|

|

Singapore’s new digital insurer. I’ve never seen an insurance website like this before.

|

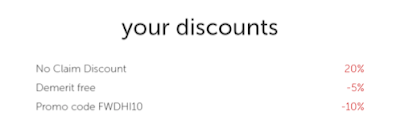

A new insurer has landed in town, and there are a few benefits they’re providing which I think are a real game-changer. Beyond the new digital buying experience, you might also want to take note that FWD Insurance is now offering car owners in Singapore protection of your 50% No Claims Discount (NCD) for life.

Car insurance is mandatory in Singapore for those who own a car, so it is an expense we can’t really avoid. To encourage safe driving, you get 10% NCD every year if you do not get into any accident, with the maximum discount capped at 50%.

Unfortunately, sometimes accidents do happen, and some drivers lose their NCD even if they aren’t always the one at fault. This explains why some drivers choose not to claim from their car insurance even in accident, as the cost of repairs may sometimes be less than the NCD if they do not claim.

|

Current No Claim Discount

|

Reduced No Claim Discount

|

|

|

1 Claim Made

|

> 2 Claims Made

|

|

|

50%

|

20%

|

0%

|

|

40%

|

10%

|

0%

|

|

30-10%

|

0%

|

0%

|

But in life, accidents sometimes do happen. When it does, it gets frustrating that your insurer punishes you for it (by reducing your NCD), regardless of how many years you’ve spent accident-free.

Well, we don’t have to put up with this anymore.

You can now enjoy lifetime 50% NCD on FWD Insurance Singapore, regardless of how many accidents you get into.

In case you’re worried about losing your 50% NCD when you switch to FWD, this benefit will be protected for life, even if you have multiple accidents in the same year! They are the first insurer to offer this, and I’m now waiting for the other insurers to follow suit.

—-

The other product FWD Insurance currently has available on their Singapore website is travel insurance. To shake up the market, another first they’re introducing in Singapore is that you can now submit claims for travel and baggage delays directly via WhatsApp.

I remember a few years ago when I was stuck at the Seattle airport. My flight to LA was delayed for 8 hours, and I was irritated with losing so much precious time for nothing. I initially wanted to claim compensation from my travel insurance, but when I checked out the procedures online on what I needed to do…I gave up.

It was wayyyyyytoo complicated – they needed an official letter from the airline stating the cause and duration of the delay, copies of my flight tickets and itineraries, and more.

In the end I figured the amount wouldn’t be worth my time anyway, and dropped the idea.

Thankfully, FWD Insurance Singapore has simplified the process – all I need to do now is to WhatsApp them a picture of my boarding pass and the travel delay board announcement.

That’s it! Given how ingrained WhatsApp is in our everyday lives, it makes you wonder why no other insurer has thought of this idea before.

—

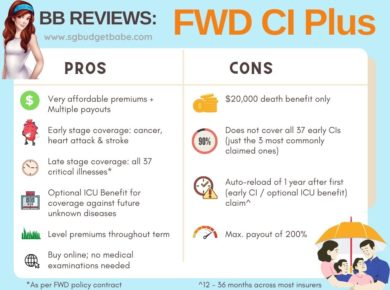

Only term life, car, and travel insurance are being offered at the moment, but FWD Insurance Singapore has plans to add more shortly.

I’m most excited to see their other offerings when they launch, but in the meantime, here’s what I’ve seen so far:

A fuss-free way to buy insurance directly online.

If you’re a regular reader, you probably already know how much I believe and advocate in the importance of insurance. What I don’t like, however, is the buying process.

