If you think $600 a month won’t be enough in the event of disability, CareShield Life supplements by private insurers could help. This guide looks into CareShield Life, its limitations, and why additional coverage might just be necessary.

The Ministry of Health estimates that 1 in 2 Singaporeans above age 65 could become severely disabled in their lifetime. And about 3 in 10 Singaporeans will live a decade (or longer) after they become severely disabled. With better medical care and longer life expectancy, more Singaporeans may become severely disabled in their old age and live with the disability for a longer duration.

|

| Screenshot from MOH Youtube |

As such, they’ve introduced CareShield Life (as an “improved” version of its predecessor, ElderShield) to help provide lifelong payouts starting at $600 / month and increases annually until age 67, or when a successful claim is made. Premiums start from $206 a year for men and $253 for women at the age of 30, and are payable until age 67.

Designed as a long-term care and disability insurance scheme, CareShield Life is meant to support us by providing a stream of income upon severe disability.

Severe disability is basically defined as when you can no longer do 3 Activities of Daily Living (ADL) by yourself:

|

| Screenshot from MOH Youtube |

If you’re unable to do any 3 of these activities and this has been confirmed by a MOH-accredited severe disability assessor, then you’ll be eligible for CareShield Life payouts.

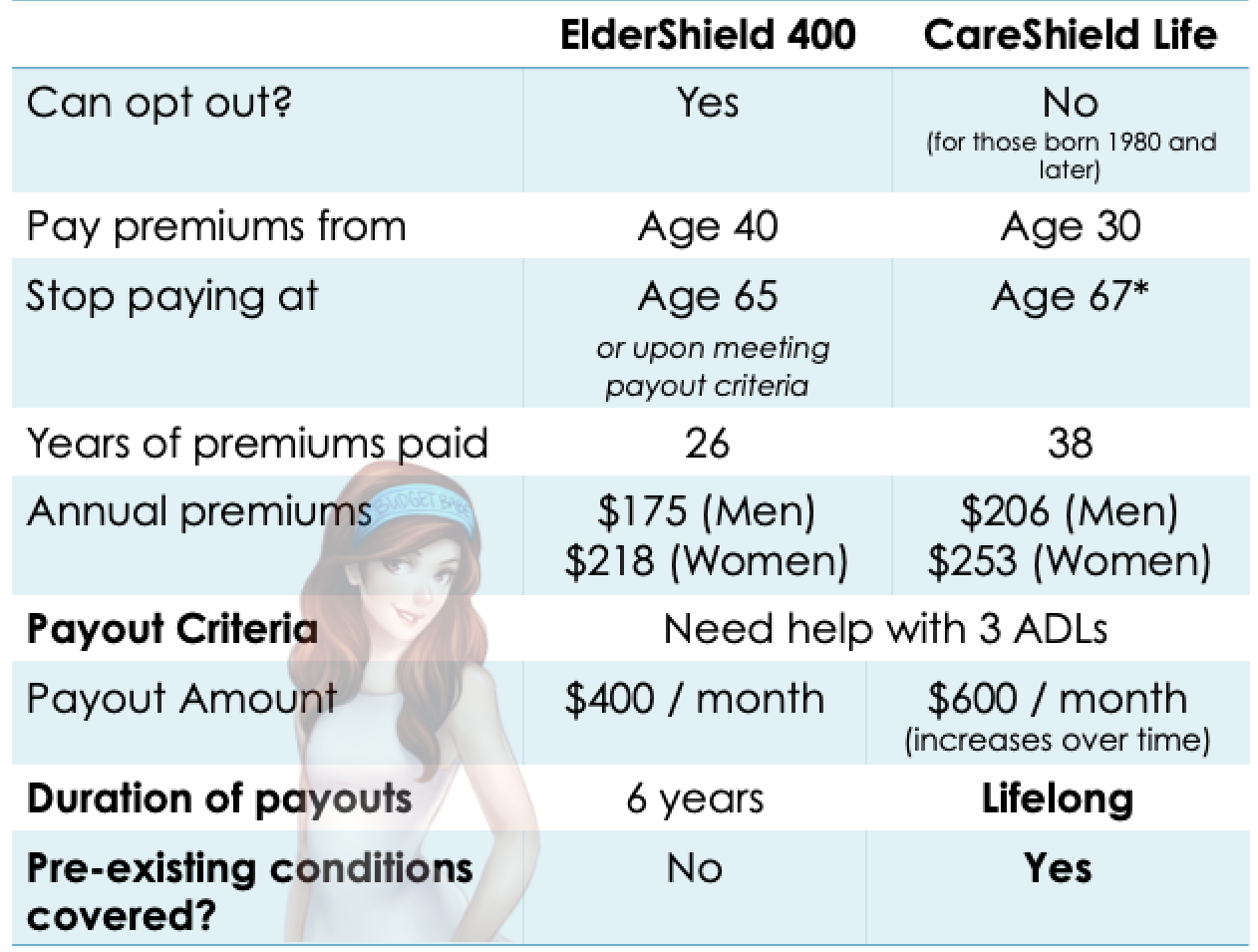

How is CareShield Life different from ElderShield?

