If I could distill my time and experience in investing into 5 key lessons that I’ve learned, they would be:

1. Time in the market is more important than timing the market.

When I first started out investing, I knew the mantra of “buy low, sell high” was the way to profits, so I naively believed that timing the market was more important, even though experienced investors told me otherwise.

But I’ve come to realise that it is extremely difficult to time the market. I’ve tried technical analysis and various indicators, but one thing that you can never account for is black swan events i.e. surprise events that majorly affect the company or its stock price. Take for instance, the sudden oil rig explosion which caused BP’s stock price to plummet by more than 50%.

Instead, some of the best-performing stocks in my portfolio are the ones that I’ve bought and just let them sit (aside from doing regular reviews to make sure my thesis is still sound). One stock I bought 2 years ago (and not touched it since) has been paying me regular dividends still, along with an added sweet bonus in capital appreciation while riding out fluctuations in its share price.

As a value investor, buying and holding onto my investments while enjoying dividends (I only buy stocks that pay out dividends) has been more beneficial for me than my numerous attempts to try and time the market.

2. You WILL lose money at some point, and that’s where you’ll learn the best lessons.

We become better investor over time, especially when we learn from having lost our own money.

Two personal mistakes that come to mind:

- I got excited about the oil crisis in 2015 and bought Sembcorp Marine, even though I knew very little about the oil industry (it is something that I’ve tried studying, but is still too technical for me).

My reasoning then was overly simplistic – I believed that oil prices would go back up, and all the associated oil companies will then recover in share price. However, I did not account for the fact that not every oil company will make it out of the crisis, and that some might never return to its all-time highs again. Most importantly, it made me realise I should stop putting my money into things I don’t understand.

- The other painful experience? That was when I bought SingPost after listening to my broker, who kept egging me on by saying all of his clients were buying it because it was an undervalued growth stock given the future of e-commerce and shipping. I wasn’t too sure, but then he pulled the parents card saying, “Trust me, I’ve even recommended this to my parents!”

I was swayed by his emotional arguments which led me to make a really expensive mistake – one that I regret even till this day, because it led me to ignore all the other warning signs that were flashing in front of me.

When the market teaches you an expensive lesson, you’ll remember it for life.

3. Diversify your investments.

You’ve always heard this word, but what does it mean to diversify?

It is good to diversify across asset classes and different industries. Please don’t kid yourself by buying Singtel, Starhub and M1, and then pat yourself on the back for diversifying. Consider the possibility that should the telco industry come to a standstill, all three of your stocks will drop. When that happens, you’ll lose your capital.

I personally diversify across stock markets too, on top of owning bonds, commodities and equities.

4. Look at your risk before looking for your reward.

Many people are quick to go into investments that seem to promise them a certain level of returns. The higher, the better.

“9% dividends a year!” sounds really sexy, but that’s when you should be cautious about the company’s outlook. Sounds familiar? That’s because I’ve previously written about Starhub’s drop in share price here, and how I predicted it was bound to happen.

When I bought into a bank stock in January 2016, I looked at the risks and potential problems that it would face and decided that the risk was low given present valuations, so I put my money in. Today, that counter (which I had bought at $13.88), remains one of the best performing stock in my portfolio.

Take care of the downside, and the upside will take care of itself.

5. Investing is hard work, so put in the effort if you want to reap the rewards.

If you wish to be rewarded, you’ll have to invest time and effort. Don’t count on sheer luck. Yes, there are always index funds available that don’t require as much effort, but you still need to do your homework regardless.

I personally make it a point to keep learning by attending courses, reading books, and following financial blogs for their insights and opinions. And of course, I do plenty of research before buying anything.

But I also understand that not all of us may have the time or energy to do so. Some others may not be confident enough to manage their own investments, especially when given talks of an impending recession, property market lull, or even a stock market crash. So if you wish to stay invested nonetheless, you can always outsource the management of your investments to someone else to do it for you, for a fee.

That’s why fund managers exist – they serve people who do not do their own investments (for various reasons), but yet want to still be invested. If you’re willing to pay to outsource your investments to someone else who does it full-time, there are definitely options available from asset management firms to private bankers or even insurers.

Personally, I still prefer to invest directly myself, but I understand that not everyone might subscribe to the same preferences. So for folks who wish to leave their investments to full-time fund managers instead and aim to have potential capital growth, all while fulfilling their income needs, an example of one such option could be to look for dividend-paying funds, such as Manulife InvestReady Wealth. Do note that this is an Investment-Linked Plan (ILP).

Locally, there are only 2 insurers that offer dividends out of a regular premium ILP. Between both of them, Manulife InvestReady Wealth has a larger suite of funds: 51 dividend-paying funds out of its 110 funds, to be exact.

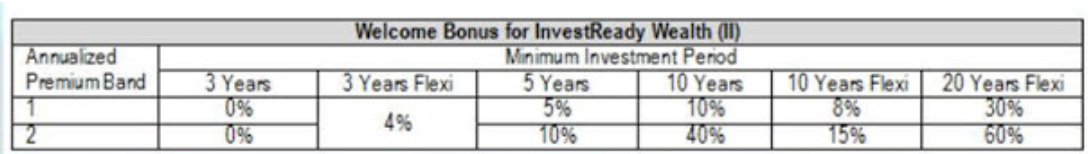

A welcome bonus is also provided upfront, determined by the following rates:

|

|

This essentially allows you to invest more right from the start. You have the option of putting 100% of your regular basic premiums up to purchase units of your chosen fund(s).

|

Flexibility in varying your regular basic premiums and partial withdrawals are also allowed on the plan. And should you decide to continue investing in the plan after the end of your chosen minimum investment period, you get a yearly loyalty bonus thereafter.

Of course, ILPs come with both risks and benefits, and while I don’t currently own any ILPs, I am well aware that some ILPs have indeed generated returns to their customers. For instance, folks whose policies had Indian funds (which I don’t have access to) did very well recently, even outperforming the U.S. market, which I invest in together with the local market.

But do always remember that historical returns are not indicative of future performance, which is why you should still do your own homework after hearing out what the financial advisors have to say.

Disclosure: This post is written in collaboration with Manulife in sharing 5 investment tips useful to any investor.

3 comments

ILP are risky products that I don’t recommend at all. The fund managers gets commission regardless of the fund’s performance, thus there isn’t any incentive to get better returns for stakeholders unless the commission is tied to the performance. Second, the fund manager will always recommend you good performing funds but bear in mind that these funds have already ride through the growth wave and you are possibly buying at the mature stage which gives very little room for future high returns.

I don't use ILPs myself since I do direct investments, but with more readers that I've met and spoken to over the years, some are so afraid / no confidence / no time to manage that they don't wish to do their own investments, even when I recommend simpler tools like ETFs or RSS plans. What else would you recommend for these profile of folks then?

If they continue to stay out of the market and keep their savings in the bank like they've told me, it'll only be eroded over time. ILPs (I'm only referring to those where you can invest majority if not ALL of the premiums, since I prefer to keep my insurance and investments separated) may have a cost tagged to them, but at least with a good FA, the returns will be better than if they hadn't done anything at all.

Would be keen to hear your views on how we can help this particular group out!

This comment has been removed by a blog administrator.

Comments are closed.