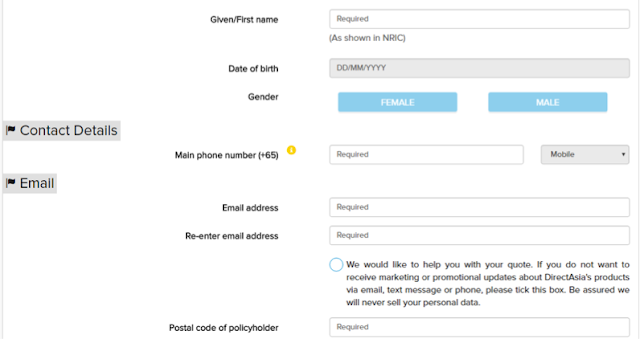

Aside from preferring to skip the agent (most of whom try to upsell me something I’m not keen on), even buying insurance online is unnecessarily long and complex. I also hate the fact that I have to provide SO MUCH PERSONAL DATA when all I want is a simple quote.

I really like MAS’ DPI scheme, but it is only limited to life insurance policies at the moment. It is about time that the insurance industry reinvents itself and really start catering to our tech-savvy generation.

I got my car insurance quote from FWD in under a minute. No personal data was required.

No more lengthy, intrusive forms to fill up anymore! I literally got the information I needed within a few seconds.

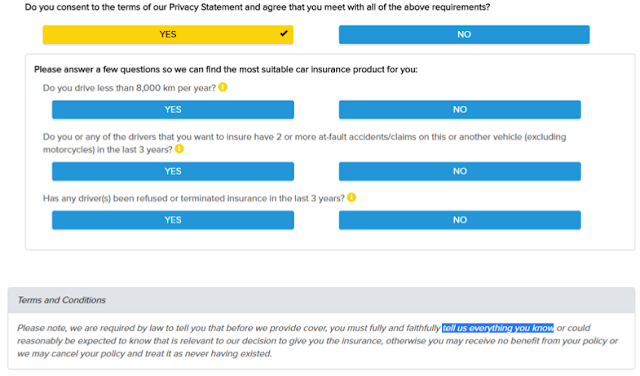

Compare that to this other direct purchase website I used:

SO MANY redundant questions! Can you imagine filling this up on your mobile phone? I would probably just throw my phone at the wall before I’m even halfway through.

Why is it necessary for me to provide my full name, NRIC, mobile and email address when I’m only looking around to get an idea how much prices will be?

I was trying to get an idea of the price just so I could compare to FWD’s, but in the end I gave up after wasting 10 minutes on this form on my tiny mobile screen (am writing this from the airport now).

You get the idea. Although many of our current insurers have gone digital, they have simply placed the same (super lengthy) forms online which we used to fill up manually in the presence of an agent. FWD Insurance Singapore has simplified this whole process into a web app where I can get a quote for car insurance in under 60 seconds and travel insurance in 10 seconds. This is the fastest in SG today and I’m waiting for the rest of the insurance industry to play catch up.

TLDR Summary:

FWD Insurance Singapore is the first insurer to offer a fully mobile quote, purchase and claims services. Everything can be done online.

They’ve introduced 2 new elements which are unheard of in Singapore – a lifetime benefit of 50% NCD for car insurance, and allowing consumers to make travel claims via WhatsApp.

In case you’ve never heard of FWD, they’re a huge insurance brand in other parts of Asia – my Hong Kong colleagues, for instance, are familiar with them. They serve over 1 million customers in Asia and have S$500 million in backing for the Singapore market, which is good news for us.

You already read about how much I loved Singapore’s first digital telco previously, and I’m equally pleased that we now have a digital insurer.

I’m glad that I no longer need to put up with an agent if all I want is to buy direct, fast and without too many questions asked. I don’t even need to give them my personal data until I’ve decided to buy.

With all the disruptions in FinTech, it is about time for the insurance industry to undergo some changes as well. Are the rest listening?

(Disclaimer: This post is brought to you in collaboration with FWD Insurance Singapore. I never promote anything I do not personally believe in, and I had reviewed their offerings before agreeing to this partnership. All content and opinions are 100% that of my own. I do not get any monetary benefits or referral commissions if you choose to purchase any policies from them.)