Aside from higher payouts (which naturally come with higher premiums payable), I’ve summed up the main differences below.

A key benefit is that payouts are now for the rest of your life, and pre-existing conditions are covered, allowing for wider coverage as a social security net.

This was the question I asked myself in deciding whether to switch my parents over to the new scheme.

What if my parents already have an ElderShield supplement?

Some of our parents may have already bought ElderShield supplements previously. These policies will still continue to be in force.

These ElderShield supplements had a maximum limit of $3,000 – $3,500 monthly payouts (see here or here). If you wish to increase your monthly benefit, you can either switch to, or add on, a CareShield Life supplement.

In our case, we intend to switch our parents over to CareShield Life once they receive their letter(s) from the government.

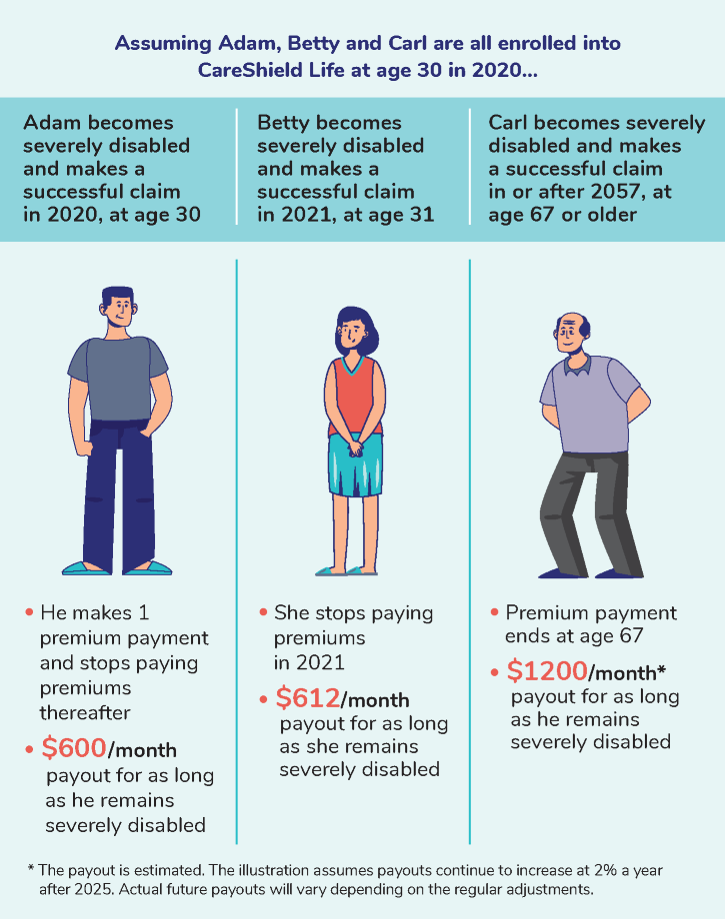

How much will I get from CareShield Life?

If you haven’t already received the brochure from MOH, here’s a good illustration of how CareShield Life could work for different people:

|

| Source: MOH CareShield Life |

What happens if you recover from your disability, and subsequently become disabled again?

