Are markets crashing? Is this the start of a global recession, and how long will it last this time?

There’s been a lot of talk (and action) in the market recently. While I obviously do not have a crystal ball that sees into the future, I do feel that we’re on the cusp of a global recession, and how investors navigate the next few months of turmoil will determine whether we come out in the red (lose money) or in the green (make tons of profits) when the crisis all blows over.

Disclaimer: This is my personal opinion on the stock markets. Nothing in this article should be taken as investment advice. Please do your own due diligence before making any investment moves.

Signs of a Recession in 2020?

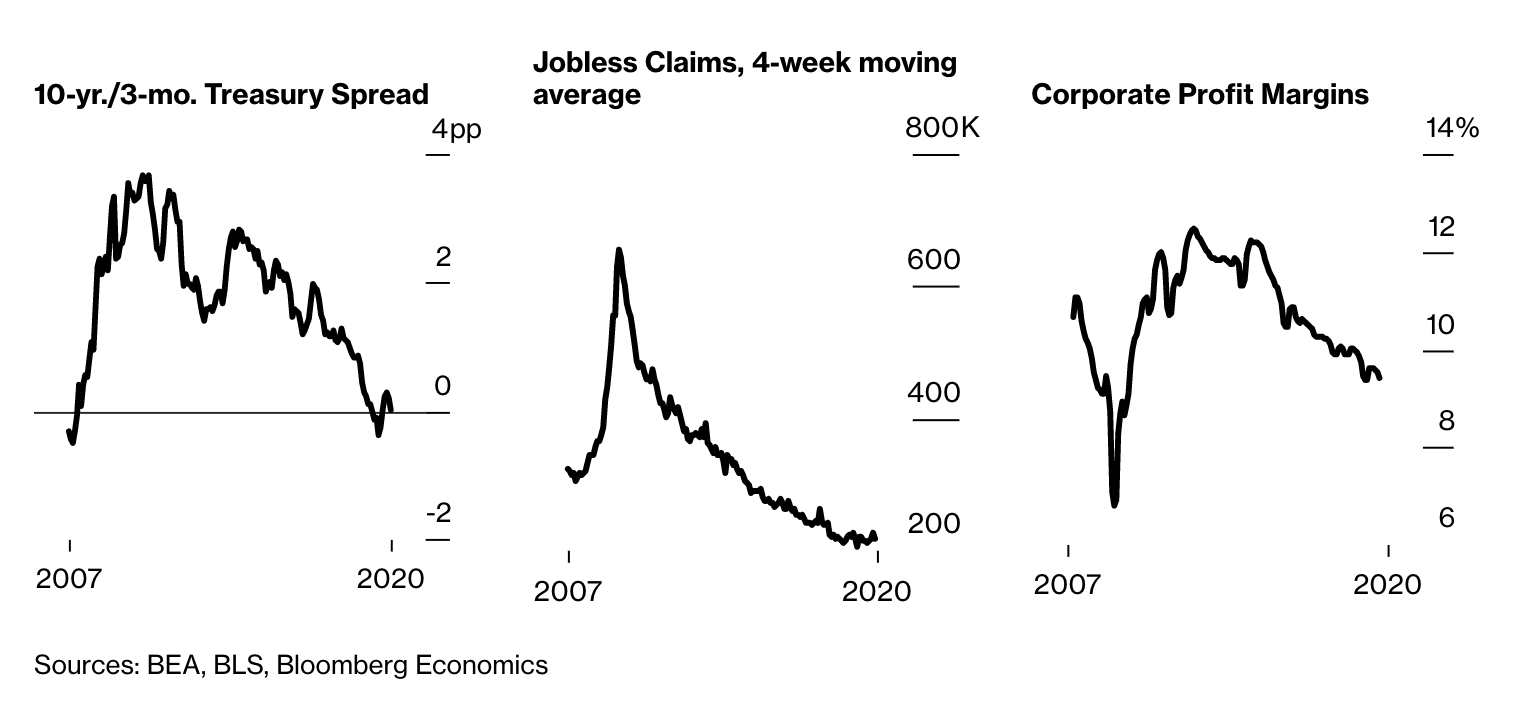

If you believe in the yield curve inversion theory (some claim it is an accurate predictor of recessions), then Forbes has a fantastic article here that talks about how it is a sign of a recession coming in 2020.

