(These investment schemes were alerted to me by some of my readers, who requested for this blog post to be written for greater awareness and that hopefully, this reaches and helps to inform more people.)

Is it legal, or ethical, for influencers to peddle and push out investment schemes in Singapore?

While the laws surrounding this at still murky (or non-existent) at best, I’ve been seeing Instagram influencers aggressively push out investment opportunities, promoting it to their followers and asking them to direct message them for more details. The question is, can they do this? Who will be held accountable if the investment falls through?

+ 24% fixed returns!

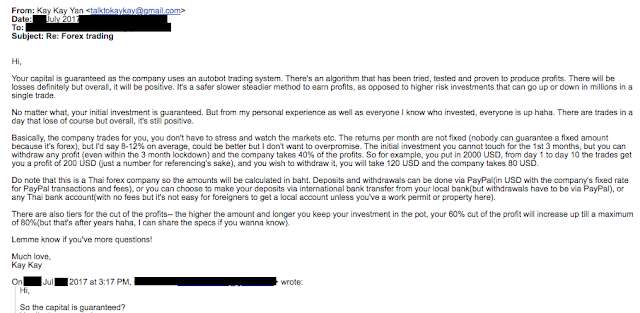

Let’s look at this forex investment case which a reader came to ask me about because she was keen on investing (yep, she got “influenced”). I gave her my honest opinion, which was that forex is highly volatile and extremely difficult to guarantee profits all the time, while also sharing about how most people get burnt in the forex markets (including my own dad).

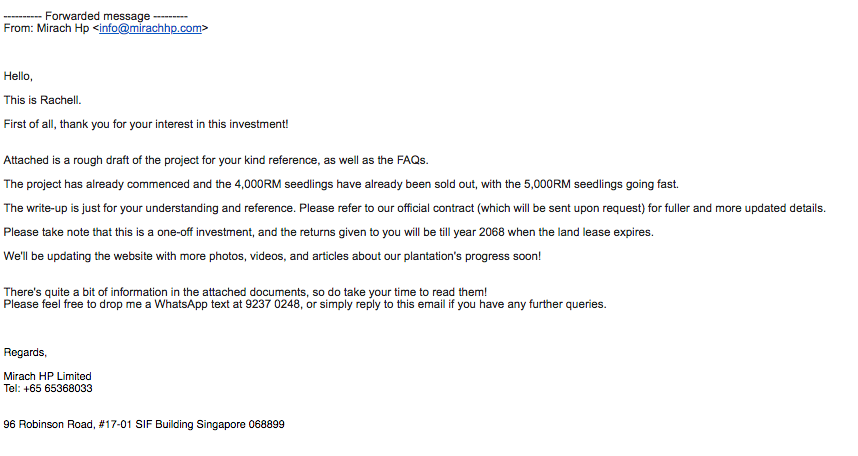

A local influencer with over 100,000 followers peddled this on her Instagram stories (where it disappears after 24 hours) a few months ago, asking her followers to park their money with her on a “personal agreement…based on mutual respect and trust”.

Here are 2 of the exchanges with her readers:

and here is another exchange that took place with another reader who DM-ed her to find out more:

Personally, I do not advocate putting your money with someone you know only from the Internet vs. financial instruments that are offered by reputable banks or financial institutions which are governed by MAS.

You’d wanna look for people you know and whom you can hold accountable if anything goes wrong. Unfortunately, parking your investment monies with an influencer whom you don’t even know personally (or for long) doesn’t sound like a good idea to me.

Do you know the influencer’s address? Their full legal name and residence? If anything goes wrong and they go Missing-In-Action, how are you going to track them down? Are you simply going to file a police report based on their Instagram handle?

Just because they’re famous on Instagram, does that mean they are authorized to collect your money and invest on behalf of you? Should you be giving them your money just like that?!?

Also, note how the investment arrangement promises guaranteed capital and 24% in fixed returns.

24% FIXED RETURNS!!!

The said influencer above eventually stopped the investment scheme because there was supposedly “overwhelming demand”. It remains unknown if the people who invested with her made profits or losses.

2019 Update: The results are in. Those who followed lost money as the forex broker closed down, suspended withdrawals and ended up being a Ponzi scheme. Close to 10,000 victims lost money and the company ended up being investigated by the Thai government.

In January 2023, a Singaporean man (Daryl Cai Younghui, 32) who reportedly fled to Singapore after the DSI pressed charges against him, was arrested for his involvement in the Forex-3D online Ponzi scheme. 3 years after the scheme collapsed, investigations are still ongoing. The victims have yet to get their money back.

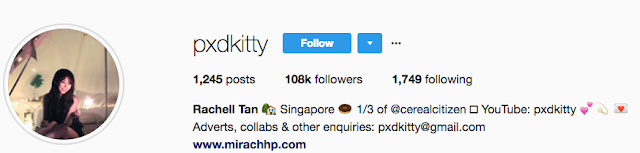

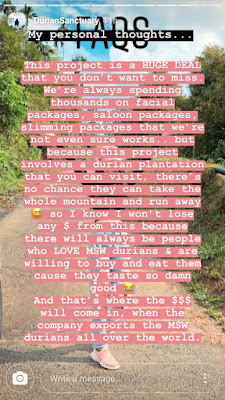

Another one that’s currently trending on Instagram is another local blogger who’s currently peddling a durian investment scheme to her 100,000+ followers.