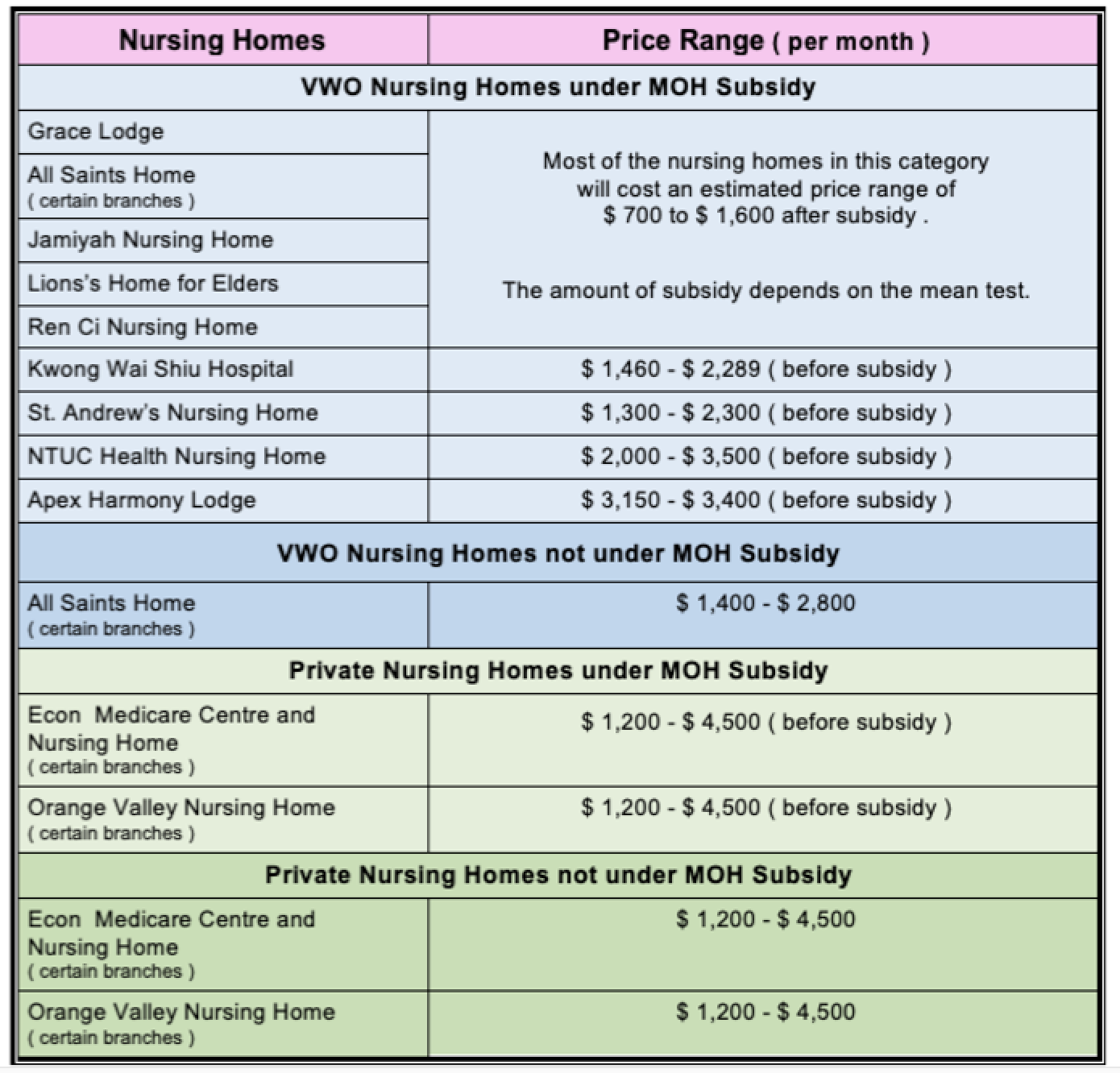

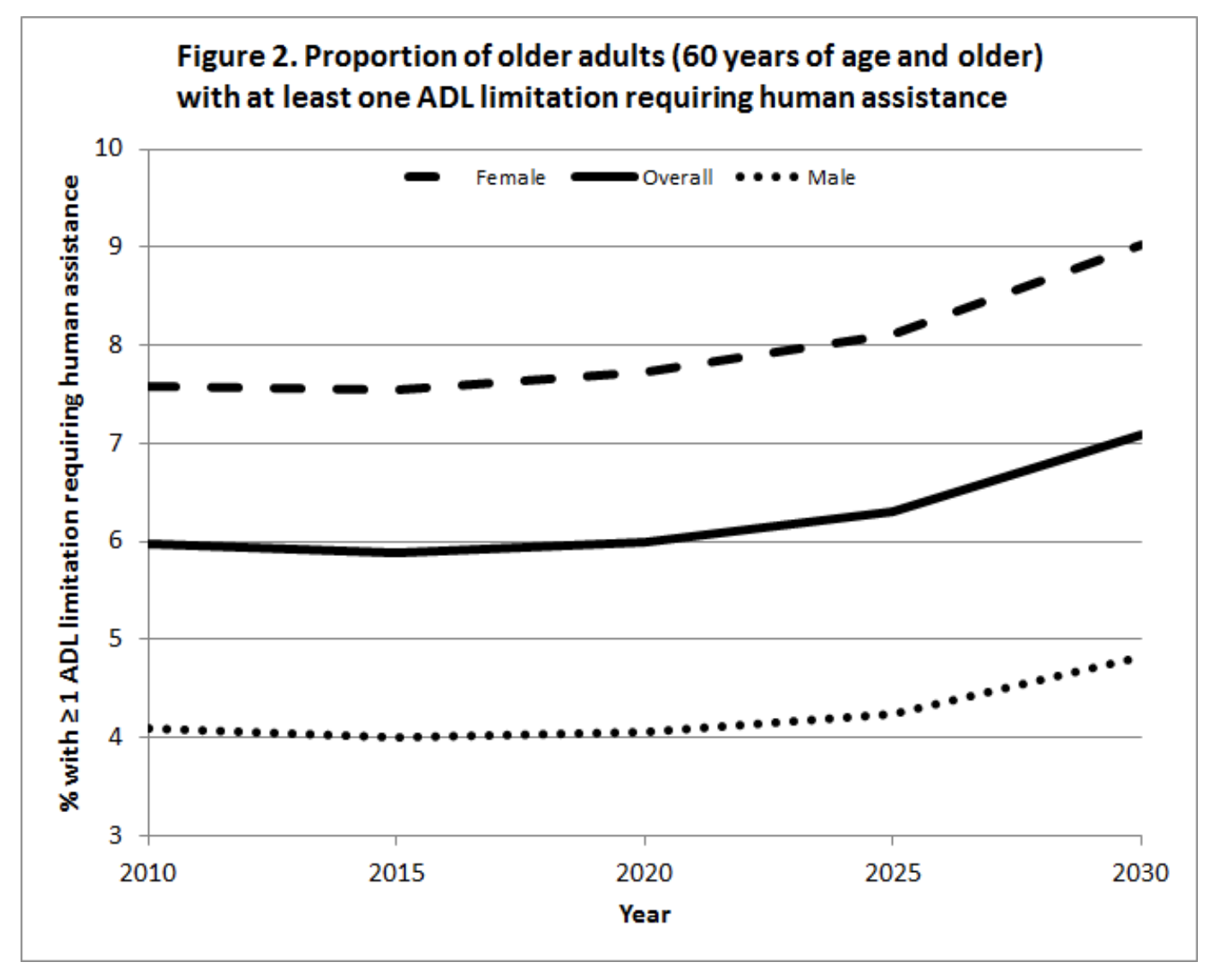

How much does long-term care cost?

