A viral letter about The Queen Mary has caused shares of Eagle Hospitality Trust (EHT) to plummet. Is the sell-down justified, or could this crisis present a good opportunity to buy?

When EHT’s share price crashed so much within a single day, I got all excited because hey, what if this was a fabulous opportunity to buy into a portfolio of international brand-name hotels for cheap?

The financial blogosphere is rife with everyone’s opinions on the issue right now but here’s my take, and why I bought it.

What happened?

Before I go into details, there are primarily 2 risks for potential investors to be concerned about at this stage:

- Cost of repairs needed for The Queen Mary

- If valuations for the properties in EHT’s portfolios have indeed been inflated

We gotta thank The Edge for their two pretty damning articles on EHT that started this whole sell-down. Here’s what happened:

The tale of a sinking ship?

The sell-down was triggered after an article in the Edge covered the viral letter from John Keisler (the economic development director of the City of Long Beach) to Taylor Woods (CEO of Urband Commons) alleging that the company had failed to meet its obligations to upkeep the ship, and would face the possibility of default. You can read the letter here.

Errrr but hey, this news is not new. As early as 2017, there were already reports stating that a study showed the Queen Mary needed at least $235 million in structural repairs and restorations in the next decade, due to severe corrosion and other concerns. The condition was supposedly so dire that politicians in Scotland (where The Queen Mary was built) called for an international fundraising campaign, urging Prime Minister Theresa May to put pressure on the US government to step in and save their architectural treasure. Woods said then that an expansive renovation program will result in more upgrades to the ship than what had been done in the last 30 years. As part of the 66-year lease agreement, Long Beach also agreed to pay $23 million for critical repairs.

As The Queen Mary is on a triple-net-lease basis, tenants (Urban Commons) are therefore responsible for the maintenance, property tax and insurance but the liability of structural works and capital expenditure is still the liability of the owners (Long Beach City).

EHT has since responded by saying neither itself nor Urban Commons is in default of lease on The Queen Mary, and the City of Long Beach has also confirmed this. Moreover, Urban Commons estimates that the repair works to be done within the next 2 years will cost US$7 million.

It is also worth mentioning that EHT is also working with the City of Long Beach to establish the Historical Preservation Capital Improvement Plan (HPCIP), funded by passenger fees collected from Carnival Cruise Line Terminal. The tenant, Urban Commons, has also committed 2% – 3% of revenue to the Capital Improvement Fund (CIF). Both fund reserves are expected to support the capital expenditure of US$4.5 million a year for repairs and maintenance of The Queen Mary.

So will the repairs cost $7 million or $235 million?

Assuming that the findings of the Marine Survey is true, Urban Commons would have forked out a total of US$429 million (purchase price + repairs) for a 66-year lease on a decommissioned ocean liner. According to Eagle Hospitality Trust’s prospectus, it was revealed that The Queen Mary generated Gross Operating Profits of US$7.1 mil, US$6.5 mil, and US$11.2 mil in Years 2016, 2017 and 2018 respectively. It would take many years (almost 2/3 into the leasehold tenure) to even reach payback. The IRR for such a project would be so poor that it is hard to fathom the Board/Investment Committee ever approving such an investment. Moreover, Heartland Boy found it odd/not very plausible that a survey conducted in Jan 2017 could retrospectively form the basis of a sale of lease agreement executed in Apr 2016. This goes back to the point that any competent management would not have recommended/signed off on an investment when the cost of repairs, which the purchaser is obligated to co-pay, remains an unknown entity.

