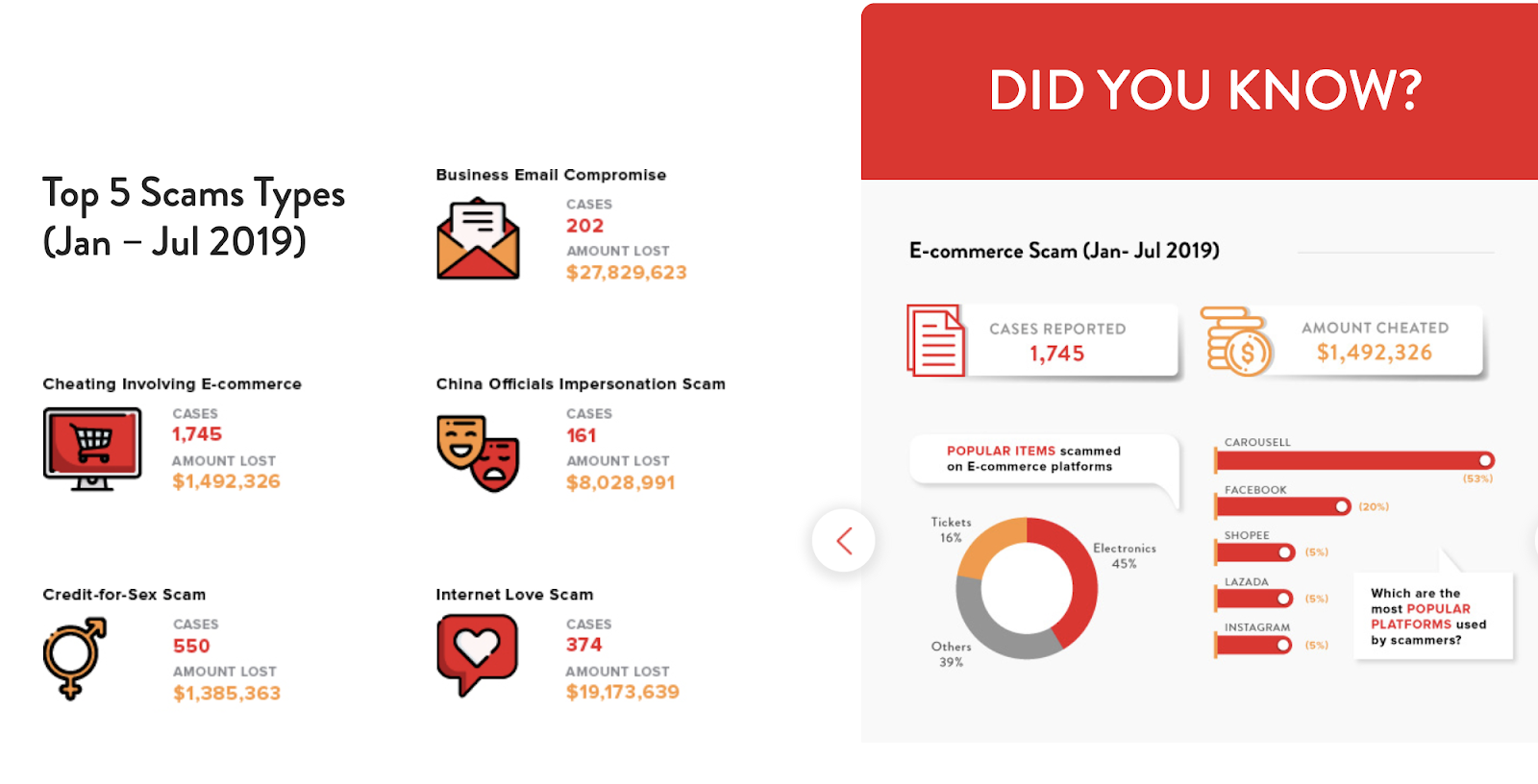

In the first 7 months of 2019 alone, more than 57 million dollars was scammed from unsuspecting victims.

These sobering statistics are according to the National Crime Prevention Council (NCPC). With scammers becoming savvier these days and constantly changing their tactics to appear increasingly legitimate, it isn’t surprising that more people are falling prey to these schemes and losing their hard-earned money.

|

| Source credits: ScamAlert |

Read: The number of loan scams more than doubled to 692 cases and losses of $2.2 million in the first half of 2019, and the number of e-commerce scams climbed to 1,435 and a total of $1.2 million cheated from unsuspecting victims. 128 suspects are currently being investigated by the police after an islandwide operation conducted the week before.

We’ve seen so many scams in recent years that it is getting hard to keep track. Some notable examples include the DHL scam, the customs police scam, the DBS phishing scam, the SingPost parcel scam, the Sheng Siong lucky draw scam, etc. If you wish to protect yourself from becoming their next victim, your only defence is to become better at spotting them.

Aside from Scam Alerts, several websites I would recommend to keep up with for the latest scam alerts would be financial blogs and the MAS Investor Alert List – the former typically investigates and uncovers financial and investment scams, whereas the latter alerts you to scam that have already been flagged out by multiple victims.

Scams typically have several characteristics in common. Some areas I would encourage you to investigate and check would be:

- Who’s the mastermind? (common for MLM, pyramid and ponzi schemes)

- Is there a main individual, or a group of individuals (usually the founders) benefiting from your money?

- If you need to make any payments (or invest a sum of money), can you verify the identity of the person to whom you’re transferring to? (I would typically ask for a copy of their passport or other forms of identity documents, including their address.)

- How much are they asking from you? Is the investment amount low, but returns are sky high with minimal effort? Beware!

- How is the money being transferred or paid out? Be careful of anything using cash (which does not leave a banking trail that could lead to the recipient being traced)

- Are you being asked to refer your friends or recruit any downlines? How many?

- Pyramid and ponzi schemes, as well as MLMs, typically require you to recruit many downlines, and the more the better

- Pyramid and ponzi schemes, as well as MLMs, typically require you to recruit many downlines, and the more the better

- Is there a black-and-white contract? (Even if there is, note that it doesn’t mean it isn’t a scam – see previous cases in Singapore where contracts with signatures and company stamps were issued but meant nothing once the founder ran away or the company shut down)

- Is a company involved? If so, check the background of the company i.e. who are its founders, how much share capital it started out with, when was it incorporated, is it licensed by MAS to provide financial services, etc.

- Who’s the ultimate winner or beneficiary if you participate in the get-rich-quick scheme?

Learn to spot a scam, and you’re less inclined to end up a victim.

One thing is for sure: scammers will constantly change their tactics and get harder to catch, but as long as you know how to critically assess whether something is legitimate or a scam in disguise, that’ll be your best line of defence.

Stay safe.

With love,

Budget Babe

2 comments

awesome

For more information how to get more money, check this page : http://www.themarketingblog.co.uk/2019/08/best-content-marketing-tools-to-develop-and-promote-your-website/. I so hope that this page will help you.

Comments are closed.