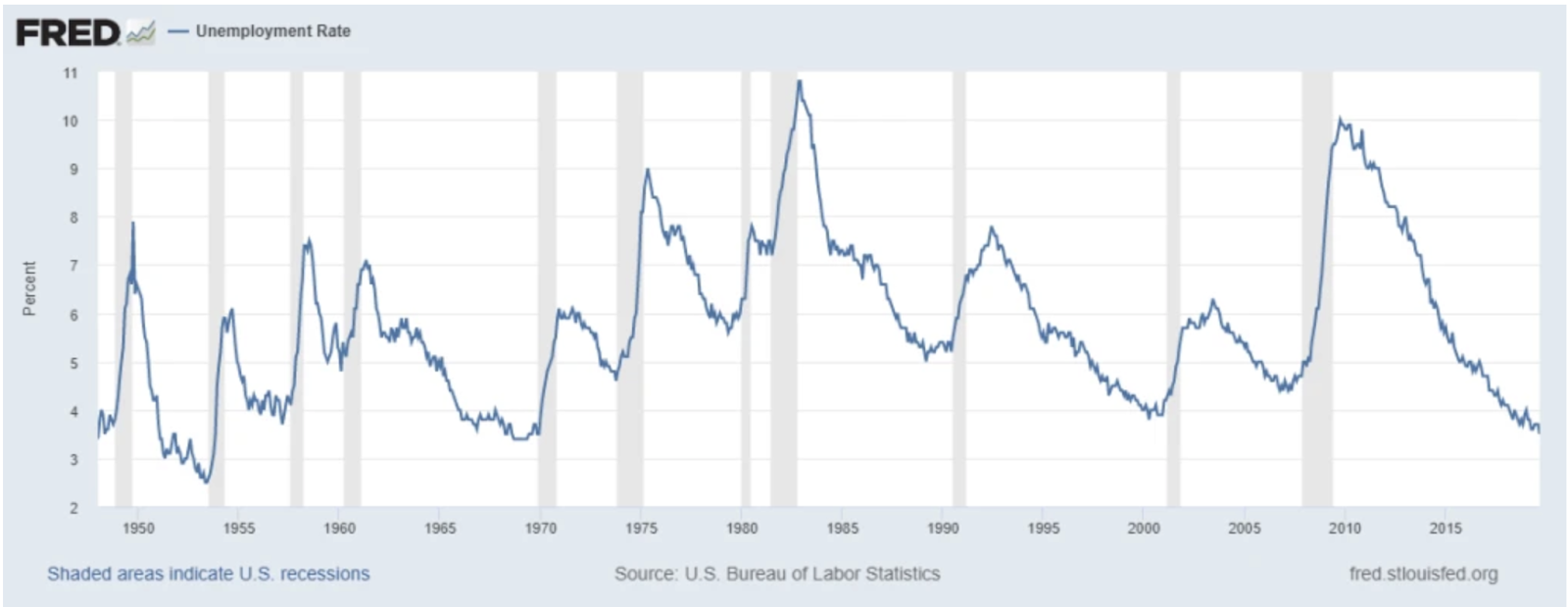

The following charts are also worth taking a closer look at:

