How much does it cost to raise a baby in Singapore?

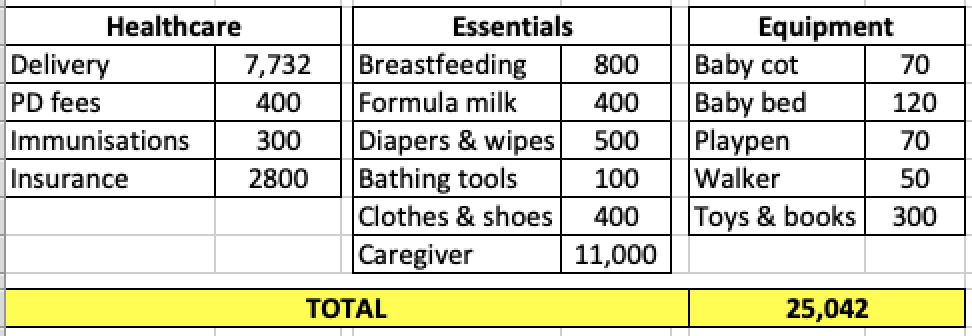

Nate turned one recently and in total, we calculated that we’ve spent $25,000 on key essentials for his first 12 months of life. Here’s how our breakdown looks like:

I’ve excluded stuff like birthday parties and holidays, because these are non-essentials that you can choose to forgo if you wanted to. The bulk of our expenses went to paying for healthcare and essentials like food, diapering, and caregiving. We hired a full-time helper to take care of our baby, and despite the cost, that finally allowed us to go back to work and focus without too much worries.

We saved considerably on baby equipment by buying almost everything secondhand, so that helped as well!

As for insurance, costs were higher this year because of the maternity insurance we bought, but we’ve since cancelled it. Moving forward, we’ve covered our baby with 3 types of insurance plans – an integrated shield plan for hospitalisation, a personal accident plan, and a multi-pay critical illness policy.

Unexpected costs

One of the major costs I did not expect was for breastfeeding, as I was told during my pregnancy days that breastfeeding is cheap because it is free, but don’t be fooled – that only holds true when you’re blessed with an abundance of breastmilk, which wasn’t the case for me. As a low-supply mummy, I ended up having to spend extra on lactation foods and supplements just to bring up my milk levels, but even then that wasn’t enough, and we still had to top up with formula milk. Luckily, after switching to NatureOne Dairy, our milk expenses went down by 50%. We also managed to save more on diapers after switching to Pee-Ka-Poo.

We didn’t plan to hire a helper initially, but boy, did I overestimate my own capabilities! Somehow I had the (misguided) impression that I’d be able to juggle taking care of a baby, go back to my corporate job, teach tuition and write on this blog without any trouble, but I was wrong. It wasn’t an easy decision to make, but in the end, we reasoned that the $11,000 spent on our helper would be worth it because we’re using that money to buy time and energy for us to earn income elsewhere, and in a sense, outsourcing so that our time can be exchanged for more money to keep the household going.

Yearly costs from now?

For next year onwards, I’m expecting our expenses to drop to about $15,000 since many of the one-time fees like delivery and breastfeeding will no longer apply anymore. However, we’re now looking into playgroups and educational/enrichment classes, so I’ll update more on those again next year.

As a rough estimate though, if our current expenditure trends continue, we will need at least S$270k to raise our baby until he reaches age 18.

If our incomes don’t increase, then we’ll have to rely on investments to pay for the rest.

How much did you spend on your baby in your first year, and what other saving tips would you use?

With love,

Budget Babe

4 comments

Hi, how do u get 2.7mil with 25k yearly spending?

Ah, that was a typo, thanks for pointing it out! I used $15k x 18 years = $270000 but accidentally saw an extra zero *facepalm*

Hello! Can I enquire why you cancelled your maternity insurance in the end and also why did you not get a Life Insurance for your child? Thanks!

because we only needed it to cover for the pregnancy period + the first few months (i.e. the non-insurability period for newborns / after first 14 days) of his life. so once we passed that mark, we no longer needed the policy.

We didn't get Life insurance because term/life insurance benefits those who are left behind in the event that the insured passes away, and since our child isn't earning income nor do we rely on him now for it, there's no need for such a policy. the returns on whole life plans are also sub-par vs. if we invested that sum on his behalf into the stock markets instead. hence we eventually bought hospitalisation, CI and personal accident plans 🙂

Comments are closed.