|

| Screengrab from Dollars and Sense – read their article on this topic too! |

- Major cancer will now exclude all grades of dysplasia, squamous, intraepithelial lesions (HSIL and LSIL) and intra epithelial neoplasia; all neuroendocrine tumours histologically classified as T1N0M0 or below; all gastro-intestinal stromal tumours histologically classified as Stage I or IA or below.

- Aplastic anemia (a disease in which the body fails to produce blood cells in sufficient numbers) is now amended to Irreversible aplastic anemia.

- Heart attacks will now cover both Type 1 and Type 2 myocardial infarction (“death of heart muscle due to ischaemia“) instead of previously being attributed only to obstruction of blood flow.

- Coma due to alcohol or drug abuse will be specifically excluded.

- New exclusions added for benign brain tumour i.e. abscess, angioma and tumours of skull base.

- Encephalitis (inflammation of brain) will now include non-viral causes, but must be documented with permanent neurological deficit for at least 6 weeks and supported by confirmatory diagnostic tests

What does this mean?

Given that research has shown over 90% of all severe stage claims received by life insurers are generally for 5 types of CIs – major cancer, heart attack, stroke, coronary artery bypass surgery and kidney failure – this also means the new LIA definitions will affect the majority of these claims given the change in headings.

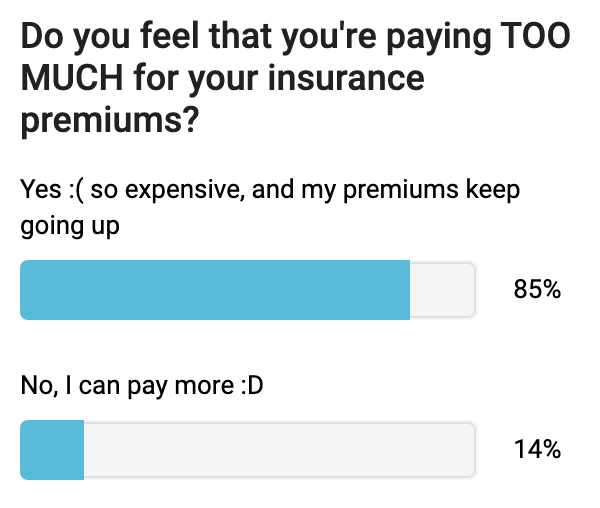

Obviously, premiums for critical illness insurance aren’t cheap, and the big question remains on whether you (i) need it and (ii) can you afford it?

I tend to think from the other way around: can I afford NOT to have this insurance?

If my answer is no, then I’ll usually get covered as long as it is within my realm of affordability.

Aside from extent of coverage, you’d want to think about the affordability of premiums. For those of you worrying over policies lapsing in the event that you might lose your job, ask your financial advisor to check for policies that offer you a premium holiday.

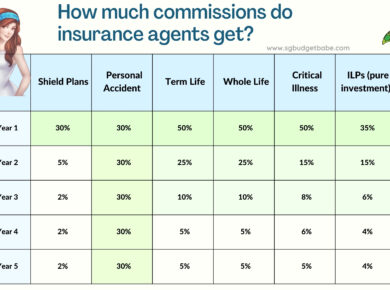

Of course, if your insurance agent is hounding you to buy a CI policy NOW because of these changes, please evaluate whether they’re truly doing it for your own good or simply for the sake of their commissions.

I still choose to believe there are good agents around, but I’ve also seen many unethical ones.

A lot of you have asked me about these changes, but unfortunately I’m not (and choose not to be) a licensed insurance agent so I won’t be able to help you buy or review any of your policies in detail.

Please go and schedule a review session with your own financial advisor to get a more personalised consult on your own circumstances instead.

I’ll be having a webinar to share my thoughts on the changes and what I intend to do.

Only readers of this blog are welcomed, and NO insurance agents please – you should do your own homework on the changes as a professional, and not defer to a financial blogger for it.

Date: 5 August 2020 (Wednesday)

Time: 7pm

Venue: Online (WebinarJam – limited slots due to the subscription plan, please register in advance)

Register for the webinar here.

Update: The webinar has ended, thanks everyone who tuned in and we hope that what we shared was helpful + the Q&A session that we had! Some of you asked me for the poll results, so here are some of the interesting ones:

Glad that after tonight’s webinar, most of you understand the changes now! Remember to read the LIA document in detail ok?

This was sobering – 2 in 3 attendees surveyed knew at least one other person with CI. I actually know of quite a number of people who had CI, so it was a real worry for me.

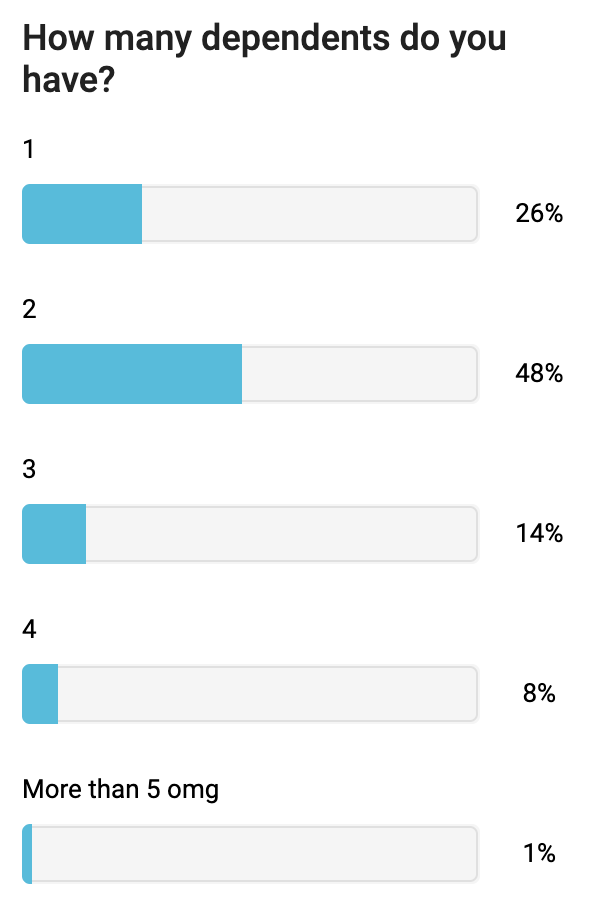

I wasn’t expecting this! Personally, I have 6 dependents who are fully reliant on my income + my husband’s, and that’s not even including the second kid that we hope to have in the near future. Pretty scary to know that I’m in the 1%.

We talked about how to NOT overpay for your insurance as well, so you can invest the remainder for better growth. Get what you need covered, and invest the rest – this will always be my personal strategy 🙂

Download the full document with the changes on CI definitions here!

With love,

Budget Babe