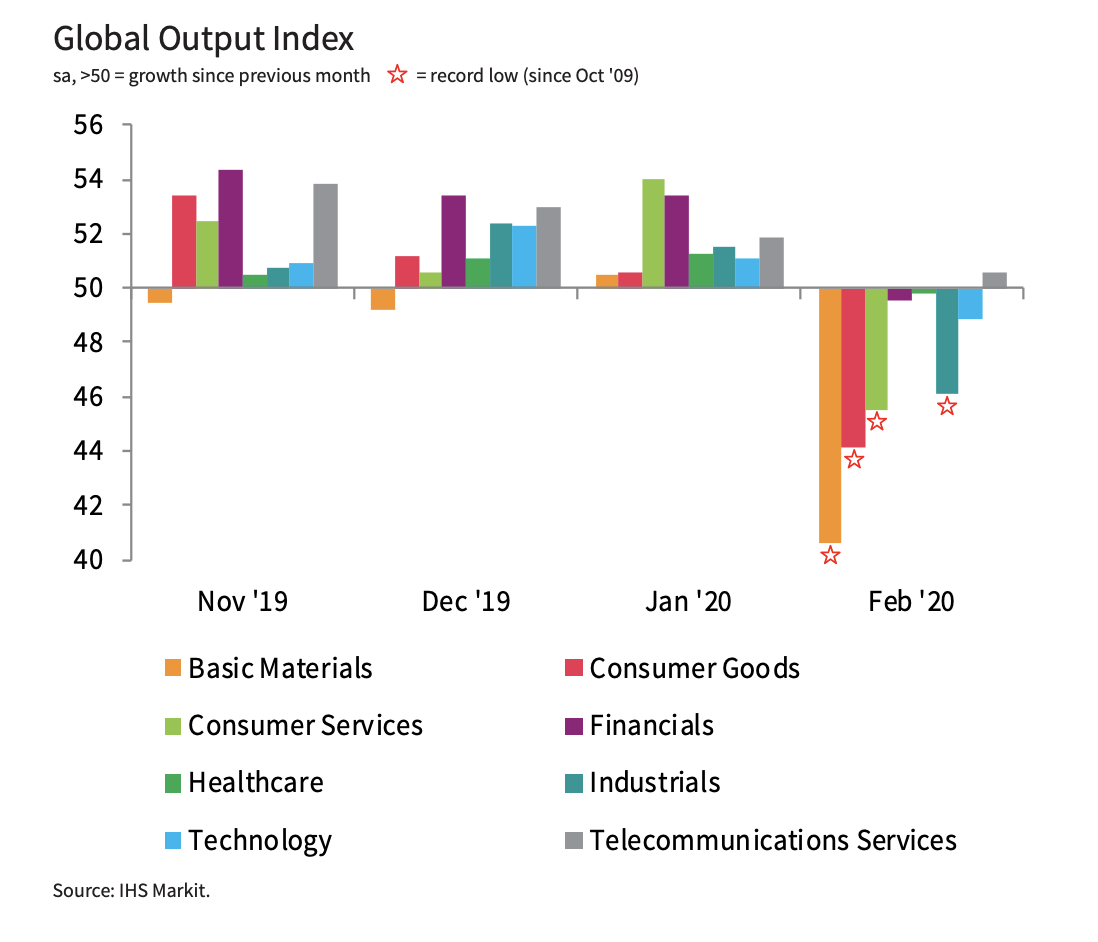

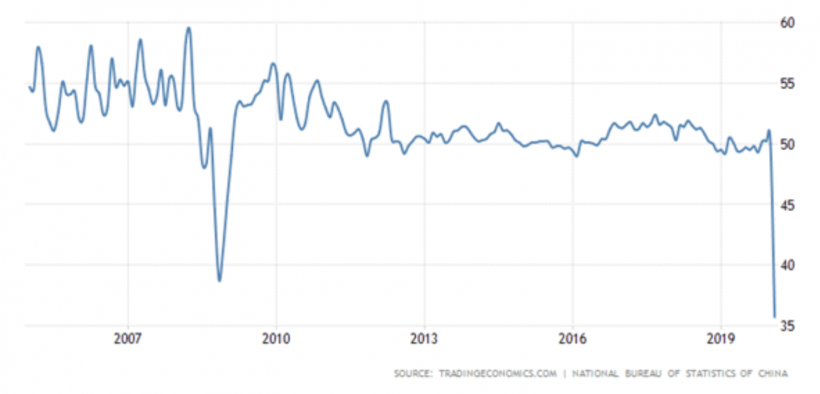

However, what I’m more concerned about is the Global Manufacturing Purchasing Managers’ Index (PMI), which was released just a few days ago:

A value below 50 is regarded as a contraction, and as you can see from the graph above, it looks like the world is in trouble. And the picture in China is equally worrying, with China’s PMIs having fallen sharply from 50 to 35.7 within a single month (Jan – Feb). This number is the lowest reading ever (since they started tracking in 2005); for context, it was 38.8 during the 2008 Global Financial Crisis (GFC).

