Stock markets seem to have become disconnected from economic fundamentals. How sustainable is this? And now that IMF has issued a warning on the disconnect, what should investors make of their latest announcement? Here’s my personal take.

- IMF warns of a second stock market correction after grim economic forecast

- Global stock market rally is a gamble, IMF warns investors

- IMF warns disconnect in financial markets risks a correction in asset prices

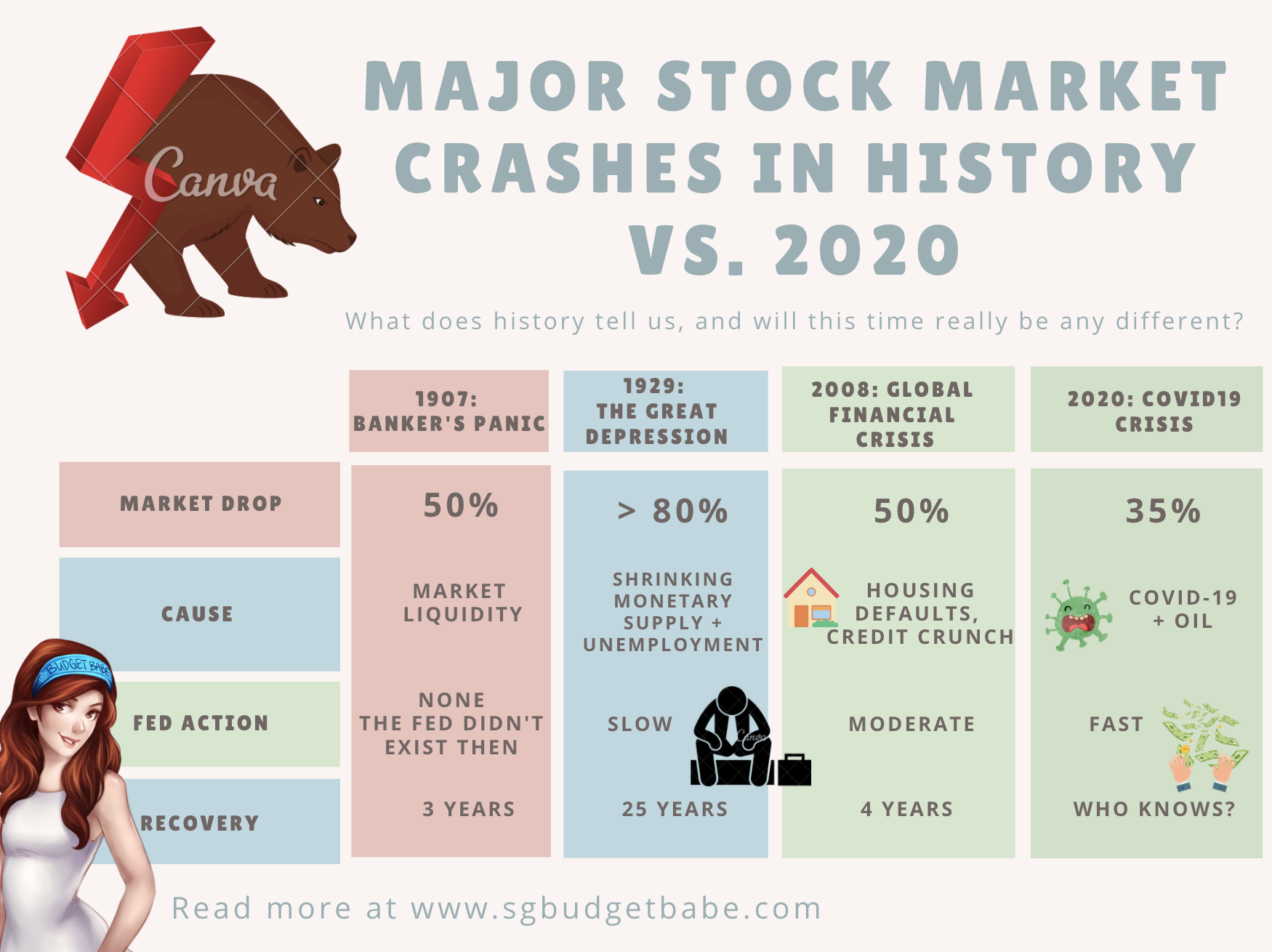

- How the current stock market collapse compares with others in history

1907: Banker’s Panic

1929: The Great Depression

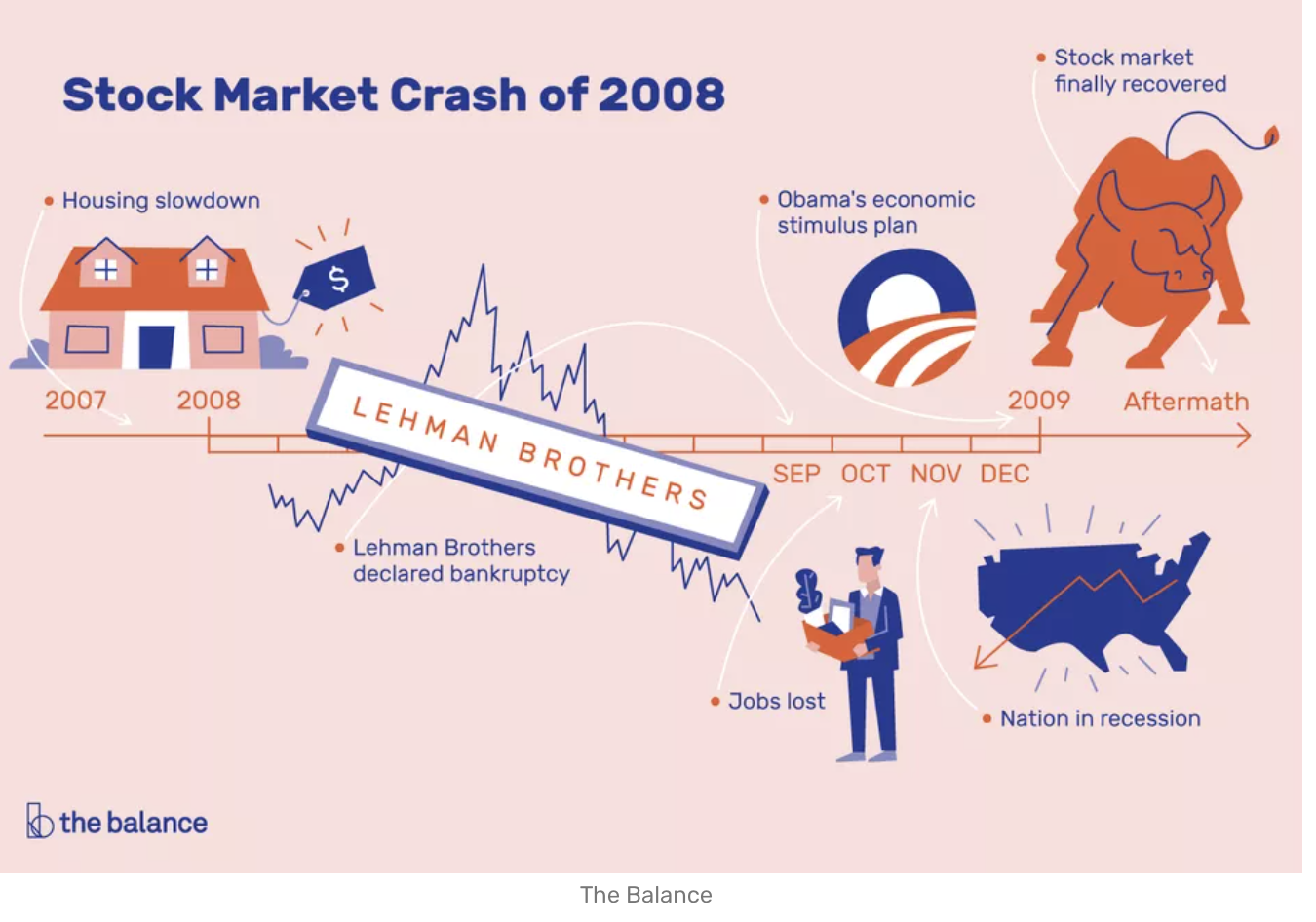

2008: Global Financial Crisis

|

| Image Credits: The Balance |

2020: Start of a new crisis?

