Just because your broker tells you investing is simple (or maybe you’ve seen those online ads promoting an easy solution in the form of their investing courses…) doesn’t mean you can take it lightly. After all, you don’t have unlimited lives to keep playing this Russian roulette.

This is a guest post contributed by Call Levels and edited by Budget Babe (my words in blue).

The electronic environment in which we trade in these days remove a need to deal with any human element. This means the way we receive data, make a decision and execute a trade has, to a certain extent, become seemingly easier than it really is.

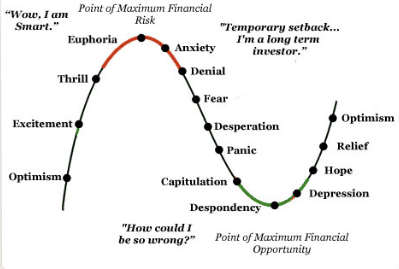

Such a mindset is dangerous. Making investment decisions in such an environment is actually harder to do than one believes. Many people often find themselves oscillating between states of fearand greed – they become greedy when they make money, and want to make as much as possible; when they lose money, they panic and worry that they’ll lose it out.

The Academy of Behavioural Finance & Economics identifies a number of traits and tendencies that help explain why people make poor investment decisions. Today, we take a look at the top 10.

1. Greed

“I will tell you how to be rich. Be fearful when others are greedy. Be greedy when others are fearful.” – Warren Buffett

Every investor worth his salt would probably be familiar with the above quote by the most celebrated investor of our times, but of course, executing such wisdom is a whole different ball game altogether.

Greed can manifest in several ways. Putting all your money into one stock, for instance, or buying irrationally. When this happens, you can bet that you’re likely taking positions based on emotional guidance, and this usually leads to some very poor decisions being made.

2. Thinking it is a game

“If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.” – George Soros

Thanks to the proliferation of apps and games centred around investing, we’re now becoming desensitized to the manner in which stock trading is performed. This makes it feel like a game and can easily lead to over-trading. The truth is, investment requires a great deal of research, strategizing, and hours spent mulling over entry and exit plans. If you’re not sure, here’s one way I do it.

3. Unwilling to take losses

“If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.” – John (Jack) Bogle

My broker has an occupational hazard of showing off to me whenever the stocks he recommends (and which I often don’t end up buying) have risen in price whenever there is a (false?) rally or a bull market. But hey, almost everyone makes money in these cases. More often than not, you should be selling on these rallies instead of foolishly chasing them. I should know; I speak from personal experience.

Stock prices move up and down. If you’re looking to park your money in the stock market, thinking that you’ll sell off everything when you reach 65 and cash out the money for your golden retirement, I urge you to think again. What if the year in which you retire is a recession year, where stock prices have fallen to all-time lows? There is no certainty in the stock market – that’s why all investment statements and prospectus always come with a disclaimer about risks.

If you’re unwilling to stomach losses, perhaps you should be looking at more stable (but often also lower-yielding) instruments such as fixed deposits or bonds instead.

4. Getting married to a stock

“Know what you own, and know why you own it.” – Peter Lynch

This is the opposite from the above on being unwilling to take losses. In such a situation, one has made good gains from a stock and then decides to marry it and never sell. Whilst Warren Buffett has famously quoted that he would hold on to stocks forever, few of us have this sort of holding power and it would make more sense to cash out and redeploy the money to better-producing counters once your stock has run its course.

I made 23% in capital gains on a counter within 2 months not too long ago and cashed out on 75% of my holdings, thinking I would hold the rest for the long-term as I thought well of the management and it had been rewarding for me thus far. However, I eventually forced myself to sell the entire lot after discovering a potential problem in the company which I had missed out previously.

Not all winners remain winners forever.

5. Herdentality

“The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell.” – John Templeton

We see this in financial news all the time. Whenever a piece of news is announced, the markets respond almost immediately. That is the herd moving, and the worst thing you can do is to you’re your trades based on where they go. The problem here is that the herd moves fast, and by the time news has hit, they’ve already left. How fast can you react and catch up?

For instance, investors who had bought in during the Global Financial Crisis are sitting on hefty gains right now. While some people are flocking to REITs now in the midst of today’s (false?) rally, some of us financial bloggers have taken the opportunity to cash out on our stocks, including yours truly. Did you do the same, or have you already missed the boat?

6. Believing history will repeat itself

“Markets can remain irrational longer than you can remain solvent.” – John Maynard Keynes

In every trading account you set up or any investment-linked plan (ILP) you sign, you’re almost always given the following disclaimer: “Past performance is not an indicator of future results.” That being said, it is human nature to look for patterns and precedences and hope they’ll happen again. How many unfortunate victims have seen this happen on their ILPs, which they had mistakenly thought would be a safe instrument for their retirement?

7. Make decisions that are blind to company performance

In the thick of trading action, we sometimes forget that stock prices are ultimately just numerical numbers rising and falling; are the end of the day, they reflect companies run by real people selling real products and services. If we stress ourselves through buying and selling by the minute on small profits, we potentially lose out on the fat profits if we simply patiently waited for the companies to grow.

8. Overestimating your own knowledge

“I’m only rich because I know when I’m wrong…I basically have survived by recognizing my mistakes.” – George Soros

Sometimes when we make quick profits, we think it is because of our awesomeness. Let’s take this one strategy for example: there are some folks who believe that choosing stocks trading at 52-week lows is a smart move.

These people then scour the markets regularly to find such “cheap” stocks, with a theory that since these stocks are already low, the next trajectory must be up. The tragic fact is that the counter can slide further to hit new record lows. Don’t believe me? Look at what happened with Noble (SGX: N21).

If a strategy sounds too smart and easy to implement, it probably is. The smartest thing you can do is to recognize the folly and move on.

9. Adopting a gambler’s attitude

The four most dangerous words in investing are “This time it’s different” – John Templeton

Trying something over and over again with the same facts / strategies and hoping that things will be different this time? This often (subconsciously) leads us to look for information which validates our decisions and choices, convincing ourselves further that it will surely work this time.

“Hope” is a dangerous thing in investing.

10. Assume that trading can become a day job

The most dangerous illusion about modern electronic stock trading is that one is easily led to believe this can provide a sustainable, daily income. A couple of hundred dollars from a small trade each day resulting in over $4000 income a month sounds like a feasible business plan, but it is not. What are the chances of you getting it 100% right all the time? Even geniuses have gotten it wrong sometimes.

The stock market is NOT your friend. It is not a friendly app that resides on your phone giving you hours of entertainment and small profits by the side; it is an international battlefield which attracts the sharpest minds on the planet as well as herds of speculators with not a clue about what they’re doing.

It is chaos.

For you to successfully turn a good trade and see results from your investments, you need to keep disciplined, trade with clarity and be armed for a wide variety of scenarios to happen (Google “margin of safety” to learn a little more).

Good luck!

With love,

Budget Babe

2 comments

Pretty section of content. I just stumbled upon your website and in accession capital to

assert that I acquire actually enjoyed account your blog posts.

Visit our php tutorial

mobile bd price

Discover how 1,000's of individuals like YOU are working for a LIVING by staying home and are fulfilling their wildest dreams TODAY.

JOIN NOW

Comments are closed.