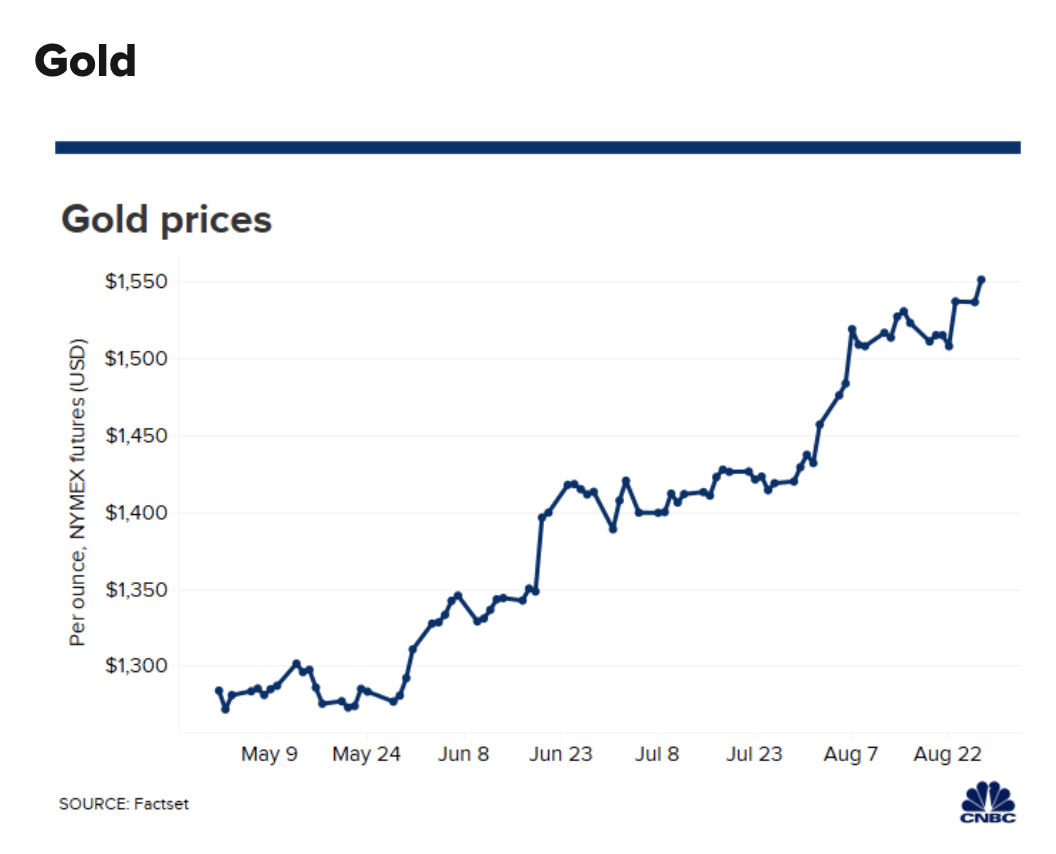

Gold, often seen as a safe haven during downturns, have also been trending upwards.

Another warning sign? Sequoia Capital recently issued a letter to warn its startups about the negative business impact from the “black swan of 2020” i.e. COVID-19. The last time they did this was in 2008 (yes, the GFC). According to Sequoia, they believe that it will take “perhaps several quarters, [and] even longer for the global economy to recover”.

Interestinggggggg.

How did COVID-19 lead to this?

While the virus certainly didn’t cause the immediate collapse of financial markets, I see COVID-19 as merely the trigger that the global economy needed to push it over the edge. Stock valuations have been at an all-time high and have only climbed even higher last year, which was barely accompanied by a similar level of improvement in its underlying business fundamentals.

COVID-19 is a black swan event hitting an overvalued stock market and a weakening economy. It certainly caught us by huge surprise, and is already severely impacting the global economy. With the world economy being more interconnected than it was in the last GFC, and China comprising almost 10% of the world GDP today, the effects will definitely be even worse.

Companies like MasterCard has already announced expectations of lower revenue, while Apple is facing iPhone supply shortages and lower demand. Several airlines (and its related industries) has already been badly hit by the fall in tourism numbers. Countries that rely heavily on tourism (especially on visitors from China) are suffering as their economies contract.

With the COVID-19 numbers in Italy, Iran and Korea taking the world by surprise, I’m inclined to believe that things could get worse in the coming weeks.

