There’s been a lot of sponsored ads popping up on my Facebook recently, each claiming how to teach you to buy your first Bitcoin.

All of those ads were mainly promoting CFDs (contracts for differences), which basically allows you to speculate on the rise or fall in prices of Bitcoin. For those who are new to CFDs, you are basically buying a contract between yourself and the CFD provider, and NOT the underlying asset. In other words, you’re not buying the actual Bitcoin(s) and neither do you own it.

I won’t name and shame the companies here, but their tactics are similar:

- – Talk about how some young Singaporean investor became a millionaire by investing in Bitcoin and tell you to “learn how he did it here!”

- – Highlight how you could have been rich by now if you had invested in Bitcoin earlier this year

- – Tell you to either go for their paid course / sign up on their platform to start buying before you miss out

None of them actually tell you how to buy and own your own Bitcoin, but I will. If you’re a beginner, head over here for a legitimate step-by-step guide where the Bitcoins you buy is yours and entirely yours for keeps.

In a recent (private) readers’ meet-up held on 1 Dec, someone asked me if I was buying any alts other than Bitcoins, and I mentioned that I was buying heavily into Litecoin on Coinbase. Here’s how both currencies performed since:

| 1-Dec | 18-Dec | % gain | |

| Bitcoin | $11,000.00 | $19,500.00 | 77% |

| Litecoin | $99.00 | $321.00 | 224% |

(Disclaimer: I invested in Bitcoin and Litecoin much earlier on, prior to the meet-up)

If you’ve already bought the big 3 – Bitcoin, Ethereum, Litecoin – and you’re looking at buying other types of cryptocurrencies (termed as “alts”, short for alternative coins), there are a few cryptocurrency exchanges (similar to stock exchanges) that will allow you to do that.

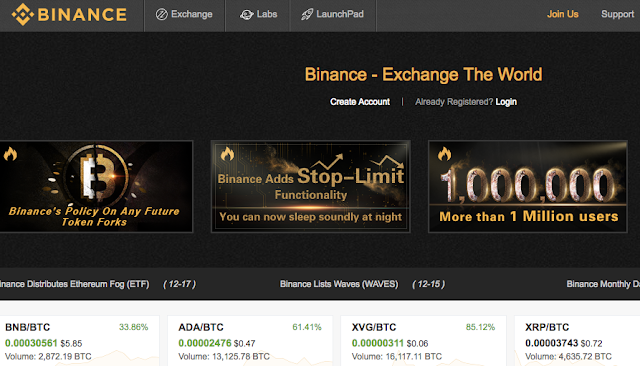

Binance

My top exchange of choice now is Binance, which is also now the #1 cryptocurrency exchange in the world. They’re registered in Hong Kong (a key financial hub in Asia, aside from Singapore) and support many of the alts available for trading.

You can sign up for a secure account on Binance here.

Note: I previously used Bittrex, but I won’t recommend them because my account has been pending verification for months and there’s still no word on when verifications will finally be complete. This is a huge problem, because as an unverified user, you can only deposit funds and buy, but you’re not allowed to withdraw / cash out at all!

If you’re interested on the problems plaguing Bittrex, you can have a look at this article here.

HitBTC

Another exchange I use is HitBTC, although I’m not a complete fan because HitBTC got hacked in early 2015 where coins were stolen. However, they do have a wide variety of trading pairs as well so it is generally easy to find alts that you wish to buy.

I’m lost! How exactly do I buy alts?

As most of the exchanges don’t accept direct cash to alts, you’ll have to first convert your cash into either BTC or ETH, and then send them over to the exchange where you can buy alts.

Step 1: Buy Bitcoin / Ethereum on Coinbase or Gemini.

I use both, but would recommend Coinbase as it is the most secure and offers instant purchases. Using the SCB Singpost credit card gave us 7% cashback, which offsets Coinbase’s fees, but the card’s T&Cs has changed since. Gemini, on the other hand, requires you to wire transfer USD into their overseas bank, and takes 2 – 5 days to clear your deposits before your funds appear on your account and are available for trading. Thanks to Gemini’s inefficiency, I’ve missed out on many opportunities to buy at a low in the past weeks, so I still prefer Coinbase when I need to purchase BTC / ETH immediately so I can buy my alts.

Step 2: Send your Bitcoin / Ethereum to your exchange wallet

Step 3: Once your coins are received on the exchange, you can now use them to buy alts

For security reasons, do not leave your coins on the exchange(s) where they can get hacked or stolen. As such, I would recommend getting a hardware wallet such as a Trezor or Ledger Nano S to store your coins securely.

I’ll write about how to buy and set up your hardware wallet shortly, but if you’re in a hurry to get one, you can buy them from an authorized distributor here and enter promo code “SGBUDGETBABE” for a freebie 🙂

With love,

Dawn

5 comments

Ahh. I see the nice returns you've got there 🙂

This comment has been removed by the author.

Hello my fellow crypto friend! haha my returns are more but I don't wanna post here in case people FOMO.

Hi Budget Babe, I have a few questions on binance, not sure if you are able to help

1) actually we can avoid being verified successfully if we withdraw just 2BTC.

2) how do we actually deposit BTC from exchanges such as gemini to binance?

3) notice withdrawal requires 0.001 BTC (seems to be regardless of amt). Sounds like if we want to trade xrp, we need to deposit BTC to binance then buy using XRP/BTC. Then when selling, we need to use BTC/ XRP and then withdraw XRP to gemini to cash out?

Thank you.

Hello!

1) not if your basic verification had issues. Bittrex claimed mine "didn't match public records". apparently they seem to have an issue with Asian names because a lot of others are experienced in the same, if you check out social media. failed basic verification = have to do enhanced = cannot withdraw a single cent until they verify you.

2) Transfer from your exchange wallet into binance wallet

3) all correct except the last part. once you sell your XRP to BTC, you go back to your exchange to sell BTC, and then cash out.

….but why cash out? 😛

Comments are closed.