The answer isn’t as simple as “buy more insurance”. Here’s why.

Longer life expectancies. Rising healthcare costs. The sandwiched generation.

Add that together and you basically have an equation for disaster.

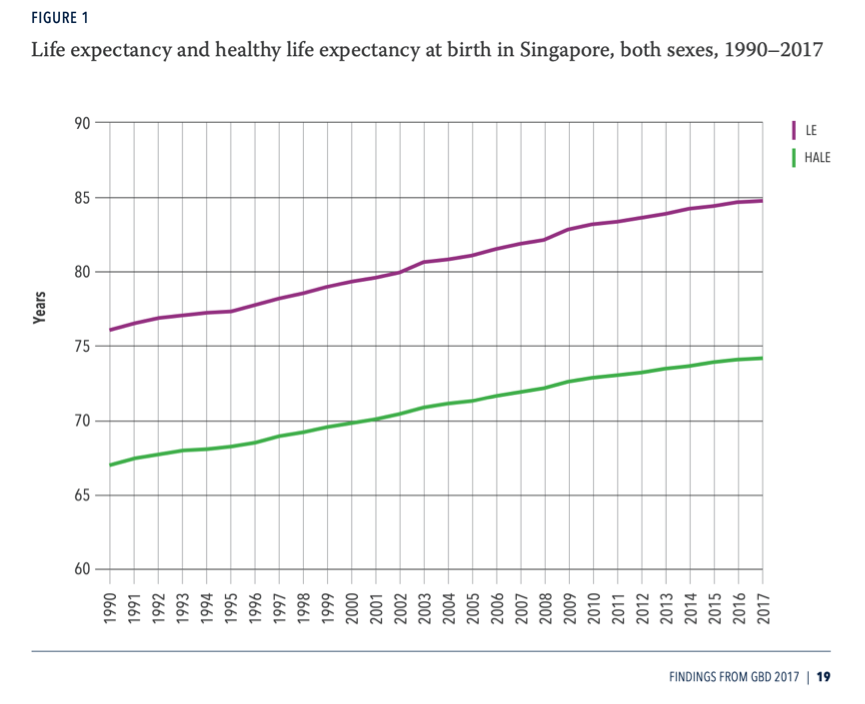

Singapore officially has the world’s longest life expectancy, but most spend at least 10 or more years of that in ill health. And that’s easily one of the fastest ways to deplete your savings, especially when you’re faced with large hospital bills for medical treatment. Depending on what you’re hospitalised for and the length of your stay, essentially what took you years to save up could easily be gone with your bill in a matter of days.

The report by the Health Insurance Task Force revealed several interesting findings that were believed to contribute to the rising healthcare costs. These included

- the choice of hospital (private hospital bills were typically 2 to 4 times higher vs public hospitals)

- over-charging and inappropriate treatment

- those with IP riders incurred 20% to 25% higher medical bills vs those with IPs only (insulation from medical costs resulted in little incentive for policyholders to manage their health and medical costs)

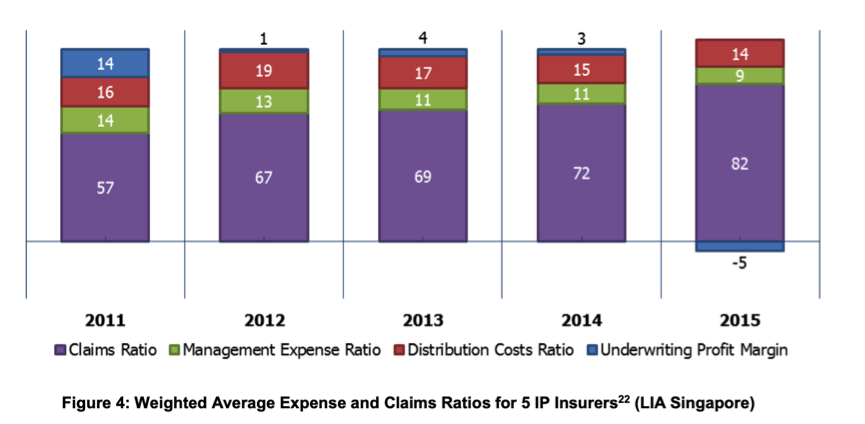

And as much as consumers believed that insurers make good profits from health insurance policies, the statistics show otherwise. In fact, most of the insurers had been making losses from underwriting integrated shield plans over the past few years.

