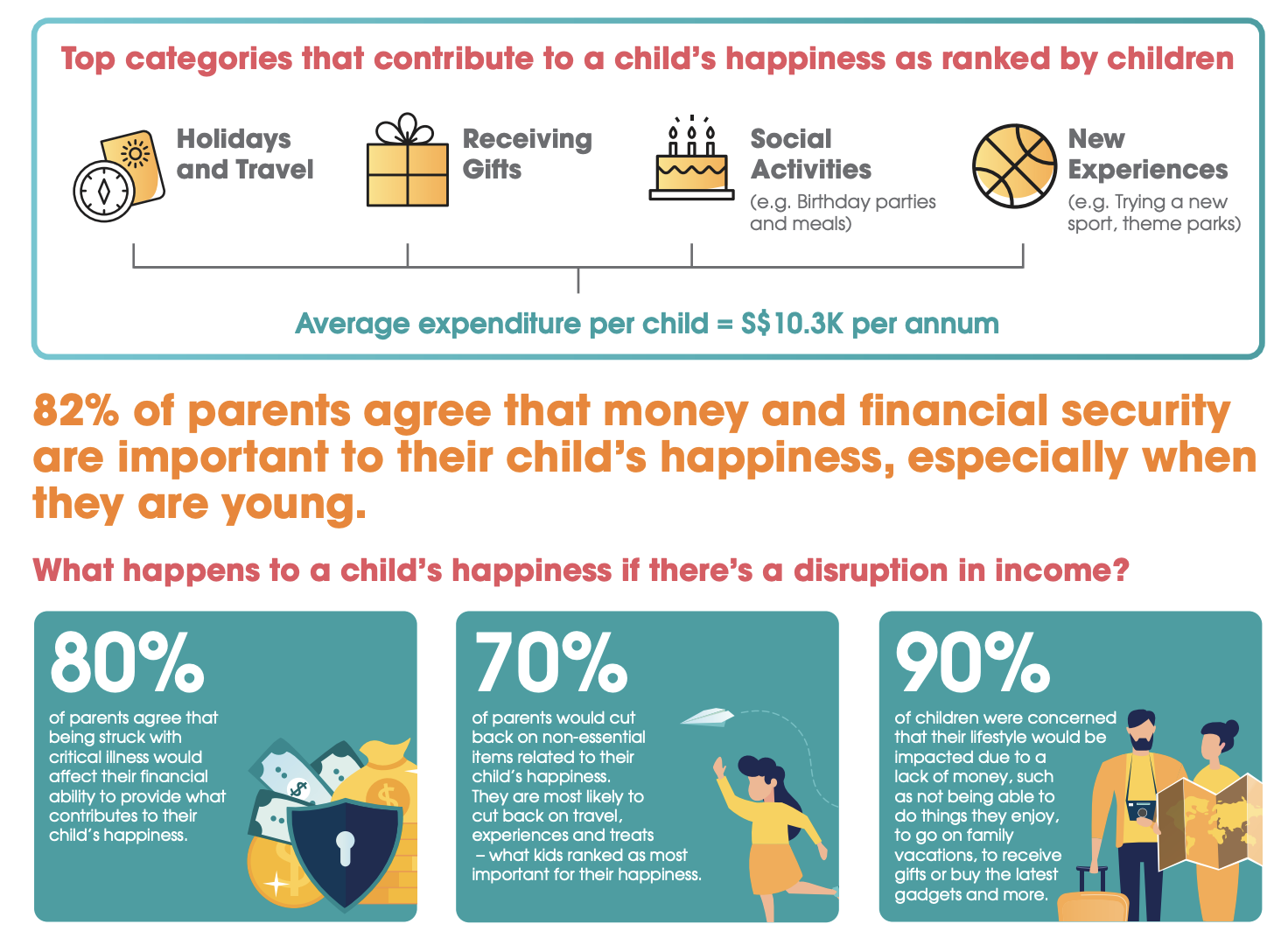

How can I ensure I will always be able to provide for my child’s happiness no matter what happens? In the event that I have to pay for a sudden increase in my bills, the money shouldn’t have to come from my child’s developmental classes or other things that he will enjoy as he grows up.

This realisation really hit home recently when we had to deal with a sudden increase in expenditure as Nate’s recent medical checkup necessitated the start of speech therapy sessions, which certainly do not come cheap. Thankfully, both my husband and I are still working so we can still finance this, but I shuddered at the thought of what would happen if one of us were no longer contributing to the household finances due to unexpected circumstances. With that in mind, I went about building a safety net – diversifying our sources of income, life insurance, critical illness, and emergency savings.