She trusts her dad! Obviously, but that isn’t not a strong reason for investing with someone. Trusting someone (be it an influencer or friend) doesn’t mean by extension, you trust the people they trust, whether or not they’re family.

But why should you? Even if you trust Rachell Tan whom you barely even know in real life, do you know her address, phone number, NRIC and what not, so that you can make a police report or track her down just in case anything goes wrong? Or that of her dad?

If you trust your favourite beauty blogger who’s dating Joal, would you trust him?

If you trust DJ Jade Rasif, do you trust her dad?

|

| Source |

Back to durians.

“You’re set to receive $$$ sent to you via cheque every year…until 2068!”

(that’s 50 years)

Wow. I’m invested in DBS stocks, which pays me dividends twice yearly and has been around since 1968, but even then DBS doesn’t make promises like GUARANTEED RETURNS EVERY YEAR SENT TO YOU for the next 50 years!!!!!

Even the Singapore Savings Bonds, backed by our own government, makes no such guarantee for FIFTY years. Who knows what will happen in 50 years?!?! No one has a crystal ball.

She even tries to entice investors further by saying they can earn an “estimated SGD$44,000 PER SEEDLING”!!!!!!!!!!!!!!

No wonder this sounds so incredibly attractive. Pay $1,796 for a seedling and get back $44,000?!?!? Tell me where do I sign up for this guaranteed investment!!!!!!!!

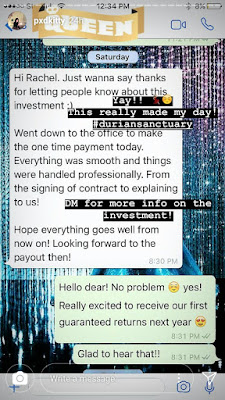

Apparently her followers are grateful to her and have made the investment… Folks, I hope you know what you’re doing.

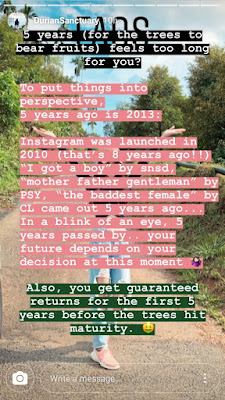

Someone tell me what does Instagram got to do with this durian investment. Creating FOMO by association fallacy (the illogical argument of irrelevant association which often appeals to emotion, suggesting that that qualities of one thing are inherently qualities of another).

To convince her followers that the investment is TOTALLY legitimate, photos of the plantation and the seedlings are shared as well.

|

| Rachell emphasizes small starting capital, low risk, long term returns + passive income…for the next 50 years! |

THE CONTRACT

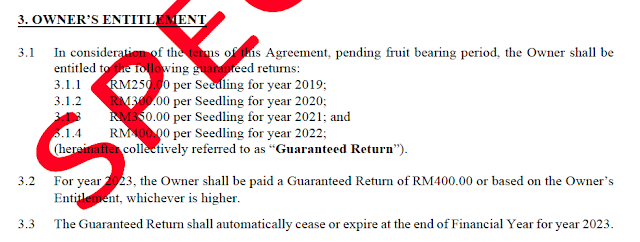

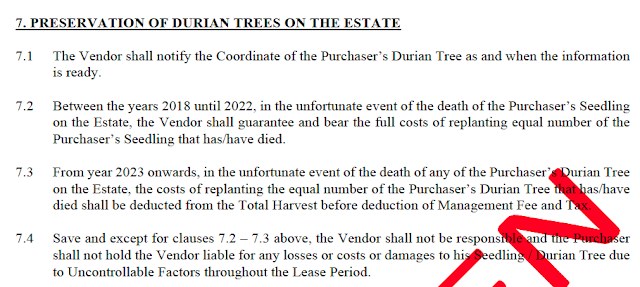

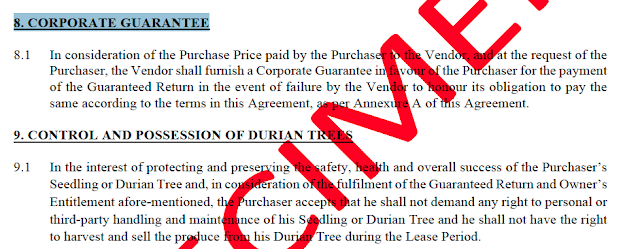

Some concerned readers who were initially considering parking their investments with her (that is, until they saw my thoughts on the scheme yesterday on 19 April on my private Dayre) emailed me and requested for me to study the contract and investment documents that they were sent. I highlight the worrying portions here:

RED FLAGS:

1. The contract makes the promise that the investor shall be paid a GUARANTEED RETURN.

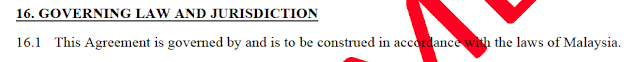

2. You’re signing a contract with a Malaysian company and the contract will be governed under Malaysia law. This means that if something happens to your investment, you can’t fight your case out in the Singapore court.