Ok, that sounds like a mind-boggling figure. How about what’s required per month, or per year?

|

| Source: MoneySmart |

Another common option in Singapore is to hire a foreign domestic worker (FDW) together with receiving professional care at home regularly instead. In this case, the cost could easily add up to $1,850 per month, which consists of $800 (for an experienced FDW) + $800 (1 x weekly home care nurse visit) + $250 (1 x monthly home doctor visit).

If you’re thinking of funding this with your savings alone, note that even a $180,000 savings will only last you for 5 – 8 years, depending on the type of care you go for.

Hardly enough for the average of 10 years that MOH is projecting, and you’ll likely run out of cash savings if you live beyond that.

And that’s assuming today’s numbers. Say if you were 30 years old today and expect disability costs to only set in when you’re 65, projecting 2% inflation rate over the next 35 years will mean you’ll be needing $3,700 a month for long-term care in 2055.

With inflation, expect these costs to increase over time.

|

| Modified screenshot (figures added) from MOH Youtube |

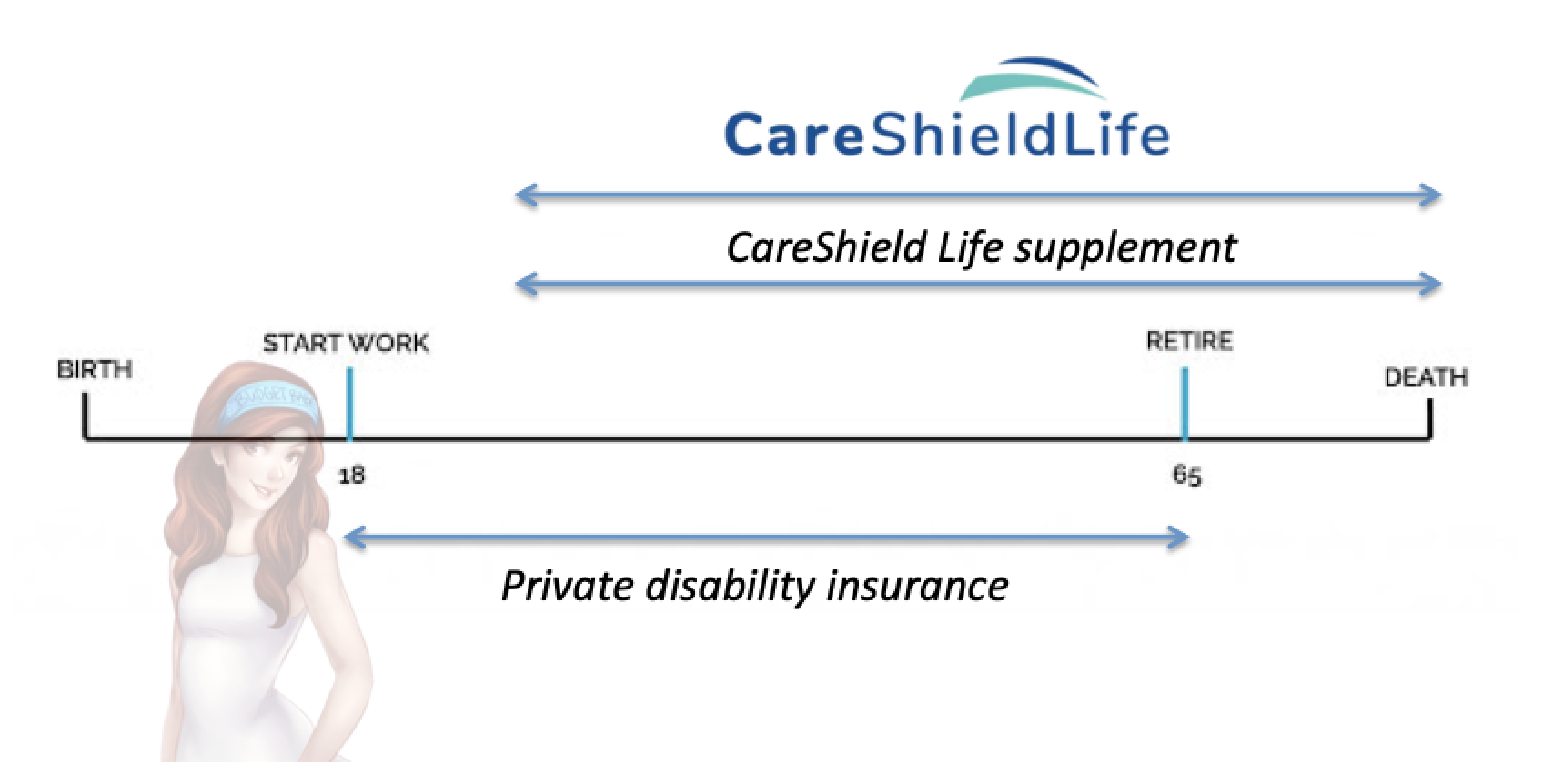

Is there duplicate coverage if I already have private disability insurance?

