Who doesn’t love a short-cut?

But when it comes to personal finance, there is no real short-cut. And to all those who have been shelling out $5,000 for an investment course is going to automatically make you a millionaire, then you’re only setting yourself up for disappointment.

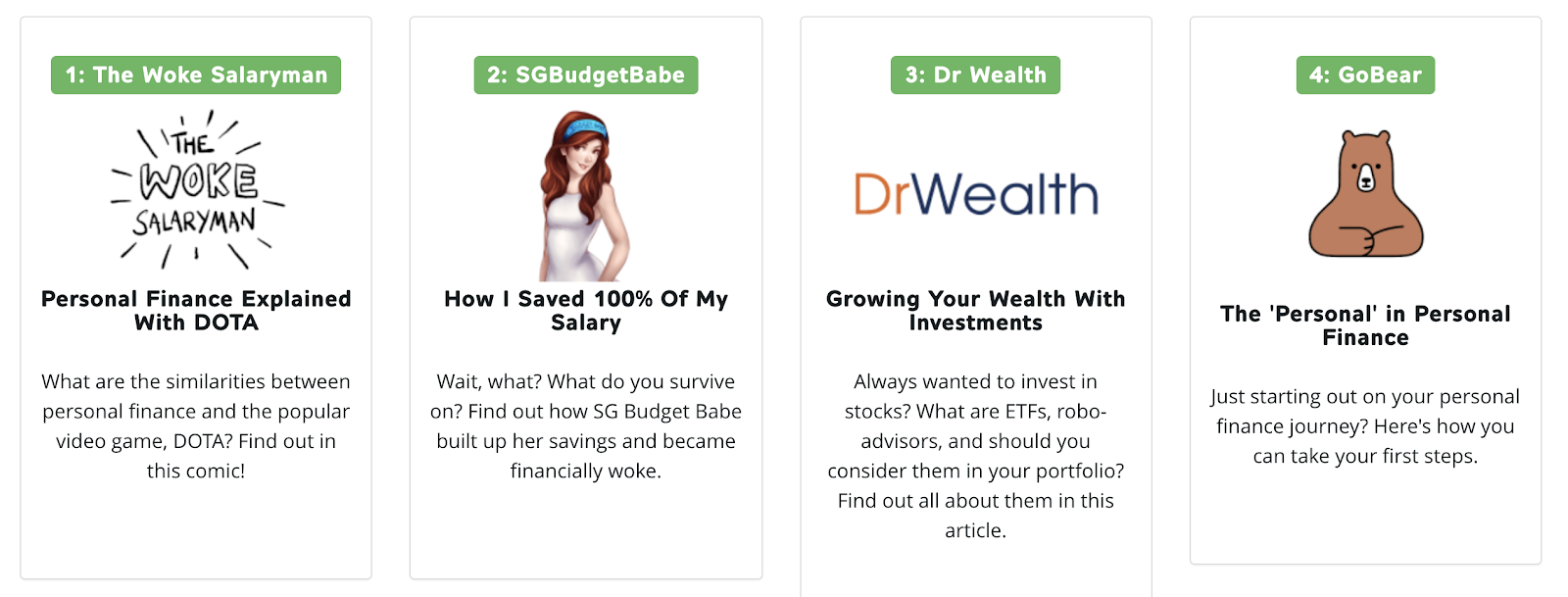

GoBear has just published a fantastic article that I think deserves to be read by everyone who’s concerned about their personal finances. With more people coming out to share their stories, we’ll need to think twice before we simply apply their practices to our own lives. While we’re certainly in a much better place to manage our finances today because of the wealth of knowledge shared by websites and financial bloggers, it also means that for those who follow blindly without adapting the tips taught to their own personal circumstances could also find themselves in financial ruin.

There are many roads to financial freedom, but you’ve to navigate your own journey and chart a path that works for you. We are all born into different families, and the responsibilities that we have to shoulder are not always the same.

So don’t feel pressured when you see folks like Christopher of (Tree of Prosperity) earning $9,000 of passive income from stock dividends every month. In fact, it might be almost impossible for you to have the same results now unless you (i) have $2.7 million of capital to invest or (ii) you were born earlier and already actively investing during the 2008 global financial crisis.

There’s no need to feel envious that this guy gets paid $40,000 every year for seemingly doing nothing. If you’re in a low-wage job or have no surplus cash to buy a house and can only rely on your CPF, what he was able to pull off wouldn’t be applicable in your situation.

Instead, look for what they’ve done and think about whether you can apply that to your own life. I love reading these inspirational stories and how they motivate me to do more for myself, but ultimately it is never about copying their steps exactly.

It is about crafting your own.

Read the rest of the fantastic article here, and view the full series here.

Don’t forget to take a quiz and win some cash while you’re at it!

With love,

Budget Babe

3 comments

hi

i searched high and low for your email on your blog but couldn't find it. Anyway, I came across your podcast interview recently on Tencent and would like to know if you use Warrant instrument to go long on this stock as well. This is newly added into SGX and I found not many practical videos out there. Most are text book copy and paste with lots of definitions but not much actual applications. It would be nice if you could do a video on that , thanks a zillion. D

This comment has been removed by a blog administrator.

Hi Mr Chua! I've yet to try warrant instruments so this is definitely something I'm not familiar with. When I understand enough of it, I might write a post then 🙂 thanks!

Comments are closed.