3. Note that this guaranteed return, however, expires after FY 2023. That doesn’t seem to gel with what Rachell said on her Instagram about receiving a cheque every year for the next 50 years?

4. Take note of the costs liable to you after the year 2023 if anything happens to your durian seedling. Also, you sign the contract agreeing that you cannot hold the company liable for any losses or damages due to uncontrollable factors in the next 50 years.

Update: A lawyer weighs in and adds on a few more pointers that folks should be aware of before signing the contract and parking their money in:

5. A Corporate Guarantee (clause 8.1) is provided, which is generally valid as long as the company is solvent. If the owners decide to dissolve Mirach HP Limited (the Malaysian entity you’re signing the contract with), the corporate guarantee will no longer hold. In this case, a bank guarantee would be better, but note that isn’t given.

6. The land isn’t even owned by Mirach HP Limited. It is leased to RCL Kelstar Sdn. Bhd. instead. Yes, I’m aware that the parent company, Mirach Energy, is trying to negotiate for a 70% acquisition in RCL, but till date I don’t know if they’ve been successful or not.

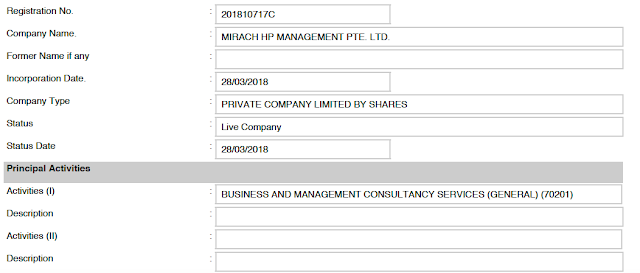

My readers have asked if this is legal and allowable by MAS here in Singapore. The truth is, I don’t know, but I’d certainly love to hear from the Monetary Authority of Singapore (MAS) if it is legal to market such an investment scheme here in Singapore, particularly when the Singapore entity isn’t even registered as an investment entity.

Because the last I checked, Mirach HP Management Pte Ltd is not even regulated to provide financial services (according to the MAS Financial Institutions Directory here).

5. The Singapore entity was only recently registered in March 2018, barely even a month ago.

The question also remains as: if an influencer really has nothing to gain from promoting a durian investment, why would a person put in so much effort into replying each of her followers DMs, and WHY is she sending out emails using Mirach’s address?

There’s definitely more than meets the eye, and not all details regarding relationships and renumeration may being transparently disclosed.

Should influencers be allowed to solicit for investment funds on their public platforms?

I’ll leave you to judge.

Does MAS need to start regulating investment schemes / products promoted by influencers? Only time will tell.

With love,

Budget Babe

14 comments

Dumb people into investing are every where. There is no way to stop them from getting influenced by influencers, friends, colleagues or relatives.

One real case of Oilpods; he made good return on his investment for a few months and then influenced his siblings and relatives to follow into this investment and all lost big!

I like the durian one best … strangers sponsor $$$$$ for lifetime supply of durians! And all I need to do is plant a few of the eaten durian seeds into trash bags & take some photos! LOL!!

Hell, even if you just wet a durian seed & keep it on your toilet shelf, it'll start sprouting seedling in a couple days … can secretly plant a few around your neighbourhood & hope some survive for you to reap rewards in 10-15 years … no need 50 yrs lah!

Ponzi schemes do works well on many people

I don't think it is legal for people without the financial services license to peddle such investment schemes online. Not too sure if the relevant authorities are alerted to these.

No one can regulate greed as no one has found a cure for stupidty.

Thank you for sharing! Please add "MLM/Pyramid" like products to the list of dubious things influencers are peddling. E.g. Wowo beauty products and Beautiful teeth whitening kit.

96 Robinson Road

#17-01 SIF Building

Singapore 068899

Same address but different company name ?

Mirach Energy Limited

Mirach HP Limited

https://www.mirachhp.com/management-profiles

http://www.mirachenergy.com/directors.html

Cos the parent company is Mirach Energy, which is a listed O&G company in SGX. I'm glad I don't own any AWO shares, which has collapsed by 98% since their ATH in 2013!

It is sad. This is why financial literacy is so important. I really dislike how beauty / lifestyle influencers are using their, erm, influence, for such stuff.

haha sure or not! Singapore can grow durians meh?! anyway I just hope people who chose to invest in this durian investment know what they're doing.

🙁

I'm not sure if it is legal or illegal… couldn't find much data on this.

very sad. I just hope people know what they're getting themselves into.

Already exposed!

WoWo: https://dayre.me/sgbudgetbabe/5UXvUsnd5P

Beautiful Teeth Whitening Kit: https://dayre.me/sgbudgetbabe/oy2WrIu6EF

Comments are closed.