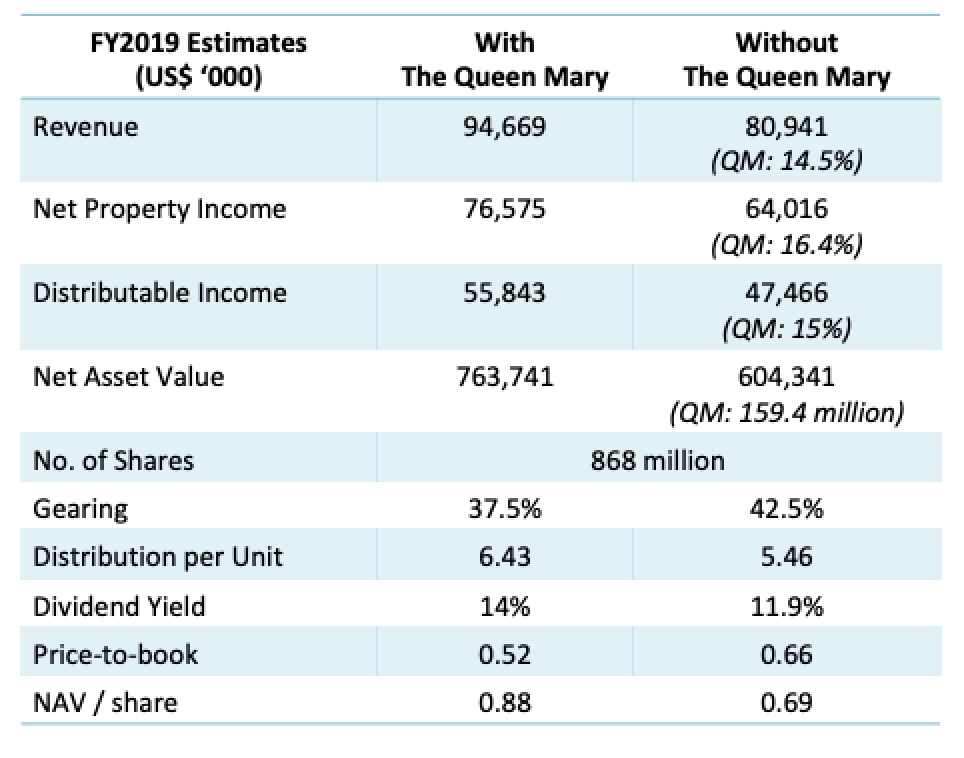

How would EHT look like if we were to completely take out The Queen Mary?

In the worst-case scenario, let’s assume that The Queen Mary has to be completely written off, while EHT retains the debt on its books. Do note that the ship:

- is forecasted to contribute 14.5% to total portfolio Revenue

- is forecasted to contribute 16.4% to Net Property Income

|

| Figures annualized, and valuations are for the current share price of US$0.46. |

Gearing will increase significantly from 37.5% to 42.5% if so, but still under the regulatory limit of 45%. What this means is that EHT should not be forced to liquidate its assets or issue new shares to raise funds in the near term.

Since EHT’s dividend policy is 100% of distributable income till the end of FY2020, this means that at the current share price of 56 (US) cents, it represents a sizeable 11.9% yield even if EHT is forced to write off The Queen Mary.

That’s a pretty big temptation.

But now comes the second risk,

Are the properties in EHT’s portfolio massively overvalued?

The Edge ran another article earlier this week that highlighted several beneficial relationships, and the valuation figures used at different stages of the property ownership:

