Although we’ve yet to apply for our BTO, I’ve been asked to share my plans and financial calculations, so here goes! Hopefully this will help those of you who need a guide on how to plan your finances for your housing needs.

I previously wroteabout waiting for the February 2017 BTO launch, but unfortunately neither Bukit Batok nor Sengkang appealed to my fiancé and I as we prefer to stay within 20 minutes of our parents. Nonetheless, HDB conducts a BTO exercise every quarter with projects in different towns, so we’re now waiting for the May 2017 launch instead!

What type of housing should we get?

The first thing we did was to discuss what housing options we should go for. Some people see their first house as an investment, but I don’t. To me, as long as it is a house I’m staying in, it qualifies more as a home rather than an investment asset.

My fiancé had initially wanted to go for a condo or an EC as he perceived such homes as symbols of one’s status. However, we finally agreed to start with a BTO flat, which is definitely the most logical and financially-sound option for us.

We decided to go for a 4-room flat, which comes with 3 bedrooms (same as 5-room flats) since his parents will be staying with us. The size will be just nice to accommodate us, his parents and our future kids along the way! Of course, it is always tempting to buy a bigger house closer to town, but that would also mean we’ll have to spend more money upfront. We prefer to go for a size that suits our budget while saving the money for other things that are more important to us instead.

How much money do we need?

After deciding on the type of flat we will be getting, we immediately checked how much grants we would be able to qualify for. This would help us in calculating the amount of downpayment we need to come up with and the mortgage loan we could afford.

Aside from housing grants to subsidize our purchase, the amount and type of loan we go for will also determine how much we have to pay.

How much can we get in housing grants?

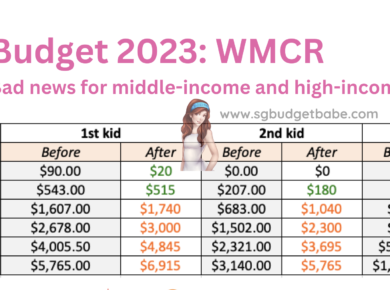

If you and your spouse earn a combined household income of not more than $8,500 and buy up to a 4-room BTO flat in a non-mature estate, you will be eligible for up to $40,000 under the Special CPF Housing Grant (SHG). If your income is not more than $5,000, you can also qualify for up to $40,000 more, under the Additional CPF Housing Grant (AHG).

Source: HDB

Example:

To illustrate, let’s consider a pair of fresh university graduates (Jack & Jill) who are in their second year of work. Jill is a junior designer who earns $1,800 each month, whereas Jack, who works as a HR executive, had a pay raise 2 months ago from $2,500 to $3,000 as he got promoted to a senior executive. Jack’s average monthly income for the last 12 months works out to be $2,583*. Their combined income of $4,383 makes them eligible for $10,000 of AHG and $40,000 of SHG, or a total of $50,000 in grants.

*($2,500 x 10 months) + ($3,000 x 2 months) = $31,000

$31,000 / 12 months = $2,583.33

This is why I feel young couples should apply for their BTO early once they’re ready, so that you can maximise the amount of grants you qualify for! However, note that when you sell off your flat, you’ll have to put the grant amount plus accrued interest back into your CPF accounts.

On hindsight, I wish we had applied for our BTO much earlier before both of us got our recent pay raise. Based on our previous income, we would have qualified for $10,000 of the Additional Housing Grant (AHG), but after the recent pay raise, our income bracket no longer entitles us to this benefit. But we may still be able to get $20,000 in the Special Housing Grant (SHG) if all goes according to plan.

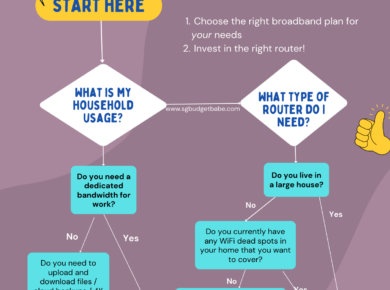

What type of housing loan should we go for?

|

| Credits: www.moneysmart.sg |

HDB Loan

We’re eligible for an HDB loan since our total monthly income is under $12,000. We liked the fixed interest rate on a HDB loan (which means that there won’t be any surprise interest hikes anytime soon) allowing us to plan for future mortgage repayments consistently. Of course, since the HDB loan interest is pegged to prevailing CPF-OA interest rates with a margin of 0.1%, there is still the possibility for it to change, but it is definitely much less volatile than a bank loan. We can also retain the option to opt to refinance to a bank loan later on.

