With more financial advisors taking to social media for marketing their services, CNA recently invited me to share a commentary on my views towards insurance for young adults who have just entered the workforce. You can read the full article here (click to head over to CNA’s website), but in the meantime, here’s a quick summary of key points I wanted to reiterate:

1. Social media posts on insurance can be misleading

With young people getting their information from social media, insurance agents have also taken to Instagram and Facebook to market their products.

Many produce and share bite-sized infographics to artfully illustrated case studies. While these tidbits can be useful, they also can be potentially misleading when read without context.

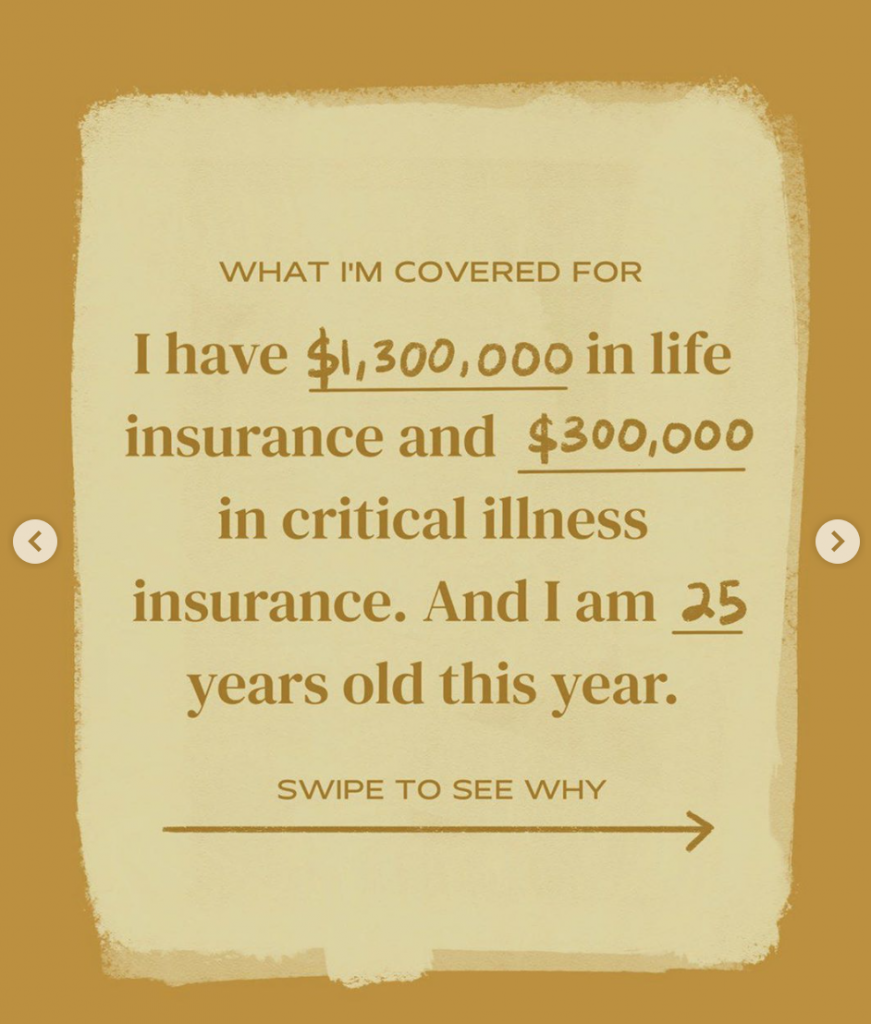

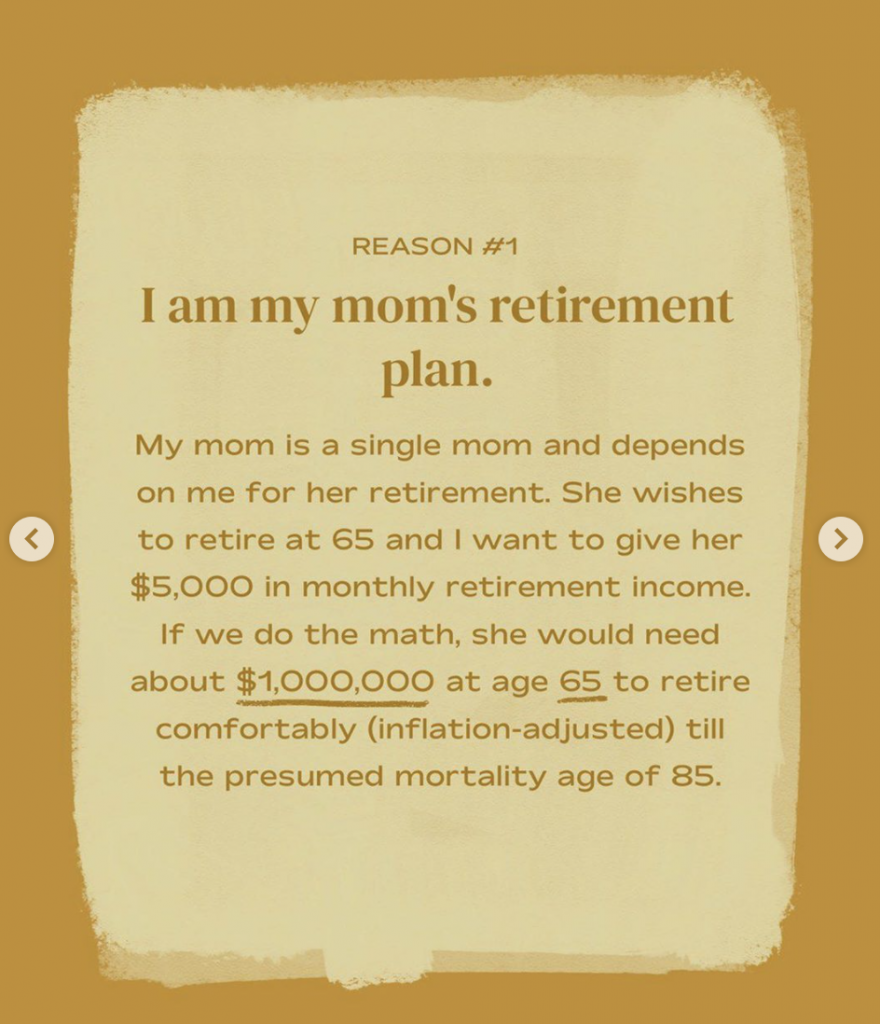

For instance, I was alerted to a a recent Instagram post (a finance page run by a group of insurance agents) which talked about a 25-year-old male having $1.3 million in life insurance.

This is one of the most popular posts on their page in the past few months, and aside from the shocking number that catches your attention right away, the problem is in the next few images. That’s when you realise how one of the reasons behind that decision was to give his mother $5,000 in monthly retirement allowance.

As a skeptical reader questioned, is this young man even going to give his mother $5k a month while he’s alive?

Short lesson here: don’t get swayed by the pretty graphics or seemingly relatable case studies. Context matters.

2. Prioritise healthcare insurance

With the rising costs of medical healthcare and hospitalisation in Singapore, it is often said that we can afford to die but not to fall sick.

