Not too long ago, the Internet was buzzing about discussions of dishonest or unethical financial advisors after lifestyle influencer Francesca Soh shared her bad experience. (Click here to read Part 1, where I distilled why the “advice” she shared after being through it herself is not entirely sound). While much has been said about black-sheep agents who mislead their clients into purchasing certain policies, the bigger question of how you can differentiate the bad FAs from the good ones still remains. I promised to teach you guys how you can do it, so here’s Part 2.

I’m a strong believer that consumers should always get a full disclosure from their agents, although reality is far from that. After all, if your FA is digging so much into your own profile with all those sensitive questions about your income, money and other goals, it is only fair for you to ask them for a full disclosure of their interests as well. That way, you’ll be able to discern for yourself whether their “recommendations” are genuine…or whether they come with perhaps a slightly different agenda.

To assess if your financial advisor is good and truly has your interests at heart, here are some tough questions you can ask your financial advisor:

1. What credentials do you have?

These days, it is easy to become a financial planner. Many companies are also recruiting aggressively (think AIA, Prudential, etc) and there’s hardly any prior education requirements or experience in finance needed as a pre-requisite. Of all the financial agents I encountered, fewer than half graduated from university, and even among the degree-holders, most of them didn’t study in a related (finance) field!

Would you trust someone with a degree in mechanical engineering to advise you on financial matters? The funny thing is, too many people do. (Now, there might be some engineers who are great with finance, but I’m just speaking in general.)

Note that for the majority, the only “credentials” these agents have are on how to sell the insurance and investment products their company offers. Some of the top advisors in the industry have qualifications such as Certified Public Accountant (CPA) or a Chartered Financial Analyst (CFA), although these aren’t technically essential for the job. You might want to look to see if your agent has a CFP® designation, which is issued by FPAS (Financial Planning Association of Singapore). You can even do a quick search on their website to verify if your planner is on there.

If your agent has any of these credentials and has been in the industry for at least a decade, it might give you a greater peace of mind.

Make sure the advisor you’re signing with is fully qualified to make recommendations to you, otherwise, you’re better off reading and learning from financial blogs in order to decide what policies are best for you.

2. How many years of experience do you have?

Finding out how long the agent has been in this line can be another important tool to help you assess them.

If your agent is relatively new, there could be two possibilities:

(i) Money-minded, as they’re starting out and would want to close as many deals as they can. This could also mean they might recommend you products where they earn the most commission on, rather than what is really suitable for you.

(ii) Trying to build real, genuine relationships based on trust so that you’ll be a long-term returning customer to them. Rare, but these sort of agents are more likely to recommend you the right products, although few of their kind earn enough to eke out a career in the industry.

5 years could be a good measure, although it could also mean two possibilities:

(i) Already has a stable income from passive insurance sold during their early years, so they may recommend you what’s right even if it means lower commissions for them, since they’re earning enough already anyway.

(ii) They may have earned their money from recommending products with high commission rates over the years, so you might want to be a bit careful on what they propose to you.

Ultimately, there’s no hard or fast rule, so you’ll have to be a judge of their character and decide for yourself which is a more likely possibility.

3. How much are you paid?

Your financial advisor should be able to answer this without a blink of an eye, and with full transparency. If they’re stammering and trying to cover up i.e. make it sound as though they’re barely earning anything from you, be careful!

Unfortunately, not a lot of agents are going to be honest about the money they make from your policy. There are rough estimates – for instance, if you buy an ILP for $500 a month, your agent will usually enjoy a nice commission of about $6,000.

Few agents get paid a basic monthly salary, in which case they are less reliant on your commissions compared to other agents who do not even get a base pay. However, it’s always a good idea to ask them if how high their quotas are to hit as well – if it is relatively high, again, that could be a red flag.

4. How many clients do you have?

There is nothing wrong in wanting to support a new insurance agent who is only just starting out, especially if he or she happens to be your friend, but remember that once you sign on a policy you’re making a long-term commitment with your money.

It can also be easy for an agent to lie on this point, so make it a point to ask them for client referrals. The truly good ones should have a pool of satisfied clients who will be more than happy to help out. Get the agent to provide you with the contact details of someone you can call or Facebook message to ask about their service and track record before you commit to purchasing anything.

5. What kind of after-sales services can I expect to get from you?

Lifestyle influencer Francesca Soh has already shared about the lack of after-sales service rendered by her insurance agent, and she isn’t the only one. Most agents are extremely proactive while they’re still pursuing you for a deal; after you’ve signed, they disappear and you hardly ever hear from them again.

The insurance industry is notorious for a high turnover rate, and plenty of people leave within the first few years. Ask what your agent intends to do for you after the sale, and hold them accountable for it.

6. How many claims have you helped your clients get so far?

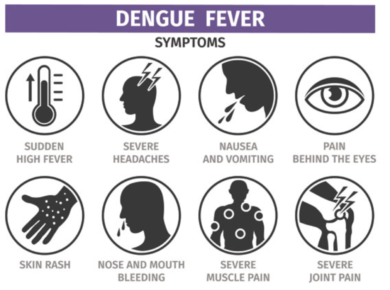

The whole purpose of buying insurance is to protect yourself against unwanted or unexpected costs, so what happens if your agent is incapable of helping you to get your claims and payouts approved?

This forms part of the after-sales service, as mentioned in the previous question. Many agents only know how to sell, but disappear when it comes to handling claims, because it can be quite a messy process (or they just simply aren’t in the profession anymore).

Ask them for evidence of successful claims they’ve handled – or even get client referrals to make sure they aren’t lying (like in question 4).

7. What happens to my money (or plan) if you quit?

We’ve already discussed the industry’s high turnover rate and agents quitting, leaving their clients behind. While your agent may not be honest with you about his or her intention to quit, at least push them to be accountable if you decide to sign with them. Get a contingency plan worked out – otherwise, find another agent whom you know will be sticking around for good.

We live in a meritocracy today – there’s nothing wrong with expecting the best, or wanting to work with only the best agents. And if you’re an agent reading this today, I hope you learn to live up to these standards and become one of the shining gems among the black sheep.

With love,

Budget Babe

2 comments

The products Financial Advisors sell are pretty much standard. Met a few and all recommend unit trust and endowment.

ILPs and life insurance too! Although the last one could be useful for many people. I just don't like FAs who push whole life insurance to me when I already stated flat-out I only want term though, haha.

Comments are closed.