How can you invest in high dividend stocks without getting burnt?

Let’s admit it, who wouldn’t want a stock that pays you high dividends every year (or quarter)?

It sounds really sexy but reality is not always that pretty.

I love investments that pay me a dividend and I cannot lie. What’s not to love, when I can shake leg at home and still get paid regularly?

But whenever you invest in such, you have to first and foremost make sure that your underlying capital is protected.

And don’t just trust analyst reports. You need to do your own due diligence and form your own opinion, for no one is going to take responsibility for your money if you encounter a loss. I cannot stress this enough. I’ll talk more about how you can do this towards the end of this post, but first, let’s look at an example to understand what I mean:

Sounds attractive, right? This is why it isn’t entirely surprisingly why so many investors flocked to buy. High dividends, a blue-chip stock, attractive dividends…it seemed to tick off all the right boxes. But then retail investors got caught really badly after parking their money in its 6% perpetual securities i.e. bonds with no maturity date.

(In recent years, more purchased the bonds as its price dropped i.e. started trading at an even higher coupon yield. I know some people personally who bought it, so this was truly sad to watch as the whole saga played out).

Today, Hyflux’s shares and related securities remain suspended (since May 21). Hyflux eventually defaulted on its coupon payment for its 6% perpetual securities, and has since applied for a debt reorganization to work things out. In the worst case scenario, there’s no telling if Hyflux might end up declaring bankrupt. Who knows?

Let me now admit something else. I too, was tempted to buy these bonds back then. My fellow financial bloggers who once sat with me at Starbucks discussing this would know.

Then I went home to do my research, read plenty of analyst reports about these perpetual securities, but still chickened out in the end.

Analyst Reports on Hyflux

(credits to The Bear Prowl for the fruitful discussion we had about Hyflux and their analyst reports, and for providing the said reports because I’d cleared them from my emails a long time ago, lol)

2010: BUY call

- “This would also give [Hyflux] very good financial backing to tender for bigger projects and in other vibrant water industries in China, Indonesia and Australia.”

- “In view of its potential global diversification and the still upbeat industry outlook, we maintain our BUY rating and S$2.41 fair value).” Current price then was $2.18 at time of publishing.

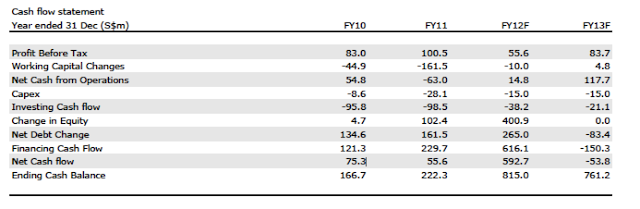

- The analyst then modelled Hyflux’s OCF to go positive in the next few years:

- “Selldown overdone, recent developments are positive”

- “Outlook intact and poised for a recovery”

- “Contract win is a significant endorsement of Hyflux’s superior competence in desalination”

- “We believe the risk-to-reward ratio is favorable to investors especially when the outlook of the company has not changed fundamentally and Hyflux still has one of the most coveted franchise in the water industry”

- “Hyflux has never bought back shares the way they did in the last two weeks of 2011…We reckon management probably sees value at recent lows”

- “Maintain BUY for 15% upside”

- So Hyflux’s operating cash flows got even deeper in the red, but still analysts modelled it to go positive in the next few years.

- “Divestment boosts bottom-line and unlocks capital to fund potential projects, albeit a temporary uplift”

- 2012 and 2013’s OCFs were significantly worse than expected, but again, the analyst modelled it to become positive in the following year. From $421 million in the red to $143 million in the green within a year?!

- “We do see several positives”

- “We believe the recent selldown may have been overdone.”

| Year | Operating Cashflow (‘000) |

| 2009 | $60,600 |

| 2010 | -$49,500 |

| 2011 | -$56,100 |

| 2012 | -$234,000 |

| 2013 | -$422,400 |

| 2014 | -$226,100 |

| 2015 | -$43,600 |

| 2016 | -$272,000 |

| 2017 | -$214,100 |

No data for 2018 available.

Everything I’d learnt in Dividend Machines and from my own investment journey gave me a nagging feeling about these bonds that I couldn’t quite shrug off. So I chickened out and gave this 6% investment a miss.

Obviously I was quite sian at the thought of others getting 6% while I had no guts for it, but today, I’m just glad I stuck by my guns and avoided a capital downfall.

|

| This made me laugh. |

I feel sad for all the retail investors who had bought Hyflux. They don’t deserve it. But then again, it isn’t surprising that they got caught up in all the stories around Hyflux.