As a parent, all I want is for my child to grow up safe, healthy and happy. There’s nothing more precious to me than my baby’s laughter, and the look of pure, unadulterated joy on his face as he visits a new place, tries out another new activity, or even going for his favourite Heguru classes.

And there’s a lot that we want to be able to give him to help him reach his fullest potential, especially if it is for activities that he enjoys – art classes, gymnastics, musical lessons. As a huge believer of experiences, we’ve also brought him out on trips to the zoo, Snow City, Sentosa, and even family vacations overseas – some are free, but many of these do not come cheap.

However, I’ve seen many cases of parents who had to put all of these to a halt due to financial difficulties when an unexpected event hits. But the last thing I want is to have to stop my son’s art or hobbyist classes or say no to a gift that we would have otherwise bought for him…just because we need the money to pay for a hospital bill first.

So we made sure we had contingency plans in place to prevent exactly that, instead of having to cut from what we would have otherwise given our child.

To avoid having to run out of our own funds, we topped up our life insurance and critical illness coverage. We also increased our liquid funds for any short-term emergencies otherwise.

Watching Income’s latest advertising video feels like a reminder of what we did, and why we did it.

In the video, a mother sings to her baby about the future. Both parents watch on as their daughter grows up and starts preschool, where she gets her first exposure to a piano. They try out many new experiences together, when suddenly the mother feels faint – the first sign of her cancer. Her husband takes over, bringing their daughter around while his wife goes for her medical treatments.

Life for their daughter goes on as per normal, except that the mother is now conspicuously absent in the scenes. She even gets a piano for her birthday (exactly what she wanted), even though it must surely be a considerable expense with the medical bills at that point.

Her husband then turns to his wife at the end of the video and says, things would have turned out differently if we weren’t covered.

The song Semoga Bahagia (which stands for may you achieve happiness) fades to an end, a reminder of how there’s nothing more precious – or more important – than our child’s happiness. Fellow parents, I’m sure I wasn’t the only one who cried while watching the video.

One of the Korean dramas I recently completed (The Memorist) showed how a father was driven to commit fraud because he needed money to provide for his genius daughter and nurture her talents. It may be an extreme example, but the story made me wonder – how do some parents handle it if they don’t have the money? I know that if I had to suddenly stop Nate’s activities due to unexpected financial issues, even though he loves them and looks forward to every class with excitement…my own feelings will kill me on the inside.

Having to make a choice between our child’s happiness and their (immediate, unexpected) needs can be painful.

But the good news is, if we protect our own downside, we may never have to make that choice.

What insurance do I need to get?

We started by thinking about what were the major areas that we needed coverage for, as parents, and I recommend that you do the same. Here’s one example of how you could potentially pull this off with Income:

Income’s Star Assure also come with a retrenchment benefit, whereby in the event that you are retrenched and unable to find employment for 3 consecutive months, you can apply for a waiver of premiums.

Once we had gotten our necessary insurance plans settled, the next place we looked at was to grow our emergency savings. In the past, I used to stash away 6 months’ worth of living expenses, but ever since our son was born, we’ve increased this to 12 months (just in case it takes us up to 1 year to find another job).

I almost quit my job to become a full-time freelancer, but in the end, we decided that it would be safer to have just one self-employed person between the two of us. The pandemic has reinforced this as my husband’s income got affected, but mine remained intact, so Nate didn’t have to stop any of his activities.

Insurance. Savings. Income.

Your choice of tools might differ, but ultimately, what’s important is to focus on getting what you need so you don’t have to give up on what you least want to.

|

| Source: NTUC Income |

With a life insurance plan for yourself, you can protect your child’s happiness for life and ensure you don’t have to put a pause on providing what makes your child happy. Let Income help you take the first step towards protecting your child’s happiness today. Learn more about plans that can suit your financial planning needs here.

Disclosure: This article was sponsored by Income, so the examples used are their plans, which are also among Singapore’s most competitive. However, for a detailed quote and financial planning, you’re encouraged to seek out a trusted advisor instead of making your decisions regarding insurance purely based on this article (or any other articles you read online). Premiums used in this article are based on the quotes we received, and may or may not be reflective of the premiums you will need to pay as your age, smoking status, medical history, preferred sum assured, riders, and more will likely vary.

This article is meant purely for informational purposes and should not be relied upon as financial advice. The precise terms, conditions and exclusions of any Income products mentioned are specified in their respective policy contracts. For customised advice to suit your specific needs, consult an Income insurance advisor.

This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is correct as of 5 October 2020.