Insurance

Investing

DBS POSB Retirement digiPortfolio review: Is it any good?

You may have heard of target date funds as the popular choice for retirement savers in the US. So, why are they not the default here? The new Retirement digiPortfolio…

Here’s how you can earn miles on your income tax payments

Disclaimer: My bias towards CardUp is real, especially given how it has been a fail-proof solution for me for the last 6+ years. But here’s how the other options currently…

Best credit cards to use for miles in 2024

If you’re trying to clock up enough miles fast, here are the best credit cards in Singapore to use right now and what I personally recommend.

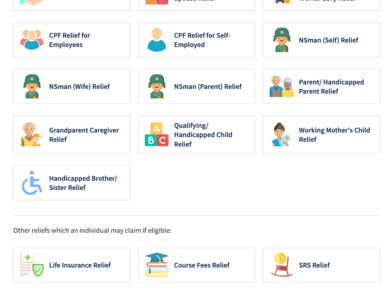

How to reduce your income tax in 2024 – for working parents

Here are the various methods you can use to reduce your income tax bill as a working parent in Singapore.

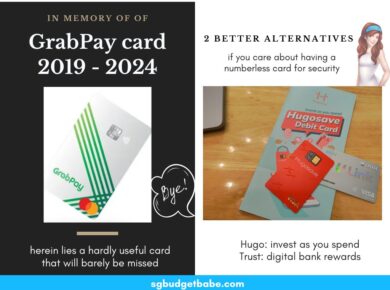

Goodbye GrabPay, hello better numberless card alternatives!

There’s no need to bemoan the loss of the GrabPay card, since it was hardly that fantastic to begin with. But for those of you who think you’ll miss the numberless card feature, here are 2 better alternatives you can consider.

How to Find the Right Critical Illness Plan For Yourself

With so many different types of critical illness (CI) insurance plans, how does one go about choosing? Here’s my guide to help you!

How to reach $100k by 30

Will saving money alone, or even more money each year, help you to cross the $100k by 30 financial milestone? How I hit mine, and how you can do the same.

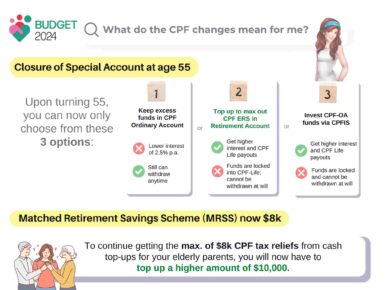

Budget 2024 – changes to our personal finance strategies

There’s been a lot of news coverage about what Budget benefits you can get, so I won’t go into detail here, but I wanted to focus on the changes in…

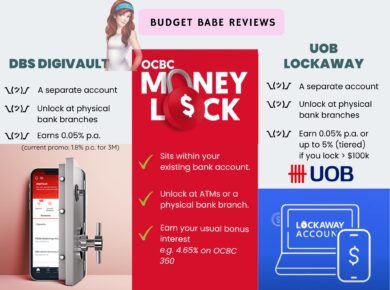

Review: Why are most people choosing OCBC Money Lock over DBS digiVault and UOB LockAway?

Now that you can now “lock” your money stored in your bank and prevent it from being transferred out by scammers who illegitimately gain access to your account or banking credentials, should you? Even if it means giving up higher interest in return?

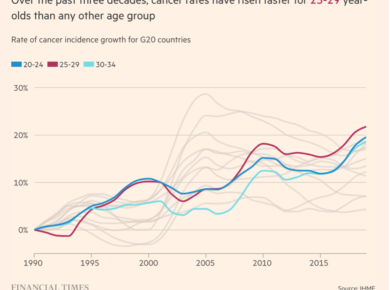

Our modern lifestyles might just be ruining us

We thought we were moving forward, but might our life of comfort and modern day luxuries be ruining our health instead? Over the years, as I watched friends around me…