- The world has enjoyed a prolonged bull market up till now (or rather, the longest-running bull market in history…until the crash happened) from the 2009 crisis. Macro-economic theories tell us that markets tend to go through 10-year periods of bulls and bears.

- The economic crisis this time was triggered NOT by a liquidity crunch (as per 1907, 1929 and 2008) but by an unexpected global pandemic with lockdowns that led to a halt on global economic activity.

- The Fed has intervened much quicker this time round, but unlimited QE is not the solution to the root cause of the today’s issue. A vaccine, or a cure, is. Unfortunately, the WHO has stated that a vaccine may only be available next year at its earliest (possibly June 2020).

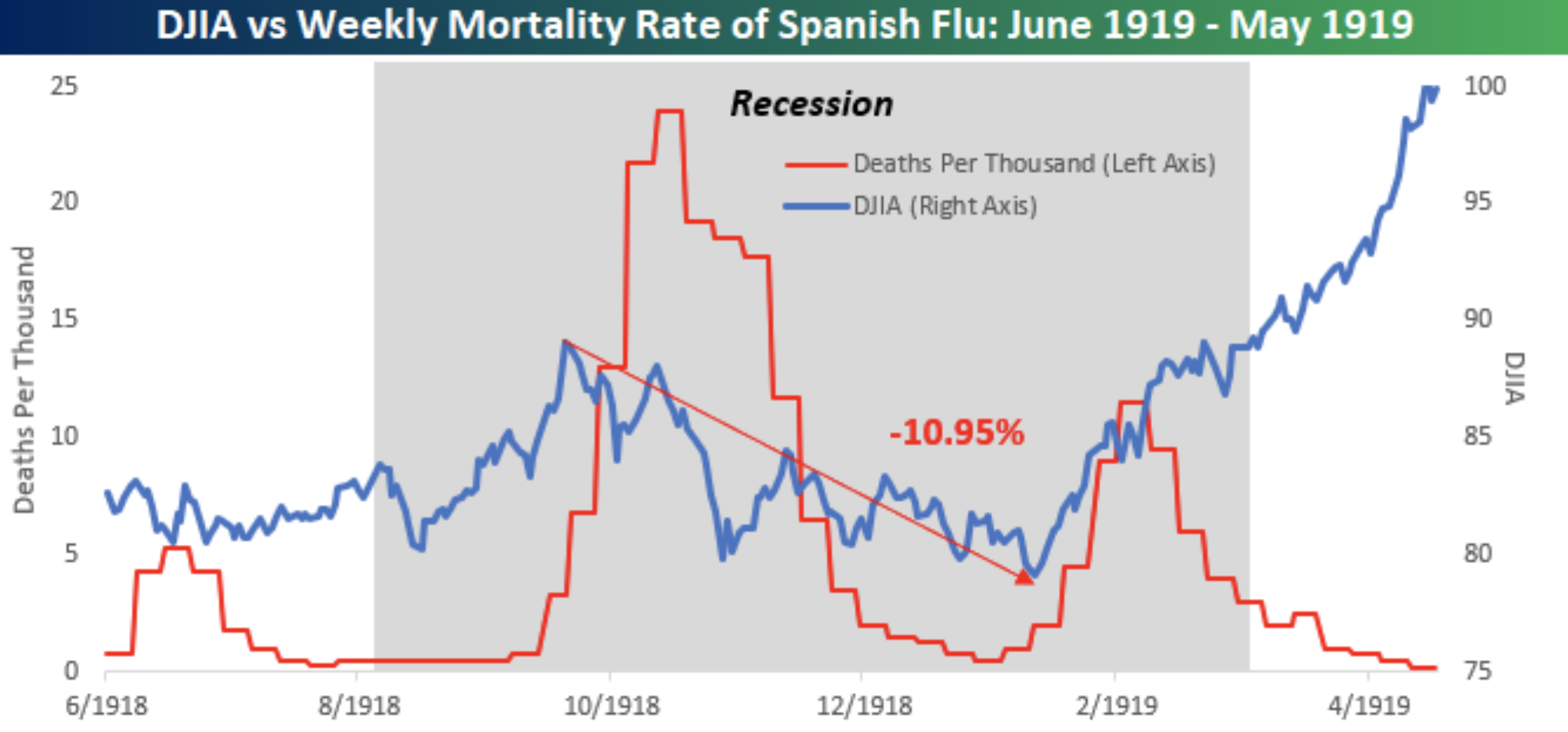

- Fears of a second wave seem to have been validated so far, and uncannily enough, we’re on the exact timeline as the 1918 Spanish Flu pandemic, which was the deadliest in history with one-third of the world infected. The pandemic back then had started in March 1918 and the second wave emerged in August, followed by a third wave in January 1919 before finally abating in the summer.

- At time of writing, the world has hit 9 million of infected Covid-19 cases. New daily highs are being reported in 29 US states, China just identified their biggest cluster of cases since February, and even New Zealand (which was declared coronavirus-free) has reported new cases this month.

- Information spreads much faster today than it did in the last few financial crises, so the reactionary time will also be much shorter. Again, this is hindsight analysis, since I have the recent March crash (and subsequent recovery) to base it on.

|

| The stock market vs. the Spanish flu pandemic |

Don’t be misled by the recent market rallies

One thing I’ve learnt in my investment journey is not to overestimate my own competencies…and to recognise when luck plays a part.

We could have guessed – or even predicted – that the Fed would intervene with QE (although few predicted that the Fed would actually announce they’ll start buying junk bonds as well), but who would have known that it would be implemented so fast and furious.

But remember, while QE was the cure to the previous financial crises (because the root cause was a liquidity crunch), the current crisis is NOT due to liquidity or credit issues at all.

Similarly, we could have then easily predicted that the surge in liquidity would cause the stock markets to rise…or not.

You see, all these are only easy on hindsight. When we were living it out in March, no one knew for sure that this would happen. No one knew for sure that the markets were gonna recover. Anyone who said definitively then that they were buying or selling had a 50% chance of getting it right and becoming the next “investment guru who predicted the stock market rise/crash”.

