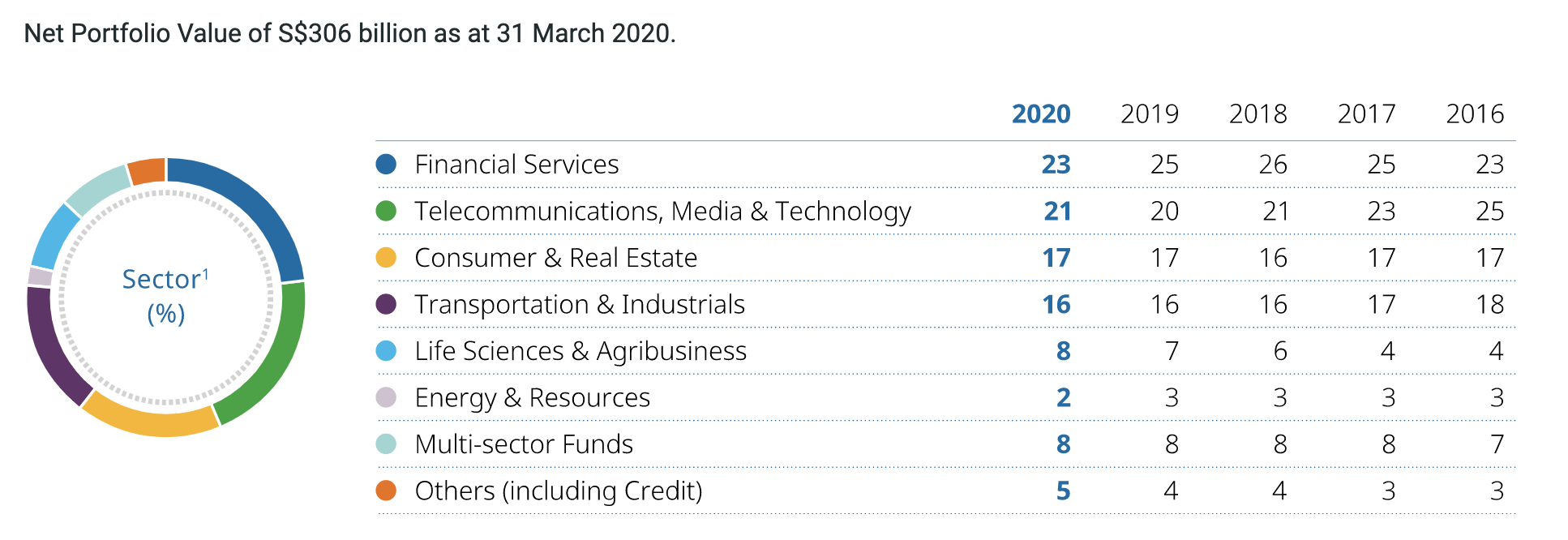

Here are Temasek’s major investment holdings in 2020. Their investment approach is outlined below.

It is often said that how you invest is a reflection of where you see the future going. I had the honour of attending Temasek’s virtual briefing earlier today where they shared their investment approach, which centres around 4 investment themes:

“We see big new opportunities in spaces that will reshape what the world will look like in the next 5 or 10 years. We won’t get every part of it right, but we’ll build a number of scenarios, and we’ll invest around those scenarios”. – Stephen Forshaw, Head of Public Affairs

(Quote was made while in a private session which I attended earlier today.)