Not exactly. Most private disability income covers for your working years, and within your policy T&Cs, you’ll see that you have to be gainfully employed or drawing an income at the point where the disability occurred.

The exception would be for insurance policies covering total and permanent disability (TPD) such as through an accident or life plan, although the eligibility for claims would be a pretty detrimental state of disability that renders you unable to engage in any gainful activity henceforth.

This leaves behind a coverage gap in your later years. What happens if disability sets in after retirement?

Some people rely on their savings, while others rely on their family members to foot the bill.

For my husband’s grandmother who needed help with almost all the ADLs, they opted for a domestic helper and sent her for regular medical treatments. As she had 8 children who helped to contribute, the costs of long-term care was still manageable.

But what about for our generation, where we’re having fewer kids…or perhaps none at all? Even the government echos this sentiment, having said that

I definitely don’t want to pass this financial burden to my child, so I’m planning early to try and mitigate any future costs.

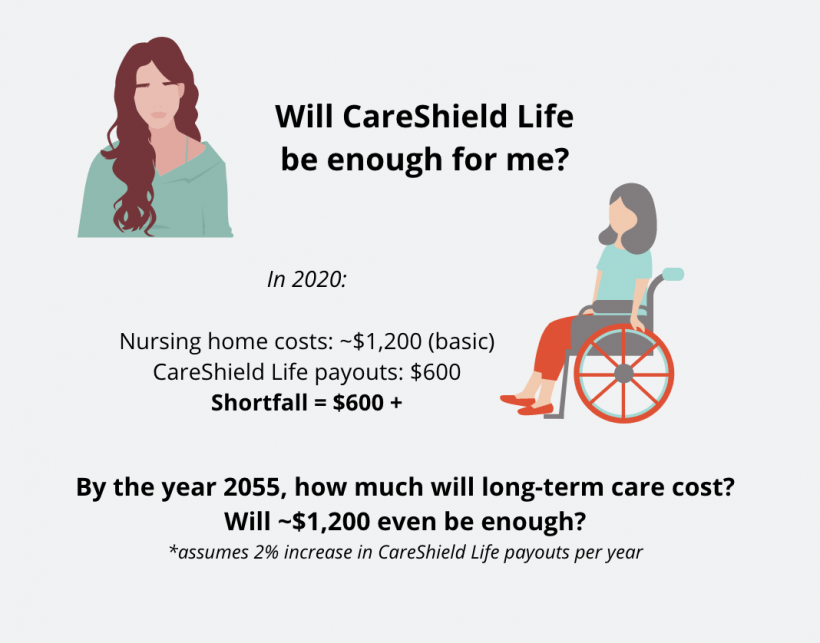

Is a CareShield Life supplement necessary?

CareShield Life was designed as a basic long-term care plan. In reality, it is already hard to survive on just $600 a month for food and transport, so the I don’t expect the money to be enough for someone who is severely disabled, needs to pay for a caregiver, and cannot work for income all at the same time either.

And lest you think CareShield Life only benefits the older crowd, the truth is, being young does not mean we’re immune to disability – especially as we are often more active – as disability can be caused by accidents or illness.

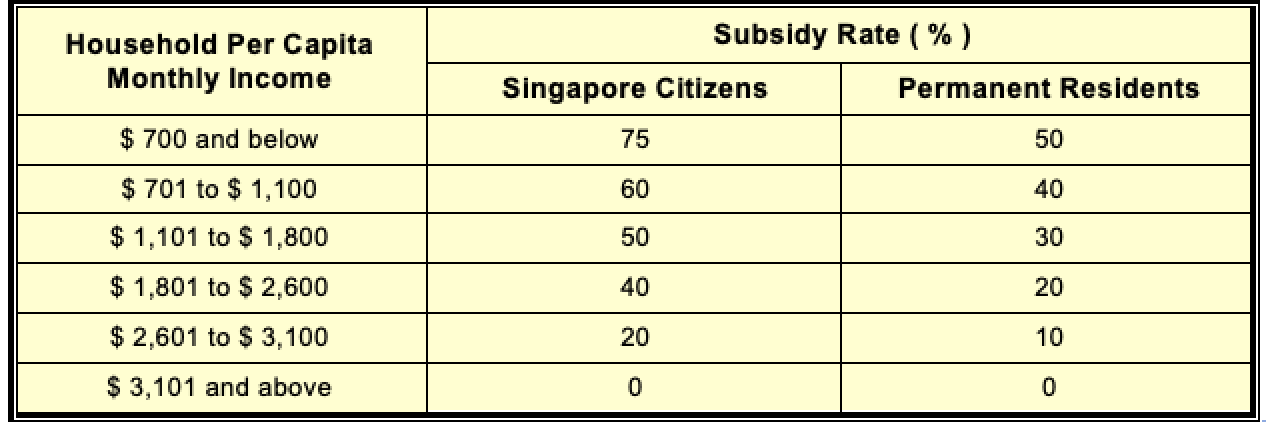

To finance such long-term costs of care, we need to adopt a 3-pronged approach of government subsidies, insurance and personal/family savings.

|

| Screenshot from MOH Youtube |

This is where private supplementary plans come in handy.