The only thing some of us knew for sure was that valuations of several stocks were cheap based on their historical averages. And that was what led me to snap up stocks in March – April.

So when the markets rallied thereafter, I was proud of the fact that I had invested such a huge lump sum even when the world’s prospects had seemed so gloomy. But I was also left wondering if I should have invested more, lest this was the start of a V-shaped recovery.

The rallies soon got me befuddled as the disconnect between economic fundamentals and the stock market widened. The sense of FOMO then was definitely strong, and I certainly regretted not having pumped my entire war chest in during my March – April buys, but at the heart of it I asked myself – has the economy recovered? Are we truly out of the woods yet?

What could possibly go wrong from here?

What should investors do from here?

Perhaps the recent red could signal the start of a prolonged crash (like what happened during the Great Depression), or we could get lucky and a vaccine is found sooner than expected…and then we continue our bull run.

Take care of your downside, and the upside will take care of itself.

Before you invest, make sure you have already gotten yourself protected with insurance and a solid emergency fund. That way, even if your boss were to fire you tomorrow because business got worse, you don’t have to draw down from your stock market investments to pay for your bills, and still have excess left to invest.

While I personally think you most definitely should invest in the markets now, the big questions are (i) how much, (ii) in which stocks and (iii) how long to hold? And that…is an answer that only you can answer for yourself. If you’re curious about which stocks I’m buying, you can always get access to my Patreon here.

There’s no need to panic if your end-goal is to invest for retirement. We still have a long runway to go, and I’m confident that stocks will be at new highs 10, 20, 30 years from now.

But if you’re trying to time the market, then I wouldn’t be surprised if you’re thinking of taking profits now. The question then is when are you going to go back in next, and if you’ll be able to put your anchoring bias aside.

As for myself, I know that I don’t have a crystal ball on the market, so I’ll just continue to invest in stocks that I feel at trading at cheap valuations.

Since the Great Financial Crisis took 3 years to play out, and the 1918 Spanish flu took a whole year for the world to recover from, I expect that our problems aren’t going to go away anytime soon for sure…at least until a vaccine is found.