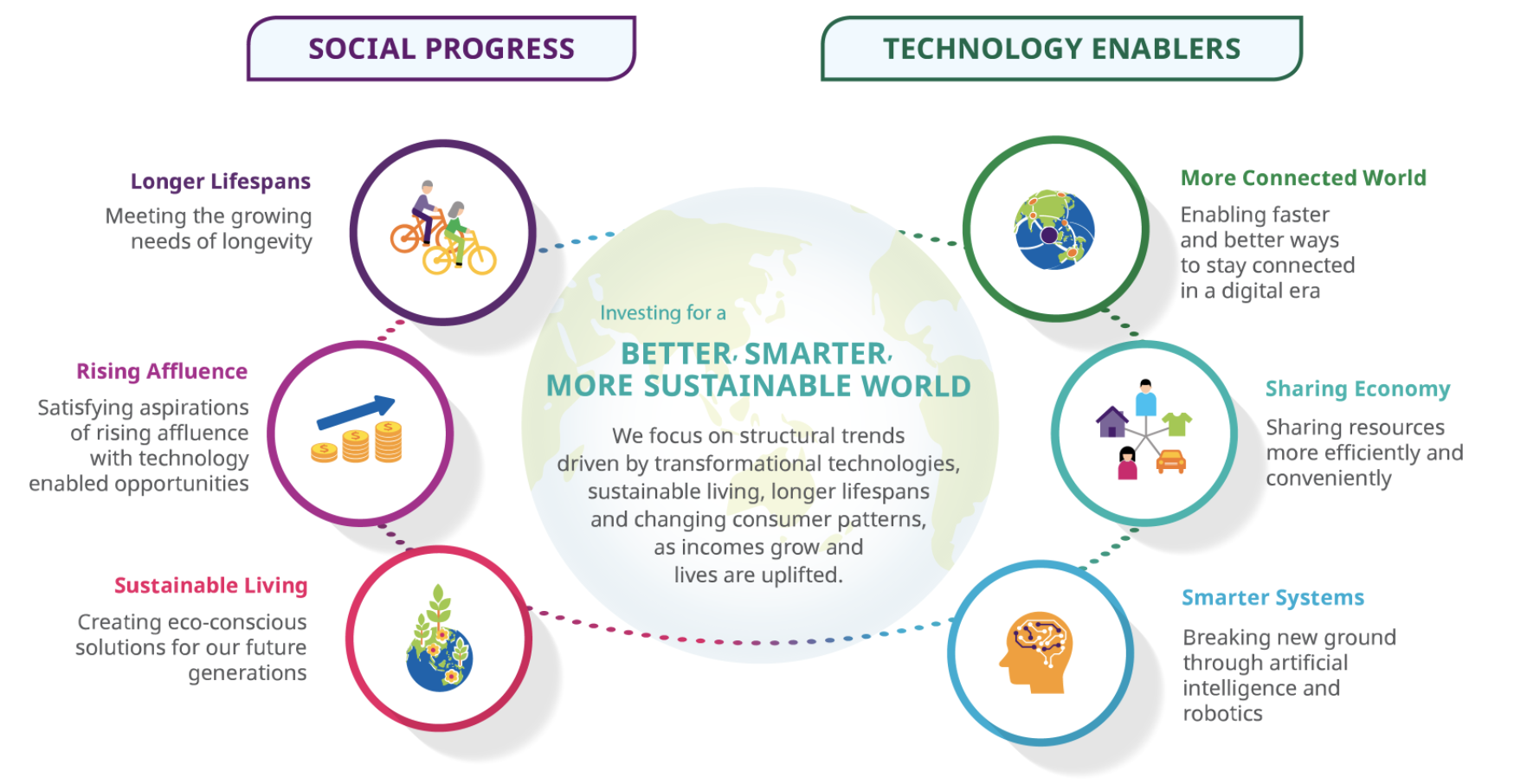

These themes then translate into the following 6 structural trends:

Judging from Temasek’s current portfolio, they are also shaping up to be pretty bullish on China (Temasek’s exposure to China has surpassed Singapore for the first time), as well as core trends around digital payments, life sciences, agriculture, and more.

Mr Yeoh Keat Chuan, Senior Managing Director, Enterprise Development Group and Deputy Head, Singapore Projects, noted, “The COVID-19 pandemic has amplified and accelerated the structural trends that guide our investment direction. These trends are driven by social progress, demographic shifts and changing consumption patterns, as well as enabled by technological advances. They have been brought into sharper focus for us by this pandemic.”

“One way for us to shape our portfolio for the future is to seek innovative companies at the forefront of developing new, sometimes disruptive, solutions that create new opportunities.”