Currently, only 3 insurers have been approved to offer CareShield Life supplement plans – Great Eastern, Aviva and NTUC Income.

These plans allow you to receive monthly payouts at an earlier stage, without needing to pay for your premiums in cash (as you can use up to $600 from your Medisave each year to pay for it).

However, if you wish to have higher coverage, then you can always top up with cash for a higher monthly payout of up to $5,000.

Important Note: do check whether the monthly benefit offered by your insurer are inclusive or in addition to your CareShield Life payouts.

For insurers like Great Eastern, the payouts are on top of your CareShield Life payouts (so you get a higher total sum).

To provide greater assurance, some insurers will also waive premiums upon your inability to perform at least 1 ADL.

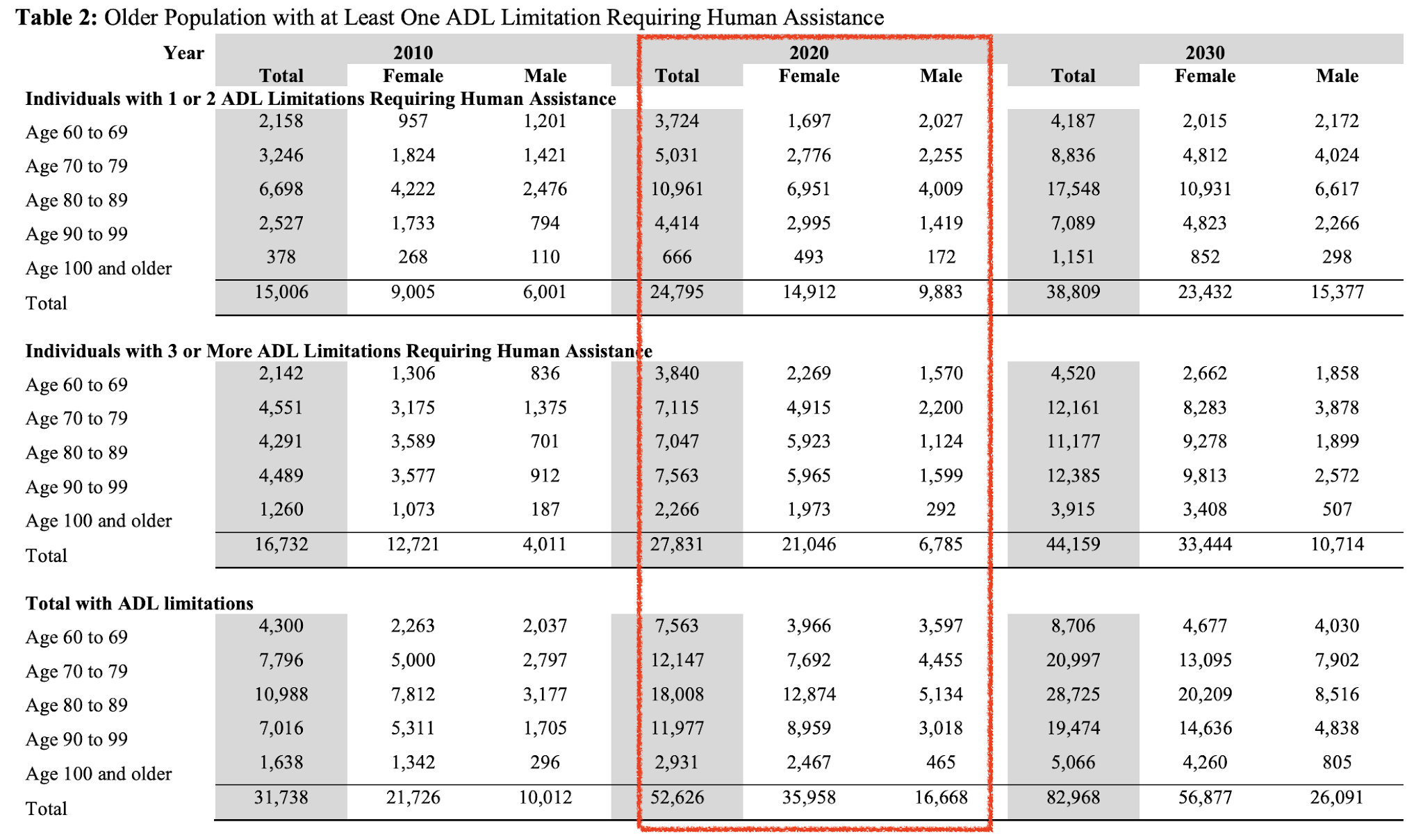

What are the odds of being unable to perform 1 ADL?

