At the core of your discussions for a future together, experts recommend that financial considerations should be at the heart of everything you do. If you’ve not discussed these things with your partner yet, here are some questions to get you started:

1. How will we manage our money in the future?

If you don’t already have a system planned, here are some common strategies you can tweak:

|

| Credits here. |

The “let’s share everything” method – for couples who have very similar spending styles and saving goals (how rare is this?!), you can consider combining all your income and expenses into a single account. That way, both parties will always know how much is coming in and how much is going out.

The “pocket money” method – for couples who wish to share their savings and limit their expenses, but yet have individual control over what they each spend on. Open a joint account combining your savings and monthly income, and withdraw an equal amount for each person every month to spend as they wish. Any excess can be channeled either back to the joint account, or a separate individual savings account (especially if one spouse is delaying spending for a bigger-ticket item).

Another factor to consider when you’re working out future monetary arrangements also includes the element of debt. Asking your partner about how much debt they have might be perhaps the toughest question, but it is also the most important. You don’t just marry your partner; you also marry their debts and financial obligations, which will affect your own financial status. Thankfully, my boyfriend and I have no outstanding debt, but for most young couples, their student loans will probably be the most pertinent. If you’re looking for a guide on how to pay off your TFL as soon as possible, check out these tips.

Work out a debt repayment plan before you start discussing about saving for other bigger-ticket items like your wedding, honeymoon or house.

2. How much should we have in our emergency fund?

Work Building up a shared emergency fund should be a priority of all couples, because there are simply too many possible scenarios that could crop up and derail your financial goals. Read more about emergency funds here.

Open a joint account and decide how much cash you wish to deposit as emergency funds. You can project this by taking your monthly household expenses (include your housing loan) and multiplying this over a duration of 3 – 12 months. For a start, I personally believe $20,000 is a good number to work with.

Most banks allow you to dictate conditional fund withdrawals, so set it up such that the signatures / approval of both parties are required before the money can be taken out of the account.

3. Are we ready for the next big (financial) step?

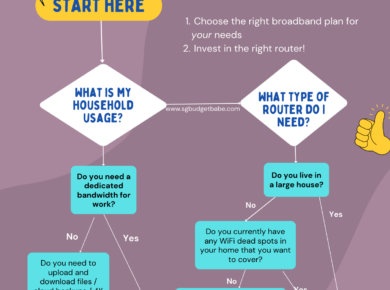

(i) What type of house should we buy?

One mistake many newlyweds make is to buy their dream house as their first home. Often, this ends up being a house they cannot afford (especially for those who are hankering after condos or large HDB flats).

Rethink your romanticism and adopt a more practical stance instead. It pays to be prudent with your first home as it is a long-term financial commitment. Avoid buying a bigger house on the assumption that your income will increase in the future – what happens then if you don’t get a pay raise? Ensure that you will always have enough to pay for your monthly housing instalments before you commit.

I used the Our First Home calculator provided by CPF to estimate what housing prices we could afford to go for before we decided on gunning for a 3-room HDB flat, as our combined income now is under $6,000 every month. Some people may find this small, but we would rather buy a house that we can afford now without breaking our backs, and upgrade in the future instead when our earning powers have increased.

After all, a dream home is not necessarily equivalent to a big house.

(ii) How much are we willing to spend on our wedding?

The average wedding costs range from $40,000 to $75,000 for most couples. Read more about a breakdown of the estimated costs you’ll be spending (and some other ways to do it for cheaper) here. This isn’t surprising when you consider the fact that the diamond engagement ring already costs a 4-digit sum alone.

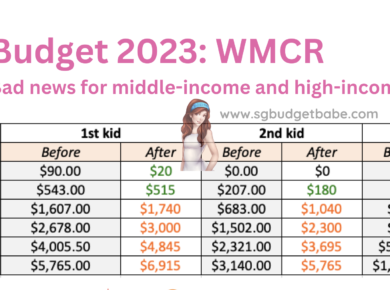

(iii) How should we prepare to have a child?

4. How can we invest in our future, together?

5. How do we ensure we will grow older together comfortably?

|

| Credits: The Straits Times & CPF Facebook page |

I personally view CPF funds as a fantastic tool to support one’s retirement savings as well. The system has been built to ensure that we will have sufficient funds for our golden years – you technically can’t squander the funds away and end up having nothing in your old age! The interest rates are quite attractive as well, as CPF funds have almost zero risk and earns between 2.5% to 5% of interest annually. When you compound this, the returns can be quite significant over time. You can take a look at another blogger’s CPF statement here – he received over $7,000 in CPF interest alone within a year on his SA.

These questions may not make for the most romantic of conversations, but you’ll be glad you discussed them sooner rather than later after you’ve signed the marriage certificate. In fact, research shows that couples who argue a lot about money are at a greater risk of divorce.

“Arguments about money [are] by far the top predictor of divorce. It’s not children, sex, in-laws or anything else. It’s money – for both men and women.”

5 comments

CPF also gets less foreboding as one gets closer to age 55.

I thought the 5 questions is :

do u love me? x 5 times! Ok, I am wrong! More chim than that!

haha…

It is a system few Singaporeans appreciate, but the smart ones like AK are already maximizing it for their personal benefit! 🙂

Haha! Where got so easy?!?

Looking for the Ultimate Dating Site? Join to find your perfect match.

Comments are closed.