6% leh!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

It seemed like a low-risk, high-rewards move.

Except that it was eventually not.

So the big question is, how can we learn to avoid making the same (costly) mistake?

By learning how to invest in the right dividend stocks, and doing your own due diligence.

Yes, I get that it can be quite daunting. After all, few people enjoy combing through annual reports. Some get headaches from all the numbers presented and don’t know what numbers to evaluate because there’s just so much of everything, everywhere.

I was once like that.

But after having attending Dividend Machines back in 2015 (not sponsored; I paid for it), I’m glad that I’ve not gotten burnt in any of my dividend stock investments thus far. In fact, the tenets of dividend investing taught in the course saved me on many occasions – Hyflux, Starhub, Asian Pay Television Trust, etc.

But not all high-paying dividend stocks are bad. In fact, there’s a good one I had bought into previously (head over to Patreon to find out which) which has rewarded me handsomely since.

Becoming a successful income investor is a lot simpler than a becoming a great value or growth investor, which is why it appeals to so many people.

You’ll need knowledge and experience in order to be able to tell whether a high-yielding dividend stock is good or bad, which is why I’ve emphasized time and time again about the importance of getting educated about investments – either through books or courses, or a combination of both. I choose to use both, because some courses give me insights that books alone cannot give me. Dividend Machines is one of them.

If you’re one of my readers who have waited for Dividend Machines to reopen, or if you simply want to learn how to invest your money for passive income, you can now sign up HERE and get $50 off the original course fee.

You’ll get to learn things like

- What financial numbers should you pay attention to in a company’s annual report? (and the ones you can ignore)

- Metrics that a dividend stock MUST pass before you invest

- What are the companies with the best type of business models to invest for dividends?

- How to spot “red flag” dividend stocks that look attractive but could crash any moment (using this method, that was how I predicted Starhub and Hyflux’s impending cuts)

- How can you predict whether a company is about to cut or suspend dividends?

- Are REITs still a good dividend investment today?

and more. There are formulas that are not taught in books either, so keep an eye out for that.

You’ll also get 24/7 unlimited support via the private members’ Q&A forum to ask questions. The best part is that, beyond just a one-time course, I also get all their future updates they make to their course content. It’s an investment that pays off throughout my lifetime!

Please also try to go for the (free) face-to-face investment workshop that they give to all members in Singapore, once you’ve signed up. You won’t regret it. And don’t wait for too long, because once registration closes, you’re gonna have to wait for over a year again before you can enrol. And the course fee goes up every year – for a very good reason, because more and more case studies get added, thus giving even more value for money for students who enrolled earlier vs later.

Should I put screenshots of the conversations I’ve had with readers who regretted missing the last one? 😛

This is one course I highly recommend EVERYONE to go for. If you’re a regular reader, you know that I don’t make such bold recommendations often.

There’s a special promo for Budget Babe readers, so

Sign up here to get $50 off Dividend Machines!

Limited slots available, as usual, on a first-come-first-served basis.

The registration link and discount will close on 10 March 2019.

After you’ve signed up at the link above, email me the confirmation if you’ll like a complimentary stock report of a dividend stock I’ve bought (which is still pretty decent to buy now, imo). I hope this will help you in your dividend investing journey!

———————————————–

Also, while we’re on the topic of educating yourself to invest better, I thought I’d share about another conference I’ll be attending on 23 February 2019.

Because it isn’t everyday where you come across an investment conference where you can hear from more than 10 investment analysts – each respected as an expert in their own field – about their views and tips on investing….and all for free.

A friend told me about Asia Wealth Summit 2019 and I’ve since marked my calendars to attend this event, where respected money managers in Asia will be revealing their top trades, investments and asset classes, as well as where they’ll be putting their money in 2019 and beyond.

They’ll also be highlighting the risks they’ve identified in specific countries, and which countries and sectors they’re most excited about in terms of investment opportunities. You’ll also learn about:

- The Net Net strategy (popularised by Benjamin Graham and Warren Buffett)

- The trend following strategy

- Which Asian markets could double in the next 3 – 5 years (even while China continues to slow)?

- How to combine value and growth investing in Asia to make maximum profits

- Where is investment legend Jim Rogers putting his money in 2019 and beyond?

Take those tips / lobangs, then do your own research, and make your own decision.

It’s free anyway, so all you have to do is make time for it.

Reserve your spot for Asia Wealth Summit 2019 here before they run out. I’ve already reserved mine!

With love,

Budget Babe