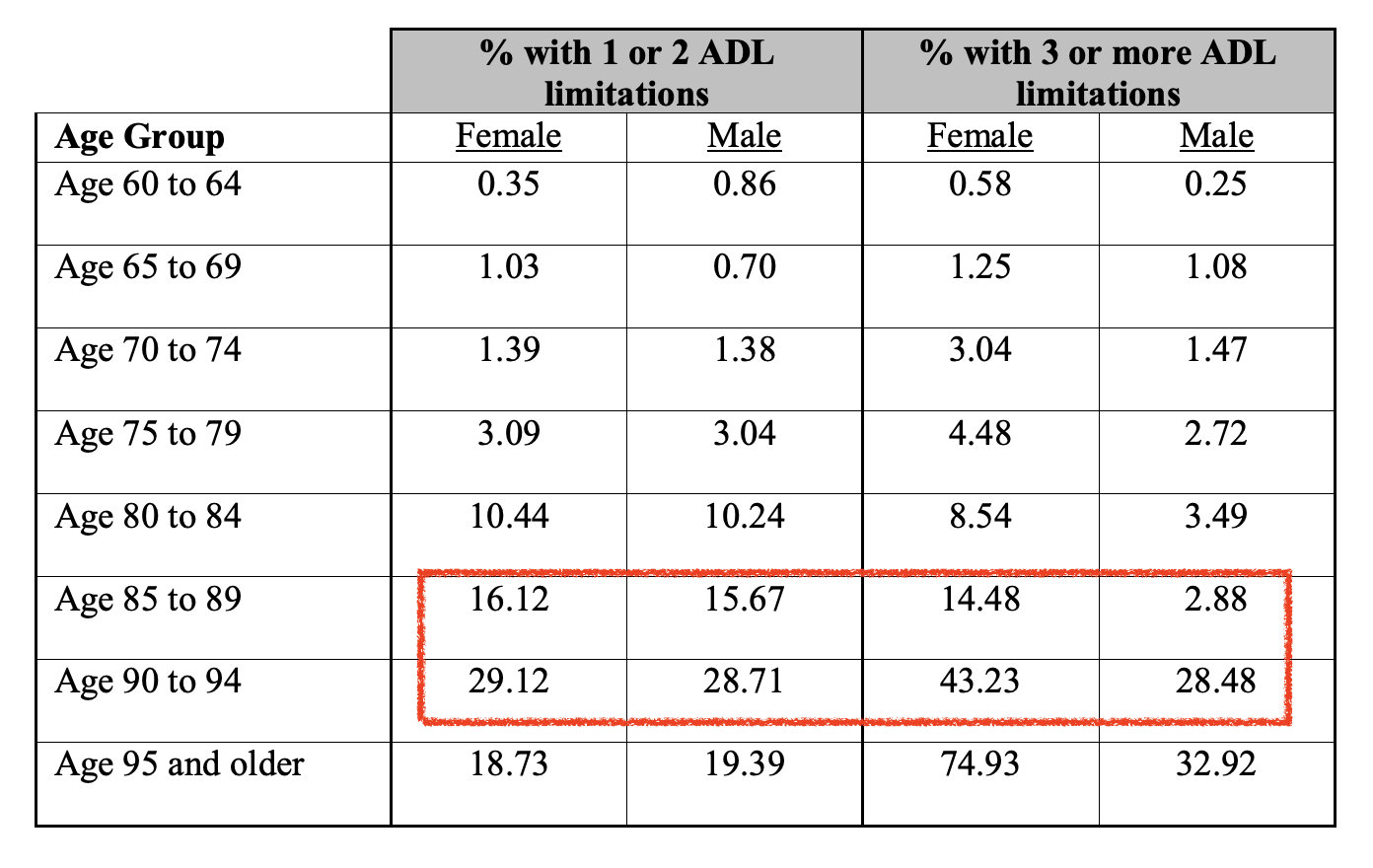

This table shows how many individuals in Singapore currently live with the inability of 1 or 2 ADL (making them ineligible for CareShield Life payouts):

That’s 47% of the total population with disability, or close to a 1 in 2 chance!

This other table shows that as one gets older, the odds become stacked against you. If you’re a female and past 85 years old, the chances are 16% to 29% of 1 or 2 ADL limitation.

If you’re a female like me, you might want to start seriously thinking about whether you need supplementary CareShield Life insurance to protect you in your later years.

Given the odds of being disabled in our golden years, if you’re concerned about the rising cost of long-term care, a private supplementary plan can come in handy to offset the costs.

