If you think financial education is expensive, try financial ignorance instead.

Two notable investment schemes were in the news last week for all the wrong reasons, and they both had eerily similar characteristics of promising their investors unbelievably high monthly returns. Last week, investors cried out when their money didn’t come through.

You may call me skeptical, but I never believe folks who tell me they have any “lobang” or “proven tactic” which is “guaranteed to make money”. If money is really that easy to come by, then there wouldn’t be so many poor people in the world. I believe in hard work and patience instead.

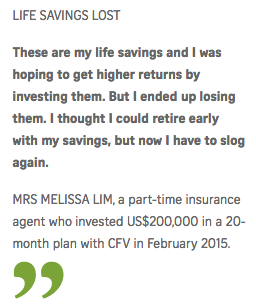

Charter Fine Ventures offered their investors 15% in monthly returns and it is believed that investors deposited USD 20 million with them, whereas JJPTR offered 20% and went on to lose 500 million ringgit in a single day (>USD 100 million). I can only say I’m glad I wasn’t one of those investors.

|

| Taken from The Straits Times |

Here’s the interesting part – even an insurance agent got involved and lost her money. See, this is why I always say I don’t believe most insurance agents know much about investments…what they DO know, is how to sell it to you.

If these insurance agents can become victim to debt, moreover get mired in a scheme that sounds like an obvious no-no to me, why would I trust them to manage and grow my money?

Here’s the hard truth : there’s no short-cut to investment success.

If you still believe that there’s an easy way to grow your money, I’ll tell you to continue dreaming. I don’t believe in anything that comes too easily – investment success is made through hard work, due diligence, patience, and sometimes with a little dose of luck.

The best way to avoid becoming the next victim is to get yourself educated, so that you can make informed decisions. The same goes for insurance – when I was still naive, I believed 100% in what my insurance agent told me (that an ILP was the best policy for me); once I became more savvy, I realised what a terrible product fit that was.

I’m still honing my own personal investment system and methodology, but here are some constants that I always come back to:

1. Identify great companies.

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” – Warren Buffett

I like to look for companies who have superior business models and a strong competitive advantage (ideally with a wide moat). You guys should see me when my friends or readers discuss a potential stock with me – the first thing I always ask is: what does the company do? And if it doesn’t sound like a good business model for me, I’m quick to dismiss it without further homework.

An example would be that of Best World – an MLM marketing firm which distributes skincare and wellness products – and whose stock price soared last year. It was a pity that I missed this stock, but when a friend brought it to my attention, I didn’t like the brands Best World had and neither am I a fan of MLM companies, so I decided to stay out.

If a company has powerful growth drivers as its tailwinds (eg. the healthcare industry vis-a-vis Singapore’s ageing population), that’ll be even better!

2. Can I trust the management team?

Trust is extremely important in business, and I believe it goes the same for investments too. One red flag I often spot is management paying themselves exorbitant salaries. Needless to say, these companies then get booted out of my watch-list. I don’t like management who treats the company like their own personal ATM.

I prefer a management who is committed to creating value for its customers, shareholders and society at large. This almost always leads a business to higher growth, revenue and profits. Just look at Steve Jobs and the early days of Apple. Look at Bill Gates and Microsoft.

The best way is to attend the Annual General Meeting (AGM) to assess the management in real life, but busy work schedules do not always allow that luxury, so I tend to reserve those for stocks that I’m looking to go big on.

3. Quantitative Analysis – what do the financial statements say?

A company can have a fantastic business but not be earning much money #truestory. Once I’ve done my qualitative analysis of what the company does and who runs the business, I’ll study their financial statements to see if the track record is there.

This is where I crunch the numbers – the income statement, the balance sheet and the cash flow statement. How exciting -.- I’m not a numbers kind of person, so this is the part I dread the most, but I deem it necessary before I even invest.

4. What’s the value of the stock?

Value can be quite subjective, so this is often the most difficult step. While there are some methodologies for you to use and calculate a value, I usually feel that the quantitative value assigned often neglects the quality of the company / stock, which ought to be a key factor too.

I’m still refining my strategy and coming up with my own scoring system to assess this, so hopefully I’ll be able to share more in the future once I’m more certain of my own methodology.

You can thus see how I don’t really trust anyone but myself to make my money for me, and over the years, I’ve been attending various investment courses to try and learn from the best brains out there while I personalize a system that works for me.

Some of these include the courses offered by The Fifth Person and Dr Wealth.

This month, I’ve signed up for another one : The Investment Quadrant

I decided to sign up because I saw that The Fifth Person will be covering quite a broad range of topics, including core themes that I feel are crucial before making any stock investment.

Module 1: Investor Psychology

Module 2: The Investment Quadrant

Module 3: The Business Model

Module 4: Management Assessment

Module 5: Financials

Module 6: Valuation

Module 7: Stock Screening

Module 8: Entry & Exit Strategies

Module 9: Strategic Portfolio Management

The best part is that beyond just a one-time course, I also get all their future updates they make to their course content. I paid for their Dividend Machines course in 2015, and have been enjoying that benefit since.

For just USD 397, I’ve been telling the folks at The Fifth Person that they’re seriously under-pricing their courses (I mean, that’s almost the same price as what I paid in 2015. What happened to inflation?). Furthermore, my friend went for another company’s $4000+ course and the stuff they taught were so basic in contrast to what I learnt from The Fifth Person, but I also like that they’re keeping it affordable so folks like me can jump in without questions.

The Investment Quadrant course closes on 12 May, and if you haven’t signed up yet, you can sign up here to get another $50 off (so that’s just $347 now, mad insane ok).

If you see me at the classroom lesson, please say hi! 🙂

With love,

Budget Babe

8 comments

Thanks for the info on the course. Definitely signing up for it.

Hi, any idea when the classroom lesson is? I couldn't find the date on their website.

Hi, after you sign up you'll be able to choose from a range of dates for the physical classroom lesson. I didn't take a screenshot of all the dates, but there were a few on June Saturday's!

I might just see you in the classroom!:)

Hello,

Do you know if this is an online course or physical class? The way that it phases sounds more like an online course.

It is an online course with lifetime access, and comes free with a physical classroom class to run through all the course content within a single day as well!

May I ask if this is a sponsored post?

I just want to be careful before I part with my money as I am not rich. sorry to be blunt.

No sponsored disclosure on my blog = not a sponsored post.

I signed up and paid for this course on my own.

Comments are closed.