If you’re a safe driver looking to try and reduce your insurance premiums, I might have found just the answer for you.

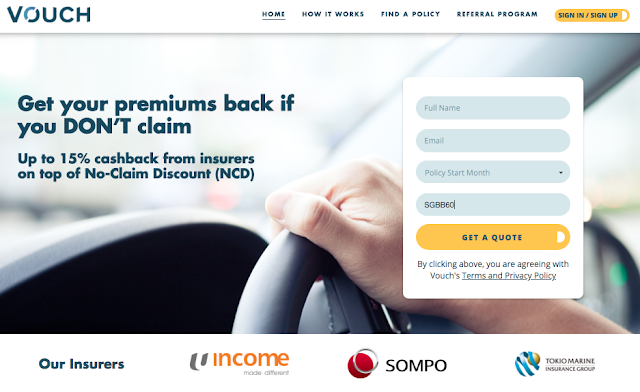

I recently came across Vouch when a friend of mine shared about it on Facebook. Vouch, which is essentially a local digital car insurance platform partnering with major motor insurers like NTUC Income, Sompo and Tokio Marine. The exciting news is that they’ve just launched Singapore’s first No-Claims Rebate (NCR) for motor insurance last month!

You guys know how I’m like when I see a good deal – I go digging into whether it truly is as good as it sounds. So in this case, I reached out to the founder and grilled him about what Vouch is about, how they purportedly can offer a “cheaper and fairer” insurance model, and tried digging up the dirt. Surely there must be a catch!

But I found none. And that’s why I’m here today to share with you what I feel is a massive game-changer for the car insurance industry and for us drivers.

Note: This is NOT a paid or sponsored post. All opinions are that of my own.

Background

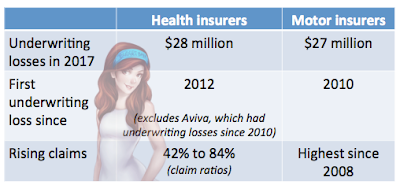

Now, remember how I highlighted my concerns last month about whether the motor insurance is headed down the same path as healthcare (where consumers now have to pay higher premiums and will no longer get to purchase full riders anymore)? You can read this article on the warning signs which I pointed out here.

My worry is that motor insurance premiums could soon be raised as well, given the industry’s underwriting losses and rising claims (highest since 2008). My husband and I pay pretty high premiums on our car so obviously if there’s a better option in the market, I want in.

How do car insurance claims really work?

If you’re not familiar with how insurance works, think of it as you outsourcing your financial risk to the insurer each time you buy a policy. The insurer collects the premiums from consumers like yourself, and pools them together – this sum of money then goes towards paying the distributors or agent commissions, administrative costs, claims…and whatever is left then becomes their profit.

So basically, you’re grouped and the risk is now spread out among all of you who are paying for the insurance protection (a.k.a. “risk pooling”).

Now, the problem comes in when too many claims are made and have to be paid out, which then eats into the insurers’ margins and profits. If it goes beyond a tipping point, the insurer (or the industry, depending on how severe the problem is) then runs into losses and needs to find other ways now so they can sustain their business. That’s what we recently saw in the healthcare space, where MOH and the insurers attribute the cause to a “buffet syndrome” which caused overall healthcare claims to go up and tip the insurers into danger zone.

Thus, is it really fair when your insurance premiums go up, even when you didn’t claim anything?

Obviously not!

For drivers, statistics show that 9 in 10 consumers don’t make claims on their motor insurance. So where exactly do the premiums (of the 9) go to?

Paying out the claims of others (the 1 in 10)?

But wait, there’s the No-Claims Discount (NCD), you say. The truth is, that’s still not good enough.

It is about time safe drivers stop being penalized for the reckless driving habits of others. How?

Introducing: Singapore’s first No-Claim Rebate (NCR)

Vouch is a Singapore startup (an insurtech platform) that now rewards people for safe driving.

They have recently launched Singapore’s first ever No-Claim Rebate (NCR) car insurance feature, partnering with major motor insurers to offer customers up to 15% cashback on our annual premiums, on top of our No-Claim Discounts (NCD)!

This translates into cheaper and fairer motor insurance for us consumers.

How does Vouch do this?

- For all motor insurance policies bought on the Vouch platform,15% of the driver’s premiums will be set aside for NCR, which is pooled with the other members in the group to form a common rebate pool.

- During the policy period, if any member makes a claim, part of the claim is deducted from the total rebate pool.

- At the end of each driver’s respective policy period, the remainder of the pool will be returned and split proportionally amongst the members who did not make a claim (the No-Claim Rebate).

- If the pool runs out, there is no negative impact to customers, as everyone is still covered by their respective insurance company. However, because Vouch is attracting safe drivers only, it is more likely that the group stays accident-free (or in the unluckiest of scenarios, claims a little bit), and so everyone should receive the 15% cashback.

Their co-founder Chean Yujun, shared with me about how the traditional car insurance model works whereby safe drivers end up paying higher premiums to cover the risks of unsafe drivers. Vouch felt that this was unfair, and saw an opportunity to work with insurers to promote and reward safe driving instead.

Is this a good deal for us consumers? Should I switch now?

Yes, especially if you’re a safe driver.

If you’re a reckless driver, there’ll be no difference whether you stay with your existing insurer / policy or switch to purchase a new one through Vouch. The No-Claims Rebate won’t apply to you anyway.

But if you’re like the majority of drivers who hardly get into accidents, Vouch’s offer is extremely compelling because it is not only cheaper, but also fairer.

For instance, if you choose to buy with NTUC Income, you’ll pay the same for the policy, regardless of whether you buy through Vouch or elsewhere.

However, if you purchase through the Vouch platform, $138.55 (15% of your premiums) is set aside for your No-Claim Rebate, to be given back to you at the end of your policy year if you make no claims.

So with this cashback, you’ve effectively only paid $785 for your car insurance premiums!

TLDR Conclusion

– If you’re a generally safe driver looking to reduce your premiums paid, Vouch is looking for you, because they want to reward you for your responsible driving habits with up to 15% of No-Claims Rebate.

– This is on top of your existing No-Claims Discount (NCD), which means you’re paying much less for your car insurance policy now!

– Reader’s promo code: Use SGBB60 to get an extra $60 cashback!

With love,

Budget Babe