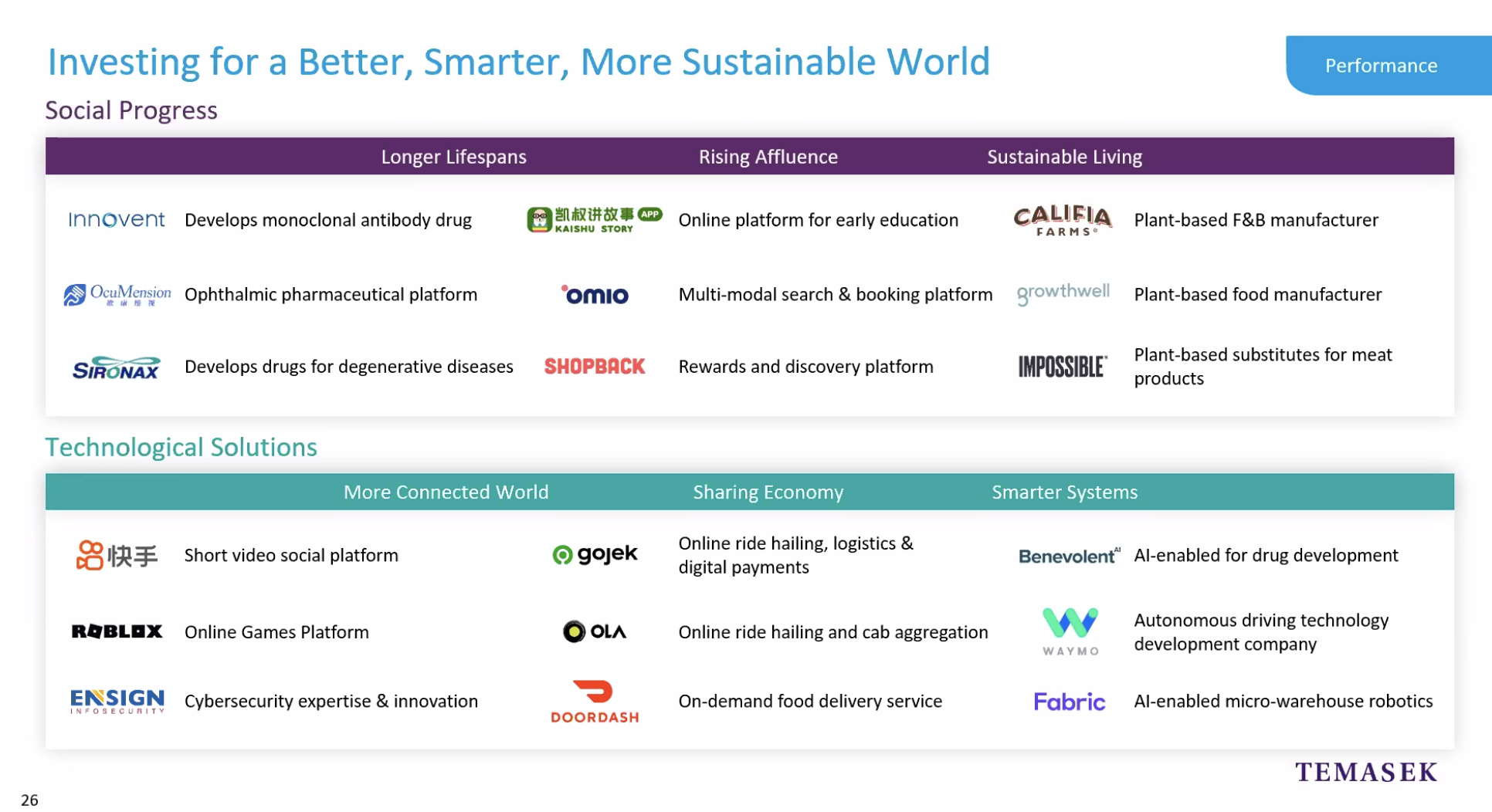

Recent Investments into Innovative Companies

Temasek has increased its exposure to the payments sector and other non-bank financial services companies, to benefit from the acceleration in digitisation of financial services. They added stakes in PayPal, Mastercard and Visa; and invested in promising emerging companies such as Blend, a US-based digital lending platform for mortgages and consumer banking.

New technology investments included Duck Creek Technologies, a US-based software provider to the property and casualty insurance industry; ManoMano, a European home improvement product online marketplace; and MiningLamp, a big data solutions company in China.

Investments for sustainable living included Sunseap, an Asian solar developer based in Singapore, as Temasek saw growing demand for sustainably produced food, and increased their exposure in companies producing alternative and plant-based proteins, such as Calysta, Impossible Foods, and Perfect Day; and made new investments in Califia Farms and Memphis Meats.

Life sciences and healthcare investments included AIER Eye Hospital; CareBridge, an integrated healthcare system; and biopharma companies developing new drugs and therapeutic solutions such as Beam Therapeutics, Coherus BioSciences, Transcenta and Vir Biotechnology.

I’ve consolidated their major investments in the image above, but you can view the full list here as well.

Choosing what to invest in is never easy, and a lot of due diligence needs to be undertaken before a decision is made.