Thus, with medical inflation at an unsustainable 10%, the Ministry of Health (MOH) has implemented several changes, namely

- implementing compulsory co-payment (patients with riders co-pay 5% and those without riders co-pay 10% of the bill, and this should help reduce the “buffet” practice),

- introducing benchmarks for medical fees, and

- encouraged insurers to use a panel of preferred healthcare providers.

How can I protect myself against rising healthcare costs in Singapore?

I believe fees will continue to rise – both in terms of hospital bill sizes and our insurance premiums. The top health risk factors that influence medical cost globally are metabolic and cardiovascular risk, dietary risk and emotional or mental risk. So the answer certainly isn’t just to buy more insurance, but we need to be proactive in owning our health as well.

Here are a few ways we’re protecting ourselves against it:

1. Maintain a Healthy Diet

It is easy to simply opt for fast (or processed) food these days, especially during hectic work schedules, given how cheap and convenient these foods are. However, don’t make the mistake of neglecting your diet, for a sustained unhealthy diet is one of the leading causes of illnesses and deaths in the developed world.

For instance,

– foods high in sodium and saturated fat can lead to high blood pressure

– a diet that contains high calories and sugar can cause type 2 diabetes

– you’re at a higher risk of cancer caused by immune deficiency if you do not obtain enough vitamins and nutrients in your diet

– consuming too much proteins high in animal fat increases your chances of developing coronary heart disease

Instead of feeding our bodies with excessive junk like instant noodles and potato chips, we should reduce our dietary risk by opting for healthier foods. And if healthy lunches in the CBD is depleting your monthly budget, try meal prep instead. Preparing our own meals at home not only saves us money, but also allows us to control the amount of oil / sugar / salt used.

It is worth setting aside a few hours each week (usually on weekends) to do meal prep for the rest of the week.

2. Exercise Regularly

“But I’m too busy and don’t have time to exercise!”

I know how tough it is to squeeze in exercise when you’re already running on a packed schedule (especially if you have a side hustle like me). But our busy lifestyles should not be an excuse. If you wish to be around with your loved ones longer, then we should be proactively setting aside time to exercise and keep fit.

One way to do it is to schedule in exercise either early in the morning before work, during your lunch hour (if there’s a gym near your office), or towards the end of the day.

In my case, I tried signing up for yoga classes in the past, but soon found that the exercise time plus travelling to and fro was too much for me to handle, so I’ve recently opted for home workouts by following Youtube fitness channels instead. This has allowed me to complete workouts within 30 – 40 minutes, which is a lot more easier for me to keep up with instead of having to allocate 2 – 3 hours for a fitness class outside.

3. Set Aside Emergency Funds to Complement Your Insurance Cover

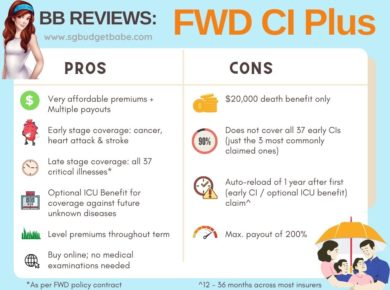

Given how expensive hospital bills are, you can and should opt to outsource this risk to a third party. Integrated shield plans help to mitigate such bills, and you can also add on riders for a greater peace of mind.

With the new 5% or 10% co-payment scheme in place, make sure you’ve saved up sufficient emergency funds that you can tap on for medical bills as well, in the event of any unfortunate incidents. Do not simply assume that your hospital bills will be paid in full even with a rider.

4. Go For Regular Health Checkups

Early diagnosis not only allows for early (and usually less aggressive) treatment but can also help reduce healthcare costs. It also gives you a better chance of fighting and recovering from the illness.

5. Pay Attention to Your Emotional and Mental Well-being.

If you’re in a high-pressure job, then you might want to think about whether the cost of your health is worth it in the long-term. One of my friends experienced this recently – after she switched her jobs, her blood pressure and cholesterol levels finally went down. So if your job is causing you too much health problems and you find yourself falling sick more frequently than before, then it might be time to do a health check and consider if your job is truly worth the sacrifice.

Nothing is more valuable than good health.

Hospital claims are more common than you think!

At the end of the day, our best bet against rising healthcare costs would be to ensure we’re adequately protected and to proactively manage our diet and lifestyle.

After all, prevention is much better than cure.

P.S. Feeling lost about why your insurance plan now has stuff like pre-approvals and panel specialists? Keep a lookout for my next article on how the changes affect us, and what to do next!

Disclosure: This post is written in collaboration with Aviva as part of their educational outreach efforts.