9 March update: Oil prices crashed 31%

There’s more bad news – oil prices have tanked due to the results from last week’s OPEC meeting, where Russia refused to cut output and Saudi Arabia unexpectedly slashing its oil prices and initiating a price war. This could get worse from here combined with the oversupply of oil.

Companies in the O&G sector will be massively affected (as it is, they’ve yet to truly recover from the 2015 – 2016 oil crisis yet) and we may see more bad debts and defaults coming. This will then affect the banks, which will then affect its loans, which will then affect the companies who are highly leveraged…it’ll be a vicious cycle.

Insights from hedge fund Baupost

The Baupost Group’s 2019 letter to shareholders contains several illuminating insights, and I’ve extracted some notable ones here:

“the relative underperformance of small cap value has only been more extreme twice in history – before the Great Depression in 1929 and at the height of the tech bubble in 1999”.

Baupost acknowledges 2019 was a great year for stock investors and traders alike, with the S&P 500 rising on 60% of all trading days throughout the year, putting 2019’s performance in the 97th percentile since 1962. But amongst this rise, Apple and Microsoft were largely responsible (for about 15% of the S&P increase), while technology and financial firms dominated the list of other top contributors. Curiously, the Wall Street Journal reported that nearly 40% of listed companies had no earnings in 2019.

The letter also highlighted how global debt rose to record levels in excess of $250 trillion and that Fed cut interest rates not once, but thrice. Policy rates had never in history been negative (like what we saw in Europe and Japan), so it is a little crazy now that borrowers in Denmark get paid to incur debt on their homes. And as it turns out, the further easing did not generate the incremental economic activity that was hoped for.

Of course, we have no way to know whether low interest rates will become a permanent fixture of the current and future economic landscape.

Nonetheless, while most people see unicorns like Netflix and Tesla as outstanding success stories, Baupost flags out the possibility that this might be partly a mirage, which reflects tulip bulb pricing (read about the tulip bulb mania here) driven by nearly limitless inflows of undemanding capital. And, just like many of the wildly overvalued stocks of the late 1990s to early 2000s, WeWork was branded as a futuristic innovator with boundless possibilities…rather than describing itself as an unprofitable office landlord that depends on unusually short leases from its tenants. In the end, the hard truth of business fundamentals eventually brought its lofty valuations down and caused a huge scandal.

Baupost also rightfully highlights how while lofty valuations present risk for investors, extended valuations alone do not predict imminent collapse. As we saw in 2019, high can still go higher. The short-term performance pressures drive investors to shun out-of-favour bargains as they fall in price, while chasing overpriced holdings that become more and more expensive.

As a value investor, that runs contrary to our belief of investing only in stocks of good companies with strong underlying business fundamentals with positive cashflows and capable leadership.

|

| Image credits |

What I plan to do

If you’re already on my Patreon, you should have seen my watchlist of what I’m eyeing at the moment – including related tourism stocks and China equities, with my picks concentrated in three key markets – Singapore, USA and Hong Kong.

I’ve already started liquidating some stock positions to conserve cash for the other opportunities I’m seeing in the market, as plummeting stock prices now throw up compelling valuations for me to enter. My cash position is now at the largest it has ever been, and I’ll be slowly firing my bullets over the next few weeks to take advantage of these low valuations.

If this is merely a short-term correction, I’m ready to be proven wrong, but at least I would have gotten in several good buys.

If this is a longer and more sustained market crash, then I’m going to try and pace out my bullets so I don’t run out of my investment war chest. But whatever it is, I will not be taking a loan to finance my investments at this time.

Of course, I might be wrong, and there’s no guarantee that COVID-19 and oil prices (updated 9 March) will really send the market crashing. For all we know, the world might recover in a few weeks time, although I’m more inclined to believe that is unlikely.

Disclaimer: This is my personal opinion on the stock markets. Nothing in this article should be taken as investment advice. Please do your own due diligence before making any investment moves.

Invest safely.

With love,

Budget Babe

1 comment

Should look into trading play of the market including the infra-day activities especially the wild swings indicative of death throes struggle. There are many ways to interpret technical trends and more than one way to determine the trend going forward at forks.

Especially when currency can be printed at will by the FED,

the volumetric justification for technical direction falls flat. Market battles are real especially involving large blocks of stocks.

Comments are closed.