“For every 10 companies we look at, 8 of them we pass up pretty quickly. Maybe 1 in 50 ends up being a deal that we think is the right thing for us to do” – Stephen Forshaw, Head of Public Affairs

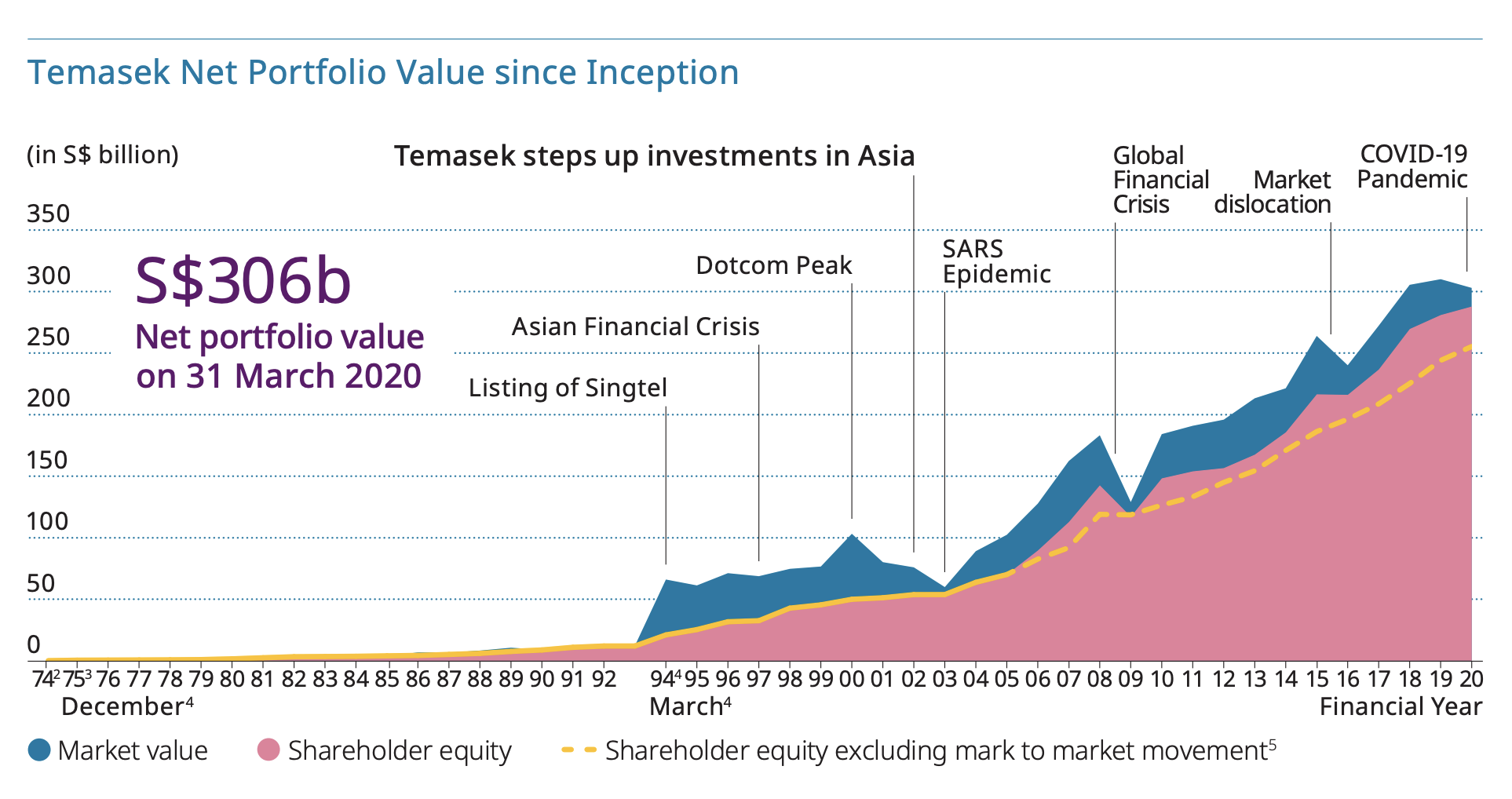

Temasek’s initial portfolio in 1974 started out with shares in 35 companies that were previously held by the Singapore Government. Back then, the portfolio was worth S$354 million; today, the portfolio has grown to S$306 billion today.

“46% of land today is being used for cultivation of crops that are being used for animal feed. As we embark on using more plant-based proteins, I think that there is real investment opportunity there. [cities example of Impossible meat] We saw this coming and we invested in it early.” – Stephen Forshaw, Head of Public Affairs

About Temasek

Temasek’s role in the fight against Covid19

With love,

Budget Babe