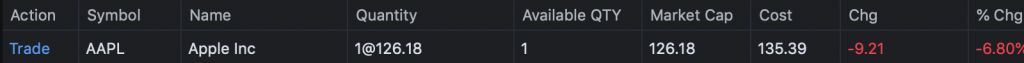

Q: How long does it take to receive the free AAPL share?Mine took 3 – 4 days to show up. Yours might be faster, as the team has added resources since to help cope with the overwhelming demand.

Q: Are you sure the AAPL share is legit? I don’t believe it!Here’s a screenshot of mine 😉 At the time they credited it to my account, the Futu SG team had to buy it for USD 135, too.

HISTORY OF moomoo

Futu (the company – Futu Securities International) has been around since 2012, and was founded in Hong Kong.

Its founder is Leaf Li Hua, who was an early key executive of Tencent (its 18th employee, to be exact). He was one of the earliest developers of QQ, and held many of Tencent’s domestic and international patents.

For those of you who are Tencent fanatics like me, you might find his name familiar 😉

After he became financially free from earning his first pot of gold from Tencent’s Hong Kong IPO (employee shares, lucky guy!), Leaf achieved FIRE and took a break to be a stock investor to manage his wealth of HKD 4 billion, which translates to a grand total S$693,976,507 in 2007!

He was a trading junkie of Hong Kong stocks at that time, but struggled with the trading software provided by Hong Kong securities firms at that time. What’s more, if one wasn’t paying enough attention, a little carelessness could easily lead to capital loss.

That was when he realized a big problem existed in the Hong Kong stock market: it was not only difficult to open an account, but there were also challenges with accessing capital, poor UI of most trading software…and very high fees. He saw first-hand that many people were trading via the banks, where they couldn’t see real-time costs, news nor charting information (unless they paid for a separate charting software – Singaporean investors, remember the time we did this too?).

So as a product person, you can imagine what he did next.

That’s right – he came out of FIRE and swore to make investing simpler by lowering the barriers for people to enter the financial markets.

Leaf saw a gap and worked to bridge that, thus becoming the first to integrate everything into a single app and bring it to the Hong Kong market. It was such a great product and innovative solution that it also attracted prominent investors – Tencent Holdings, Matrix Partners and even Sequoia Capital!

As a result, it successfully bridged the Chinese investors in mainland China with the stock markets in Hong Kong and the US, through Futu’s online and mobile app called NiuNiu (富途牛牛).

It is also worth mentioning that their founding Chief Technology Officer, Weihua Chen, was previously in charge of Tencent’s WeChat security, maintenance and big data areas before coming over to Futu.

The global version was launched not long after, and that’s moomoo for you.

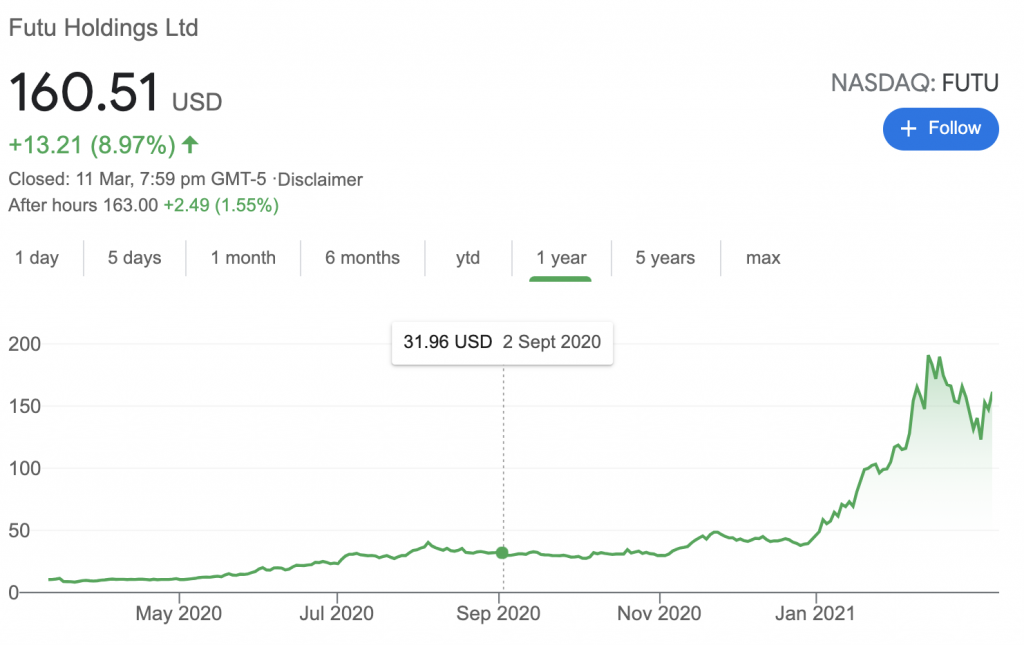

The company is also listed in the US, and I regret not having invested in them sooner. Just take a look – the share price has gone up by 500% since!

Is moomoo safe?

Well, you can be reassured that Futu is not an unlicensed or unregulated brokerage who simply appeared out of the blue.

The company’s Singapore subsidiary received its license from MAS to expand to and operate locally. Aside from that, its U.S. subsidiary is also a member of the Financial Industry Regulatory Authority.

What’s more, U.S. securities in your account are protected up to $500,000 by Securities Investor Protection Corporation (SIPC).

A reader privately confided in me over an Instagram DM that he was worried about opening an account and transferring his hard-earned money into moomoo. I answered him with this:

With over 21 billion dollars of market capitalisation right now, what do you think will happen if moomoo chooses to run away with your $2,000? As long as word gets out on social media that they’re not a reliable brokerage, what do you think will happen to all that $21B of equity that they currently have? I personally don’t think that my $2,000 is more precious to them than their reputation, especially when they’ve worked so hard for close to a decade to establish themselves in China, Hong Kong and worldwide. And their growth explosion is only just getting started.

Futu primarily generates its revenue through fees and margin financing – NOT on your deposits. Thus, how likely are they to run away with your money…at risk of sending their global expansion plans to an immediate halt once word gets out, and have you and everyone else stop using their platform right away? You decide.

I will also leave you with Leaf’s public statement at Futu’s IPO listing ceremony:

去看远方更美丽的风景 i.e. this is only the start. We are in it for the long run, where there’s a better view (reward) waiting.

So that’s why I’m not afraid after understanding their history, and I hope it provides some reassurance to you guys who weren’t familiar with them before, too.

How do I sign up for moomoo?

Now that you know moomoo is completely legitimate, don’t miss out on this chance to claim the following freebies:

- a FREE APPLE (NASDAQ:AAPL) SHARE (limited to first 10,000 clients)

- SGD 30 cash coupon

- 90 days of commission-free trading in US, HK and SG stock markets

- unlimited access to US Level 2 market data

- free real-time quotes for US options

All you’ll need to do is deposit a minimum of SGD 2,700 (USD 2,000) after you have registered and opened a trading account with Futu SG via moomoo.

Once you’re all set up, you will be able to trade HK, US and SGX stocks on their platform easily. I’ve already tried it out first to check on its safety, reliability and to make sure that they delivered on their promises, so I can confidently tell you now that I’ve received everything they said we retail investors would get without any issues. For fees, click here for more details.

You’ll also be able to trade HK, US and SGX stocks after their official launch, so don’t miss out.

TLDR: I was pleasantly surprised and liked what I see, so I’ll continue to use moomoo. Until then, do give them a try – you might find that you like what you see as well!

Disclosure: This post is sponsored by Futu Holdings. All opinions (and money deposited) are that of my own.