If you do not outsource your healthcare financial risks, then be prepared to pay for it. The question is, will it be enough?

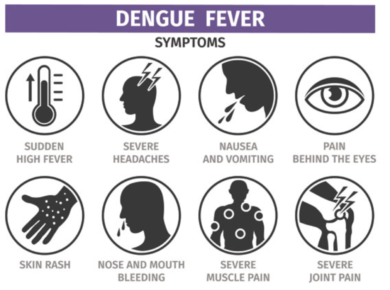

40% of critically ill patients use up most, or all, of their savings battling illness. And with 1 in 4 in Singapore expected to develop cancer, our risks are high.

So even if you are young and healthy, a good medical insurance plan should be high on your list.

While Singaporeans can use tap on MediShield Life and our own Medisave to pay for healthcare bills, there are also withdrawal limits of S$450 a day for hospitalisation costs, and a variable surgical limit based on the complexity of your procedures.

In an emergency, you may want to skip the queues at a public hospital and head to a private one. Here is where you will need an Integrated Shield Plan so you can pay the difference.

Large bills can be stressful and your savings may not be enough.

3. Don’t mix up insurance and investment.

(Unless you need such plans to enforce discipline, that is.)

Many insurance agents also recommend investment-linked plans for both protection and for building your nest egg. But these can come with administrative costs, which was a huge reason why I cancelled my investment-linked policy after realising how much I was really paying.

These were for sales and distribution charges (agent commission, fund management charge, administration charges, fund switching charges) and my investment units were also sold (on a monthly or yearly basis) to pay for insurance charges and policy fees, which was hardly in my best interests when it comes to building up a retirement investment nest egg.

