If you wish to achieve financial independence, you need to plan and consistently ensure you’re on track to meeting your goals.

For anyone looking for a framework, I’ve repeatedly emphasized that the route involves:

1. Cutting your expenses

2. Setting up your emergency fund

3. Growing your savings

4. Protecting your assets

5. Invest to further grow your capital and build passive income

To promote this message and culture of planning for financial independence (because we all know that inflation and the high cost of living in Singapore sucks), I’ve been working quite closely with DBS Bank to speak at their classes for NAV – Your Financial GPS, held in Tanjong Pagar at their NAV Hub.

I’ve have also encouraged many of you to go for the free financial analysis and consultation sessions which they offer where there is zero product pushing or hard-selling. This is important, because if you’re unlucky enough to work with a financial advisor who has a vested interest in their own commissions, you could very well end up with “recommendations” that serve to line their pockets instead of really fulfilling your needs at the best value.

Getting such a personalized session to help you understand your current financial health (awareness is always the first step to change), getting financial tips and attending financial planning classes at NAV Hub are just some of the reasons why I’ve been supporting the intiative and sharing my experience at some of their classes.

But time is always a valuable resource, so even if you haven’t yet had the chance to go down to Tanjong Pagar for a consultation, don’t fret! DBS has now gone one step further to launch Your Financial GPS in order to deliver a digital financial advisor straight to your fingertips. Yes, or those of you who might have attended the NAV sessions before, you’ll recognise this as an extension of their their existing “NAV – Your Financial GPS” intiative.

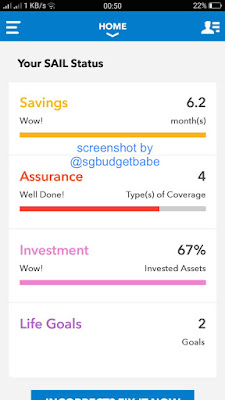

This operates on a SAIL concept – Saving, Assurance, Invest and Life Goals – which is pretty much in line with what I’ve always been preaching. If you’re an existing DBS or POSB customer, you probably want to log into your digibank app and check out this newly-launched feature for yourself.

Features & Benefits

Your Financial GPS relies on a combination of user data and behavioural activity to offer you personalised and tailored suggestions.

This digital financial advisor is integrated into your banking transactions, which allows it to provide an analysis of your activities, including:

– automatically categorising your income and expenses (I like that you can create custom categories as well)

– provide an overview of your set budgets

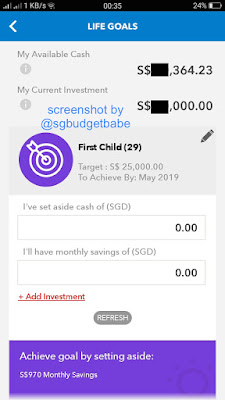

– tracking your status against long-term financial life goals (that you’ve set)

If your transactions are through DBS, it will be categorised automatically for you (based on merchant codes and transaction descriptions, in case you were wondering about the “how”). You can also create additional customisation fields, add in non-DBS transactions and input them accordingly if you wish to use this as your main expense tracker from now.

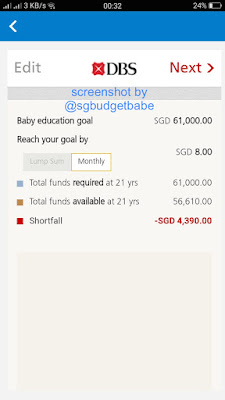

It also makes some recommendations (which you might otherwise not have thought of!). For instance, want to set up a long-term goal to save for your baby’s university fees but unsure of how much is enough? Your Financial GPS will propose an ideal savings amount that you can consider and also offer some tips on small, actionable steps that you can take to achieve this goal. Or, if you’re saving for a wedding, you’ll be fed with tips on how to save money while planning for your big day!

And for those of you who have been looking for a community to support and accompany you on your financial growth journey, DBS will be launching YourNAV Community forum next month, where you’ll be able to ask questions online and get answers or tips related to financial planning. If you’re a “YourNAVer” member, you can also look forward to getting access to exclusive members-only events, classes, games and contests.

Disclaimer: I’ve been speaking at NAV Hub for multiple events so far, so this article is naturally written in collaboration with DBS to share their latest initiative with you guys. All opinions are of my own. Screenshots involve cursory numbers and are not meant to be taken as an accurate representation of my current financial status, which loyal readers should be able to recognise.

1 comment

You are really getting the complete package when you have a wedding at wedding venues here: a unique space, with an incredible view; and amazing food from start to finish. The best decision one can made is to book this place.

Comments are closed.