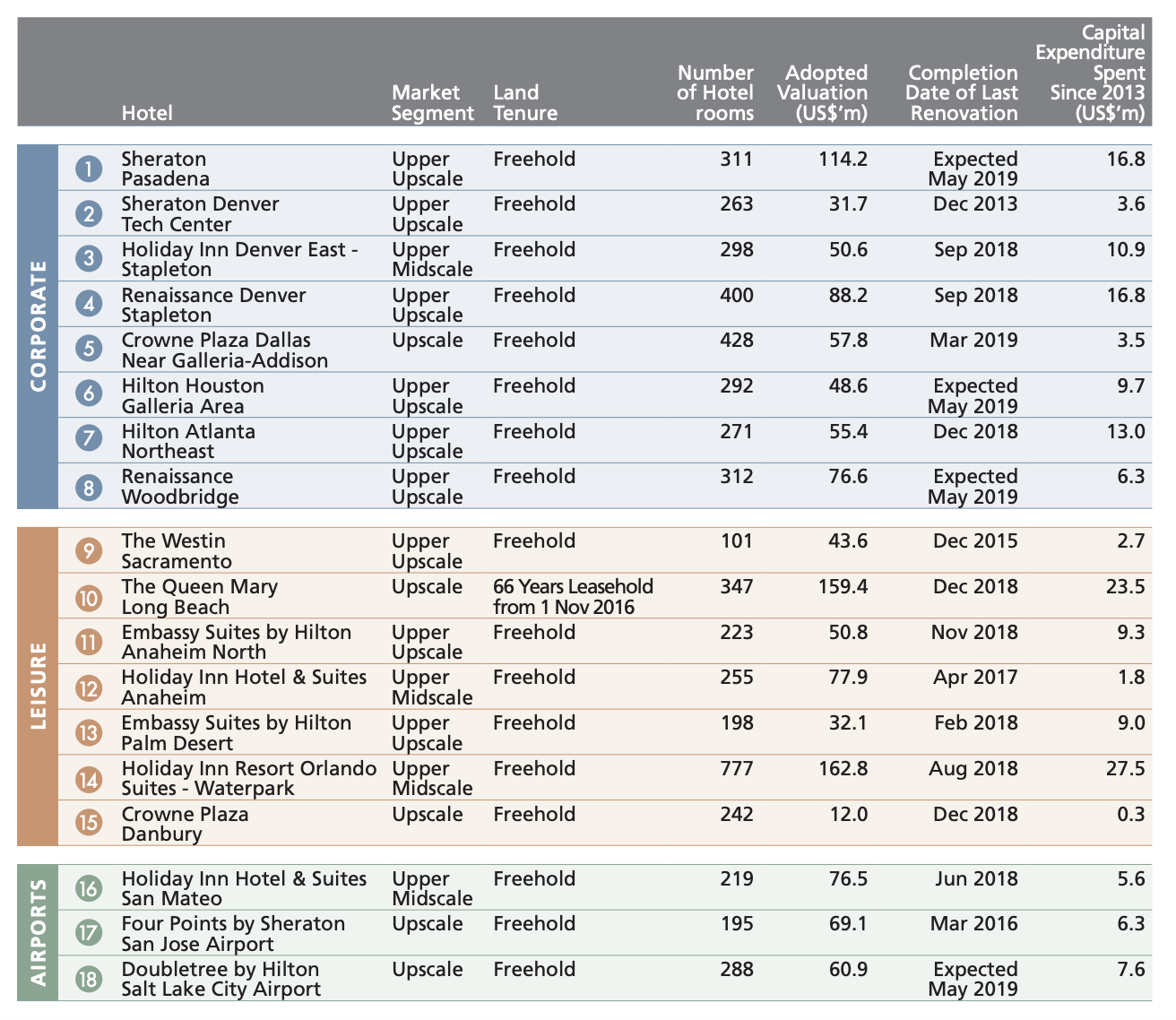

- Crowne Plaza Dallas was purchased by ASAP International Holdings for US$27.6 million, then sold to EHT for US$50.7 million. The valuation adopted in the REIT is US$57.8 million.

- ASAP acquired Renaissance Woodbridge for US$30 million, then sold to ETH for US$67.1 million. The valuation adopted in the REIT is US$76.6 million.

- ASAP acquired Doubletree by Hilton Salt Lake City for US$31.38 million, then sold into ETH at US$53.4 million. The valuation in the REIT is US$60.9 million.

It raises the question as to whether there was some sort of financial engineering going on to make the books look more attractive to investors. But while we do not have that level of visibility, I can’t imagine that DBS (the REIT’s Trustee) could have failed so spectacularly by not do their due diligence on this prior to the listing.

Fun fact: The owners of ASAP Holdings (the Yuan family) also happen to be very sizeable shareholders in EHT, and who have been reducing their stake recently. Hmm.

So is the marketing overreacting, or is the sell-down justified?