In today’s climate, retail investors have plenty of options to invest without having to go through an insurer. There are regular shares savings plans, low-cost ETFs, and even robo-advisors like Syfe. And if you want access to the much-raved Dimensional Funds, MoneyOwl offers it.

4. There is NO “best” insurance plan

One question I often get is: “What is the best plan?” A better question to ask yourself should be, which is the best plan for me?

Insurance is highly personal – what someone else does or buys may not necessarily be the best solution for you.

Someone who has ageing parents and multiple children to look after may require a life plan with greater coverage, whereas another without dependents may not need it at all.

Think about your personal circumstances and work out your goals – do you want to take a break from employment to study or you want a comfortable nest egg by a certain age?

5. You don’t have to rush to buy everything

As a young working adult in the early years of your career, you may not be drawing a sizeable income just yet, so there’s no rush to buy everything.

Your needs will also evolve as you get married, have children, and when your parents retire.

One strategy is to layer your insurance policies to ensure you get the protection during these prime years, and pare it down in your later years once you have fewer dependents.

Each insurer offers plans with different benefits, payment terms and premium levels. Think about which ones you prioritise and are willing to pay for.

6. There is a difference between tied agents vs. IFAs

Most agents will insist the plans they offer are the “best”.

If you talk to someone from Prudential, they will recommend you Prudential policies – that’s the only ones they can sell you.

Ask the same question to an AIA agent and you will likely get a completely different answer.

While there’s no right or wrong, my personal preference has always been to go with IFAs so that they can provide a comparison across different insurers for me to choose from. However, there can be limitations there as well, as some insurers do not allow their products to be distributed by non-tied agents.

My bias might also be tainted by the fact that none of my tied agents have ever stuck with me throughout the past few years – unfortunately, they often come and go. If you have a good agent, treasure them.

7. Ultimately, affordability is key

It is tempting to want to get as much coverage as you possibly can. But you’ll have to balance that with the premiums that you can comfortably afford to finance. Today, we already pay almost four times more in annual premiums for life insurance compared to 10 years ago. I won’t be surprised if that figure continues to rise.

The more you pay for insurance, the less you have for retirement or just extra cash for holidays or other life events.

Many financial advisers advocate spending no more than 10 to 20 per cent of your monthly income on insurance. But I would say, even that is not a hard and fast rule.

If you are starting out with a lower income, you may want to stagger your insurance purchases. Focus on the policies you need the most right now.

Ultimately, it is helpful to think of insurance as something that moves and changes with your own life.

With love, Budget Babe

3 comments

Hi,

A simple rule of thumb: One ensures that the insurance premium does not exceed 1% of his/her take-home pay. For married individual, the amount does not exceed 2%.

My perspective.

WTK

assuming $4k monthly take-home pay, that's $40 / month (or $480 / year) for a single individual,

or $80 / month ($960 / year) for a married individual. Would that be realistically achievable though? just private hospitalisation plans alone + CI bundled with a term plan would cost a lot more than just <$500 in a year for most people. I don't have exact quotes, but am just using myself and my friends as an example.

instead of life, for normal people, always go for term insurance. if you have dependents, you can spend about $98/mth getting a 2 million coverage for death and TPD. A 1 million plan for NS Aviva ($41/month) and 1 million plan from Aviva itself ($57). The difference is that the former only allow you to claim 250K immediately upon death and the rest about 1 year later following some admin process. The latter pay out 1 million immediately upon receiving the death cert. With 1.25million immediately and another 750k a year later, your dependents should be able to survive for awhile.

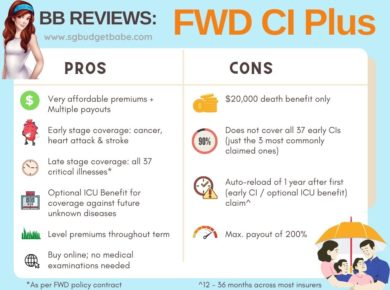

Also, as cancer hits 1 in 4 Singaporeans, can consider FWD cancer insurance which pay out even for early stage cancer (full 250K) at about $288/year. These 2 should be enough defence for a normal working adult.

Leave the bulk of your income to derive investment returns, be it through stock or property (this is preferred) Stocks drop about 30% since covid but property hardly drop and gives consistent rental income.

Comments are closed.