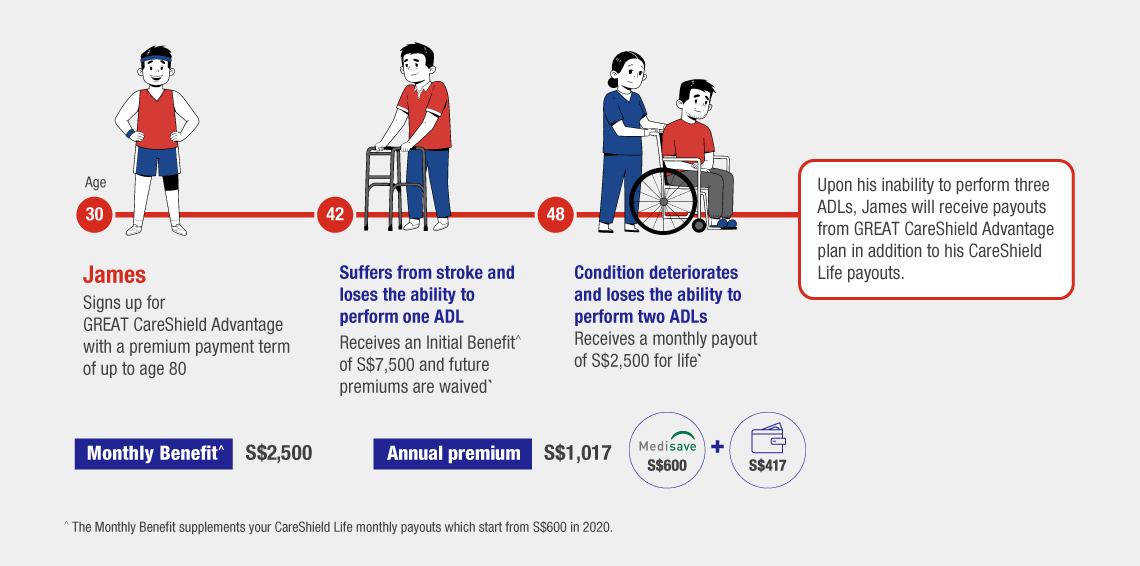

Review: GREAT CareShield – Enhanced / Advantage

If you’re looking for a plan that gives you a lump sum payout (of 300% your monthly benefit)^ from as early as the inability to perform 1 ADL, then there’s only one insurer with this benefit, and that’s Great Eastern.

Premiums also remain level throughout* your policy term, which means you won’t have to pay more for rising premiums as you grow older. This way, you can better plan your budget to account for this amount, since you know how much you have to set aside each year.

By getting covered at a younger age, your premiums are fixed at your entry age (i.e. younger starting age = lower premiums) and payable until you’re 65 (you can also opt to stretch the payment duration until 80 years old).

|

|

|

- 1 ADL: premiums are waived`

- 2 ADLs: 50% of monthly benefits

- 3 ADLs: 100% of monthly benefits (in addition to your CareShield Life payouts)

- 1 ADL: premiums are waived` and you’ll also receive a 300% monthly benefit (up to $15,000)^

- 2 ADLs: 100% of monthly benefits (vs. 3 ADLs on the Enhanced plan)

If you’re looking for a plan that gives you coverage from as early as the inability to perform 1 ADL, then there’s only one insurer with this benefit, and that’s Great Eastern.

Should I buy my CareShield Life supplement now or later?

- $20,764 in total premiums (up to age 80) if you start at 30

- $27,407 in total premiums (up to age 80) if you delay and start only at age 45

- MediShield Life premiums

- your hospitalisation (integrated shield plan) premiums

- your dependents’ integrated shield plan premiums (e.g. Nate’s premiums are being paid out of my CPF MediSave)

- CareShield Life

- CareShield Life supplement

5 comments

Hi,

Please take a look at the GE Careshield link, it's not working properly and I'm not sure if you had a chance to test it before publishing the sponsored article.

https://buy.greateasternlife.com/sg/en/health-insurance/200403/get-quotation.html

The link is not working fully – unable to find out the payable premium based on my preferred benefits as the input field just doesn't work – sometimes you can input the amount but it doesn't show the payable premium and sometimes the field is just not imputable. And fyi, I'm using Chrome web browser.

Already wrote to GE but quite surprised such a fundamental issue can happen especially this is part of the input form.

Thanks.

Hi Nightmare_Angel,

Thanks for letting me know! Can I check where you're seeing that link from within the article? The only GE link I put in is actually towards the end, at "Find out more or get a quote here today!" and it doesn't go to the URL you provided?

I just tested out the link here though and it's working for me, odd! Will also check with the GE team for you.

https://buy.greateasternlife.com/sg/en/health-insurance/200403/get-quotation.html

Hello,

After you proceeded with get quotation and filled in the DOB and Name, the error will appear in the next page under 'enter your preferred monthly benefit' field. Either you can't enter the amount into the field or even if you can enter, there is no yearly premium shown.

Thanks.

Hi Nightmare_Angel!

I've escalated your concern to the GE team and they tested it, but it is working for them. Could you send in your screenshots to their customer service, or leave me your contact so I can get them to reach out to you?

Also, can you help me confirm where you're seeing that link from within my article?

Hi Nightmare_Angel,

Thanks! I've checked with GE and am glad to hear that they've already reached out to you to check the issue, which was due to you being based in Korea – since there are legal restrictions that do not allow any insurance contractual transaction to take place in a foreign country.

You'll need to be physically present in Singapore for the policy application, so that's why your error was coming up! Hope it has been resolved by now 🙂

P.S. I've deleted your comment with your email address so that spam bots won't be able to catch it!

Comments are closed.