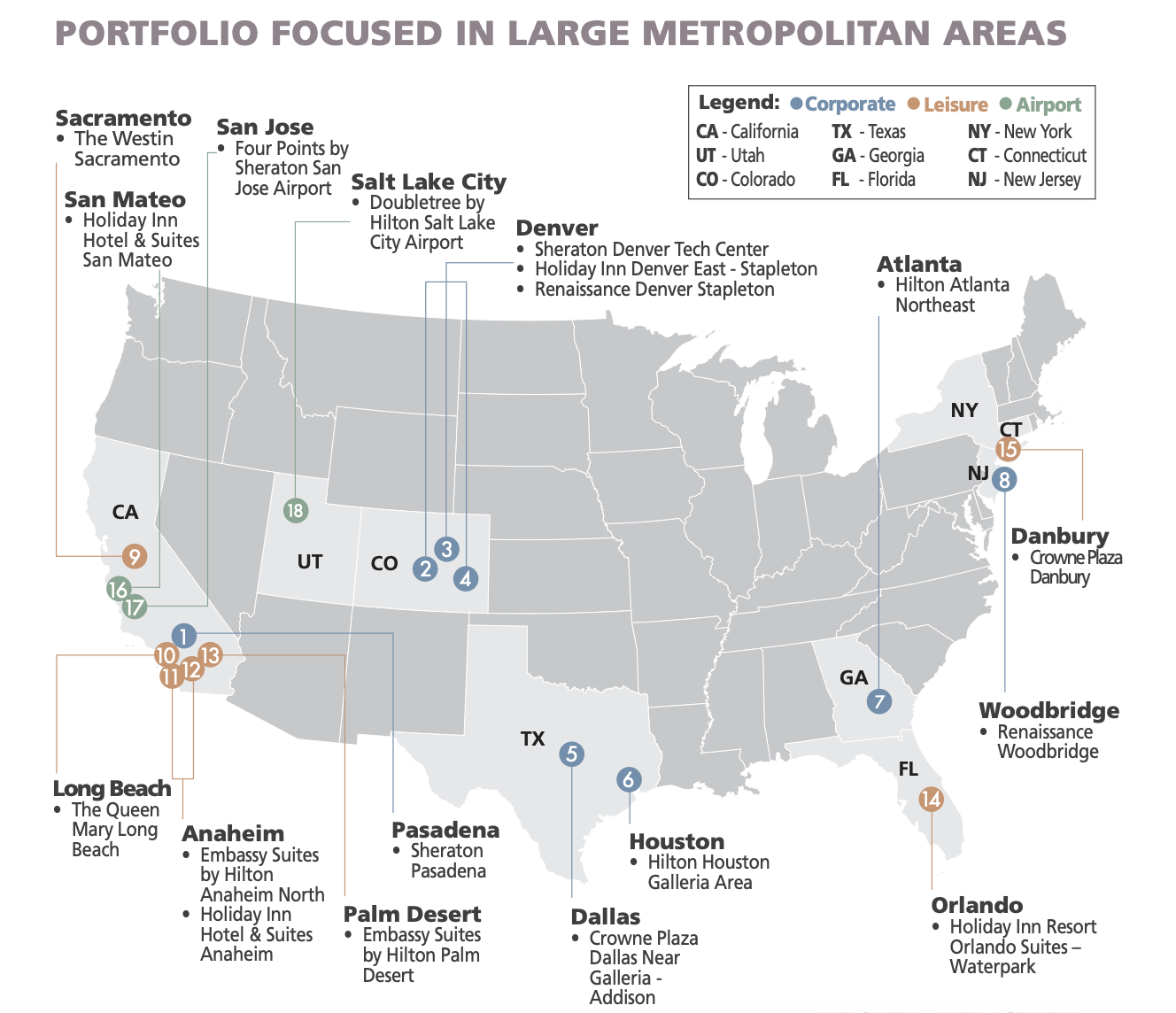

At this stage, no one knows for sure. My guess is as good as yours, but I see this crisis as an opportunity to buy into a portfolio of US hotels for cheap. I mean, just take a look at what else you’re getting:

I ignored EHT at IPO because I wasn’t quite interested, but situations like this always get me excited enough to take a second look. And from the way I see it, even if EHT has to write off The Queen Mary, the numbers still look decent and offer a juicy yield of 11.4% for investors who are willing to take the risk. After all, as the saying goes, fortune favours the brave (lol).

For investors who have the risk appetite for this sort of events, there might just be a potential for both capital gains and a decent dividend yield.

But if you belong to the camp who feel the lack of confidence in the Sponsor is warranted given what has been revealed recently by The Edge, then perhaps it might be better for you to sit this one out. Anyway, the results are out on 13 November so you could always adopt a wait-and-see approach before deciding.

By then, the ship might have already sailed.

Or not. (okay that was a bad joke :P)

With love,

Budget Babe