The downpayment is 10%, which we can pay using either our CPF or cash savings. If your finances are tight, you can also opt to pay 5% first when you apply for the BTO and the remaining 5% later once your BTO is ready for you to move in. Last but not least, you have the option to pay off more of your loan at any time, with no extra fees and penalty.

Bank Loan

On the other hand, bank loans can sometimes offer a more attractive interest rate for the initial few years (especially when you refinance your loan), but we were concerned about the possibility of a rising interest rate environment in the future. Furthermore, taking a bank loan for a period of 25 years will require us to make a downpayment of 20%, of which the first 5% has to come strictly from cash. There’s also the early repayment penalty of 1.5% to 1.75% of our loan to consider.

Since a maximum of 30% of our combined income can be used to pay for our housing loan, our top priority was not to find the biggest flat, but a flat that we could reasonably afford to pay the monthly mortgage without stretching our finances too thin.

Planning our finances to pay for the flat

Buying our flat isn’t the end of the journey – there’s still renovation to take care of, and we’ve estimated that we will spend between $25,000 and $40,000.

After these big payments have been settled, we’ll still need to ensure that we have enough money to comfortably pay our housing-related bills each month as well. These include:

– Housing loan instalments

– Fire insurance

– Mortgage-reducing term insurance (note that you’ll have to be insured under the Home Protection Scheme if you’re using your CPF savings to pay your monthly housing loan instalments on your HDB flat)

– Conservancy fees

– Property taxes

– Utilities bill

Since many of these ongoing expenses cannot be paid for using our CPF savings, we will need to make sure our income can sustain the payments without having to borrow.

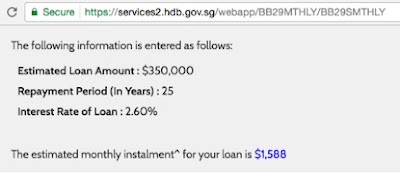

Calculating our repayment plan (how much can we expect to pay monthly?)

Factoring the above-mentioned expenses in, we expect to pay no more than $2,000 a month (or $1,000 each). While I’ll ideally like the figure to be lower, this is frankly quite manageable for us (even if either of us takes a break at work, my emergency savings should be able to sustain us for a few months at least).

We’re more interested in the May 2017 BTO launch, so we’ll probably revisit this again when we finally find a suitable location. Till then, I hope you’ll find my guide useful!

This post is sponsored by the Ministry of National Development (MND), who asked me to share my housing financial plans publicly to help other young couples who may be in a similar situation. All opinions stated here are that of my own.

6 comments

This comment has been removed by a blog administrator.

Healthy skin is the scope of practices that bolster skin respectability including nourishment, shirking of unnecessary sun presentation, and suitable utilization of emollients; that upgrade appearance, for example, utilization of beautifying agents, botulinum, shedding, fillers, laser reemerging, microdermabrasion, peels, retinol treatment; and that remediate skin separate and ease skin conditions.

Buying Essential Oils

Hi sgbudgetbabe, are you more of the idea of paying off the HDB loan as soon as possible (pay more per month to shorten repayment period), or dragging it out as long as possible?

Also, do you know if we can repay the grant amount "back to CPF" to reduce the interest incurred, in case we sell our HDB in the future?

Thanks in advance for your help! My bf and I having different schools of thought now and your answer would help us immensely!

CamilkDairy: Our main goal is to achieve those wellbeing cognizant individuals who request more beneficial, and prevalent quality Camel Milk and by items.

Source https://www.camilkdairy.com/collections/all

Get Instantly Cleansed And Polished With Aqua Peel.Sensitive skin is hard to cleanse using off-the-shelf cleansers and masks. Sensitivity makes it very uncomfortable to do manual extractions of comedones and impurities.

https://www.nourifbc.com/best-facial-in-singapore

If you are looking for a cheap and good prenatal body treatment in Singapore, you're not going to find it. The good ones are never cheap!

Prenatal massage Singapore

Comments are closed.