Insurance

Investing

A better way for Singapore investors to trade options

We no longer have to stay up past midnight anymore to trade options. Introducing the world’s first pre-market US options trading platform, which is also the only brokerage in Singapore right now that allows you to trade during your after-office hours of 5pm – 10.30pm.

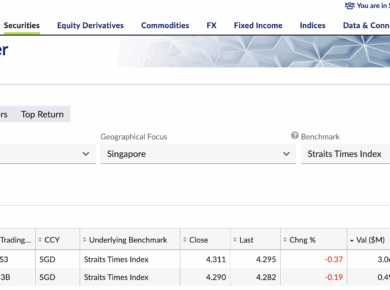

Is it too late to invest in the Straits Times Index today?

The Straits Times Index (STI) has surged to record highs again – the highest in its entire history. But for investors, the real question is: where do we go from here? And can this growth last?

2025 Financial Review

Released my book. Saw more multi-baggers. Dealt with haters. And yes, I managed to beat the S&P 500 again.

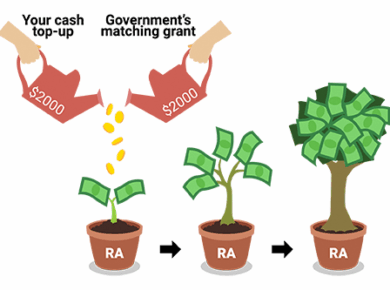

Topping up your parent’s CPF for MRSS? You’ll no longer get tax reliefs on the first $2k

4 years after I wrote about the CPF Matched Retirement Savings Scheme (MRSS), the policy has undergone further changes that anyone looking to leverage it should take note of. Launched…

Maybank XL Cards Review: A Must-Have in 2025

Imagine getting rewarded with 4 air miles per dollar (mpd) or 5% cashback for stuff you’re already paying for whenever you dine, shop, travel, play or spend overseas.

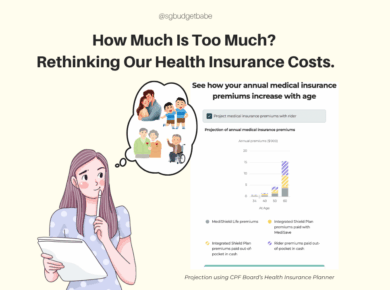

How Much Is Too Much? Rethinking Our Health Insurance Costs

I got a shock upon receiving my bill for my Integrated Shield plan (IP) last year. Even though I’m still in my 30s, it came up to almost S$2,000. My…

Franchise vs a Job: The Career Hack No One Told You About?

Instead of joining the rat race, could starting a business be an alternative route to success? And in this case, what’s the difference between building from scratch vs. launching via a franchise?

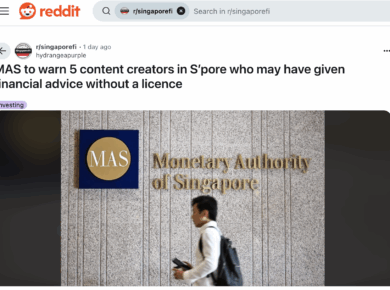

BTS on MAS latest guidelines for finance content

MAS has issued advisory letters to warn 5 content creators on their financial content, and has concurrently released a new set of guidelines for both financial institutions and content creators…

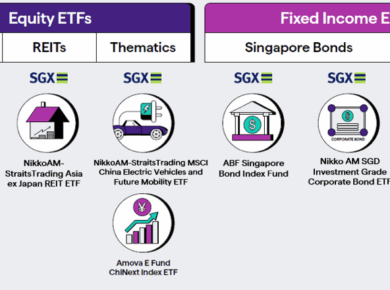

Investing in the STI: Does it makes sense to buy the newest Amundi Singapore Straits Times Index Fund?

There is now a third investment option tracking the Straits Times Index. But for experienced investors, does it make sense to put our money into the newest Amundi Singapore Straits Times Index Fund? Or is it better to access an ETF directly on the Singapore Exchange (SGX)?

-1-820x1025.png)

-1-390x290.png)